NEO Price Analysis: NEO 3.0 launches to begin addressing inherent flaws

Price performance of the NEO token in 2019 has been strong, rewarding long term holders who held onto their tokens through 2018's price bear. The project's recent approach of embracing centralization is a reversal on previous attitudes but has advantages such as making it easier to implement network changes like the overarching NEO 3.0 updates. Inherent technical flaws within the network remain, however.

NEO is a platform blockchain that is often described as the ‘Chinese Ethereum.’ NEO was designed to host ICOs and Dapps using smart contracts powered by its own version of gas. The project was developed by a team originating from Mainland China with strong links to local enterprise, investors, and app developers in the region.

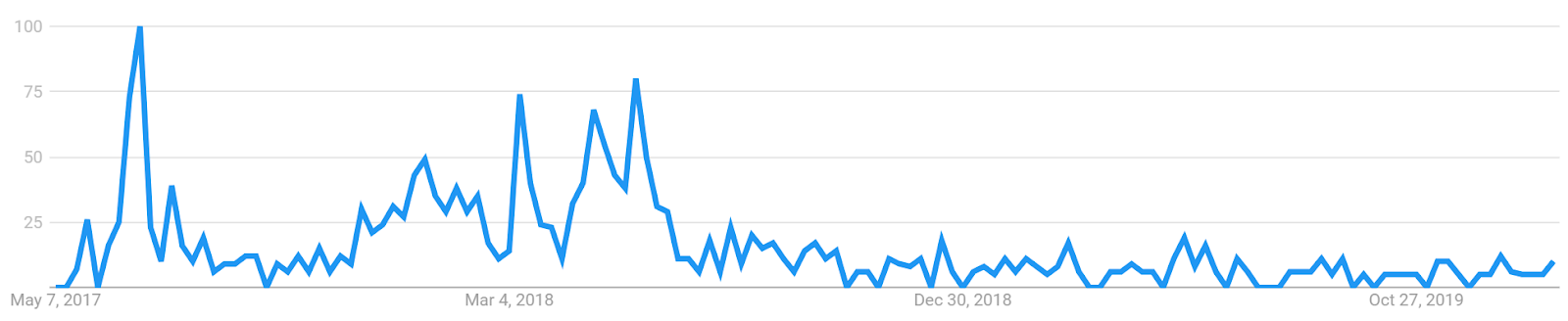

The price of the network’s native token (also called NEO), which acts as a share of the blockchain and as a way to access network governance rights, has risen ~77% since the start of January 2019. The price rises have coincided with a pick up in trading volume, particularly from the USDT market pairs on exchanges like Bitforex, Bitmart, and DragonEX.

NEO currently occupies the 17th position on Brave New Coin’s market cap table and has risen ~15% in the last week and 29% in the last month, performing well alongside the rest of the large/medium cap crypto market. This suggests that there is still underlying speculative demand for the token, and some bullishness towards the project’s future prospects because of ties to mega corporations like Microsoft. Some fundamentals, however, appear shaky.

A better colloquial title for NEO might be the ‘Centralized Ethereum.’ In a recent interview at Consensus 2019, NEO founder Da Hongfei stated, “If you are comparing NEO to Bitcoin, it is more centralized. That’s intentional. We want to keep it more efficient.”

At present, it appears that the NEO Foundation (formerly known as the NEO Council) operates 6 out of the 8 consensus nodes that manage the blockchain’s Delegated Byzantine fault tolerance (DBft) consensus algorithm. Based on the foundation’s most recent financial report (May 11th, 2019) it currently holds 43,871,532 NEO tokens. This is just under 44% of NEO’s total supply, an objectively high amount.

The NEO blockchain lets NEO token holders vote in consensus. How efficient these votes are, given the number of consensus nodes currently operated by the NEO Foundation and how much of the network’s stake they currently control, is unclear. During the interview, Hongfei described issues with network voter turnout and he outlined future goals to incentivize participation.

