Yearn Finance Price Analysis – Bearish continuation likely in the near term

Although many copycat protocols have quickly been spun up in recent weeks, YFI will likely maintain its first-mover advantage in the months to come.

Yearn.Finance (YFI) is a decentralized finance (DeFi) platform with a native governance token used for voting rights and staking rewards to holders. The network is underpinned by the Yearn protocol, a yield optimizer that aims to maximize yields for a user’s crypto holdings by automatically switching funds across a range of lending protocols.

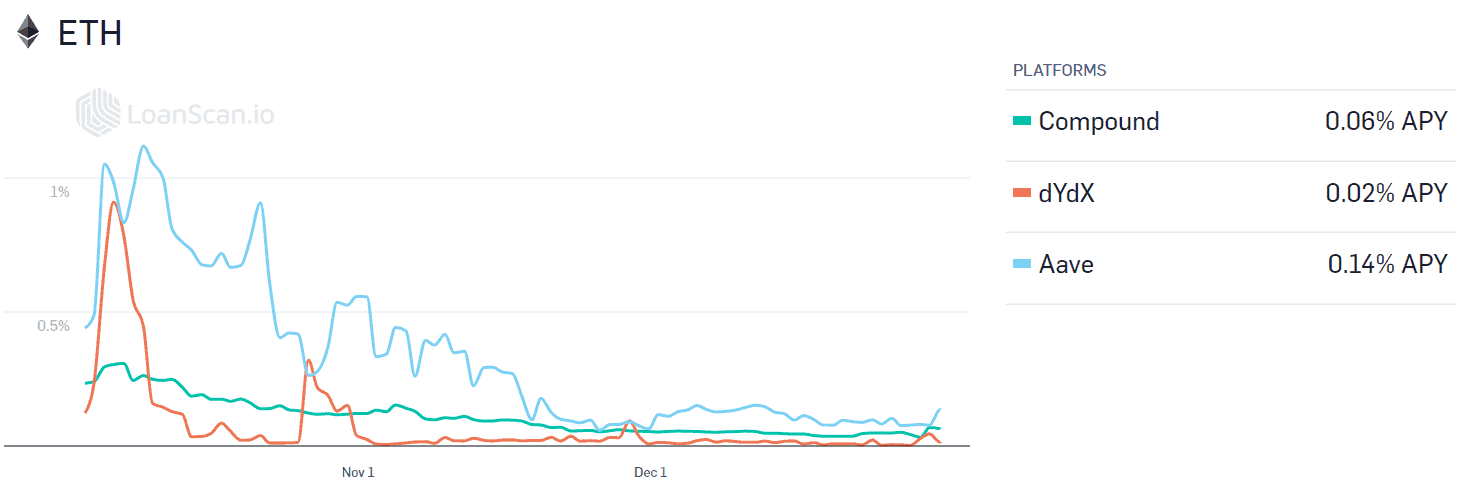

Developer Andre Cronje built the protocol in early 2020 after looking for a way to automate the process of finding the highest possible yields on his stablecoin holdings. Stablecoins like DAI (DAI), Tether (USDT), USD-Coin (USDC) can be deposited in return for yields on a number of platforms like Compound, Aave, Fulcrum, or dYdX, with each offering unique APY’s.

The protocol works by creating pools for each individual asset. When a user deposits stablecoins into one of these pools, they receive yTokens which are yield-bearing equivalents of the deposited coin. If for example, a user deposits DAI into the protocol it will issue back yDAI.

Assets are automatically shifted between lending platforms in the DeFi ecosystem, like Compound and Aave, where interest rates for deposited assets change dynamically. Every time a new user deposits assets into a pool on Yearn, the protocol checks whether there are opportunities for higher yield and rebalances the entire pool if necessary. At any time, a user can burn yTokens and withdraw the initial deposits and accrued interest in the form of the original deposit asset.

The protocol has evolved to offer more complex solutions that can efficiently maximize yields on user deposits. The yCRV liquidity pool built by Yearn on the Curve finance platform contains the following yTokens: yDAI, yUSDC, yUSDT, yTUSD and pays back a yCRV token that represents the index. Users can deposit any of the four native stablecoins into the pool and earn interest back from yield-bearing yCRV tokens. Depositors also earn trading fees from Curve for providing liquidity to other users of the platform.

