Golem Price Analysis: Technicals lean bullish

The Golem project is one of crypto’s most well funded - and has remained so throughout the crypto winter. Although development of the project’s decentralized supercomputer has progressed at a snail’s pace, both price and onchain activity have turned bullish in 2019.

The Golem (GNT) project is one of the most ambitious undertakings in the crypto space, with an overarching goal of becoming the world’s first truly decentralized supercomputer, by creating an active marketplace for computing power. The core solution of Golem works by fluidly combining the processing power of all nodes in the network to ensure that any single one can process complicated computational tasks.

Golem’s far-ranging proposition, on paper at least, appears difficult to implement. Golem’s ICO fund raise for its native token GNT was launched in November 2016 and as we enter Q2 2019 the project remains in early development stages with only a basic version of the Golem product available for beta testing on the Ethereum mainnet.

The Golem project whitepaper outlines four key network milestones for the network in progressing order, Brass, Clay, Stone and Iron. The network remains in the Brass stage.

Additionally, the Golem whitepaper roadmap (final version, 2016) suggested delivery for the network’s full ‘Brass’ solution at six months, but over 2 years of development later the project has still not completed a full version of ‘Brass’. The project has been guilty of the classic ICO trope of ‘over promising and under delivering’.

Because of the project’s high aspirations and radio silence regarding dates for tangible/market ready product delivery, GNT is beginning to send signals that it may be another ERC20 ‘futility token‘. The price of GNT is currently down ~91% from an all time high achieved in January 2018.

This is not to say progress has been entirely static, as in 2018 Golem released an initial use case to the Ethereum mainnet, six software iterations of Golem including GPU integration. The Golem project also released developer tools like Graphene-NG, and a new marketplace/hub framework for computational power requestors to communicate with providers and for providers to allocate power to nodes.

As recently as April 4th, Golem released new updates to Brass with version 0.19.1. The core of the update was to improve the user experience for Windows users and fix issues with Golem running on Windows Hyper-V virtual machines. The update also improved on some erroneous reporting flaws from previous versions of Linux and Windows Golem Brass and also improved basic features like password recovery.

In terms of recent price performance, the Golem network’s native utility/membership token has received a bear market hump, enjoying two green months of trading between February-March and March-April. Since the start of 2019, price of GNT has risen ~51%, with trading volumes also picking up sharply early in March. The token currently trades at ~USD 0.095.

This price and volume pattern suggests that GNT has found its bottom in the crypto winter and is beginning a period of steady gains and accumulation. If the majority weak hand sellers have dumped their GNT already, this opens the doors for long term bulls to begin re-accumulating at under-priced rates. The improved Golem brass product may also be adding some positive speculative buying pressure.

The Golem network solution and the purpose of its token

The basic idea of the Golem ecosystem is that users loan out their computer’s spare resources to other users who need the extra power to complete tasks. The project’s value proposition is akin to business models like AirBNB and Uber where underused resources are efficiently allocated because of an established monetary incentive.

The core transaction loop of the Golem Network begins with users (requestors) broadcasting requests to a marketplace for extra processing power, providers matching up with these orders and task managers verifying these transactions and ensuring payments happen securely. Golem also has system called concent which lets users directly call on the network anytime they feel cheated by another party. It assures a final layer of fairness for the network.

A requestor (user who needs processing power to complete) broadcasts a task to the Golem marketplace, based off a set task template.

There are currently two templates available in Brass, Blender and Luxrender. The templates focus on allocations to users seeking to participate in CGI rendering tasks, the first working use case for the Golem network. For projects deciding to run CGI rendering tasks through Golem it is required that inputs & outputs be of a small or moderate size (below 1 GB, preferably below 300 MB), so computation takes significantly more time than sending data.

This makes the current scope of the project very limited, though anticipated future builds Clay, Stone and Iron promise greater functionality and consumer friendly interfaces.

For the time being, the Golem team in Poland is taking a slow and steady approach to building an industry disruptive shared processing power solution.

Other future uses for Golem include testing hyper parameters for Machine Learning applications and protein folding simulations for scientific computing. Golem encourages projects curious to build using the network to contact them for technical and (potentially) financial support.

A provider receives the broadcasted tasks via the Golem shop, it can view the reputation of nodes broadcasting tasks, rejecting ones with low reputation. When a provider finds a suitable offer, it sends computing power information to the requestor, and in return the requestor verifies that the provider has a high enough reputation.