The recent approach by the NEO Foundation to embrace centralization is contrary to steps taken in the last few years to reduce network power held by the NEO Foundation.

Centralized networks have some inherent advantages over their decentralized counterparts. They are always likely to offer higher throughput, faster speeds, and higher capacity. NEO proposes to offer 10,000 transactions per second, which would reduce some of the bottlenecks that occur on proof-of-work platform blockchains like Ethereum.

It is also much easier to implement network updates via hard forks to the blockchain. This comes at the sacrifice of active community discussion and involvement. Centralized blockchain solutions may be coming into fashion within sections of the ecosystem given the hype and coverage surrounding Facebook’s soon to be launched permissioned blockchain project.

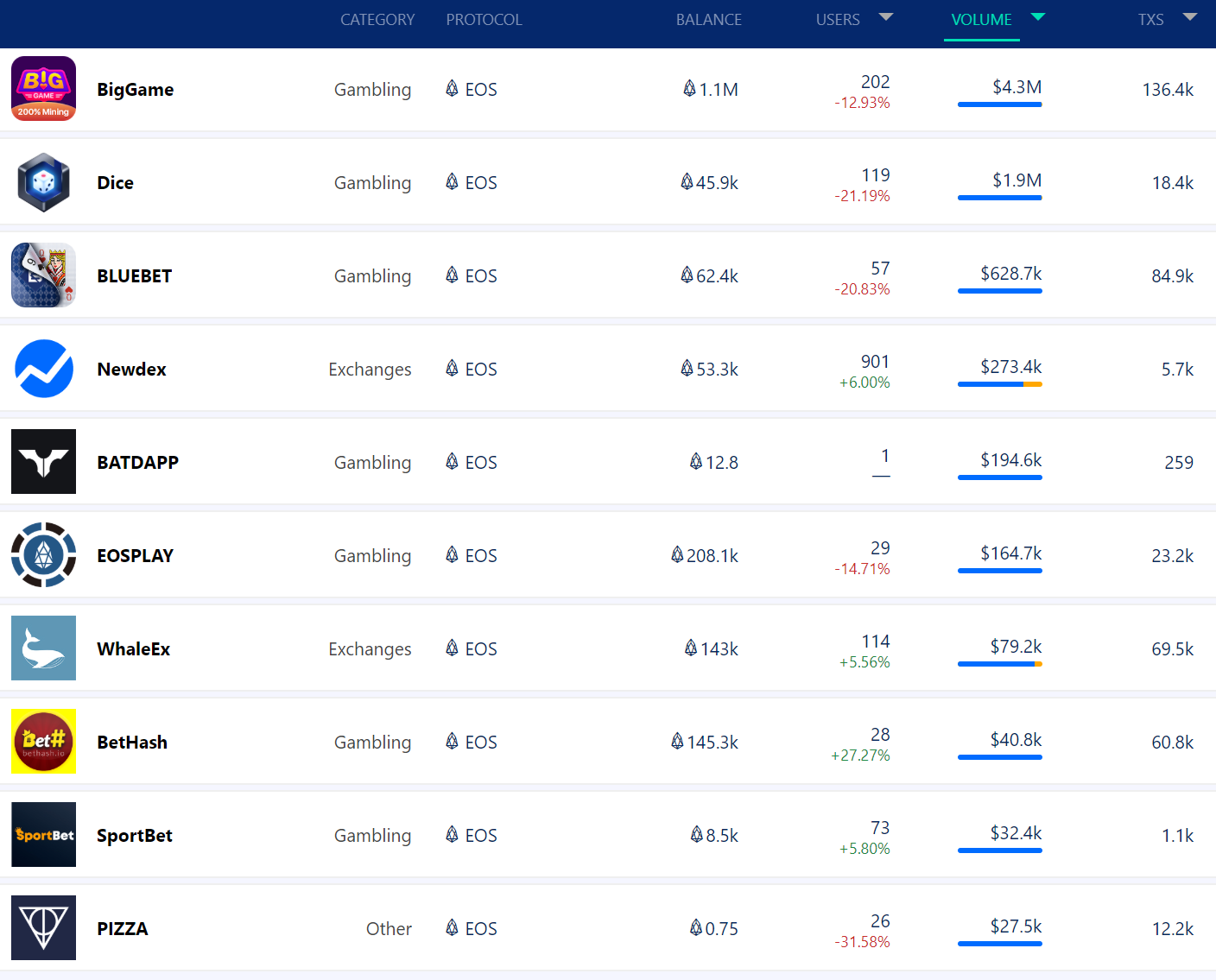

NEO uses the Delegated Byzantine Fault Tolerant (dBFT) consensus mechanism and has 15-20 second block times. The network’s nodes are separated into two categories: consensus nodes and user nodes. Consensus nodes (sometimes referred to as bookkeepers within documentation) are delegated by the network and earn a cryptocurrency called GAS through the block reward. Other nodes are simply users of the network. User nodes can earn GAS by holding NEO in a wallet, a process similar to staking. NEO GAS is used to interact with the network and is comparable to Ethereum GAS and EOS RAM.

Based on current NEO block generation rates (16.47 seconds), holding 1000 NEO (~USD 14,000) in a supported wallet would net a user ~134 GAS a year. Which equals an actual ROI of 3.1% based on the current GAS price of ~USD 3.31

While NEO was written in C#, it supports a variety of programming languages such as Javascript, Java, Python, and Go.

Idiosyncratic chain design

