SALT Price Analysis – A smart contract lending platform which uses crypto-backed collateral

SALT is a loan platform that aims to marry the old and new world of finance by enabling cryptocurrency collateralized blockchain-backed loans with smart contracts. Currently, only Bitcoin and Ethereum collateralized loans are obtainable. Further crypto-collateralized loans are also on the roadmap, as well as a SALT credit card set to launch after June 30th.

SALT is a loan platform that aims to marry the old and new world of finance by enabling cryptocurrency collateralized blockchain-backed loans with smart contracts. Currently, only Bitcoin and Ethereum collateralized loans are obtainable. Further crypto-collateralized loans are also on the roadmap, as well as a SALT credit card set to launch after June 30th.

The platforms parent company, SALT Lending Holdings LLC, is a Denver-based company. CEO Shawn Owens has extensive work experience in hospitality, most recently as COO for Southern Concepts Restaurant Group. SALT Lending Holdings COO, Gregg Bell, holds a B.S. in Financial Economics from Vanderbilt University and his previous work experience includes structured products at the Royal Bank of Scotland and ArrowMark Partners.

Owens had the idea for crypto-backed loans in 2016, after realizing that crypto investors often want to hold on to their investments rather than spend them. The biggest draw is the ability to obtain a traditional cash loan without selling the underlying crypto holdings. This allows for long-term holding while leveraging assets to spend when needed, which provides tax advantages in certain jurisdictions.

SALT Platform

The loan process occurs in stages. First, a borrower opens a membership account and forwards their collateral to the SALT Oracle Wallet (SOW), a multi-signature wallet that functions as a repository for collateral and manages the lending terms. Once the loan is approved, the funds are transferred to the borrower’s bank account or address. The borrower makes periodic payments to the lender, and once the loan is repaid, the borrower’s collateral is returned.

The SOW monitors several aspects, both the loan origination and the payments made by the borrower to the lender, the value of the blockchain asset held as collateral, storage of collateral until loan terms are fulfilled, and dispersal and/or liquidation of collateral according to loan terms. The SOW also generates alerts if the blockchain asset drops below an agreed-upon threshold, and will also trigger maintenance calls. If the threshold for collateral liquidation is breached, the SOW triggers a liquidation event.

While borrowers are not subject to credit checks, they are required to verify their identity for Know Your Customer (KYC) and Anti Money Laundering (AML) regulatory compliance. Lenders are required to be accredited investors and must also pass SALT’s lending suitability test. Loans are only currently available in New Zealand, the United Kingdom, and select states in the United States.

Current SALT Loan Availability in the U.S. and beyond.

SALT Lending Holdings, LLC, has also created a Blockchain Asset Management company, which acts as an investment advisor with a “focus on income-producing loans that offer indirect exposure to blockchain based assets via secured credit instruments” through the SALT platform.

The platform currently has 65,981 active members and $39,109,000 in funded loans. The lender to borrower ratio, the number of successful loans that have occurred, and the default or liquidation of collateral percentage do not appear to be publicly available.

One borrower on the platform, who would like to remain anonymous, spoke to BraveNewCoin (BNC) saying they’ve had a “flawless experience” after having gone through two cycles of borrowing and retrieving collateral.

Another borrower on the SALT platform, who would also like to remain anonymous, spoke to BNC saying they have had a “mixed experience” and SALT is “still figuring it out.” When excess collateral is held by the loan, SALT is required to return the excess collateral to the borrower within 24 hours if requested. In this users case, the process took over one week.

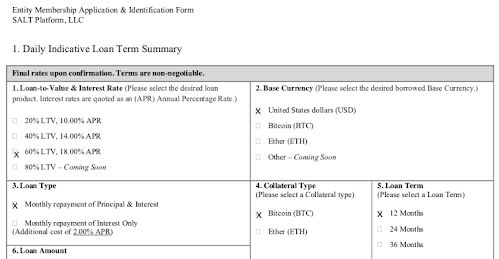

SALT Loan Application

SALT membership currently has three tiers. “Base” allows for up to US$10,000 in borrowing, with an annual cost of 1 SALT token. “Premier” allows for up to $100,000 in borrowing, with an annual cost of 10 SALT tokens. “Enterprise” allows for up to US$1,000,000 in borrowing, with an annual cost of 100 SALT tokens.

