Coins to Watch: SOLANA

In 2021 Solana soared from the 26th largest asset by market capitalization to the 5th. So what drove its rise and what can 2021's performance tell us about the Solana price potential in 2022?

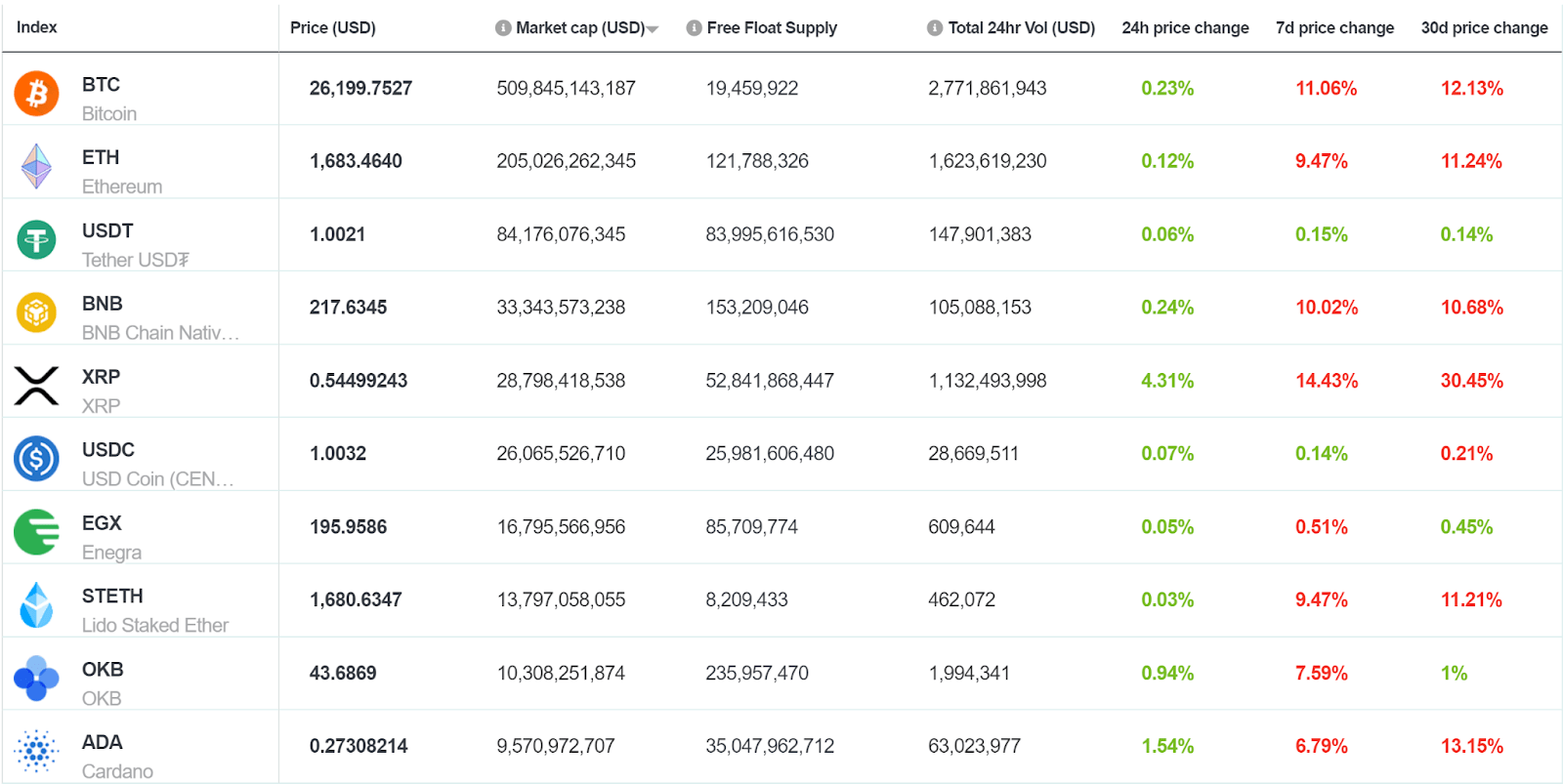

In 2021, the crypto markets were defined by the eye-popping growth of platform blockchains. Today, six out of the top 12 assets on the Brave New Coin market cap table, Ethereum (ETH), Binance Coin (BNB), Solana (SOL), Cardano (ADA), Terra (LUNA), Avalanche (AVAX) are the native tokens of platform blockchains.

