TRON Price Analysis: Network faces growing pains

The TRON protocol has grown since its mainnet launch displaying impressive active user numbers. It has also retained its ability to galvanize retail buying interest through speculative news events. Fundamental issues remain, however, with onchain economic activity dropping off in recent months and a lack of industry diversity within the Tron Dapp ecosystem.

TRON (TRX) is a platform blockchain. Its native token TRX has established a top-15 position in Brave New Coin’s market cap table. TRON is a project that has consistently divided the crypto community. Its detractors view it as vaporware with value created through aggressive, retail targeted marketing and PR. Its supporters, however, view the project as a legitimate long term challenger in the platform blockchain space, with genuine potential to disrupt legacy systems in the digital media and distribution industries.

TRON, or the TRON protocol, refers to the underlying blockchain, while Tronix or TRX, refers to the network’s native token, which serves a number of different functions within its ecosystem. It is used to power smart contracts and it can be frozen (staked) for users to access zero transaction fees and to participate in voting for network block producers. It is paid-out to block validators for confirming transactions, and a number of TRON Dapps (Decentralized applications) use it as an in-app payment token.

Like many other crypto assets, the biggest use case for TRX at present is as an asset to be traded. A large portion of Tronix holders is less interested in the user experience, or the utility options built into their tokens that enable interactions with the TRON blockchain. This group are speculators who will buy and sell their tokens based on short term price movements.

There is also likely a smaller group of inactive users who may be holding TRX for the longer term due to future expectations of utility and price appreciation. Travis Kling, Chief Investment Officer of Ikigai Capital said, “Owning Ethereum today is a call option on what you think the network is going to be in the future.”

TRX was launched with an ICO launch price of USD0.00186, with today’s price sitting at USD0.026 — that represents an increase of 1,583% for early investors. In 2019, the price of TRX has risen approximately 64% currently trading at ~USD 0.032 and occupying the 13th position on Brave New Coin’s market cap table. This compares poorly with the larger gains of other large cap assets and alts in the crypto marketplace. Market benchmark BTC has risen ~111% since the start of January, while direct competitor and platform blockchain token ETH has risen ~87%.

TRON’s broader network utility is similar to other platform blockchains such as Ethereum. TRON uses an adapted version of the Ethereum Virtual Machine to execute and test smart contracts, called the TRON Virtual Machine.

The vision of TRON as outlined in the most recently published white paper is to build a “project dedicated to the establishment of a truly decentralized internet and its infrastructure.” A major step towards this goal was the purchase of the BitTorrent protocol in June 2018 for a reported USD $120 million.

Ethereum smart contracts are compatible within the TRON Virtual Machine, and TRON markets its solution to blockchain developers as a low-cost, energy efficient deployment alternative to Ethereum.

TRON smart contracts run on a dual format system. There is an option to freeze TRX tokens (stake) to access network energy and bandwidth, foregoing standard TRX based individual smart contract operation gas fees.