If everything checks out, the requestor receives the appropriate resources via the Interplanetary File System (IPFS) and begins computation on the task computer. An external task manager verifies the results with the respective nodes, and a requestor may choose to signal their results for further verification.

Payments are verified via a smart contract, with Golem transactions verified over the Ethereum blockchain. If all elements of the information and token exchange are verified, then both parties observe an increase in their reputation score, which leads to improved matchmaking across the network.

The GNT token is an ERC20 token operable within the Golem smart contracts, it is used to pay for the rented computing power. Providers are free to set GNT rental price at their own discretion, with the pricing philosophy being that the open marketplace will regulate prices.

GNT also has utility as the participation token from Golem Application registry, an added feature of the network that lets developers publish their own Golem applications, and build features like more straightforward match-making between requesters and providers.

1,000,000,000 GNT tokens were issued during the ICO of which 82% was distributed to crowd sale participants.

Of the initial 820,000 ETH raised as part of the GNT ICO, half has been sold over the course of the last two and a half years (exactly 450,977 ETH worth ~USD 81.6 million in today’s prices). A potential bullish flag for some long term backers may be that the Golem treasury has not sold any ETH since April 2018 despite the bear market and GNT significantly losing value over the last year. This suggests well planned operations and strong treasury management – as well as long term faith in the state of the Ethereum ecosystem.

Golem is currently the second most ‘ETH rich’ ICO after DigixDAO, and the current price uptick in Ether may also contribute to short to medium term prospects because it boosts the USD value of the Golem teams holdings and may help stimulate short term capital expenditure.

Source: Diar Newsletter, Golem’s balances hold firm while other ICO projects sell off their ETH during the bear market.

Source: StateoftheDapps, via smart contract

Golem is currently listed as the 27th most popular Dapp overall, 14th most popular on Ethereum and the most popular ‘Development’ Dapp across all platform blockchains, as per StateoftheDApps. The Golem solution averages over 100 active users and 400 transactions per day for its Ethereum mainnet beta use case solution.

These numbers are encouraging, and show that a section of the blockchain community are willing to test the Golem decentralized processing power marketplace even though it is far from a finished product.

Network activity

Derived from the NVT ratio, the NVT signal is a responsive blockchain valuation metric developed by Willy Woo and Dmitriy Kalichkin.

Crypto markets are prone to bubbles of speculative purchasing, not backed up by underlying network performance and activity.

The NVT signal provides some insight into at what stage of this price cycle a token may be.

A high NVT signal is indicative of a network that is going through one of these bubble periods, and may move towards a position of becoming overbought/overvalued, because of the market’s speculative assessments running out of steam.

The Golem NVT signal has ranged between 50 and 350 points over the last two years this suggests both relative immaturity of the GNT asset and that onchain volume has a tendency to fall away quickly on the network.

A potentially bearish flag is that the GNT NVT signal has consistently been touching higher lows/oversold inflection points which suggests that speculation and not network activity is contributing more strongly in driving periods of positive price activity as time has progressed.

A strong bullish observation is that a falling NVT signal has coincided with the recent price run of GNT. This means onchain volume is rising more quickly than the token’s market cap/value. This pattern suggests that the period of rising external value is being backed by tangible economic activity and is a sign of bubbling underlying medium-long term momentum.

It also supports a narrative of long term bulls potentially re-entering the market and building buying pressure for GNT. They appear more likely to be actual users of the network and participants in onchain activity – as opposed to short term speculators/ who would be more likely to leave purchased GNT off-chain (on exchanges).

PMR signal

Metcalfe’s law is a measure of connections in a network, as established by Robert Metcalfe the founder of Ethernet. It has subsequently been used to analyze the true value of network-based financial products like Facebook and Bitcoin, and by comparing it to price, can provide a useful tool to assess whether a token is over or undervalued.

It is also a more straightforward metric to implement versus onchain transaction volume, which can be challenging to measure accurately in USD terms. Addresses are measured as the number of unique sending and receiving addresses participating in transactions daily.

This makes it a relatively transparent metric as compared to onchain volume. However, there may be a question of the granularity of the data, and who controls these addresses.

The PMR for GNT has been historically high, between 4-9 points. This means that token value far exceeds Metcalfe’s law suggesting that activity address growth and network effect play a very small effect in the value of GNT.

Because Golem is a decentralized marketplace, and as such GNT’s value is dependant on the demand of provider services from requestors, a large user network would be beneficial for Golem because it would allow task requests for processing power to be more organically fulfilled by processing power provider nodes. It is a platform primed to benefit from strong network effects.