It’s not just the token market cap that is growing, large sums of money are also flowing into these platform blockchains to be used on-chain. Defi Lama reports that the total value of assets locked (TVL) into the Solana blockchains currently sits at ~US$9.91 billion. The TVL of the platform is up ~600% since August last year.

Solana was one of the first alternative layer-1 platform blockchains to break into the Brave New Coin market cap top 10. At the start of the 2021, Solana was the 112th largest asset in the crypto space with a market capitalization of ~US$100.7 million and the Solana price was US$2.16. Today, SOL is the 6th largest asset in the crypto space with a market capitalization of ~US$33 billion. The SOL price is now US$95.59.

It has been a historic 18 months for Solana, from a position of relative obscurity at the start of the year – to the number 5 position 12 months later. The asset is now established as a large cap cryptographic asset and one of the largest platform blockchains in the world. The following article looks at the growing Solana ecosystem, considers the reasons for its strong performance in 2021 and looks at important developments that may impact its 2022 performance.

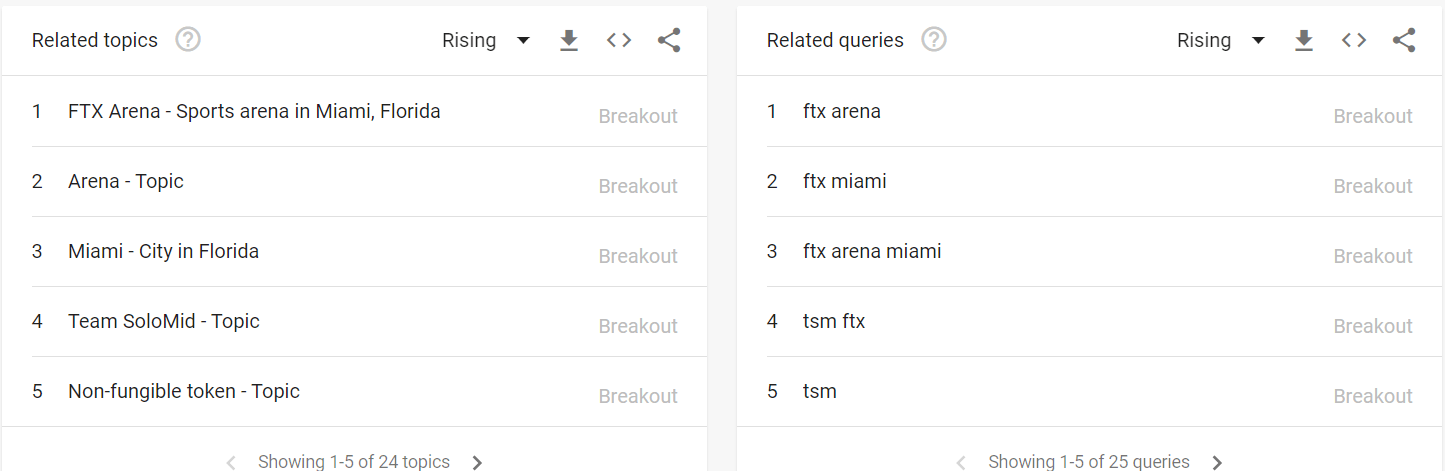

Source: Google Trends.

Source: Google Trends

Worldwide search interest for the term ‘Solana’ surged in mid-August and peaked on September 5th-11th, 2021. It has trailed off considerably since, however, this may be down to exogenous factors with search interest for other large-cap crypto assets also dropping sharply.

The all-time-high of SOL, US$260, was hit on November 6th. Since this price peak was reached the price of the asset has dropped ~63%. There have been negative macro tailwinds that have pulled back the price of SOL over this period such as a strengthening US dollar, and flight away from risk markets. The project, however, has faced internal issues stemming from issues handling congestion, and the exploit of network smart contracts. These internal issues have eroded some of the confidence in the project.

What is Solana?

Solana (SOL) is a platform blockchain that focuses on delivering fast, cheap, and scalable smart contract solutions. The network has been described as idiosyncratic because of the unique method it uses to order transactions and achieve higher blockchain throughput. The network is powered by the SOL token which is used to interact and transact with the Solana blockchain.

