Crypto market forecast: 15th July

A bearish week for Bitcoin ended with the majority of the crypto market suffering double digit trading losses. Aside from price action, tweets about Bitcoin and crypto from US President Donald Trump led to an inevitable wave of responses and opinions on crypto social media.

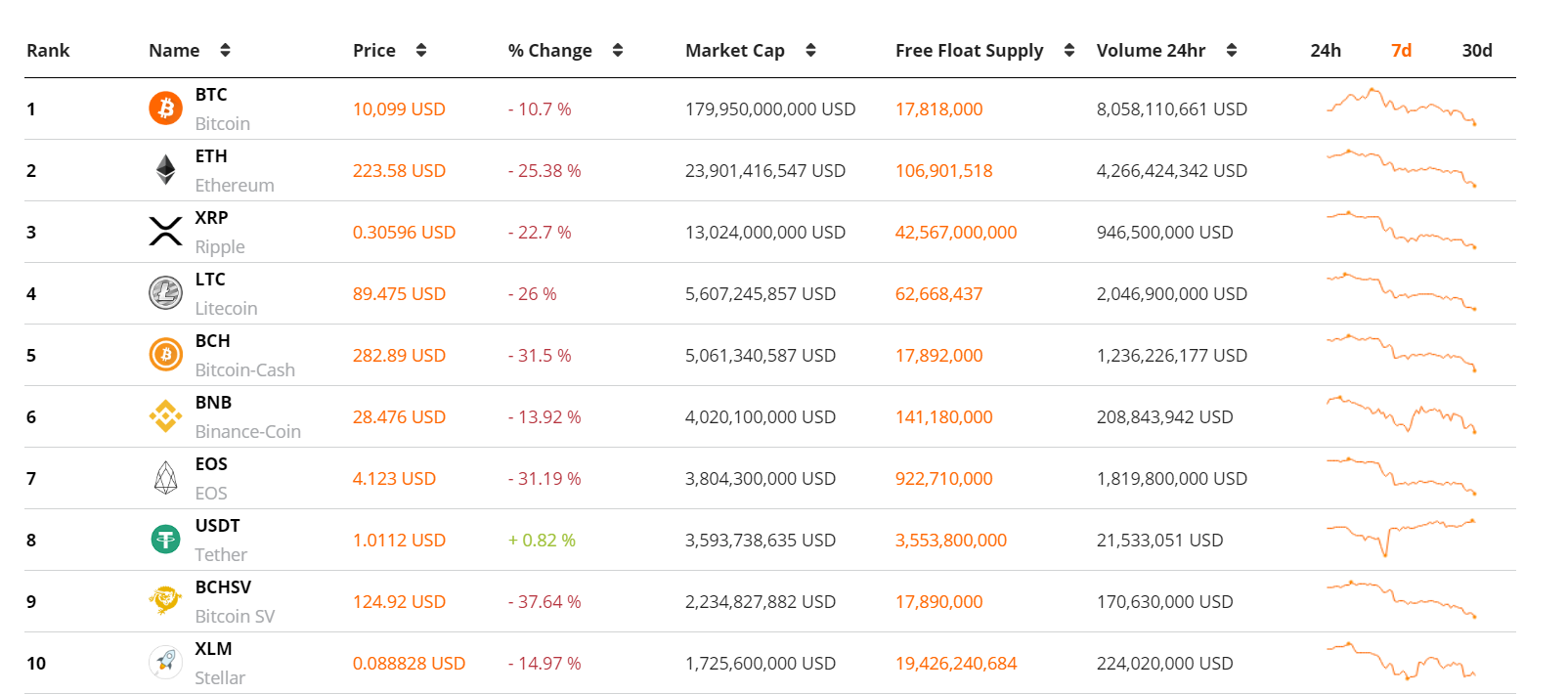

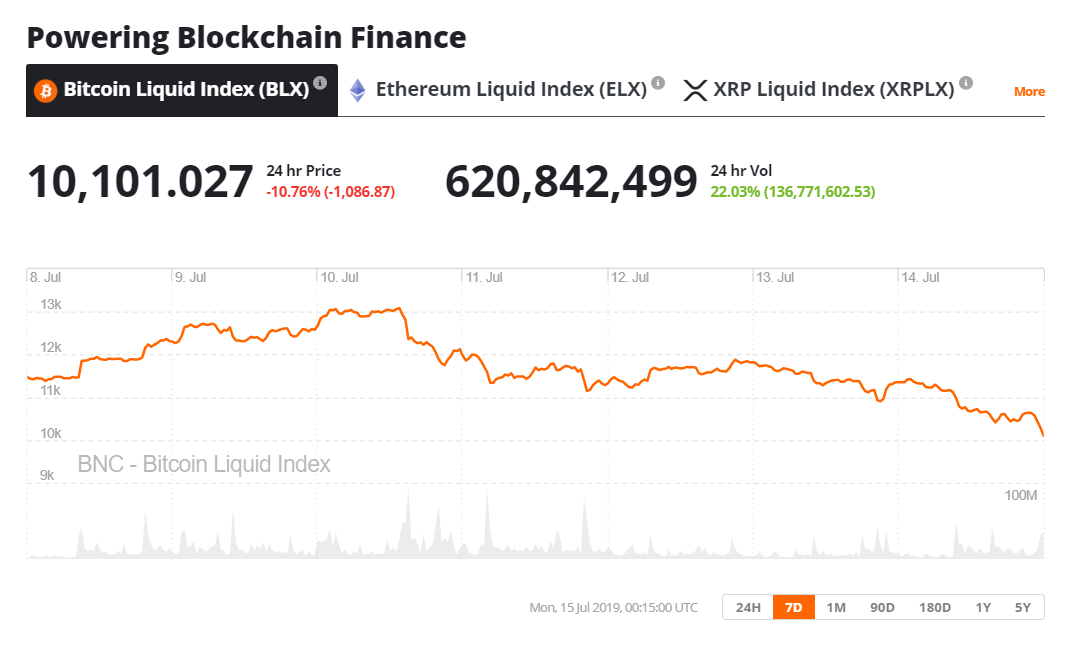

A tumultuous week of crypto trading ended with most digital assets trading strongly in the red as bears took control of the markets in the second half of the week. Market benchmark BTC fell ~11% over the last week. BTC currently trades at ~USD 10,025, having traded as high as ~USD 13,100 last Wednesday. The second and third largest crypto assets on Brave New Coin’s market cap table, ETH and XRP, fell ~27% and ~22% respectively while the overall crypto market slid ~11%.

The ongoing public discussion around Bitcoin’s validity as a digital store of value and permissionless value transfer network took another important step last week. On Friday, President Donald Trump tweeted that he was not a fan of Bitcoin or other cryptocurrencies.

In the first public mention of cryptocurrency by a US president, Mr. Trump tweeted that he did not believe that cryptocurrencies are money, that they are ‘highly volatile’, and their value is based on ‘thin air’. Despite Trump’s obvious skepticism, many in the crypto community viewed the statement as positive due to the increased public interest it creates for the wider crypto ecosystem. It also sends a clear signal that Bitcoin is now taken seriously as part of the global geopolitical discussion. Following President Trump’s original tweet there was a sharp pick up in ‘Bitcoin’ twitter mentions with many crypto and FinTech commentators providing analysis.

The global cryptocurrency industry is under wider scrutiny following the announcement of the Facebook backed Libra blockchain payment network. Speaking last Wednesday in front of the House Financial Services Committee, Federal reserve chairman Jerome Powell said that the current Libra framework has not fully addressed wider concerns around issues such as “Money laundering, data protection, and consumer privacy.” Powell said these concerns “will need to be addressed very thoroughly and carefully,” by Libra.

Offering an alternative perspective, on Friday, the Governor of the Bank of England, Mark Carney, acknowledged the issues within legacy money transfer markets. These are the issues the Libra network is attempting to address. Carney stated, “It’s way too expensive to do domestic payments. It’s way too slow, and that hurts consumers and businesses. It stifles innovation, and it’s far too expensive to send money cross-border.” Carney recognized that “we have to absolutely acknowledge the problem that they’re trying to solve. And if it’s not this, we’d better have some answers for what else it is.”