Source: Tronscan

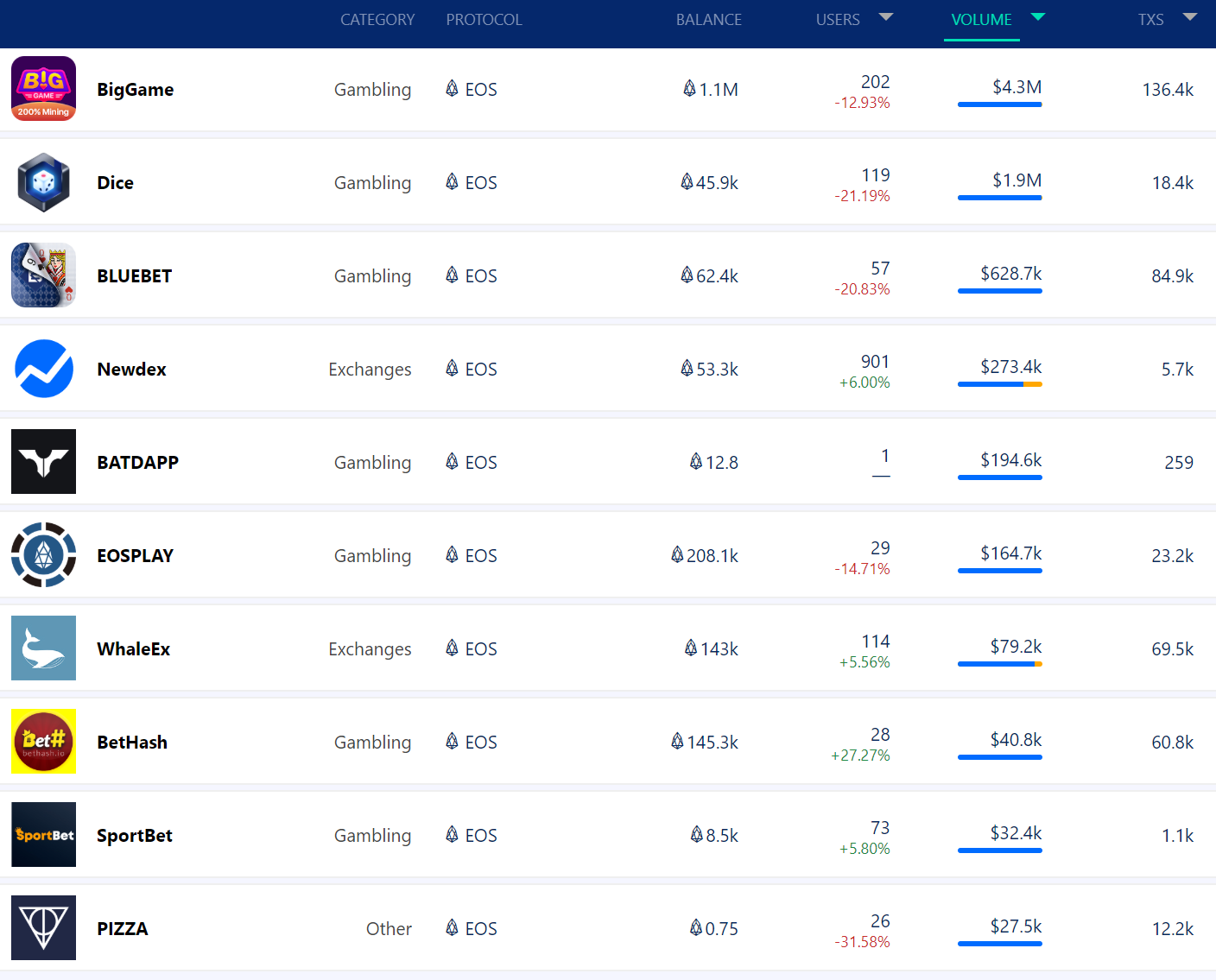

The number of TRON contract calls per day is currently dominated by a single smart contract, ‘TSvin3om2vWuw5stbxTeDQrpqH2VSKTpKz’. The contract has been assigned to ‘Tronbetlivepool’ by Tronscan. Tronbet is the TRON ecosystem’s most popular Dapp and is even ranked by DappRadar as the most popular Dapp across the TRON, EOS, Ethereum, and IOST platform blockchain ecosystems. In the last 24 hours, the app has handled $7,830,760.42, over four times the USD volume of the 2nd largest Dapp on Tron.

There are several factors for the success of Tronbet. It is a casino platform and has a number of games within it that function with liquidity, speed and zero transaction fees.

Gameplay is enabled using a unique, Dapp native TRON based token called ANTE. ANTE is minable, with new tokens created every time a user bets. ANTE also gives holders the right to rewards generated on the platform with payouts allocated in the more liquid TRX token. The model lets players hedge gambling losses with the mined tokens earned every time they make a bet, and compensates users for holding essentially illiquid tokens.

The implied Profits for large accounts on TRONbet is impressive and is a key reason for the platform’s large active user base. Some analysts have suggested that Tronbet is overlooked by many in the space because of the negative associations with the gambling industry however there are indications that the Dapp has created organic user growth because of a preferable incentive model.

Tron smart contracts run on a dual format system. There is an option to freeze TRX tokens (stake) to access network energy and bandwidth, foregoing standard TRX based individual smart contract operation gas fees.

This lets users conduct transactions on TRON without paying fees, as long as they are willing to freeze tokens for a period of time. A user on a TRON smart contract based gambling Dapp (Decentralized application), for example, provided they have enough TRX on their wallet/Dapp browser, can freeze tokens and conduct multiple fee-less transactions during a gaming session.