Solana was founded by Anatoly Yakovenko in 2017. Yakovenko worked for Qualcomm and Dropbox before building Solana. Along with co-founders Greg Fitzgerald and Eric Williams, Yakovenko sought to build a blockchain that solved the throughput and scalability issues inherent with Bitcoin (BTC) and Ethereum (ETH), but without any trade-offs.

Solana is a third-generation blockchain (as are Cardano, Tezos, and Polkadot). It seeks to challenge the incumbent centralized, legacy financial network by learning from and improving the architecture used by first and second-generation blockchains such as Bitcoin and Ethereum.

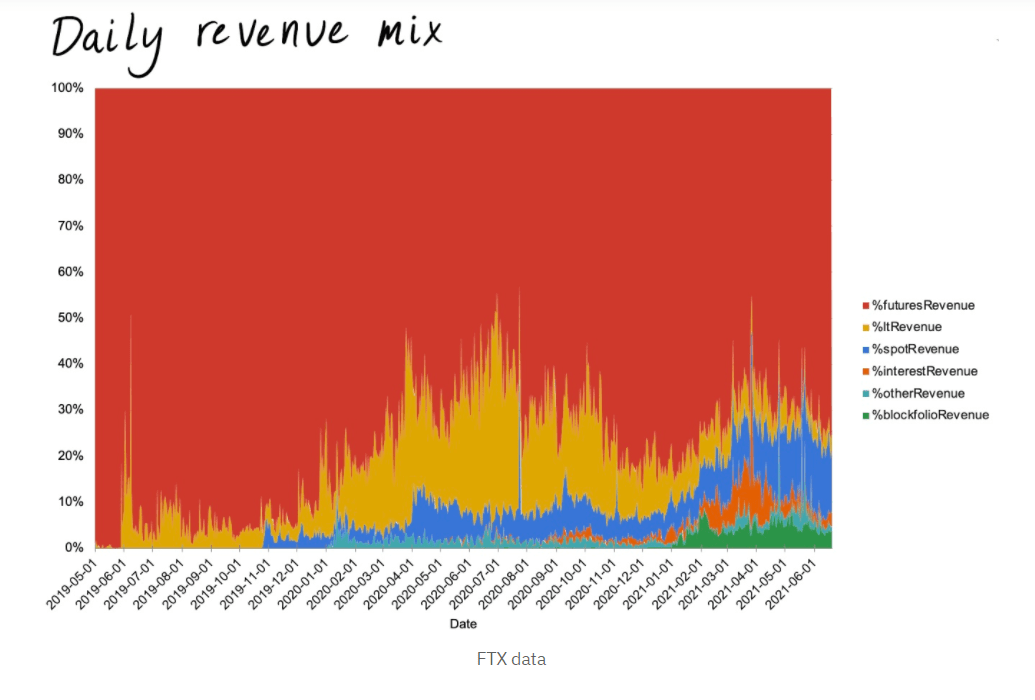

Table built by @rareliquid

Solana is currently running at a range between 2300-1700 Transactions per second (TPS), which compares favorably to Ethereum which runs at 14 TPS. As the above table indicates, however, both networks are capable of processing higher throughputs, with Solana theoretically being capable of throughput of up to 65,000 transactions per second (TPS).

Much of the buzz surrounding Solana stems from the impressive performance capabilities of its blockchain network product. It offers fast transaction times at extremely low fees, even compared to other post-Ethereum platform blockchains. Compared to other high throughput networks such as the Binance Smart Chain, Cardano, and Cosmos, it is also relatively decentralized having just over 900 validators.