The Yearn.Finance solution also aggregates rewards from yield farming programs, allowing users to earn native tokens like COMP, by offering liquidity provision services to other platforms. To capture this new value, Yearn launched yVaults as part of Yean.finance V2 launch in late July. Vaults are pools of funds that have an associated strategy designed to maximize returns on DeFi asset pools. Beyond just moving assets between lending platforms, vaults perform multiple operations to maximize returns on deposits – like farming native coins and selling them for profits, providing liquidity to earn a share of platform fees, and using pooled funds as collateral to borrow stablecoins. Each vault follows a strategy decided by the Yearn community.

Alongside the core yield aggregator services, Yearn.Finance has also built, and is building, a range of complementary DeFi products for its ecosystem, including:

- Yswap, an automated market-maker (AMM) that allows users to deposit single-sided liquidity – an alternative to the 50/50 deposit model offered by platforms like Uniswap, designed to reduce impermanent loss.

- yTrade, a leveraged stablecoin exchange that enables users to borrow stablecoins with other stablecoins up to 1000x leverage. Traders earn by betting on whether a particular stablecoin will move away from its one dollar peg.

- yInsure, a prototype for tokenized decentralized insurance that allows users to make claims and earn a share of community insurance payments by staking stablecoins.

The total value of assets locked (TVL) in YFI is currently US$345 million, down from the August all-time high of nearly US$1 billion. A falling TVL with rising Bitcoin (BTC) and Ethereum (ETH) prices suggests waning market sentiment in YFI yield strategies.

Source: defipulse

The Yearn.Finance governance token, YFI, was first issued as a reward for liquidity providers (LPs) using the Yearn.Finance protocol. When Cronje first launched the token he stated, “in further efforts to give up this control (mostly because we are lazy and don’t want to do it), we have released YFI, a completely valueless 0 supply token. We re-iterate, it has 0 financial value.” Despite Cronje’s disclaimer that the tokens were worthless, users rushed to pour money into the incentivized liquidity pools assigned for earning YFI.

A 9-day long YFI token distribution started with 10,000 tokens allocated to the liquidity providers of the yCRV pool. The LPs had to stake their yCRV LP tokens to receive YFI rewards. Shortly after yCRV distributions, two more pools to earn tokens on the Balancer asset management platform were added, each offering 10,000 tokens to liquidity providers, ending up with a total of 30,000 YFI tokens.

The YFI token price is currently US$22,000 and has been wildly volatile over the past few months, which is partially related to the lack of available tokens and partially related to the fever of listings on various exchanges. YFI reached an all-time high of US$42,000 on September 13th. The 30,000 YFI tokens in circulation have now been capped after an on-chain vote favored the permanent cap. While YFI can no longer be earned through liquidity minting, the asset is now tradeable on major centralized exchanges including Binance and Coinbase as well as decentralized platforms like Uniswap.

YFI holders can stake their tokens to a Yearn.Finance governance contract and earn a share of ecosystem rewards which are derived from;

- Yearn.Finance interest

- COMP from compound

- CRV from curve.fi

- curve.fi/y trading fees

- ytrade.finance leverage fees and liquidation bonuses

- yswap.exchange underlying system fees

- yliquidate.finance liquidation bonuses

- system dust (unassigned interest or fees)

These fees are collected on a daily/weekly basis and YFI holders can claim their share of rewards by burning their YFI tokens. Cronje explained, “as the system AUM and usage grow, so do the fees, and respectively the rewards pool.”

On-chain YFI token stats reveal declining transactions per day compared to earlier in the year (red line). Transactions per day have yet to exceed the initial token distribution period. Average transaction values (green fill) had also been relatively flat over the past few months. Over the past week, average transaction values increased dramatically.

Source: CoinMetrics

The weekly Kalichkin network value to estimated on-chain daily transactions (NVT) ratio (green line) has decreased to 10 over the past few weeks, from a high of 17. A clear downtrend in NVT suggests a coin is undervalued based on its economic activity and utility, which should be seen as a bullish price indicator.

Weekly active addresses (WAA) have essentially held between 15,000 to 20,000 since token inception. Over the past few weeks, WAAs have begun to rise again, another bullish price indicator.

