Synthetic assets: No rewards without risk

Synthetic assets are a new class of assets that mimic the value of existing assets without any physical tie to that asset. There are a growing number of synthetic assets in the crypto space. This article looks at the benefits and risks involved in trading and using synthetic assets.

Synthetic assets describe a class of assets that mimic the value of existing assets without any physical tie to the asset it mimics. In the cryptocurrency space a number of synthetic assets exist, these include sUSD (mimics the value of the US Dollar), and renBTC (mimics the value of Bitcoin). These assets were designed to give exposure to a variety of different assets without the need to hold the underlying asset. Holders of these assets can diversify portfolios and peg them to the value of these assets without ever needing to leave the crypto or Ethereum ecosystem.

Synthetics in legacy finance

In some cases, such as with Synthetic US dollars and other forms of synthetic fiat, you can add a blockchain layer to these non-blockchain assets that boosts their functionality and utility. Synthetic US dollars offers, for example, transactions that are transparent on a public ledger, open to users across the world without regulation, secured by smart contracts, and that can easily connect with decentralized finance (DeFi) borrowing and lending or yield maximizing protocols.

Synthetic assets also exist in the world of traditional finance and similarly, they mimic assets that already exist but alter key aspects of their structure like duration and cash flow. In traditional finance, synthetic assets are often used to take trading positions, or price bets, without actually having to put up the capital that would normally be needed.

Synthetics in decentralized finance

One of the most notable platforms for building synthetic assets in the crypto space is Synthetix. Synthetix is a token trading platform, it allows synthetic versions of any kind of financial asset to be created and then traded using crypto.

Synthetix uses a model for creating synthetic assets that mirrors the system built by the Maker DAO- Dai model, where overcollateralized loans are used to mint new tokens. The Synthetix system has two types of tokens, the Synthetic Network Token (SNX) and Synths. SNX tokens are locked up to create synths like sUSD (synthetic US dollar) and sAAPL (Synthetic Apple stock).

SNX is the collateral and the synthetic asset is debt. A fixed collateral to debt ratio needs to be maintained in order to keep the position open. The primary point of difference between Synthetix and Maker is that a synthetic version of any asset can be created whereas with the Maker protocol the only asset that can be minted is DAI, a US dollar stablecoin.

More than one asset can be used as collateral for the loans that are required to issue synthetix, however, only SNX collateral stakers can receive rewards in the form of inflation and exchange fees. Since December 2020 Ether and renBTC were both enabled as collateral options for creating synths “to both reduce systemic risk and ensure the Synth supply can scale effectively.”

In order to mint sUSD or another Synth a minter needs to create an overcollateralized loan. They need to put up ~600% of the amount of SNX as collateral as the amount they are going to borrow. There are a few different mechanisms that make the Synthetix protocol unique.

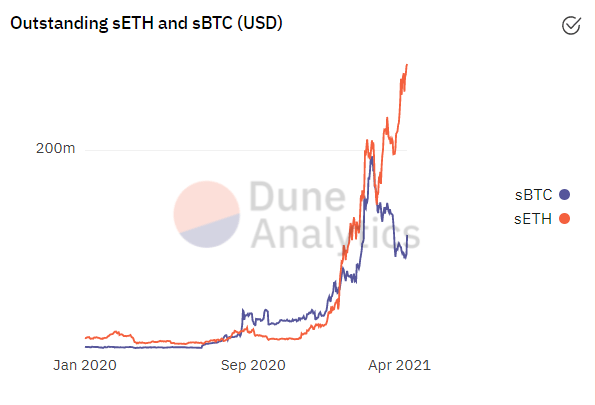

Source Dune Analytics: Growth in the popularity of Synthetic versions of ETH and BTC since 2020