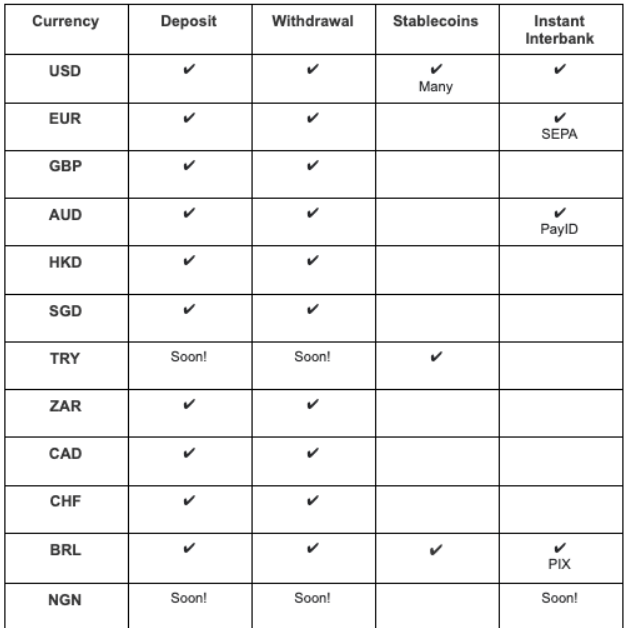

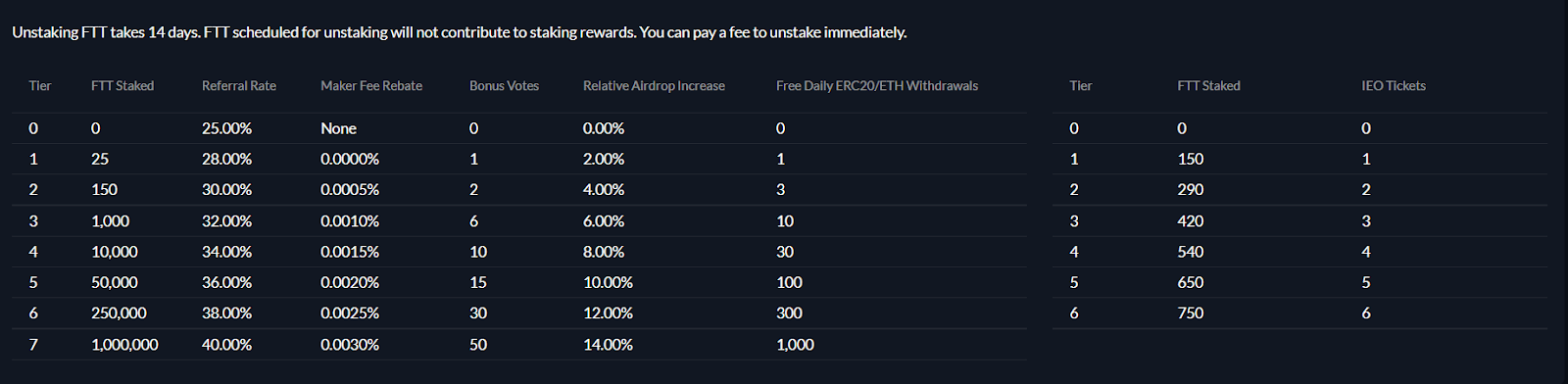

Popular business and investment blogger Packy Mcormick writes glowingly about the Solana user experience in his blog, “the proof is in the experience,” he writes. “I’ve spent a bunch of time playing around with Solana – purchasing SOL on FTX.US, downloading a Phantom wallet, staking and unstaking, buying RAY on Raydium and staking that, and I have to say… It’s really fast and really cheap. You don’t need to think twice about doing anything because it moves so quickly and costs so little. That’s the point. It feels like using the internet.”

It is also notable for its integration with the Torus wallet, a web3 wallet that lets users interact with Solana based decentralized apps and smart contracts through logins they are familiar with. Torus has a seamless 0auth login system that allows users to access web3, with similar functionality to Metamask, using Email, Google, Twitter, Facebook, and other popular social login profiles. Tools like this bridge the gap for mainstream users to access Web3 and Dapps.

What is Proof-of-History validation?

One of the reasons Solana stands out from other platform blockchains is its unique architecture and technology base. Solana is a Proof-of-Stake blockchain that uses the same hashing function as Bitcoin, SHA-256. It uses a unique, trustless way to determine the time of a transaction called Proof-of-History (PoH).

The SHA-256 algorithm takes inputs from users and encrypts them to produce a unique output that is difficult to predict. Solana takes the output of a transaction and uses it as the input for the next hash. The order of the transactions is now inbuilt into the incoming hashed output. This is different from how the Bitcoin blockchain operates.

The Solana PoH hashing process creates a long, unbroken chain of hashed transactions. This is designed to create a clear and verifiable order of transactions so that when a validator adds to a block, they don’t need to use a conventional timestamp.