This means Metcalfe’s law and PMR should be an important indication of the ‘true’ value of Golem and demand for GNT. However, because the Golem product is only in a beta phase and currently only has a single use case (CGI rendering), most of the GNT market cap and token value has been driven by speculation on crypto trading markets and expectations of future value and network size.

The relevance of GNT’s PMR as a value indicator should grow in the future, and Dapp usage numbers are encouraging – implying that Golem is a leader in the ‘developer’ focused category.

Turning to social indicators, the primary @Golemproject Twitter account currently has ~149,432 followers and is ranked as the 49,728th largest account on Twitter – averaging 12 retweets and 43 likes per post.

Follower growth has stagnated in recent months following sharp pickups during the most recent major price bull in late 2017 / early 2018. Over recent months the account has tended to pick up a few hundred followers a month, but in March the account gained over 1500 new followers.

There has been an increase in tweets per month for the Golem project account since January 2019, potentially in an attempt to capitalize on bullish momentum permeating through the alt-coin ecosystem.

Turning to developer activity, the ‘golemfactory’ has 64 repos on GitHub with core backend activity on a repo titled ‘golem’, other active repos include the Golem user interface repo.

Most coins use Github as their open development platform, where files are saved in folders called "repositories," or "repos," and changes to these files are recorded with "commits," which save a record of what changes were made, when, and by who. Although commits represent quantity and not necessarily quality, a higher number of commits can signify higher dev activity and interest.

The commit activity on the core golem repo has been consistent and active throughout the last year, generally averaging more than 20 commits per week, and on some weeks peaking as high as 66.

This is a bullish signal that developer activity and the building (quantitative) of the Golem project was generally unaffected by the bear market, with developers continuing to implement new code despite network value dropping.

Exchanges and trading pairs

Source: Brave New Coin

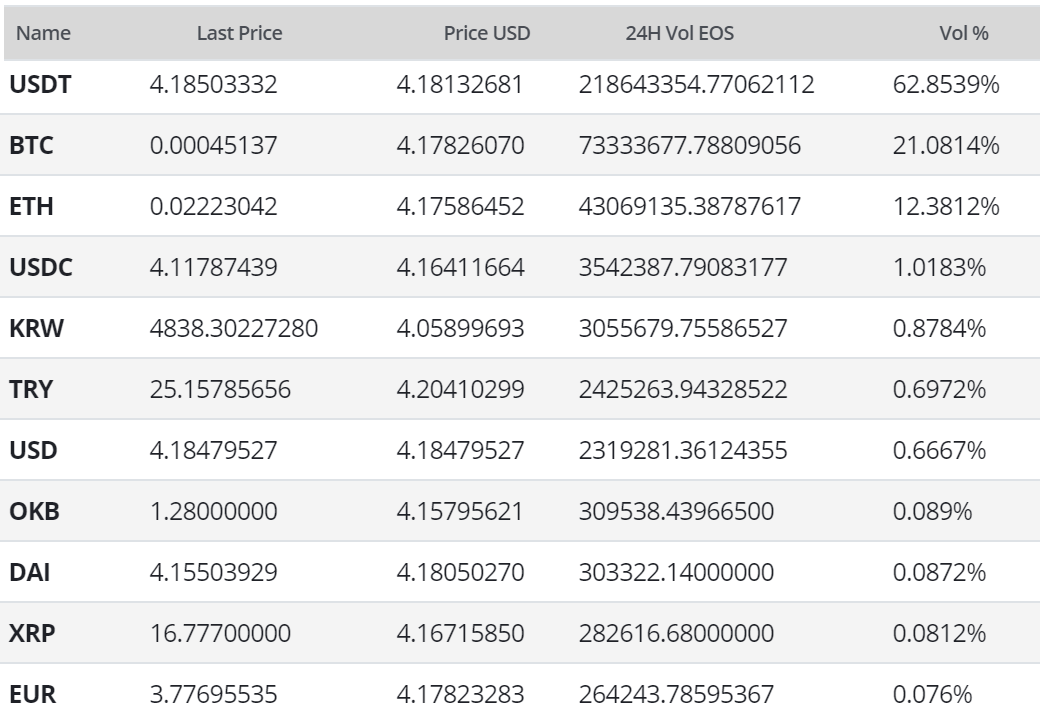

The most popular trading option for GNT is BTC, handling 46% of daily trading volume. The second most popular market is the GNT/USDT pair, and together the top two pairs make up over 73% of daily trading volume. There are multiple fiat options for GNT with the Korean won, US dollar and Turkish Lira markets all actively traded. The USD value of daily volume of the entire GNT market is ~ USD 16 million.

