0x Price Analysis – More Relayers, less token use

Fundamentals show that the quantity of Relayers continues to grow, while the order flow of those relayers has remained relatively flat over the course of the year. On balance, an increase in low-risk options for traders through DEXs is incredibly healthy for an industry plagued with exchange hacks on a regular basis.

The price of 0x (ZRX) has declined 60% since late July, alongside most large-cap token-based currencies which have taken significant losses over the past month. The market cap currently stands at US$280 million with US$8.37 million in trading volume over the past 24 hours.

Source: coin360.io

The ZRX protocol is an open and permissionless platform designed to power decentralized exchanges (DEXs) on the Ethereum network. ZRX provides the architecture for DEXs to be developed, in the form of Relayers on the ZRX platform, and uses a messaging format for trade settlement and a system of smart contracts for a decentralized governance module. Relayers using the ZRX protocol generate and manage trading on their own platforms, or "off-chain." In doing so, they can charge maker and taker fees, take advantage of the order book spread between tokens, charge listing fees for certain tokens, or include any other fees they wish, paid in ZRX.

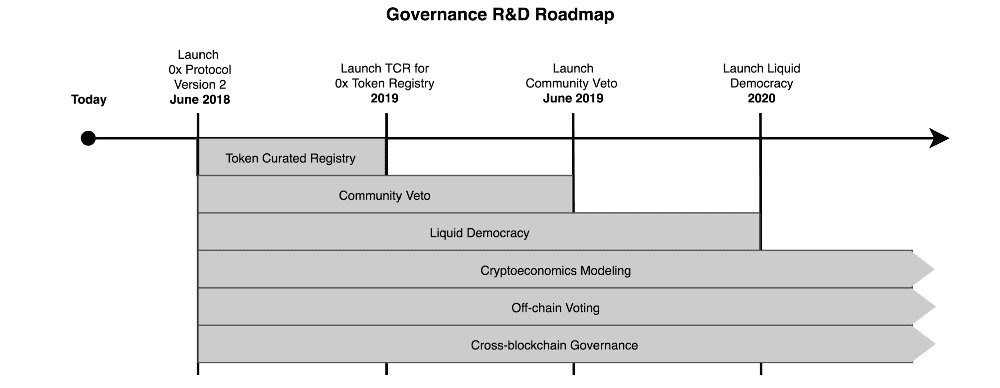

The ZRX protocol includes decentralized governance in an attempt to reduce the friction associated with upgrades and any platform downtime. The idea being that relayers will accrue the ZRX token in order to approve or disapprove potential future upgrades. This process can also decrease circulating supply, and increase the value of the token.

The main advantage of Relayers, and DEXs in general, is the removal of custodial risk. Over the past few years, crypto exchanges have served as a multimillion dollar treasure trove for hackers. Earlier this week, Zaif, a centralized Japanese exchange was hacked for over US$40 million worth of cryptocurrencies. The ZRX protocol has spawned over 15 relayers, including; DDEX, Radar Relay, The OceanX, ETHfinex, and ETHfinex Trustless.

Earlier this month, ZRX released V2 of the protocol which brought several new features including; the 0x Portal, Non-Fungible Token support (ERC-721), increased order matching efficiency, and the option for permissioned liquidity pools, where token addresses must meet specific requirements that enable the enforcement and adherence to KYC/AML regulations.