NEO’s delegated byzantine fault tolerance consensus algorithm has several unique properties that may prove advantageous. For example, the network has an increased security layer because transaction verifiers (known as bookkeepers) are permissioned (not anonymous) and have incentives aligned because of accountability within the network’s immutable ledger.

This reduces the possibility of bad actor block producers appearing on the network. The NEO chain is designed to be unforkable without clear permission from consensus nodes, with only one block being proposed at any time. In practice this means transaction times are completely equal to block times, making NEO a very unique blockchain at an operational level.

The standard ‘look’ of a POW or POS chain — with transactions needing to find the longest chain before finalizing.

The NEO delegated byzantine fault tolerance chain is not dependent on the confirmations of other transactions. This ‘perfect finality’ characteristic of the NEO blockchain can only operate because of its ‘trusted’ node structure. This allows for expedited transactions, which are likely to appeal to the large enterprise projects that NEO proposes to target.

These design decisions, however, mean that NEO has some disadvantages when compared to public, prooof-of-work blockchains that are distributed, decentralized and have a higher hash rate. Networks like Ethereum, for example, are able to offer censorship resistance and immutability of transactions, with less governance power between nodes and greater transparency of network activity.

As a more centralized network, access to granular fundamental network data is limited. Metrics like hash rate, difficulty, days destroyed, and individual Dapp usage are unavailable or irrelevant. However, data on on-chain transactions, transaction volume, and active addresses can be gathered using NEO block explorers.

