STEEM Price Analysis: Engine in need of a restart

The Steemit content platform emerged with a novel blockchain use case when it first appeared in 2016. However, time and the bear market have not been kind to the project, as a range of issues have seen user activity dwindle.

Steem is a blockchain network that supports community building and social interactions with cryptocurrency based rewards. Steem hosts social communities where users are rewarded for their participation and contributions to the platform via a blockchain based accounting system that allocates rewards based on reputation.

Steem is best known as the blockchain that supports the Steemit social content/blogging platform and Steem Dapp. The premise for Steemit is simple. Content creators write blogs, post videos, or upload pictures. Steemit users react by sharing, upvoting, and commenting. This participation is rewarded with the native Steem token. Any participation in the form of content, comments or actions that create greater interaction within the platform is rewarded with more digital currency. The model is similar to Reddit (Karma) or Medium (claps) but creators and participants receive actual payments instead of imaginary internet points.

Steemit was an immediate success, even outside of the crypto community. It quickly gained a reputation as a fun, less toxic environment when compared to centralized social platforms such as Twitter and Reddit. The platform launched in March 2016 and at its peak, had a user base of 1 million users. By July 2016, STEEM, the native membership token of the Steem blockchain and the Steemit platform, was the third largest token in the ecosystem by market cap.

This position has been difficult to maintain. During the 2018 crypto bear market, Steem’s flagship Dapp, Steemit announced that it had fired 70% of its workforce. As a result, Steemit has been in self-described ‘survival mode’, with a focus on infrastructure reduction and driving advertising sales on steemit.com.

STEEM currently ranks as the 62nd largest token by market cap on the Brave New Coin market cap table and trades at ~USD 0.41 (global spot price). Despite recent concerns around the long term viability of the project, the price of the token has risen ~57% since the start of 2019 and is up ~1% in the last week.

The STEEM economy: The 3 token options

Participants in the STEEM ecosystem can utilize three different tokens, each of which has its own separate utility. These are; STEEM, STEEM POWER and STEEM DOLLAR.

STEEM (sometimes referred to as ‘liquid STEEM’) can be thought of as an equity share in the Steemit platform, designed to be traded on exchanges on the crypto open market.

With STEEM, users can trade Steemit for other digital assets/fiat pairs, or power it up and receive STEEM POWER to interact within the Steemit ecosystem. Users holding more STEEM POWER have more say in network decision making such as changing the blockchain’s reward distribution model.

The supply of STEEM doubles each year. 90% of this new supply goes to holders of STEEM POWER tokens, while 10% is allocated for users that create and curate content on Steemit.

For users concerned about crypto volatility, Steemit offers the STEEM DOLLARS (SBD) option, which is a ‘within the ecosystem’ currency that pegs a user’s Steemit holdings one-for-one with the US dollar. Users also receive a 10% yearly reward for holding. Users can choose to receive SBD for curating and creating content, or they can exchange it for STEEM.

STEEM POWER gives a user the right to vote on Steemit content and receive dividends as the network expands. STEEM POWER is generated when new STEEM is issued, when STEEM tokens are ‘powered up’, and when content is created or curated. The greater a users’ accumulated STEEM POWER, the more power their votes have.

Steem Power can also be ‘powered down’, and converted into STEEM tokens, so a user can on-ramp into other assets and exit the STEEM ecosystem. However, accumulated STEEM POWER can only be converted back into STEEM gradually, in 104 equal parts across 24 months. The power down process can be canceled at any point in the 24 months. This mechanism is designed to create a committed ecosystem of content, where users are incentivized to stay and participate.

STEEM is allocated to Steem blockchain transaction validators at a rate of 1 STEEM per block or 0.750% per year, whichever is greater. STEEM uses the Delegated-Proof-of-Stake consensus algorithm, which was conceived and developed by the Steem blockchain’s creator, Dan Larimer. Steem functions with block-creating accounts called witnesses, that are collectively approved by Steem stakeholders.

Instead of relying on Proof-Of-Work to find blocks, the Steem network actively schedules these accounts to blocks, making the time between blocks just three seconds. Like other DPOS networks such as EOS, Steem functions without transactions, and instead sets users a weekly bandwidth limit that is consumed for operations like posting, commenting, voting and token transfers.