Source: 0xproject.com/portal

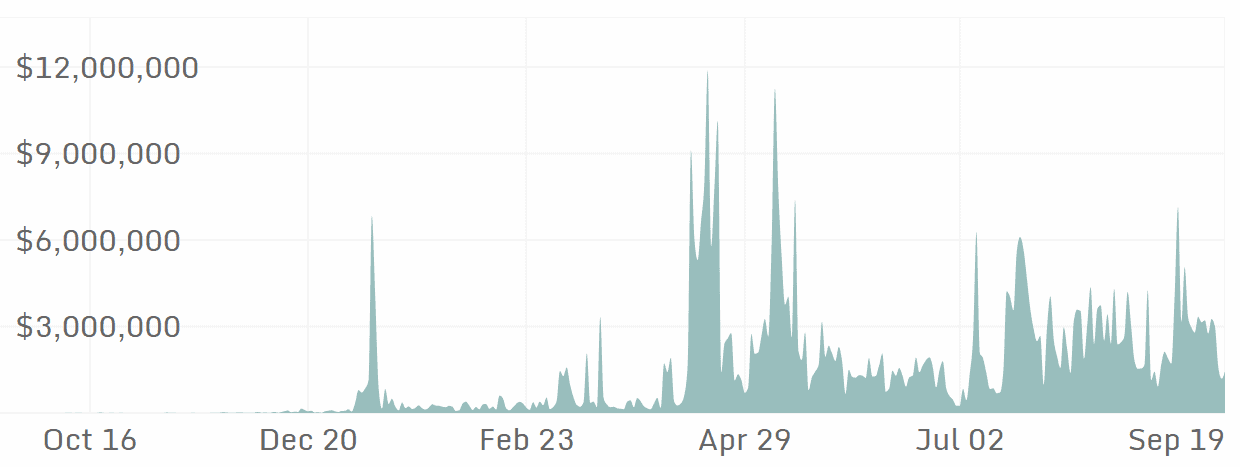

Over the past year, total network volume across all relayers has certainly increased but remains far from consistent. On average, fewer than 2,500 trades per day have occurred since July. In contrast, the most popular derivative trading platform, BitMex, regularly trades billions of dollars per day. The most popular token traded between all Relayers is Wrapped ETH (wETH), an ERC-20 compliant derivative of ETH.