This makes TRON’s no-transaction-fee model potentially more appealing than Ethereum for developers building high transaction count Dapps like dice rolling games, where users seek to have as many turns as possible in a set session.

Source: Dapp.review

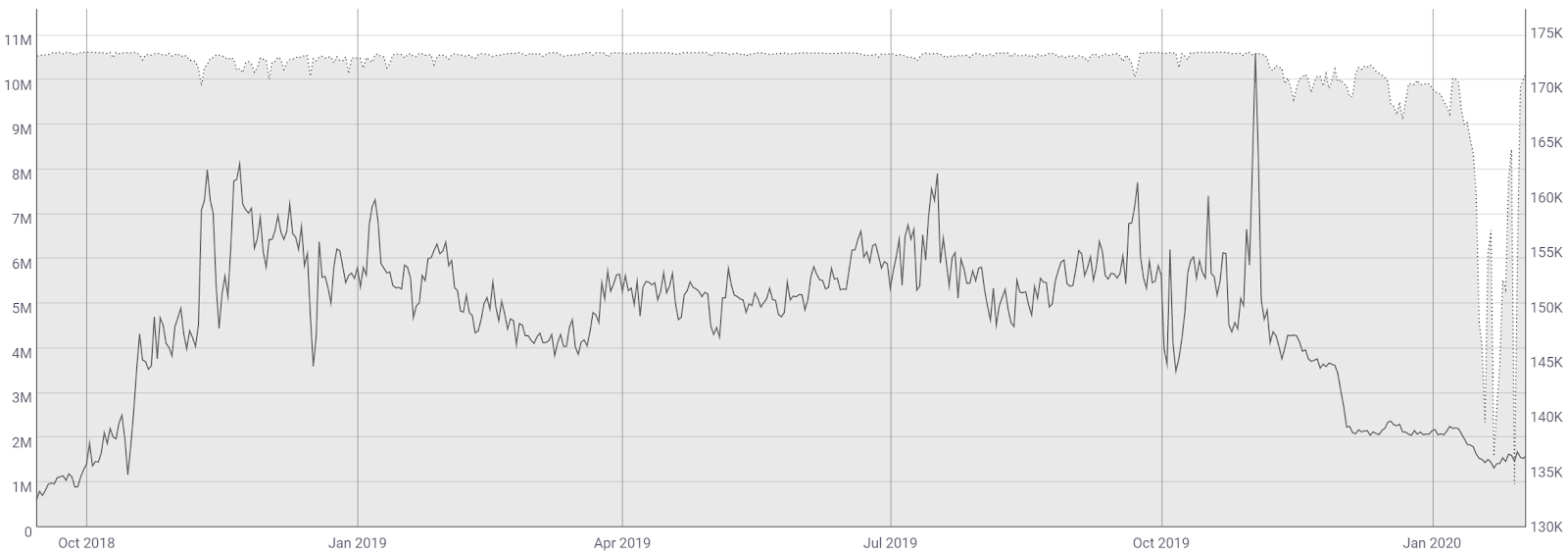

While the growth of Tronbet has been impressive, wider ecosystem Dapp activity has been less significant. Since mid-early April 2019, there has been a drop off in daily users and daily transactions. The protocol’s daily USD volume is even more concerning. The 90 day USD volume indicates a sharp drop off in the economic value of Dapp transaction activity occurring around March 2019. The sharpness of this drop may be indicative of inorganic growth and sends concerning fundamental signals.

Source: Tronscan

Coinciding with the drop off in TRON Dapp activity metrics, there has also been a slide in total daily energy used on the TRON network beginning around March/April 2019 which means less data is being consumed for energy consumption on the network.

Alongside current network capabilities, the TRON protocol recently launched a sidechain scaling solution called the Sun Network. The Sun Network will operate as a smart contract network managing a series of previously on-chain Dapp operations, off-chain.

The Sun Network aims to increase the current ceiling on network energy consumption, allow for the prolonging of smart contract execution and lower the unit price for network energy consumption. The official launch of The Sun Network testnet occurred on June 11th, 2019.