Blocks on the Bitcoin blockchain are large and unorganized. Each BTC miner adds the time and date to the block they mine based on their local time. Other nodes in the network then have to verify that the timestamp provided by the miner is valid because it may be false or differ from the time reported by other miners. This is time-consuming.

By ordering transactions into a chain of hashes, however, Solana validators are able to process and transmit less information per block. Having that hashed version of the latest state of transactions constantly recorded greatly reduces the time to confirm each block on the Solana chain. Transactions on Solana are verifiably ordered without all nodes needing to agree simultaneously. This is a key reason why it is so quick.

Proof-of-History combines with other features of Solana to optimize and speed up throughput. For example, TowerBFT is Solana’s version of a Byzantine fault-tolerant Proof-of-Stake consensus model that uses the cryptographic clock enabled by PoH to speed up blockchain consensus by reducing messaging overhead and transaction latency. Selecting the next Proof-of-Stake node to validate a block of transactions becomes faster because nodes need less time to verify the order of transactions.

In a blog post from July 2019, Anatoly Yakovenko describes eight key innovations that make Solana “the First Web-Scale Blockchain”. Aside from Proof-of-History and Tower BFT, the six other key innovations are:

- Turbine — a block propagation protocol

- Gulf Stream — a mempool-less transaction forwarding protocol

- Sealevel — parallel smart contracts run-time

- Pipelining — a transaction processing unit for validation optimization

- Cloudbreak — a horizontally-scaled accounts database

- Archivers — distributed ledger storage

When combined, these features allow Solana to offer transactions and fees at a speed and cost much lower than other smart contract platforms.

SOL staking for yield farming

As mentioned, Solana is a proof-of-stake blockchain with a focus on delegations. This means that anyone who holds SOL tokens can choose to delegate some of their SOL to one or more validators, who process transactions and run the network. SOL users need to stake or lock up their tokens with a validator.

In mid-June 2021, Staking Rewards.com listed Solana as the fourth-largest blockchain by value of assets staked – with ~US$13.5 worth of assets staked to it. The Cardano, Polkadot, and Ethereum blockchains were all ahead of it at the time. Today, Solana is the largest staked network with US$39 billion staked on it.

The current estimated interest rate for SOL holders who delegate their tokens to a validator is 5.54%. Adjusted for the inflation rate of network supply, however, this interest rate drops to 0.86%. According to Staking Rewards, validators running a Solana Node will earn an interest rate of 6.14% but once adjusted for network supply inflation this drops to 1.43%.

Users can delegate their tokens to a staking pool that will, for a fee, participate in the network’s Proof-of-Stake consensus on behalf of the delegator. Or run a node themselves and directly participate in consensus. Staking rewards.com describes the complexity of Delegating SOL to a staking pool as ‘easy’. Wallets like SOLflare.com allow for allocation to a pool within minutes and rewards are automatically compounded. It describes the complexity of running your own Solana validator node as ‘professional’. There are very high hardware requirements, validators also need to put up to 1.1 SOL per day to pay for vote transactions.

The percentage of available SOL being staked is 75.6%. The number of stakers on the network has fluctuated between 380,000 and 500,000 for the last 30 days.

75.6% of available SOL is currently staked. Source: Staking Rewards

Solana price soars after mainnet launch

The Solana mainnet was launched in March 2021 and the network has rapidly gained users since then.

Source: DefiLlama, Solana DeFi Total Value locked in US dollars.

Source: DefiLlama, Solana’s share of the platform blockchain space. Ethereum (purple) still dominates the market.

The Total Value Locked into Solana DeFi currently sits around US$9.9 billion. The most popular DeFi application on Solana is Marinade Finance. Marinade Finance is a liquid staking platform that allows users to easily maximize their Solana staking and yield rewards.

Solana has ~3.12% of the platform blockchain TVL and is the 5th largest platform blockchain by TVL. At one point Solana was the 3rd largest platform by TVL and had ~5.1% of the platform blockchain space’s TVL. Competitors Luna, Avalanche, and Fantom have eaten into Solana’s markets and in some cases overtaken it by TVL.

Source: DeFiLlama. Daily NFT volumes Solana

Beyond DeFi Solana’s Non-Fungible Token ecosystem continues to be a key driver of transaction volume and user activity on the platform. On most days, well over 40,000 new NFTs are created on Solana. The network averages around 50,000 daily active users.