Source: 0xtracker.com

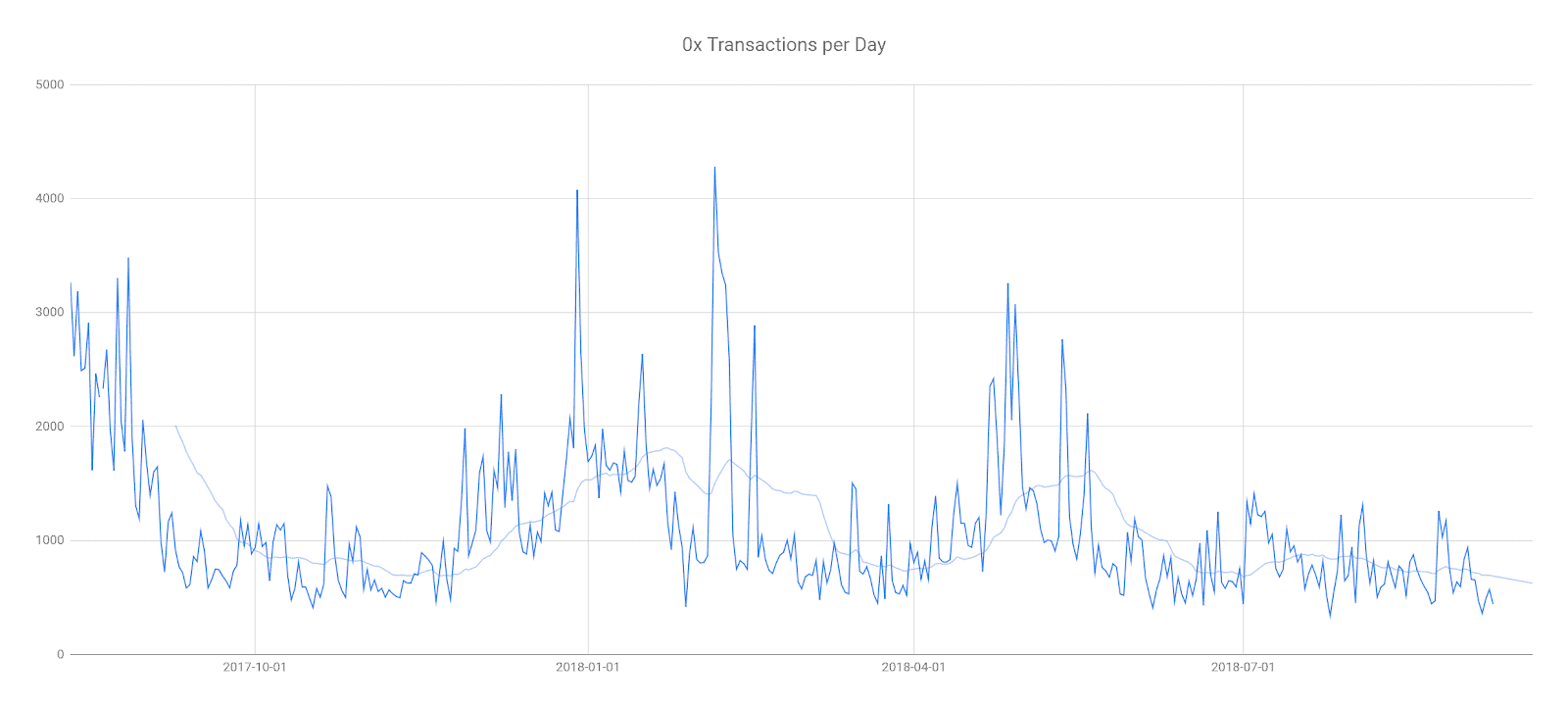

Transactions per day of the ZRX token have declined steadily over the course of the year, with far fewer than 2,000 transactions per day over the past few months. The lack of ZRX token transactions is a result of the lack of importance of the ZRX token itself. Currently, ZRX tokens are a purely speculative vehicle and are not required to trade on Relayers. Without any pending governance decisions or ZRX denominated fees, Relayers themselves have no reason to hold the token. Co-founder and CEO Will Warren has discussed this issue, including the possibility of Relayers adding a staking feature to decrease user fees, as well as ZRX focusing on long term value creation.

Source: coinmetrics.io

Other key network metrics include the network value to transactions ratio (NVT) and daily active addresses (DAA). NVT is a measure of token velocity and DAA reflects network growth, or lack thereof. NVT has increased steadily over the course of the year with DAA steadily declining. Both metrics point to a decline in fundamental network value. A sharp decline in NVT and/or a sharp increase in DAA should be seen as leading indicators for bullish price action.

Source: coinmetrics.io

Exchange traded volume has been led by the Bitcoin (BTC) and Ethereum (ETH) pairs on Binance, BitMart, and HitBTC. This week, OKCoin.com announced new ZRX/USD, ZRX/BTC, and ZRX/ETH markets. In August, Poloniex listed a ZRX/USDT pair and KuCoin listed ZRX/BTC and ZRX/ETH pairs. Although mentioned earlier this year, there has been no additional news on a Coinbase listing for any ZRX pairs.

Technical Analysis

ZRX and ETH prices have had an 80% correlation over the past three months, as both have declined significantly. As oversold conditions become apparent, counter trend trades can prove to be profitable. Entries and exits for such trades can be found using exponential moving averages (EMAs), divergences, chart patterns, and Ichimoku Cloud. Further background information on the technical analysis discussed below can be found here.