Steem has created another in-ecosystem token model in the form of Smart Media Tokens (SMTs). Smart media tokens are the STEEM version of Ethereum ERC-20s. A Smart Media Token (SMT) is a native digital asset on the Steem blockchain that can be quickly launched by anyone to help monetize online content and create incentives to encourage desired user behavior. They are built with a ‘Proof-of-Brain’ reward algorithm that encourages people to create and curate content and rewards them with new tokens based on user operations like posting and curating content.

These new tokens are designed to enable publishers to create mutually beneficial community and economic incentives to drive platform growth.

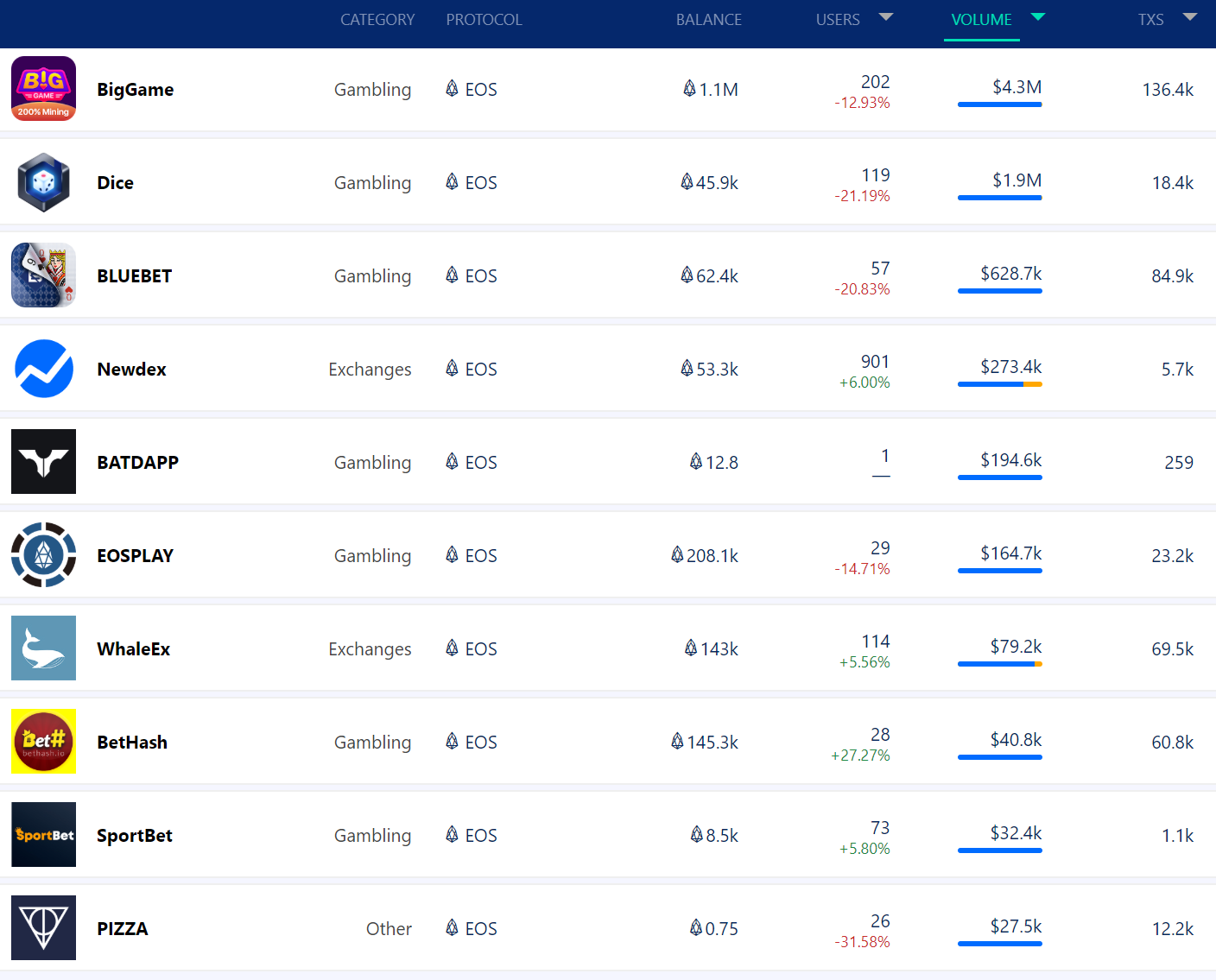

Beyond Steemit, Steem hosts a number of other Dapps that have chosen to interact with the Steem blockchain economic model. NextColony, for example, is a space colony simulator where users interact with tradeable collectibles built on the STEEM blockchain. Normal Steem upvoting and curation activities occur as blockchain operations within the Dapp’s Steem address giving it an element of novelty.

NextColony Dapp activity, last 30 days. Source: StateoftheDapps

STEEM is used to make in-Dapp purchases but users are also rewarded for upvoting and curating development updates. This model may incentivize greater community interaction both for developers to publish more frequent content, and for users to interact with and endorse high-quality developer content.

Dapp developers, however, have found flaws within the Steem blockchain model. The DLive streaming platform and Dapp, noted for being the live streaming platform of choice for mega-YouTuber Pewdiepie, decided to shift away from the Steem blockchain to a native chain in September 2018. In a blog post following the migration decision the DLive team said;