Source: Solscan

On April 25th the 5 largest NFT marketplaces on Solana — Magic Eden, Opensea, Formfunction, Solanart, and DigitalEyes — handled about ~SOL123,321. At current market rates, with each SOL trading for US$101.13, this is around US$12.4 million and up considerably from daily NFT trading volumes NFT 6 weeks ago. It may also be worth noting that the daily average price paid for NFTs across these marketplaces has risen but remains inconsistent.

Source: Dune Analytics, user:@kunal

Source: Dune Analytics, user:@kunal

The most popular NFT art marketplace on Solana is Magic Eden, it controls over 90% of the daily trading volume and buys on Solana. The start-up recently secured US$27 million worth of Series A funding. The funding round was led by Paradigm and also included participation from Sequoia, Electric Capital, Greylock Partners, Kindred, Variant, and Solana Ventures.

It also has some unique utility within the Solana NFT marketplace. Magic Eden recently enabled users to make purchases on its platform with DUST and AURY, the native tokens of two popular NFT collections. DUST is the native token of Degods, the most popular NFT collection on Magic Eden. Aurory is also a popular NFT collection that supports a Play-to-earn game.

The value of SOL jumped following a confirmation that OpenSea, the largest NFT marketplace in crypto, will launch on the Solana chain. OpenSea, was originally built on Ethereum and is by some distance the most popular application in the world to Buy Bonk On Solana Tracker and sell NFTs. Solana is the 2nd platform blockchain that the App has been launched on.

Opensea’s launch on Solana was long-anticipated. Many have speculated that the launch was delayed because of the network’s congestion issues. Leaked imagery of the OpenSea integration first popped up on Twitter in January. On the day following the OpenSea launch, the price of SOL jumped by ~9.05%, with the price of the token rapidly rising from ~US$111.41 to US$121.49. These gains however were not sustained and the price of SOL has since lost some of the positive speculation following the launch.

Source: Dune Analytics, user @rchen8

The daily volume and number of users on Solana OpenSea have dropped considerably following the immediate post-launch hype.

The complexity and coverage of the Solana NFT ecosystem has matured significantly in the last six months and created new utility for the SOL token.

Solana Denial Of Service Issues and a significant bridge hack

On September 14th 2021, the Solana network endured a long 17-hour outage that caused by a denial of service attack. On the day, it was reported that Solana’s mainnet had been suffering intermittent instability over a 45-minute period.

A few hours after the initial announcement, it was explained that a transaction load surge to 400,000 per second had overwhelmed the network, created a denial-of-service, and caused the network to start forking. Solana engineers attempted to fix the issues themselves but needed the support of network validators to organize a restart of the network.

Solana attributed the outage to a denial-of-service attack aimed at an initial decentralized exchange offering (IDO) launched on Solana’s most popular AMM, Raydium.

The outage knocked confidence in the network. The ability of blockchain networks to operate autonomously and perpetually, without interference and interruption is key their value. While Solana is noted for its speedy throughput and low costs, there are concerns that the network has chosen scalability over security. While Solana was still able to reach all-time-highs after this incident, it remains a lingering concern for investors.

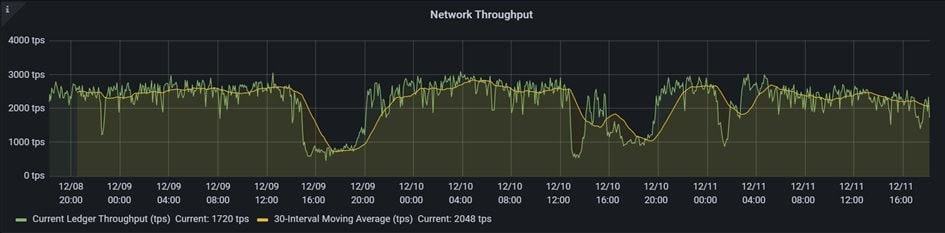

Solana has not suffered any more outages since September but in early December it faced multiple DOS attacks that slowed down the rate of transactions on the network. At the time applications operating on Solana reported that transactions were taking longer than normal to process and suggested this was because of congestion on the network.