While the initial value of 1 SALT token on the platform was US$25, it has fluctuated and is currently US$27.50. The value for SALT tokens on the platform, according to their FAQ, “is determined by the operational costs associated with providing our service.”

SALT tokens currently trade on the open market for ~US$4.35 and can be used to access the lending platform. However, the platform documentation states “SALT not purchased from SALT Lending or SALT removed from the dashboard may not be refunded.”

The SALT Initial Coin Offering (ICO) occurred in 2017, from August 1st to August 15th, where tokens were sold at a rate of US$0.89. The token was launched on Ethereum and follows the ever-popular ERC20 token standard.

The ICO raised 100% of their US$48,500,000 goal, distributing almost 55 million, or 45%, of the 120 million tokens created. A notable advisor of the project included Erik Voorhees, a Colorado native and early Bitcoin adopter with involvement in Coinapault, BitInstant, and Satoshi Dice. He is also the founder and CEO of ShapeShift.io. BNC is also a strategic partner.

SALT Token Supply

SALT transactions have essentially mirrored the market price of the token itself. The number of transactions per day is currently at one of the lowest recorded levels since inception. Aside from speculation, an increase in demand for lending and borrowing on the SALT Platform should also increase the token price.

Technical Analysis

Technical Analysis

After reaching record lows against USD, SALT looks poised for a trend reversal. Although no direct SALT/USD pair exists, a SALT/USD chart is available on TradingView. SALT also has very little available trading data, in this case, lower time frames can be reliably used to help determine if a trend exists, if a trade should be entered, and where support or resistance targets may be located. The status of any existing or emerging trend can be determined using Ichimoku Cloud. Further background information on the technical analysis discussed below can be found here.

The Ichimoku Cloud uses four metrics to determine if a trend exists; the current price in relation to the Cloud, the color of the Cloud (red for bearish, green for bullish), the Tenkan (T) and Kijun (K) cross, and the Lagging Span. The best entry always occurs when most of the signals flip from bearish to bullish, or vice versa.

The status of the current Cloud metrics on the daily time frame, with doubled settings (20/60/120/30) for more accurate signals, remain bearish on balance; price is breaching Cloud resistance, Cloud is heavily bearish, the TK cross is recently bullish, and the Lagging Span (LS) below Cloud but above price.

A traditional Cloud long entry signal will not occur until price is above Cloud with volume. The flat Kumo at ~US$11 should be considered a high probability target now that price has breached Cloud resistance. Price has also recently completed an Adam and Eve double bottom and has broken resistance on extremely high volume.

Conclusion

Conclusion

SALT is a smart contract lending platform which uses crypto-backed collateral. The secret in the sauce relies entirely on the smart contract and its ability to act as an arbiter and loan manager, which according to many users has been a successful process.

A goal of the platform, as well as blockchain technology in general, is to eventually reach the two billion underbanked and unbanked. This may be difficult for most individuals considering, on-ramping to cryptocurrency from fiat typically requires a bank account in most countries. However, OTC deals for on-ramping have begun to increase recently, especially in Venezuela.

However, the value of the SALT token on the platform seems very arbitrary and would benefit from increased transparency. In order to objectively determine if the platform is a success, or at least headed in the right direction, more platform usage data needs to be released or tracked over time.

Technicals suggest strong bullish movement against USD, BTC, and ETH pairs with respective targets of US$11, 0.000736 BTC, and 0.014 ETH. Although these targets look convincing based on the Cloud, these targets are heavily reliant on minimal historical data.

Don’t miss out – Find out more today