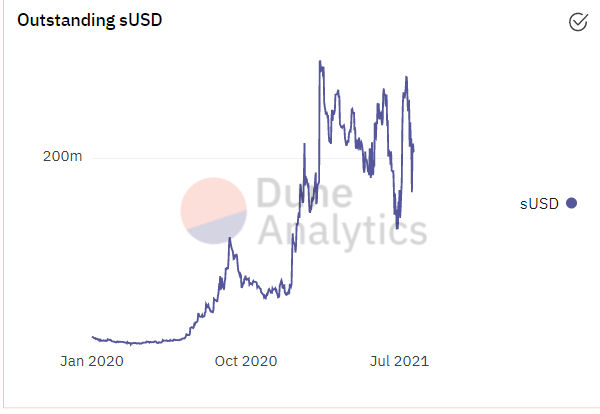

Source Dune Analytics: sUSD has been issued aggressively since October 2020.

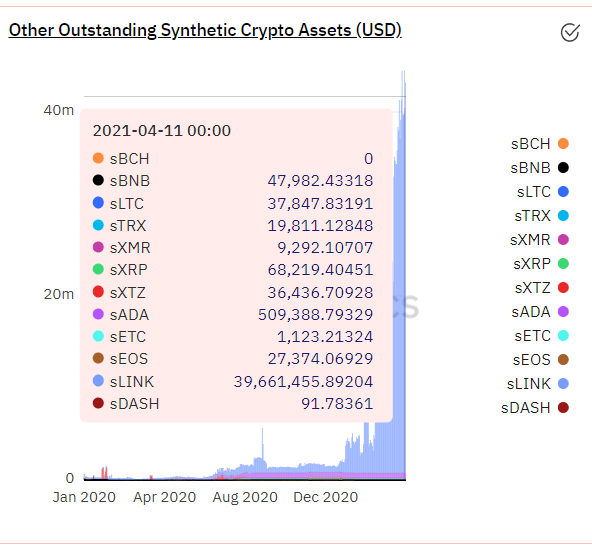

Source Dune Analytics: Heavy demand for Synthetic-LINK (sLINK).

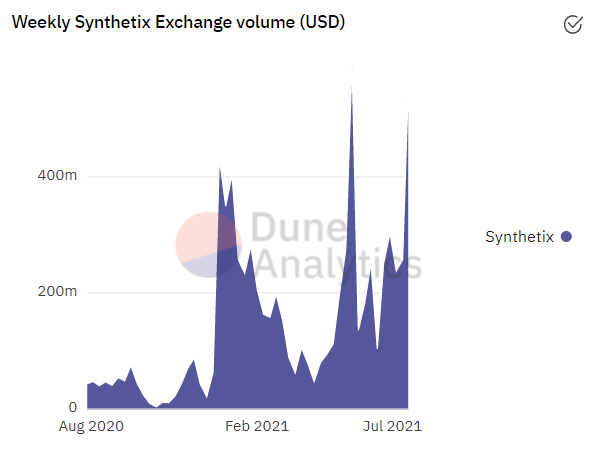

Source Dune Analytics: Volume has grown on Synthetix but remains inconsistent.

Collateralization and liquidation

Synthetix has a very high collateralization ratio of more than 500%. This is viewed by many Defi ecosystem users as capital inefficient given the much lower collateralization ratios that exist on many other Defi protocols. Maker, for example, has a collateralization ratio of 150%. It is expensive to issue new Synth and there is a risk that if the high capital requirements for loans are not met then the loans will be liquidated.

Synthetix uses a liquidation mechanism that involves redeeming Synths for Staked SNX if a stakers Collateralization Ratio drops too low. This system means the Synthetix ecosystem suffers from bouts of volatility that can affect the protocol’s liquidity and the price of SNX.