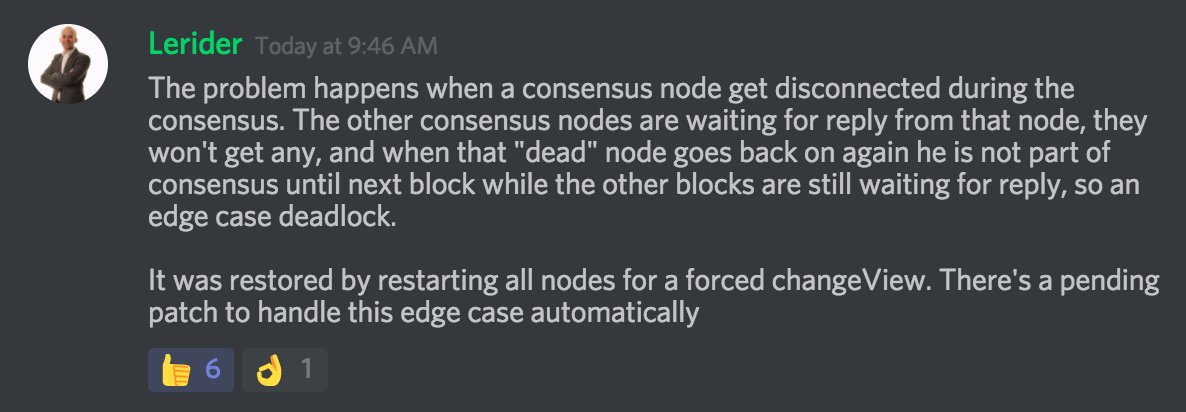

NEO recently updated its dBFT to version 2.0. In NEO dBFT 2.0, a recovery mechanism has been added to improve the stability of the consensus algorithm. In the rare occurrence of a network failure or a node failure, a quick recovery is expected.

A post from Malcolm Lerider discussing issues arising on the NEO blockchain from 2018 when individual consensus nodes switch off. These issues appear to have been addressed as part of the network’s dBFT 2.0 update.

A recently released roadmap from the NEO Foundation suggests a number of other updates are in the pipeline. They are designed to solve some of the blockchain’s historic issues. This group of key updates designed to improve and extend core network efficiency is part of a wider redesign referred to as NEO 3.0.

NEO is currently built with two native ecosystem interaction tokens. NEO is akin to the network’s membership/governance token and represents users share of the NEO blockchain. It is also used for voting rights towards consensus nodes. GAS is allocated as a dividend to wallets holding NEO. Holding it is required for executing smart contracts. Gas can be considered the native ecosystem utility token and currency for NEO. Gas appears to be a more useful way to make in-Dapp transactions and other network transactions.

Currently, there is a relatively high cost of deploying and running smart contracts on NEO that has lead to a reduction in smart contract usage and development. For example, the Loopring decentralized exchange liquidity and framework protocol decided to shift away from its NEO-based DEX solutions because of the inefficiencies and high costs associated with NEO smart contract execution. Another project, Effect.AI which ran its ICO on the NEO blockchain chose to migrate to the EOS network in February 2019.

In a blog post explaining the decision, Effect.AI stated, “NEO’s free transaction system for end users turned out not to be viable as they coped with multiple malicious spam attacks, the current state of the blockchain has a limited transaction throughput, and the smart contract compilers, besides C#, are quite immature.”

GAS costs are not the only issue associated with launching on NEO. Smart contract audits from as recently as October 2018 have found major code vulnerabilities in NEO NEP-5 contracts (the NEO network’s most commonly used ICO protocol). A particular flaw allowed users to artificially add to the total supply of a major NEO project, DeepBrain Chain, by transferring their tokens to an unspecified address. As such, NEO smart contracts have been reported to be challenging to work with and buggy.

As part of NEO 3.0, the blockchain will seek to address this issue by significantly reducing the deployment and execution costs of smart contracts. In theory, this should expand the application scenarios of NEO gas and encourage Dapp building. Prior to the launch of the new GAS pricing model, projects can apply for grants from the NEO Foundation to assist with contract deployment costs.

