BNC is the cryptocurrency sector’s leading provider of custom crypto indices and benchmarks for exchanges, brokers and asset managers.

We build indices that are:

- Robust

- High Frequency / Low Latency

- IOSCO Aligned

- Institutional Grade

Crypto Index Builders

The Crypto Index Build ‘Rule of 3’

Premium Data

- Total data coverage – by exchange, markets, assets, & history

- Refined data processes – standardization, scrubbing, validation, monitoring

- Audited as consistent with IOSCO principles for financial benchmarks

- All data types – tick, trade, order book, volumes, on-chain/off-chain, social & sentiment

- Data analytics – a complete suite of middleware

- High-frequency, low-latency & scalable data solutions

Experienced Consultancy

- Crypto’s leading index building team

- Index design – research, asset selection & exchange criteria

- Index methodology – Scope requirements, define objectives & identify solutions

- Index backtesting – historic data to validate strategies

- In-house analysts – market coverage, comparative analysis, performance & returns

- Premium partnerships with A-list benchmark administrators & crypto marketing agencies

- Cost effective – indices optimized for efficiency, cost, uptime, & performance

Trusted Calculation

- Experience – calculating crypto indices since 2014

- Trusted independent calculation

- Established index governance process

- Regular review – rebalancing, performance tracking, & criteria updates

- Resistant to market manipulation

- Exchange relationships

- 24/7/365 support

Case studies

Opportunity

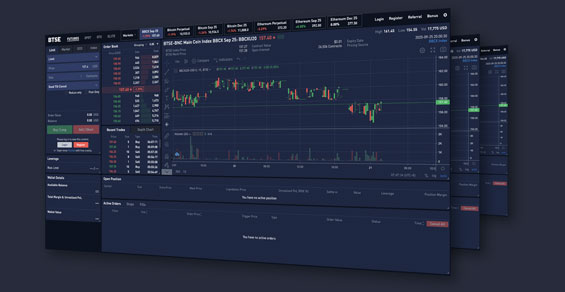

BTSE, a leading crypto derivatives exchange saw a market need for a range of institutional grade, high frequency, multi asset basket indices that enabled its customers to price and settle futures.

Solution

Brave New Coin worked with BTSE to create crypto indices to meet the market need – developing proof of concepts, index methodologies, backtesting, and launching BTSE’s first crypto index within three months of initial discussions.

Outcome

Now live, the BNC-BTSE Composite Index Family (BBCX & BBAX) tracks the real-time market performance of a basket of large cap cryptocurrencies by free float market capitalization. Launched in October 2019, the BBCX was amongst the first indices in the world to track a range of crypto assets (BTC, ETH, LTC) across multiple pricing sources at sub-second frequency. Its altcoin alternative, the BBAX, was launched in February 2020. BTSE’s most recent BNC index is the BBDX DeFi Index, launched in Q4 2020, which gives traders and investors exposure to 10 of the most popular tokens in the burgeoning DeFi sector.

Opportunity

By late 2014 it was clear that the growing number of crypto exchanges and the 24/7 nature of the industry made it difficult for traders and investors alike to find a single, reliable and fair USD price for Bitcoin – a problem Brave New Coin was committed to solving.

Solution

The company set to work developing the Bitcoin Liquid Index (BLX) – which would represent the fair value of Bitcoin, as based on actual trade and order book data sourced from the world’s most trusted and liquid trading platforms.

Outcome

Launched in 2015 and built to be consistent with key IOSCO principles, the BLX is now the world’s most trusted price source for Bitcoin – offering a robust reference rate and settlement price for any derivatives or complex financial products. Available via API, the BLX includes 30 second Intra-Day pricing, End-of-Day OHLCV and Time & Volume-Weighted-Averages. Since 2015 The “Liquid Index” series has expanded to include the Ethereum Liquid Index (ELX) in 2018, and the XRP (Ripple) Liquid Index (XRPLX) in 2019.

Opportunity

The Toronto Futures Options Swaps Exchange (tFOSE) identified a lack of institutional-grade cryptocurrency products in the Canadian marketplace and set a goal of enabling clients in Canada and globally to trade cash-settled crypto derivatives on a fully regulated Canadian exchange and clearinghouse.

Solution

After surveying the market for a reputable and experienced provider, tFOSE chose Brave New Coin to build a suite of single asset and composite indices to price and settle crypto options.

Outcome

tFOSE is now awaiting approval from Canadian regulators and CEO James Beattie is confident the exchange will be trading early in 2021. He says the indices built by BNC will enable tFOSE to drive derivative market solutions, repatriate order flow to Canada and unlock new global markets. ”BNC met all of our needs,” he says, “taking a unique approach to index design, methodology, and governance that will help us meet the specific, exacting needs of both our retail and institutional investors.”