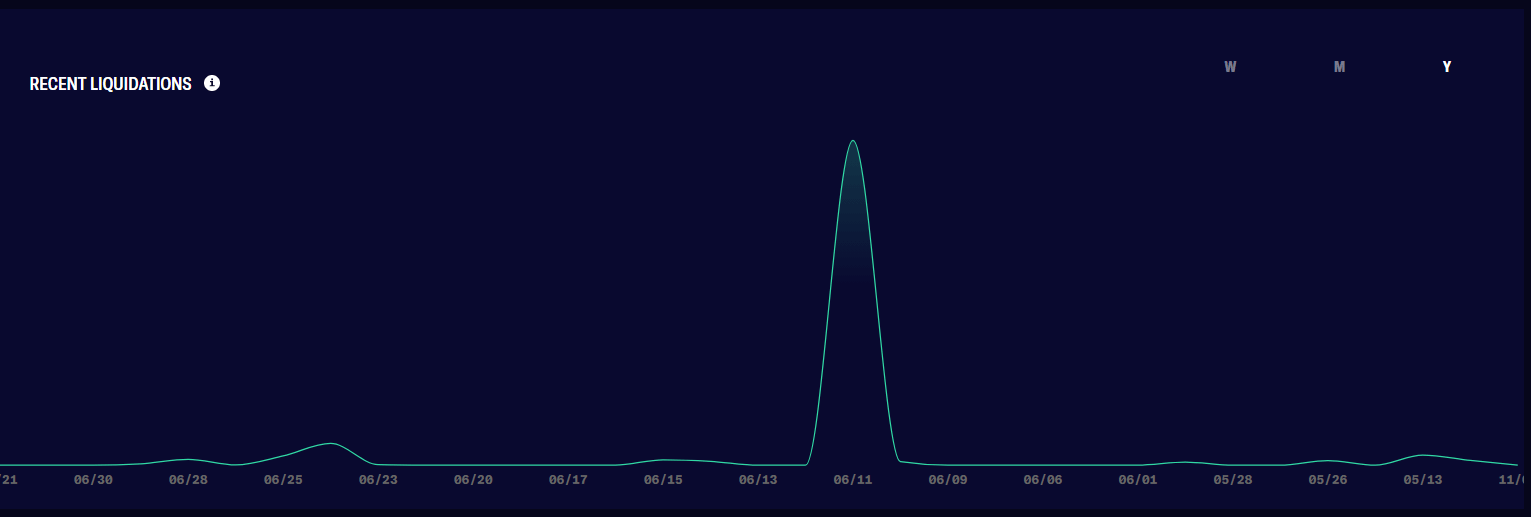

On June 11th 2021, liquidations on the Synthetix platform skyrocketed to US$19.4 million. According to Synthetix core contributor, Andrew Trudel. “Someone did not properly manage their staked position and got partially liquidated back to their target range of 500% as a result,” he told the Defiant newsletter.

Source:dashboard.synthetix.io

Synthetix does give users concessions and warnings if their debt positions become precarious. If a user’s debt falls below the liquidation collateralization ratio, they have three days to pay down the debt before a portion of the collateral is sold down.

sUSD also has a unique position within the Synthetix liquidation model. If the value of a minter’s debt falls below a 200% collateral to debt ratio then liquidators and other users can pay down debt using sUSD and allow the position to be maintained. In exchange for the sUSD, liquidators will receive the liquidated user’s SNX.

Despite the Synthetix protocol’s liquidation protection mechanisms events such as the June 11th liquidation still occur. The price of SNX dropped sharply after the major liquidation and bottomed at around US$5.91 on June 27th, down about ~40%.

Cryptocurrency investment platform Abra also built a model that allows users to deposit crypto as collateral to create synthetic assets. In Abra’s model, if a user wanted to buy US$5,000 worth of Apple stock, Abra would peg US$5000 of the users BTC against the price of Apple, If the price of Apple goes up or down then an equivalent amount of BTC would be added or subtracted from the user’s contract. Essentially in the Abra model, the investor is taking a short position in BTC while taking a long position in Apple and vice versa to this, the exchange is taking a long position in BTC and a short position on the price of apple.

In July 2020, US regulators, the Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC) teamed up to issue Abra a joint fine. The fine was issued despite Abra not offering its services to US-based customers. According to the SEC Abra built an app that “enabled users to bet on price movements of U.S. listed equity securities.” After investigations, it found that “these contracts were security-based swaps subject to U.S. securities laws.”