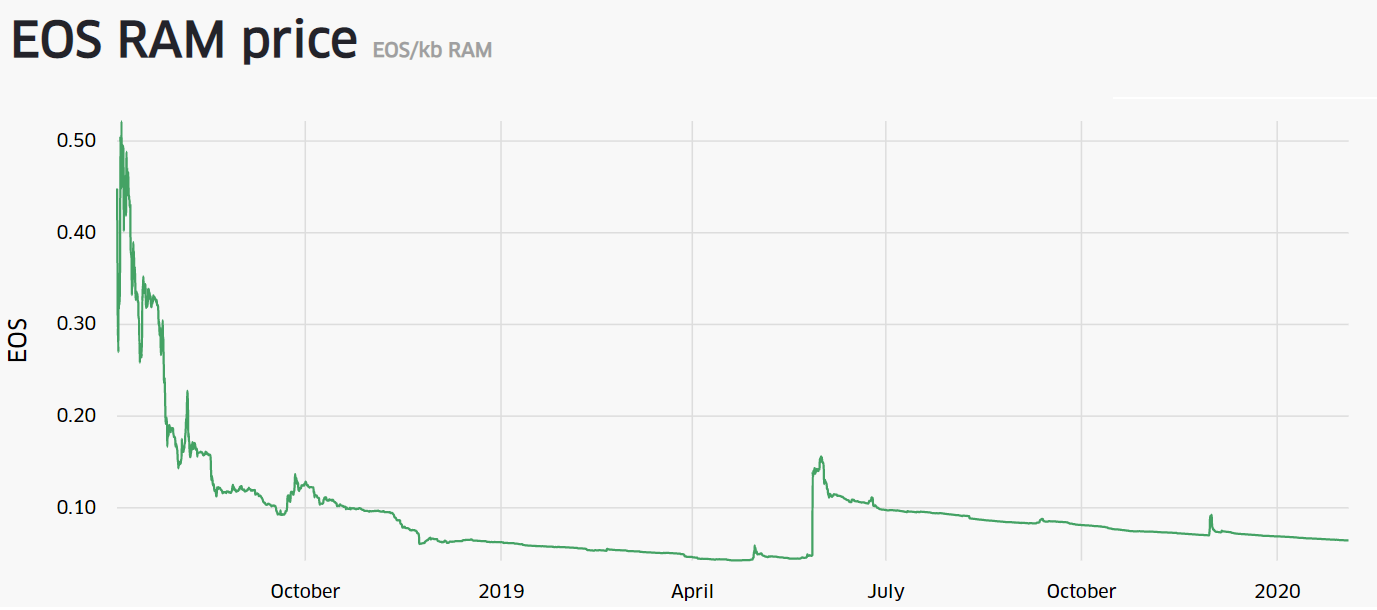

The efficiency of GAS as an ecosystem currency is often affected by a history of volatile price activity. Historical price charts indicate that the prices of NEO and GAS tend to move closely together, with both heavily affected by external market conditions and ecosystem sentiment. Given the close correlation between the two assets, the question of why the network requires two native tokens for shares and utility arises.

The tendency for GAS prices to fluctuate in price means smart contract costs are unpredictable and less effective as a medium of exchange for Dapp payments when compared to other models like DAI on Ethereum.

Objective on-chain indicators

NVT Signal

Derived from the NVT ratio, the NVT signal is a responsive blockchain valuation metric developed by Willy Woo and Dmitry Kalichkin.

Crypto markets are prone to bubbles of speculative purchasing that don’t reflect underlying network fundamentals. The NVT signal provides insight into what stage of this price cycle a token may be at.

A high NVT signal is indicative of a network that is going through one of these bubble periods and may move towards a position of becoming overbought/overvalued, as the market’s speculative momentum slows.