_ “the current economic model of Steem incentivizes large Steem holders to continuously upvote their own content and other creators who specifically support their content. This creates an ecosystem where a content’s true value can’t be recognized or be fairly rewarded. Community members who are not ‘privileged’ enough to be a part of these groups with large voting power are therefore penalized financially.”_

Steem has systems in place to prevent automated curation and upvoting to disincentivize users trying to game the platforms curation and upvoting model. However, the fact remains that small users can be squeezed out of the Steem economic model because it heavily favors more active and token rich users.

In most days in the last month, the average (mean) payout in SBD to user posts is almost 20 times the median payout in the last month. This suggests that the mean value has been skewed by larger payouts to some accounts due to the inequality of network payouts.

The Steemit platform, as the core Dapp of Steem, has faced a number of issues because of the blockchain’s incentive and monetary model. A research paper, The Concept and Criticisms of Steemit, by Usman Chohan, economist at the University of New South Wales business school, found manipulations of Steemit’s content, self-governance and community policing model including “vote-selling, bullying by wealthier members of the site, the monopolization of influence to set policy, overt control by wealthy users, and forced censorship”.

In the most extreme and dangerous examples of ineffective community self-governance, content such as child pornography was posted by some users of the platform.

The lack of centralized moderating to prevent the posting of dangerous content and malicious user behavior is one of the primary criticisms levied at decentralized, blockchain-based content platforms. Steemit and the Steem blockchain have had clear issues finding ways to minimize this problem.