The SEC explains that Abra marketed its app to retail customers and furthermore did not do anything to determine if users who downloaded the app were “eligible contract participants” as defined by the securities laws. The statement from the SEC also states that the agency contacted Abra about their synthetic security swap contracts the year before in 2019. After conversations with the SEC, Abra stopped offering the contracts between February to May 2019. In May they attempted to begin re-trading the assets attempting to limit the offers and sales to non-U.S. people.

“Businesses cannot ignore the registration requirements designed to provide investors with the information necessary to evaluate securities transactions,” said Daniel Michael, Chief of the SEC Enforcement Division’s Complex Financial Instruments Unit. “Furthermore, businesses that structure and effect security-based swaps may not evade the federal securities laws merely by transacting primarily with non-U.S. retail investors and setting up a foreign entity to act as a counterparty, while conducting crucial parts of their business in the United States.”

Conclusion

In both digital and traditional finance, the issuance and interactions with synthetic assets involves risk and jurisdictional restrictions.

A Synthetic Exchange Traded Fund (ETF) is a pooled investment product that invests in derivatives and swaps as opposed to physically possessing the assets in the fund, as is the case with Physical ETFs. With conventional physical ETFs, stocks are invested in and clumped together with the stated goal of replicating the performance of an index, like the S&P 500, or a group of stocks. Synthetic ETFs use derivative products to replicate index returns.

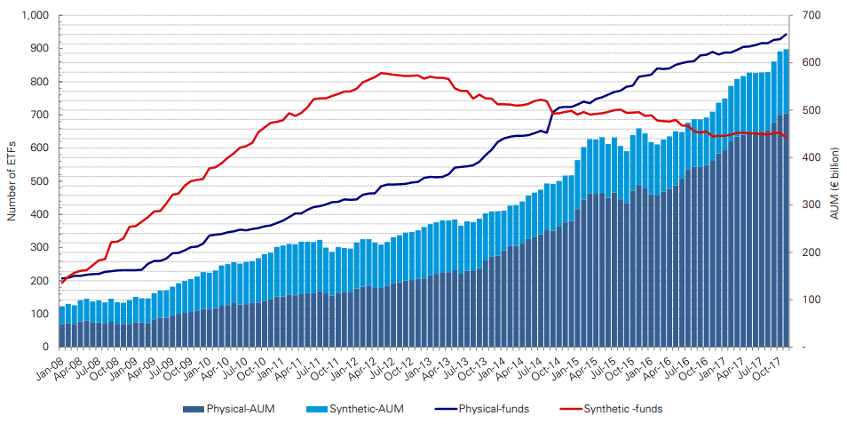

Synthetic ETFs are popular in Europe but are heavily regulated in the US. "Synthetic ETFs are riskier structures than physical ETFs because investors are exposed to counterparty risk," a 2017 Fed study concluded. As well as counterparty risk, there are also price tracking risks and collateral risks associated with Synthetic ETFs.

The popularity of synthetic ETFs has reduced significantly since 2012 with AUM in the industry shifting towards physical ETFs.

Source: Deutsche Bank

Terry Smith of Fundsmith spoke to the Financial Times in 2011. Referring to synthetic assets he said, “What if the counterparty supplying the swaps defaults? This risk may once have been considered theoretical, but after the collapse of Lehman… it surely no longer is.”

Smith’s analogy works well for synthetics in the blockchain space as well. There are counterparty risks associated with trading on Synthetix or holding the Synthetic assets created on the Synthetix protocol. In the case of Synthetix the counterparty risk is decentralized; there is trust that collateral providers can meet their obligations and there will not be cascading liquidations or that no single large liquidation poses a systematic risk.

With a model like the one used by Abra, there has to be some trust that all the synthetic swaps the platform supported were backed by physical Bitcoin. Users need to trust that they weren’t just dealing with numbers on an app.

Synthetic assets are tools that allow financial markets to expand, become borderless, and reduce capital requirements. While they are a very useful instrument and a net positive to the industry, they are inherently risky in both their traditional or decentralized forms. Traders need to have their eyes open and wits about them when interacting with them.

Don’t miss out – Find out more today