The vision of TRON as outlined in the most recently published white paper is to build a “project dedicated to the establishment of a truly decentralized internet and its infrastructure.” A major step in this wider goal was the purchase of the BitTorrent protocol in June 2018 for a reported USD $120 million.

BitTorrent is a popular shared bandwidth file storage solution. It estimates that it has 45 million daily users. TRON’s purchase of the platform was considered a major coup in crypto and finance circles because of the brand value, tech and existing user base of BitTorrent.

NEO, another cash-rich blockchain, was also interested in buying BitTorrent in the summer of 2018. The integration of BitTorrent into the TRON platform is set to begin on an unspecified date in Q2 2019. BitTorrent seeders will be given rewards for sharing their bandwidth with other users on the network for file downloading. Transactions verified by TRON protocol nodes and the TRON enabled version of BitTorrent will run as a Dapp on top of the blockchain called BitTorrent Speed. Rewards to seeders will be in a new token BTT or BitTorrent token, a TRC20 token which functions as a smart contract equivalent to Ethereum’s ERC20 standard.

On May 30th, 2019, the TRON Foundation and BitTorrent announced the release of the BitTorrent file system (BTFS) a variation on the Interplanetary file system model (IPFS). BitTorrent plans to leverage its 100 million BitTorrent monthly active users, more than 1,000 TRON full nodes, 27 Super Representative nodes, and global TronGrid nodes, to become the world’s largest distributed storage and media sharing network. Internal testing began this quarter, with full implementation expected by the end of the first quarter of 2020.

In Q3 2019, the BTFS Mainnet will be launched for public access and will power all TRON decentralized applications that require a decentralized storage network.

TRON uses a modified version of Delegated Proof of Stake (DPoS) called TRON Proof of Stake (TPoS). There are three types of nodes within the TRON network: Witnesses (Super Representatives), Full Nodes and Solidity Nodes. A Witness is responsible for block production, a Full Node provides APIs and broadcasts transactions and blocks, and a Solidity Node synchronizes irrevocable blocks and provides inquiry APIs.

Super Representatives represent the ‘Delegated’ aspect of the TRON consensus model. There are 27 possible Super Representatives that can be picked from a pool of 127 possible candidates. The 27 are selected every 6 hours to perform their tasks. The pool of 127 possible block producers is selected by the entire TRX token holding community.

The 127 candidates are activated once every 6 hours and share 115,200 TRX per interval. The reward is split in accordance with the votes each candidate receives. The total reward for candidates is set at 168,192,000 TRX (~USD 4,507,545, present spot prices) each year.

Super Representatives, the direct block producers, generate one block every 3 seconds, with each block awarding 32 TRX to Super Representatives. A total of 336,384,000 TRX (USD ~9,015,091, present spot prices) will be awarded annually to Super Representatives.

There is currently no inflation on the TRON network (no new tokens being created by block production) with the TRON Foundation (the original TRX issuer) currently awarding all block rewards and candidate rewards.

This rule has been set until January 1st, 2021 and there is no clear indication of what the TRON foundation will choose to do once this date is reached, but it appears that the current model of shrinking money supply is unsustainable in the long run.

The TRON protocol’s permissioned, tight quorum model means the TRON protocol is capable of high throughput and low transaction costs, however, this comes at the sacrifice of decentralization and censorship resistance.

The TPoS lacks the competition and objective consensus present in Bitcoin’s Proof of Work model, and as such, Super Representatives within TRON have more opportunity to game block production and maximize their own profits without fear of being held back by a large network of nodes, particularly if some SR nodes work together to rig the TRON voting model.

The TRON representative voting model has shown signs of being riggable, with evidence of a number of nodes buying, and being placed into their positions through votes from whale accounts and other super representatives who control large TRX holding wallets. Voter turnout has been as low as 10% on previous candidate elections suggesting a lack of accountability for incumbent nodes.

At present, the TRON representative voting model is not functioning like the democratic model it was designed to emulate. This is a strong bearish flag, and if the Super Representative model is not re-aligned it remains a significant long term concern for the token holding community.

In a now deleted Medium blog post, former TRON CTO Lucien Chen described his decision to leave his position at the blockchain project because it had become ‘overly centralized’ and that TRON’s current direction and state was an ‘irreconcilable contradiction’ to the original TRON ethos to ‘decentralize the web’. He blamed these issues on the TPOS model and the control over the network direction that the 27 super representatives exert.