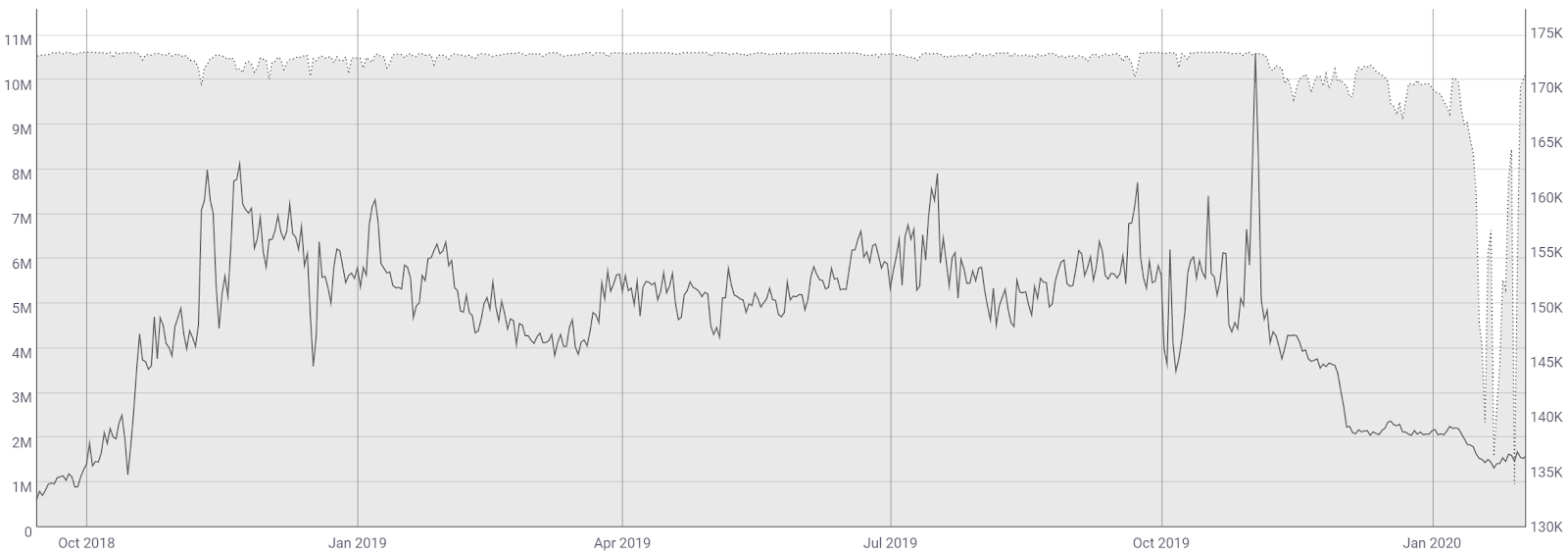

Onchain data Source: Coinmetrics community network data

The fundamental signals given by NEO’s NVT signal lean bullish. In 2019, the network’s NVTS has fallen alongside the token’s rising price line. This suggests a pick up in on-chain activity higher than the network’s rising external value and may suggest short term undervaluation that may eventually be realized by future price gains.

Dapps like the Switcheo DEX, which appears to have some active daily trading activity on pairs like NEX/NEO and SWTH/NEO, may be drivers of recent on-chain transaction activity.

PMR

Metcalfe’s law is a measure of the connections in a network, as established by Robert Metcalfe, the founder of Ethernet. It has subsequently been used to analyze the true value of network-based financial products like Facebook and Bitcoin. By comparing it to price, it can provide a useful tool to assess whether a token is over or undervalued.

It is also a more straightforward metric to assess when compared to on-chain transaction volume, which can be challenging to measure accurately in USD terms. Addresses are measured as the number of unique sending and receiving addresses participating in transactions daily.

Onchain data Source: Coinmetrics community network data

NEO’s PMR has been high in natural log points since the genesis of the network, meaning Metcalfe’s law (network connections) has always exceeded the market cap of NEO, pointing to long term overvaluation based on implied network effects.

A cryptocurrency’s network effects increase when new users join and strengthen the network, making it more valuable for existing users. The most direct network effects are improved liquidity and utility. More daily active users can be indicative of a higher level of viable Dapps (more places to spend NEO) and more counterparties willing to accept NEO for payments.

NEO, through its developer grant model and significant war chest (the NEO Foundation’s total diversified holdings (crypto and fiat) is currently worth ~USD 535,000,000), may be able to encourage ecosystem building. If more Dapps across sectors like decentralized finance and digital identity (NEO has prebuilt features for identity encryption) join the ecosystem, daily active address numbers will rise.

Active address and new address activity has fallen away significantly over the last year. This is counterintuitive given the improvements and updates to the network over this time period. This suggests recent value gains have been driven by speculative trading activity or through increased token movements from whale accounts.