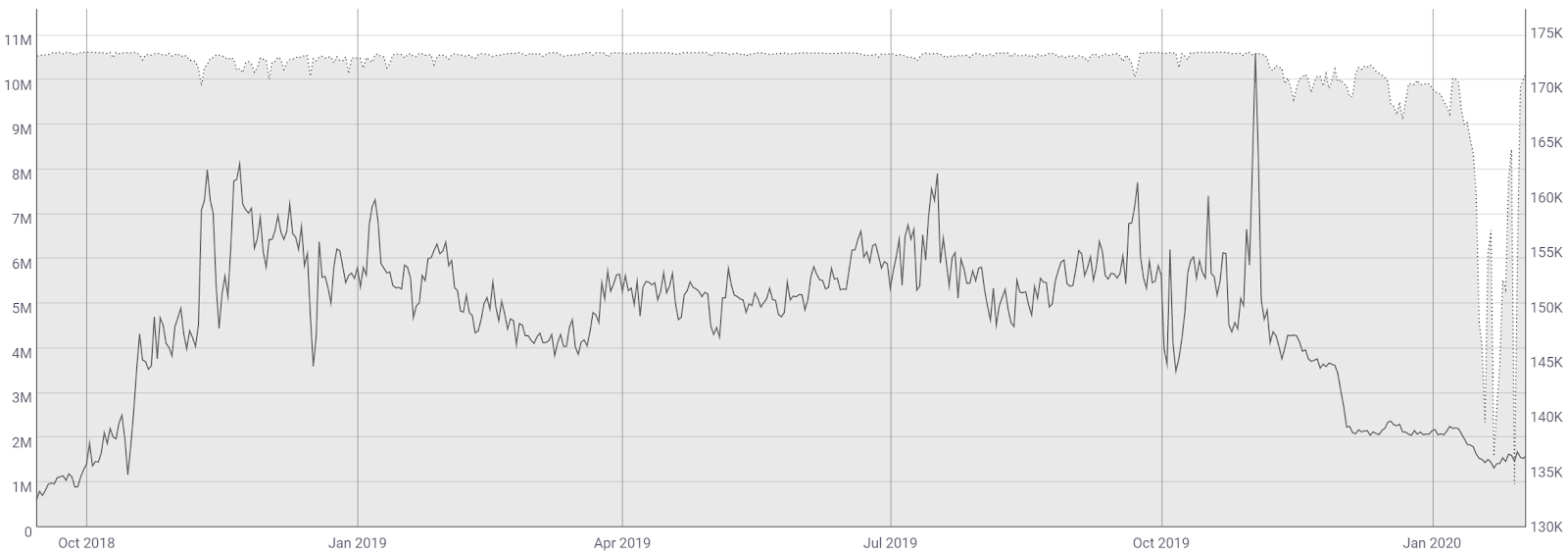

On most days in the last month, the number of new users signing up to the Steem blockchain has been in the double digits, however, a significant portion of these new sign-ups appear to have remained inactive.

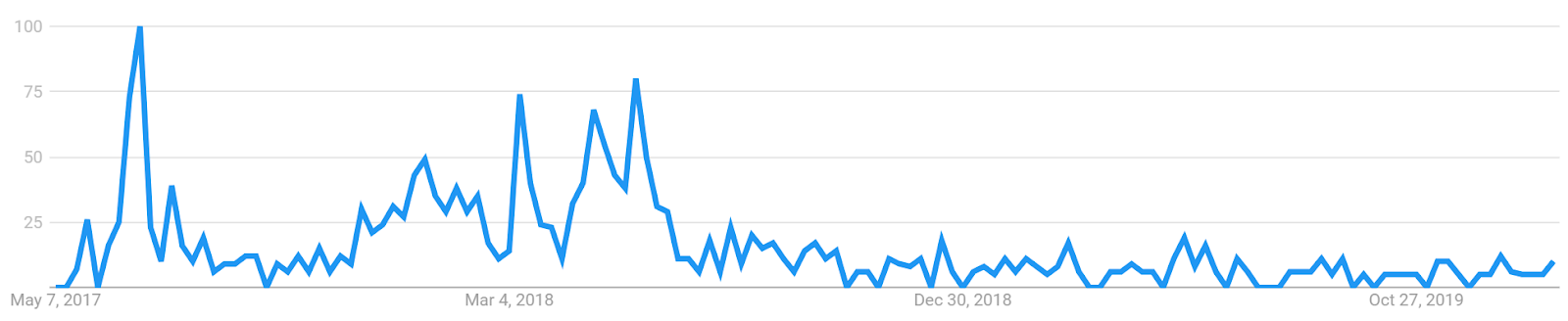

Pulling back further, there has been a decline in platform activity since the peak in early 2018. The biggest fall has been in the number of active authors on the platform, a clear concern for a social content platform. At a qualitative level, a blog titled ‘Why I left the Steem blockchain’ written by blockchain and entertainment author Matt Sokol describes a decision to leave Steemit due to the proliferation of vote bots on the platform.

Vote Bots are automated Steem accounts that have a significant amount of tokens invested as Steem Power, and they take 13 weeks to withdraw. Users can send them money in exchange for Steem upvotes, which allocate large STEEM rewards to their posts. It creates a model where users are paying Vote Bots less than they may expect to receive from subsequent upvotes. This feedback loop is affecting the overall usability of the platform. It remains an ongoing issue.

An example of a Vote Bot still available to use on the STEEM blockchain

Posts and comments on the Steem blockchain have declined sharply since a peak in early 2018.

Web traffic data indicates that Steemit.com continues to fall behind direct competitor, medium.com, in the social blogging space.