There has been some renewed buzz around the TRON project following the announcement that maverick TRON and BitTorrent CEO Justin Sun bid USD 4.6 million at a charity auction to win a lunch with super-investor and crypto skeptic Warren Buffett. Buffett has attacked cryptocurrency, famously describing Bitcoin as “rat poison squared.” Recently at an annual meeting for Berkshire Hathaway shareholders, he described wagering on Bitcoin as akin to betting on zero or double-zero on a Las Vegas roulette wheel. Despite this skepticism, Buffett stated that he is looking forward to meeting Justin and his friends and appreciates his contribution to charity.

Buffett’s prominence in the financial investment space and Justin’s position as one of crypto’s most effective PR machines have created new speculative buying pressure for the TRX token. Following the break of the story on May 29, the price of the token pumped ~25 percent in 4 days before subsequently retracing. The TRON foundation has also used the lunch as a tool to market the project as having ties with the Warren Buffett/Berkshire Hathaway.

The current @Tronfoundation account banner image

Based on how quickly the Tronix token retraced following post gain announcements suggests the market does not view Sun as the ecosystem’s best representative to convince Warren Buffett of the cryptographic asset and programmable money value proposition. Despite this, TRON has shown an ability to galvanize retail buying interest through similar announcements in the past. Dates around the lunch and post-event PR may be drivers of short term buying momentum.

Objective on-chain indicators

All on-chain indicators and assessments are made with data post mainnet launch on 30/06/2018. Pre this date TRX existed as an ERC-20 and had significantly different on-chain utility in this form.

NVT signal

Derived from the NVT ratio, the NVT signal is a responsive blockchain valuation metric developed by Willy Woo and Dmitry Kalichkin.

Crypto markets are prone to bubbles of speculative purchasing that don’t reflect underlying network fundamentals. The NVT signal provides insight into what stage of this price cycle a token may be at.

A high NVT signal is indicative of a network that is going through one of these bubble periods and may move towards a position of becoming overbought/overvalued, as the market’s speculative momentum slows.

Short term signals sent by the TRX NVT signal lean bearish. Upon hitting an inflection point of around 90 points in April, the TRX NVT signal line has begun to slide rapidly alongside a falling price line. Historically an oversold inflection level has been around 40 NVTS points for TRX, and with the NVT line is currently well above this level, this suggests that further downward fundamental price pressure may be incoming and that TRX is still overvalued based on on-chain volume.

The Tron network is also an immature protocol with a mainnet that has been active for less than a year. Price and product discovery is still being evaluated by the market and TRX has not yet found a cycle range between oversold and overbought levels. The emergence of new potential Dapps like Tronbet will bring a steady flow of daily users to the network which should help stabilize the TRX NVTS line.

PMR signal

Metcalfe’s law is a measure of the connections in a network, as established by Robert Metcalfe, the founder of Ethernet. It has subsequently been used to analyze the true value of network-based financial products like Facebook and Bitcoin. By comparing it to price, it can provide a useful tool to assess whether a token is over or undervalued.

It is also a more straightforward metric to assess when compared to on-chain transaction volume, which can be challenging to measure accurately in USD terms. Addresses are measured as the number of unique sending and receiving addresses participating in transactions daily.

Since November 2018 the PMR for TRX has been less than one in natural log points. In the medium term, this suggests that Metcalfe’s law (network connections) has always been close to the token’s market cap suggesting fair valuation and some early network effects for TRX.

A cryptocurrency’s network effects increase when new users join and strengthen the network, making it more valuable for existing users. The most direct network effects are improved liquidity and utility. More daily active users can be indicative of, for example, more counterparties to interact within peer-to-peer TRON gaming Dapp (more places to spend TRX) and more counterparties willing to accept TRX for payments.

Exchanges and trading pairs

The most popular trading option for TRX is USDT with the pair handling over 40% of daily trading volumes. The second most popular market is the TRX/BTC pair. Together the top two pairs make up ~70% of the daily trading volume. The Turkish Lira pair is the most popular fiat off-ramp liquidity solution. The USD value of the daily volume of the entire TRX trading market is ~USD 510 million.