Source: GitHub – iearn-finance/iearn-finance

Source: GitHub – iearn-finance/iearn-finance

Source: GitHub – iearn-finance/iearn-finance

Source: GitHub – iearn-finance/iearn-finance

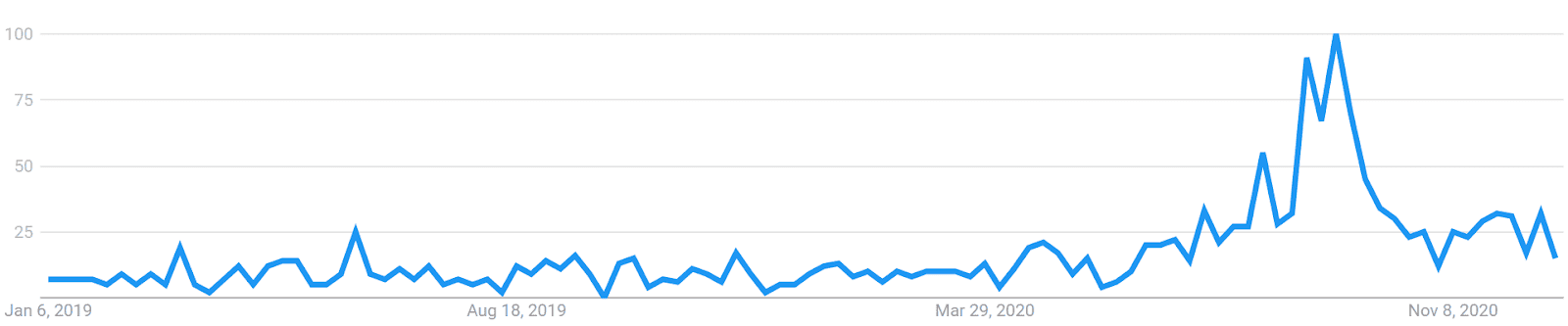

Worldwide Google Trends data for the terms “Defi Crypto” and “Yield Farming” increased massively earlier this year but have declined substantially in recent weeks. A 2015 study found a strong correlation between the Google Trends data and BTC price, while a May 2017 study concluded that when the U.S. Google "Bitcoin" searches increased dramatically, BTC price dropped.

Source: Google Trends – “Defi Crypto”

Source: Google Trends – “Yield Farming”

Technical Analysis

As a potential bearish trend resumes, roadmaps for future market movements can be found on high timeframes using Exponential Moving Averages, Volume Profile Visible Range, Pivot Points, Ichimoku Cloud, and divergences. Further background information on the technical analysis discussed below can be found here.

YFI has a limited trading history and needs to be analyzed on lower timeframes, as opposed to the daily chart. On the four-hour timeframe, the 50-period Exponential Moving Average (EMA) and 200-period EMA crossed bullish on November 13th, which resulted in a 75% increase. Last week, these key EMAs flipped bearish once again, a strong indication of upcoming bearish momentum.

The current spot price also sits below the high volume area at US$22,000 according to Volume Profile Visible Range (VPVR) and a monthly support pivot. If this horizontal support fails, the next significant support sits at US$13,000 to US$16,000 based on monthly pivots and VPVR.

The spot price has also formed a series of bearish chart patterns since the all-time high was established; including a head and shoulders and descending triangle. After both patterns reached their projected targets, a strong trend reversal occurred. Currently, price sits near the bottom of a bearish head and shoulders pattern with a 1.618 and measured move of US$15,524 and US$11,885, respectively. This pattern with be invalidated if price breaches above the right shoulder at US$28,558.

Turning to the Ichimoku Cloud, four metrics are used to indicate if a trend exists; the current price in relation to the Cloud, the color of the Cloud (red for bearish, green for bullish), the Tenkan (T) and Kijun (K) cross, and the Lagging Span. The best entry always occurs when most of the signals flip from bearish to bullish, or vice versa.

Cloud metrics on the four-hour timeframe, with doubled settings (20/60/120/30) for more accurate signals, are bearish; the spot price is below the Cloud, the Cloud is bearish, the TK cross is bearish, and the Lagging Span is above the Cloud and above the current spot price. The trend will remain bullish so long as the spot price remains above the Cloud, currently at US$23,000.

Conclusion

The Yearn.Finance platform stormed into the DeFi community’s box of tools earlier this year, furthering and improving upon yield farming through automation and efficiency. The YFI token also saw dramatic early success, despite founder Andre Cronje stating the token should have no value whatsoever.

YFI has quickly expanded its services over the past 150 days, just as DeFi yields have begun to cool across the board. With many copycat protocols quickly being spun up in recent days, YFI will likely maintain a first-mover advantage in the months to come. However, despite the increase in services, the total value locked in the YFI ecosystem has continued to decline over the past few weeks.

Technicals for the YFI token are bearish, after a significant rejection of the US$30,000 highs. Trend metrics show price below the 33-day EMA and four-hour Cloud. Strong support stands at US$13,000 to US$16,000 based on monthly pivots and VPVR. A bearish head and shoulders pattern also projects a target of US$11,885 to US$15,500. Thus far, the token has traded highly technically since inception, suggesting the high likelihood of bearish continuation in the near term.

Don’t miss out – Find out more today