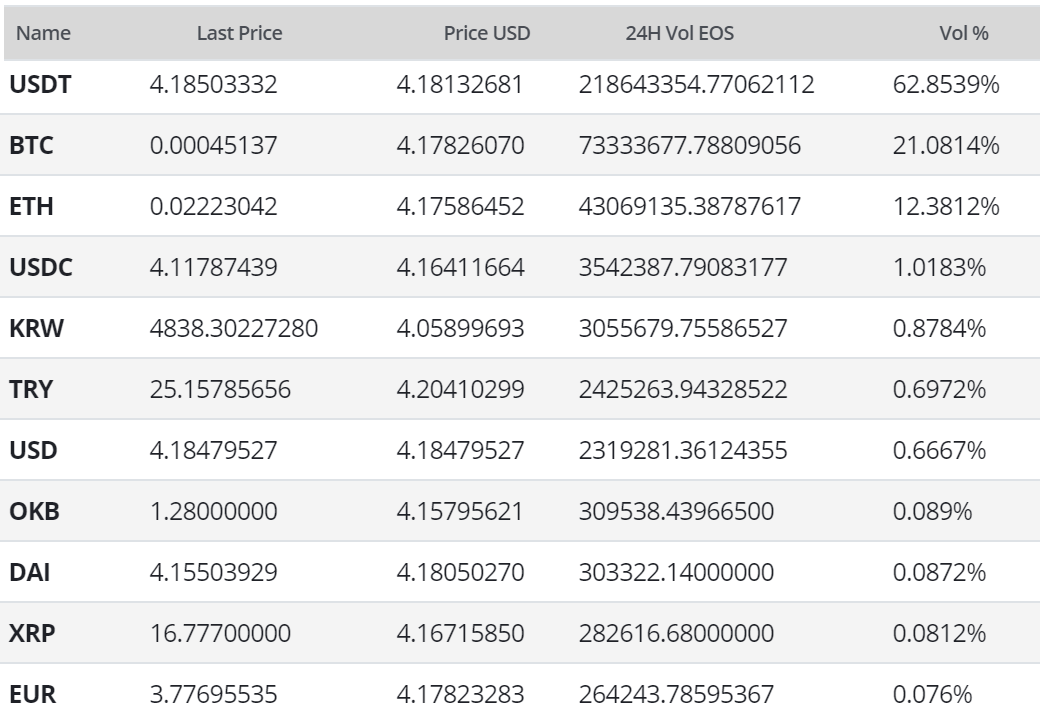

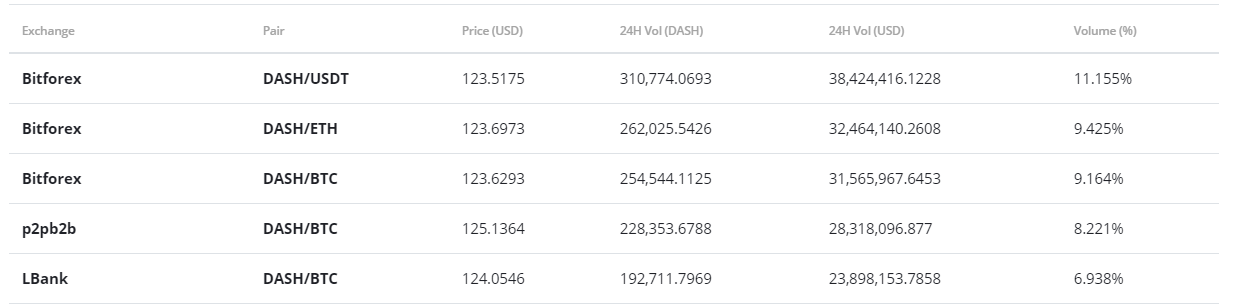

Exchanges and trading pairs

The most popular trading option for STEEM is BTC with the pair handling over 45% of daily trading volumes. The second most popular market is the STEEM/Korean Won pair. Together the top two pairs make up ~76% of daily trading volume. The USD value of daily volume of the entire daily STEEM trading market is ~USD 2.7 million.

Steemit.com has been historically popular in South Korea as a content sharing platform. Users from South Korea made up the 2nd largest group of website visitors.