A mix of exchanges contributes to the TRX trading ecosystem, with the top 5 pairs spread across 5 exchanges. The TRX/BTC market on Huobi Global is the most active market in the ecosystem. TRX is also tradeable on high profile exchanges such as Binance and Bittrex.

Technical Analysis

Moving Averages and Price Momentum

On the 1D chart, the second golden cross of 2019 recently occured for TRX in mid-May. Furthermore, since the “bottom” in mid-December 2018, TRX has followed a positive linear price trend with a Pearson R correlation of 0.75. Additionally, price is currently above both 50 and 200 day EMAs, including using the 50 day EMA ($0.03) as support.

On the 1D chart, TRX’s volatility patterns have generally followed Fibonacci retracement levels since the mid-December 2018 bottom. Particularly, price was confined between Fibonacci levels of 1.0 ($0.024) and 1.618 ($0.032) for the majority of 2019. Recently, price breached the 1.618 level, but subsequently experienced a sharp decline. However, price recently bounced off the 1.0 level and has begun to march higher. If current support holds, price is likely to head towards the 2.618 level of $0.044 in the near term.

Lastly, on the 1D chart, the volume flow indicator (VFI) is still above 0, which is positive for price. However, there appears to be a divergence between VFI (bottom line) and price (top line) trends, which might indicate future price weakness. However, the VFI of ~13 (red line) has acted as strong support historically. If this VFI support holds and breaks out to the upside, the odds of hitting $0.044 (2.618 Fibonacci level) would increase demonstrably. However, if VFI support falters and breaks out to the downside, $0.031 (1.618) or $0.024 (1.0) will be highlighted.

Ichimoku Clouds with Relative Strength Indicator (RSI)

The Ichimoku Cloud uses four metrics to determine if a trend exists; the current price in relation to the Cloud, the color of the Cloud (red for bearish, green for bullish), the Tenkan (T) and Kijun (K) cross, Lagging Span (Chikou), and Senkou Span (A & B).

The status of the current Cloud metrics on the 1D frame with singled settings (10/30/60/30) for quicker signals are bullish: price is above the Cloud, Cloud is bullish, the TK cross is bullish, and the Lagging Span is above Cloud and price.

A traditional long entry would occur with a price break above the Cloud, known as a Kumo breakout, with price holding above the Cloud. From there, the trader would use either the Tenkan, Kijun, or Senkou A as their trailing stop.

Price completed a Kumo breakout in late-May, which has endured despite recent price weakness. Currently, the Tenkan ($0.034) has acted as resistance. Despite said resistance, price has several support levels nearby, coupled with an RSI (53) value at acceptable levels. If price breaks above the current Tenkan resistance, price targets are $0.038 and $0.045. If price falters, support levels are $0.03 and $0.027.

The status of the current Cloud metrics on the 1D time frame with doubled settings (20/60/120/30) for more accurate signals are bullish: price is above the Cloud, Cloud is bullish, the TK cross is bullish, and the Lagging Span is above the Cloud and price.

The slower settings yield very similar results; including current Kumo breakout, Tenkan resistance, and price targets and support levels.

Conclusion

Almost a year on from its mainnet launch, TRX has maintained its position as a top 15 cryptographic asset through the crypto bear market. It has proven some early critics wrong, building a blockchain with an impressive quantitative transaction count and user data numbers. Most network transaction activity on TRON revolves around gambling, and the impressive size and tangible user activity of the ecosystem’s leading Dapp, Tronbet, indicates the potential for developers seeking to build on the blockchain.

TRON is, however, still an immature blockchain with a Delegated Proof Of Stake consensus model that has shown signs of corruption, and a block reward model that will soon have to be reconfigured.

In the short term, fundamentals lean bearish. The drop in on-chain volume and smart contract activity suggest that fundamentals may continue to push the price down. However, favorable market conditions and speculative events like the Justin Sun/Warren Buffett lunch may create some buying pressure to counter this.

The technicals for TRX are currently sending bullish signals with a slight sprinkle of VFI caution. However, if the divergence between price and VFI unravels in favor of the bulls, both the fast-setting trader (10/30/60/30) and slow-setting trader (20/60/120/30) will view the current Kumo breakout as an acceptable spot to enter a long position. Price targets for the bulls are $0.038 and $0.045. Support levels (price targets for bears) are $0.03 and $0.027.

Don’t miss out – Find out more today