Carney’s perspectives suggest that some global regulators are viewing Libra as both a problem and an opportunity. However, President Trump tweeted that “Facebook Libra’s virtual currency will have little standing or dependability. If Facebook and other companies want to become a bank, they must seek a new Banking Charter and become subject to all Banking Regulations, just like other Banks.”

Finally, Libra project head David Marcus has written a letter to Chairwoman Maxine Waters and members of the House Financial Services Committee ahead of the upcoming Libra hearings, reports The Hill. Marcus wrote, "I want to give you my personal assurance that we are committed to taking the time to do this right.”

This week in crypto events

July 16th– July 17th Libra hearings before the Senate Banking Committee and the House Financial Services Committee- The team from the Libra blockchain project will publicly address questions from US lawmakers on Tuesday and Wednesday. The hearings follow a statement from top US senators demanding that the Libra consortium delay its attempt to roll out the cryptocurrency by the second half of 2020 as planned.

July 15th- Binance Chain Mainnet Upgrade– This Monday, Binance chain, the native chain for Binance’s DEX solution and native BNB token, executes its first mainnet hard fork upgrade. The upgrade will add features like an on-chain token delisting protocol, a matching engine revision, and new token time-locking options for projects planning to launch on Binance chain. While the upgrade may create some buying pressure for BNB, the current bearish market conditions are likely to hold back any immediate positive price action. The price of the token has fallen ~20% in the last 7 days.

It was a difficult week for large-cap assets with only stablecoin solution US dollar Tether not trading heavily in the red. Just outside of the top 10, Chainlink (LINK) a recent standout amongst altcoin assets, fell almost 20% in the last week despite confirming partnerships with Ampleforth and Neblio.

Following a strong start to the week the bulls were unable to fight back against strong selling pressure in the BTC markets as the week progressed. With US dollar Bitcoin price now sliding towards 4 digits, USD10,000 remains a key psychological price level.

Don’t miss out – Find out more today