A mix of exchanges contributes to the STEEM trading ecosystem, with the top 5 pairs spread across 5 exchanges. The STEEM/BTC market on Binance is the most active market in the ecosystem. STEEM is also tradeable on other high profile exchanges such as Bittrex and Poloniex.

Technical analysis

Moving Averages and Price Momentum

On the 1D chart, a golden cross has yet to occur with a death cross persisting since 2018. However, since mid-December, price has increased ~86%. Currently, this uptrend has price above the 50 day EMA. If the momentum holds, the 200 day EMA of $0.49 is the next critical resistance to test.

On the 1D chart, using Fibonacci retracement levels, we are able to better categorize STEEM’s volatility since mid-December 2018. In particular, STEEM has relied on key Fibonacci support levels to limit sharp price drops. Most recently, price bounced off the 0.236 support level and has already retested the 0.382 resistance level. Since mid-May, price has been confined within a range of $0.36 (0.236) and $0.44 (0.382). An eventual price breakout will ensue, but it is still too early to accurately gauge to which side. However, two points are in favor of the bulls:

- The overall trend since the mid-December “bottom” is still upward

- Price is currently above the 50 day EMA, $0.38, which may provide additional support.

Lastly, on the 1D chart, the volume flow indicator (VFI) is still above 0, which is positive for price. However, there is a divergence between VFI (red line) and price (black line) trends, which might indicate further price weakness ahead for STEEM. Furthermore, if price falls beneath the 0.236 support level ($0.36), coupled with VFI falling beneath 0, that would be a strong sell signal in the near term.

Ichimoku Clouds with Relative Strength Indicator (RSI)

The Ichimoku Cloud uses four metrics to determine if a trend exists; the current price in relation to the Cloud, the color of the Cloud (red for bearish, green for bullish), the Tenkan (T) and Kijun (K) cross, Lagging Span (Chikou), and Senkou Span (A & B).

The status of the current Cloud metrics on the 1D frame with singled settings (10/30/60/30) for quicker signals are mixed: price is in the Cloud, Cloud is bearish, the TK cross is bullish, and the Lagging Span is below Cloud and price.

A traditional long entry would occur with a price break above the Cloud, known as a Kumo breakout, with price holding above the Cloud. From there, the trader would use either the Tenkan, Kijun, or Senkou A as their trailing stop.

Price is currently attempting a Kumo breakout, but has stalled at Cloud resistance of $0.42. If buying momentum increases, i.e. VFI begins trending upward again, price is more likely to complete the breakout. If so, STEEM would have a fairly clear path to $0.50 and $0.55. If not, support levels are $0.35 and $0.30.

There are a few positive factors for STEEM, including:

- VFI still above 0

- Price is still above key support levels

- RSI is at an acceptable value of 55.

The status of the current Cloud metrics on the 1D time frame with doubled settings (20/60/120/30) for more accurate signals are mixed: price is in the Cloud, Cloud is bearish, the TK cross is bullish, and the Lagging Span is below the Cloud and price.

The slower settings yield similar results; including current Kumo breakout attempt, coupled with price targets and support levels.

Conclusion

The crypto ecosystem owes the Steem blockchain and the STEEM token a nod of appreciation because it built one of blockchain’s first tangible real-world use cases, a decentralized social content platform. The years have not been kind to the platform, however, with clear flaws such as the manipulated upvoting of content and power disparities between users becoming increasingly apparent. As a result, many users have opted to switch to other platforms like Medium.

Price activity has been positive in recent months along with the rest of the altcoin market. Steemit now says it is well-positioned to transition from “survive mode” to “thrive mode.” With other Dapps now experimenting with maximizing community interaction using the inherent advantages that are built into Steem’s blockchain, the project remains unique within the platform blockchain space.

The technicals for STEEM are currently sending mixed signals with a potential breakout to either side looming. On the 1D chart, both the fast-setting trader (10/30/60/30) and slow-setting trader (20/60/120/30) will await price to complete a Kumo breakout above $0.42 before entering a long position. Price targets for the bulls are $0.50 and $0.55. Support levels (price targets for bears) are $0.35 and $0.30.

Don’t miss out – Find out more today