In a Twitter thread, Tomáš Eminger of Rockway Blockchain Fund, explains that for four days post-December 9th, the throughput of the Solana network slowed to 1000 transactions per second, far less than the normal 65,000 TPS it is purported to be able to run at, and the normal 3000-4000 TPS it normally runs at. Eminger says this was down to a similar issue to the outage, Raydium bots congesting an IDO. Eminger explains the technical issues for why the congestion caused the slowdown in his thread.

Source: Twitter @EmiT87

Austin Federa, head of communications at Solana Labs, has said that the outage was down to a number of transactions landing in Solana blocks that took an excessive amount of compute power, which was not properly metered by the network causing blocks to take longer than expected to process.

In January, the network suffered from 6 outages in a month. Each individual outage lasted 8 hours, in one case, Solana was down for 48 hours. This is an eternity in the crypto world. The 6th outage was caused by network congestion issues again. Solana co-founder Yakovenko cited an explanation that states that the congestion occurred because of market volatility. The volatility causes bots to rush and capture profits from leveraged positions eligible for liquidation.

This explanation is likely frustrating for traders using Solana’s DeFi solutions. Not only do they have to deal with predatory liquidation bots, but they also face the possibility of network outages.

The value of the Solana ecosystem and the value of the SOL token has also been expanded thanks to the continued development of the blockchain’s bridging and interoperability capabilities.

With tools like the Wormhole bridge, users can natively port digital assets between the Binance Smart Chain, Ethereum, Solana, and Terra networks with a single unified interface. Bridging technology has helped users shift from incumbent chains like Ethereum to new networks like Solana with a few clicks and through an easy-to-navigate portal. Bridges have helped promote the growth of emerging blockchains like Solana.

A major issue with bridges between blockchains, however, is smart contract vulnerability. Bridging between blockchains is a complex operation with many moving parts. Wormhole, one of Solana’s most notable token bridges, was hit by a major exploit in February that resulted in ~120,000 ETH (Wrapped-Solana Ether), worth over US$320 million at the time of the attack, being stolen from the platform.

Bridges such as Wormhole take Ethereum tokens, lock them into a contract and then issue them as a parallel token, using a smart contract on the chain to be bridged to. The exploit occurred because of a specific vulnerability on the Solana Wormhole contract according to an analysis by Certik. The hacker was able to mint the Solana version of ETH and then was able to redeem the tokens back on the Ethereum chain.

Certik also explained that bridges are prone to attacks because of the amount of funds they handle in escrow and the multiple lines they operate.

The potential systemic shock of the hack was minimized after quant trading firm Jump Crypto announced that it would replace the lost funds. The firm told Bloomberg, “Jump Crypto is involved with Wormhole and will be a leading player in ensuring that the bridge returns to a stable place, and that all people affected by the hack are made whole.”

It was suggested that Jump was offering the bailout because it supports Wormhole by providing liquidity in the background. The firm may also have an interest in the long-term future of Wormhole. A bridge that allows unique asset swaps to be conducted cheaply and quickly is useful for a high-frequency trading shop like Jump.

The outages and bridge hacks have dampened some of Solana’s forward momentum in 2022. They have tarnished the sheen attached to the project during its formative years. While 2022 has been a difficult year so far for digital assets, SOL’s losses have been particularly severe. So far this year Ethereum (ETH) is down ~22.9%, Terra (LUNA) is up ~4.4%. Solana is down 43% so far this year.

Another possible drag on the Solana ecosystem is that it uses an alternative coding language to Ethereum and it is not EVM compatible. Unlike on the Binance Smart Chain, where projects can essentially copy-paste what has already been built on Ethereum and use the same Solidity tooling, Solana developers need to start from scratch. Solana is written in Rust, which has far fewer Dapp building developers on it than Ethereum.

One positive consequence of Solana’s lack of EVM compatibility is there are far fewer cash grabs and scams on it than there are on direct Ethereum clone platforms like the Binance Smart Chain.

Conclusion

Solana is a blockchain platform network that found product-market fit in 2021. Solana attracted headlines after news that Solana Labs, the development team that manages the Solana chain technology, had raised US$314 million of new funding. The money will be used to develop technology in the Decentralized Finance (DeFi) space. The funding round was led by prominent Silicon Valley VC firm Andreessen Horowitz, and crypto-specific hedge fund Polychain Capital.

