Crypto Market Forecast: Week of April 19th 2021

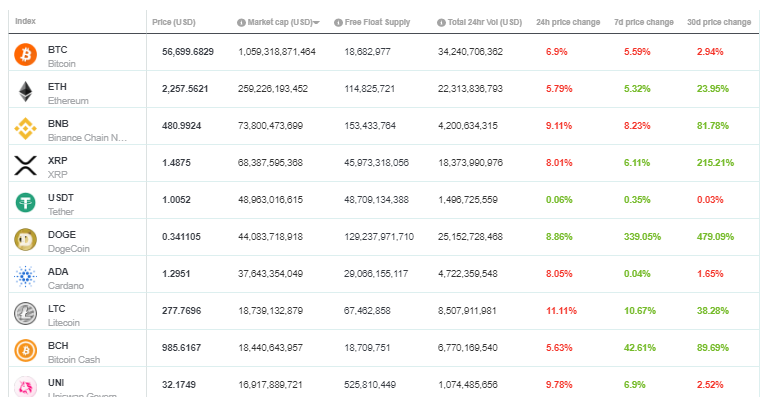

A curated weekly summary of forward-focused crypto news that matters. This week, Bitcoin and digital assets reset after a difficult weekend, the Bitcoin hashrate crashes after a blackout in Xianjing, and Dogecoin outperforms other large-cap assets.

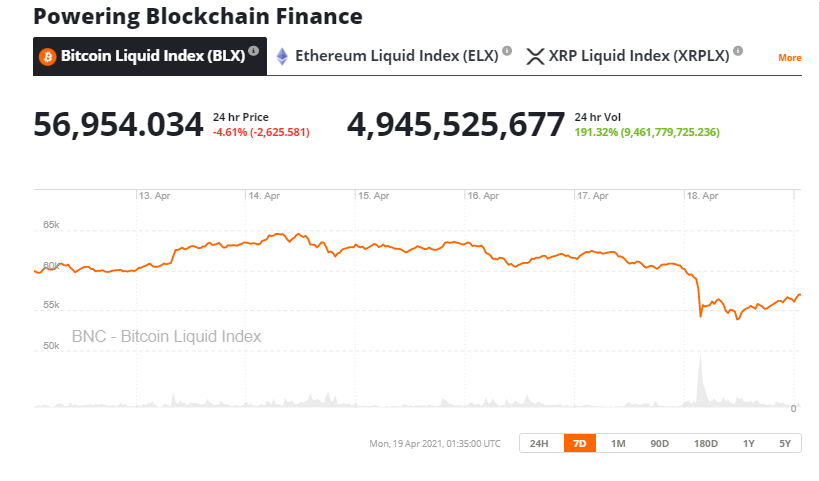

The last week of trading in digital asset markets was separated into distinct halves. After a strong start to the week with Bitcoin (BTC) and other assets breaking out and hitting all-time-highs on Wednesday, a brutal weekend of heavy selling erased much of these gains.

Bitcoin ends the week down ~6%, trading around ~US$56400 after hitting an all-time high of $64500 during the week. Ethereum (ETH) ends the week up ~5%, trading around ~$2220 after also reaching an all-time high of $2540 during the week. The third-largest asset Binance Coin (BNB) ends the week down ~5% and trading around ~$478 after reaching ~$605 last week.

Crypto markets had been rising rapidly over the last few weeks in the lead-up to Coinbase’s public listing on Wednesday, April 14th. Much of the money flowing into crypto during this period was focused on the futures markets and in high-leverage positions. After Coinbase’s listing, markets corrected after this period of temporary mania.

In the perpetual markets, the funding rate had been spiking before Coinbase’s listing. This meant there was a glut of long positions and that going long was an overcrowded trade. In the quarterly futures markets, a gap began to open between the spot and futures prices for assets, while traders were making high-risk bets that the Bitcoin and Ethereum prices would continue to rise. The phenomenon of a higher future price than the spot price for assets is known as Contango.

On April 18th, data provider Bybt reported that $9.26 billion worth of longs were liquidated in the crypto futures market. Liquidity in markets was low over the weekend as selling pressure after the Coinbase listing began to build. At the same time, the cascading effects of the long squeeze were more severe than on a weekday when trading markets are more active.

Long squeezes occur when traders who were betting on the price to rise are forced into liquidating or making sell orders to cover or close positions because the market moved against them, adding further pressure to an already dipping market.

Another factor in the price dip was an announcement from the Central Bank of Turkey on Friday, that the use of cryptocurrencies for payments would be banned and local firms cannot provide these services. Justifying its new regulations the bank reiterated the familiar litany of fears about money laundering and protecting people from price volatility and scams.

Crypto news for the week ahead

19th April- MEX snapshot for Elrond holders

The native tokens of the Maiar exchange, a new automated market maker decentralized exchange that will launch on the Elrond network, are set to be dropped to holders of EGLD tokens. The snapshot for MEX tokens will be non-linear and based on how much EGLD a user holds and their holdings of other tokens like Uniswap (UNI), Sushiswap (SUSHI) and Pancakeswap (CAKE).

21st April- Kevin Smith NFT Auction

Hollywood film director Kevin Smith is partnering with the Phantasma chain and Semkhor.io on an NFT auction using branding from Smith’s popular Jay and Silent Bob film series. Some of the items that will be sold as NFTs include a film preview, an opportunity to have a cameo appearance in an upcoming Kevin Smith film, and a comic book cover.

Trading set-ups for the week

Pro trader Josh Olszewicz explores trading options and signals for BTC and ETH – and lays out the trading setups he’s watching for the upcoming week. Start your week off right with Josh’s thoughts on trading strategies on a weekly basis.

Top 10 Crypto Summary

Despite the weekend turmoil, the majority of large-cap assets on the Brave New Coin market cap table ended the week in the green. The clear alpha performer was DOGE. The memecoin rose a staggering 339% over the week, bouncing back quicker and more aggressively from the weekend drop than any other large-cap asset. On Friday, Tesla CEO and world’s richest man Elon Musk tweeted a photo of the painting “Dog barking at the moon” by Joan Miro with the caption “Doge barking at the moon”. Musk’s tweets have previously been a bullish price driver for DOGE.

Bitcoin Price Chart

A blackout in the Xinjiang region—where much of the world’s mining electricity is created—caused a sudden dip in the Bitcoin hashrate. On April 15th the hashrate dropped by 33% in a day but has since recovered to reach pre-crash levels. There has been speculation that the hashrate crash drove sellers to the market because of concerns that the blackout may have deeper fundamental effects on the Bitcoin network.

Don’t miss out – Find out more today