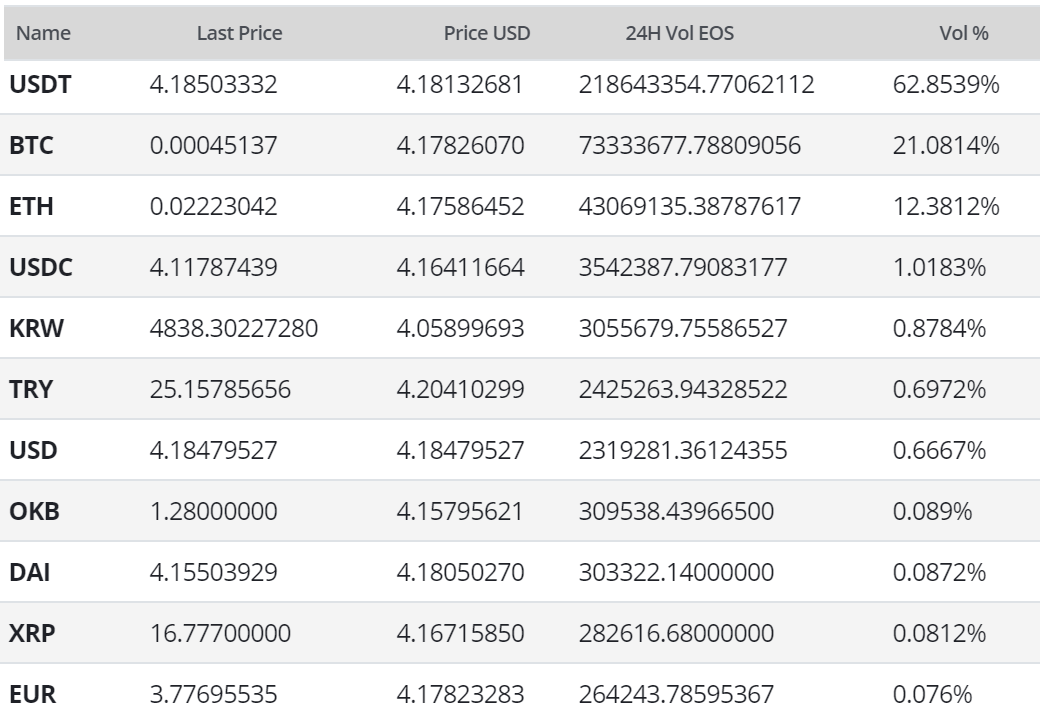

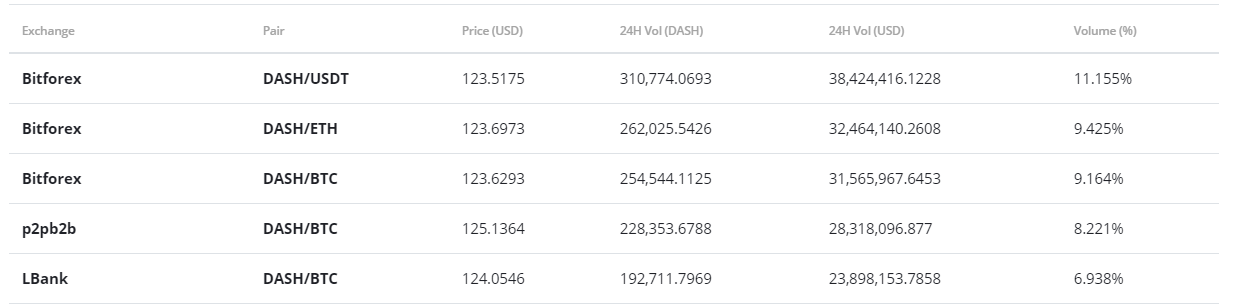

Exchanges and trading pairs

The most popular trading option for NEO is USDT with the pair currently handling close to 50% of daily trading volumes. The second most popular market is the NEO/BTC pair. Together the top two pairs make up over ~81% of the daily trading volume. The USD pair is the most popular fiat off-ramp liquidity solution for NEO. The USD value of the daily volume of the entire NEO trading market is ~USD 53 million.

A mix of exchanges contributes to the NEO trading ecosystem, with the top 5 pairs spread across 5 exchanges. The NEO/USDT market on BiteBTC is the most active market in the ecosystem. NEO is also tradeable on more high profile exchanges such as Binance and Bittrex.