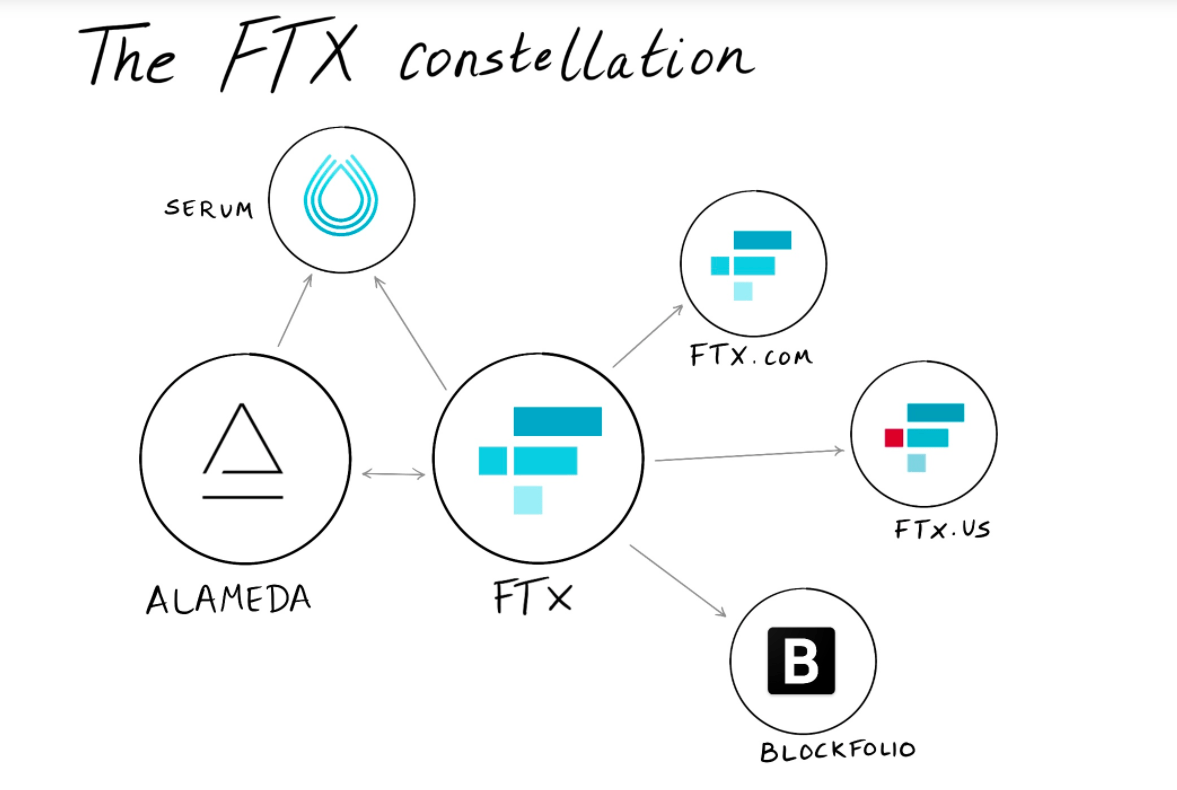

Discussing the project after the raise, Alameda Research CEO and long term Solana backer Sam Bankman-Fried said the project has “the most ambitious tech road map of any blockchain, and they’ve been making impressive progress on it. It’s a blockchain that has the potential to support a DeFi ecosystem with world-scale activity.”

Despite being attached to the 6th largest asset in crypto, Solana is still a new project that has only shown glimpses of what it is really capable of. We have also seen the first clear signs of growing pains with the network struggling to handle network business, slowing down, and breaking occasionally.

Solana’s Dapps, however, are fast, cheap, and easy to use. They offer some of the best UX in crypto. Solana also has one of the best experiences for stakers in the space. This is indicated by the increasing commitment of SOL holders to stake in the network. It also stands out because it does not directly lift from Ethereum to utilize its virtual machine. This means it is likely to have more long-term appeal than many of its competitors like BSC and Avalanche.

The network remains relatively decentralized, it has big-name VC backers and influencers endorsing it as the future and it continues to attract developers to build on it. If it can find ways to tighten security and manage congestion, long-term growth, and market position will likely continue.

Don’t miss out – Find out more today