Source: Brave New Coin

The leading exchange for GNT trading is mega exchange Binance registered which operates a GNT/BTC market which currently handles over a quarter of daily trading, Binance also offers GNT/ETH and GNT/BNB trading pairs. GNT is also tradable on Huobi, Coinbase Pro and Bittrex.

Technical analysis

Moving Averages and Price Momentum

On the 1D chart, GNT has followed a negative linear price trend with a Pearson’s R correlation between time and price of ~0.86 (not shown), which has allowed a death cross to persist since 2018. Since early-February 2019, GNT has risen almost 75% and currently sits at ~USD0.097; above the 50 day EMA.

Additionally, on the 4H chart, GNT’s momentum produced a golden cross in mid-February, which resulted in price periodically using the 50 period EMA as support throughout the upward movement. However, price has currently fallen beneath the 50 period EMA, which may result in downside pressure until the 200 period EMA support near USD0.086.

Additionally, on the 1D chart, the volume flow indicator (VFI) is still strongly above 0, which is bullish for price. However, the VFI recently bounced off its four month resistance level of 27, which may indicate near term price weakness or a reversing trend.

Ichimoku Clouds with Relative Strength Indicator (RSI)

The Ichimoku Cloud uses four metrics to determine if a trend exists; the current price in relation to the Cloud, the color of the Cloud (red for bearish, green for bullish), the Tenkan (T) and Kijun (K) cross, Lagging Span (Chikou), and Senkou Span (A & B).

The status of the current Cloud metrics on the 1D frame with singled settings (10/30/60/30) for quicker signals is bullish: price is above the Cloud, Cloud is bullish, the TK cross is bullish, and the Lagging Span is above price and Cloud.

A traditional long entry would occur with a price break above the Cloud, known as a Kumo breakout, with price holding above the Cloud. From there, the trader would use either the Tenkan, Kijun, or Senkou A as their trailing stop.

Price originally completed a Kumo breakout back in early-March, and has continued the upward momentum with strong volume since then; touching Senkou B resistance of USD0.117. Given this strong breakout, it appears price may continue higher, despite the current weakness. Also, a further indicator that price is likely to compress in the near-term, is that RSI is in overbought territory. However, price has solid support at USD0.089, Senkou B, and USD0.081, Senkou A, which may stem the decline. If the aforementioned support holds, future price targets are USD0.117 and USD0.125.

The status of the current Cloud metrics on the 1D time frame with doubled settings (20/60/120/30) for more accurate signals are mixed: price is in the Cloud, Cloud is bearish, the TK cross is bullish, and the Lagging Span is in the Cloud and above price.

Price is currently attempting to complete a Kumo breakout. To date, price has failed to breach above Senkou B, cloud resistance near USD0.116. As mentioned above, the RSI metric is currently overbought, which indicates a price decline back towards Senkou B support levels of USD0.089 as likely. However, if support holds, price may still complete a Kumo breakout in the future due to a narrowing Cloud.

Conclusion

Long term GNT holders have had to wait over two years for tangible token utility and based on current development rates, they will likely have to keep the faith for some time yet as the network appears to be a long way from anything resembling a ‘final’ product.

That said, GNT has enjoyed a period of strong, stable price gains over the last few months suggesting a possible price bottoming and the end to a long term bear trend. Network development also continues to chug along at a steady pace with features like UI for the currently running Beta product consistently being improved. Usage of the Golem marketplace Dapp on the Ethereum mainnet looks steady and leads the nascent developer focused Dapp space, while short-term onchain volume signals lean bullish.

The technical indicators for GNT show continued bullish momentum, but current price weakness due to overbought conditions. On the 1D chart, the fast-setting trader (10/30/60/30)

will await price to maintain its current Kumo breakout via defending the USD0.089 Senkou B support level before entering a long position, while the slow-setting trader (20/60/120/30) will await price to bounce off Senkou B support of USD0.089, then breakout from the Cloud before entering a long position. In the event of failure, both trader’s support levels are USD0.08, USD0.076, and USD0.07. In the event of success, both trader’s price targets are USD0.116 and USD0.124.

Don’t miss out – Find out more today