Technical Analysis

Moving Averages and Price Momentum

On the 1D chart, a golden cross has yet to occur for NEO despite following a strong linear trend since the 2018 ‘bottom’; resulting in ~155% price increase. Despite the lack of golden cross, price has consistently used the 50 day EMA as support and is currently above both 50 and 200 day EMAs.

On the 1D chart, NEO’s 2019 price patterns have generally followed the Fibonacci retracement levels. Particularly, price has failed to break above the 0.786 level of $14.15 three times (black arrows). Currently, price is attempting to breach and hold above this level at $14.19. However, if price fails to breach this level again, NEO will complete a double top pattern, which will likely see price retest the 0.382 level of $9.79.

Lastly, on the 1D chart, the volume flow indicator (VFI) is still above 0 and trending strongly upward. Additionally, the strong uptrend has persisted since the 2018 bottom and has shown no signs of abating, to-date. However, if VFI does fall through the trend line, it would likely signal that price will fail to breach the 0.786 level once again, which would be a sell signal.

Ichimoku Clouds with Relative Strength Indicator (RSI)

The Ichimoku Cloud uses four metrics to determine if a trend exists; the current price in relation to the Cloud, the color of the Cloud (red for bearish, green for bullish), the Tenkan (T) and Kijun (K) cross, Lagging Span (Chikou), and Senkou Span (A & B).

The status of the current Cloud metrics on the 1D frame with singled settings (10/30/60/30) for quicker signals are bullish: price is above the Cloud, Cloud is bullish, the TK cross is bullish, and the Lagging Span is above Cloud and price.

A traditional long entry would occur with a price break above the Cloud, known as a Kumo breakout, with price holding above the Cloud. From there, the trader would use either the Tenkan, Kijun, or Senkou A as their trailing stop.

Price recently completed a Kumo breakout in late-May 2019. Despite initial struggles to maintain the breakout, price firmly bounced off Cloud support on June 11, 2019. As mentioned prior, Fibonacci resistance is the next obstacle to overcome before marching higher. One point of hesitation might be the RSI at 67, which is approaching the overbought zone of greater or equal to 70. Entrance into this zone has resulted in subsequent price decreases (black circle).

However, if momentum persists and the Fibonacci resistance is overcome, price targets are $16.71 and $17.84. If price falters, support levels are $12.50, $11.16, and $10.50.

The status of the current Cloud metrics on the 1D time frame with doubled settings (20/60/120/30) for more accurate signals are bullish: price is above the Cloud, Cloud is bullish, the TK cross is bullish, and the Lagging Span is above the Cloud and price.

The slower settings yield very similar results; including current Kumo breakout, and price targets and support levels.

Conclusion

The price performance of the NEO token has been strong in 2019 and it has maintained its position as a top-20 digital asset. The blockchain appears to be gearing up to solve some of its most pressing issues as part of the ongoing NEO 3.0 updates. The blockchain is likely to become much easier to interact with over the course of the next year.

Implementing these changes has become more straightforward because of the project’s centralized approach. While this may frustrate some in the crypto ecosystem it is unlikely to be an issue to NEO’s core user base as it is intended to enable quicker throughput and increased spending on new projects by the NEO treasury.

NEO, however, has inherent issues that will be difficult to address. Projects seem to be opting out of the NEO blockchain because of problems with its smart contract model, and the dBFT consensus model remains ‘faulty’ because of a broken voting model.

The technicals for NEO are currently bullish with a slight hint of Fibonacci resistance caution. Despite the current Kumo breakout, a more conservative approach for both the fast-setting trader (10/30/60/30) and slow-setting trader (20/60/120/30) will be to await price to firmly settle above $14.15 (0.786 Fibonacci level) before entering a long position. If the aforementioned occurs, price targets are $16.71 and $17.84. If resistance prevails, support levels are $12.50, $11.16, and $10.50.

Don’t miss out – Find out more today