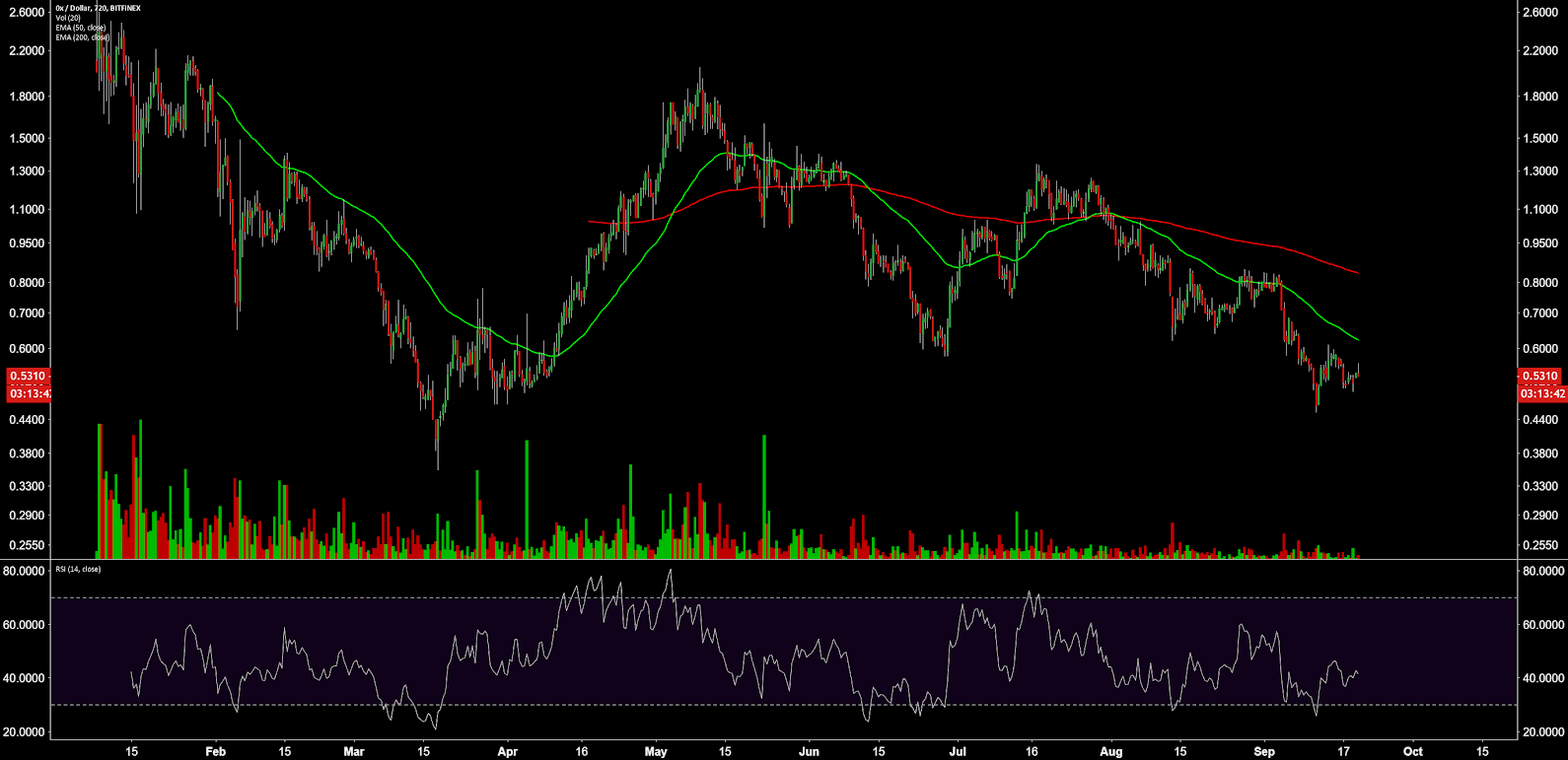

On the twelve hour chart, the 50/200EMAs have been bearishly crossed for almost 100 days, resulting in a 50% decline. The 200EMA should act as both a magnet and strong resistance for price if a mean reversion attempt is made. There are no active RSI divergences although there is a potential W-double bottom formation signaling a short-term reversal.

Turning to the Ichimoku Cloud, four metrics are used to determine if a trend exists; the current price in relation to the Cloud, the color of the Cloud (red for bearish, green for bullish), the Tenkan (T) and Kijun (K) cross, and the Lagging Span. The best entry always occurs when most of the signals flip from bearish to bullish, or vice versa.

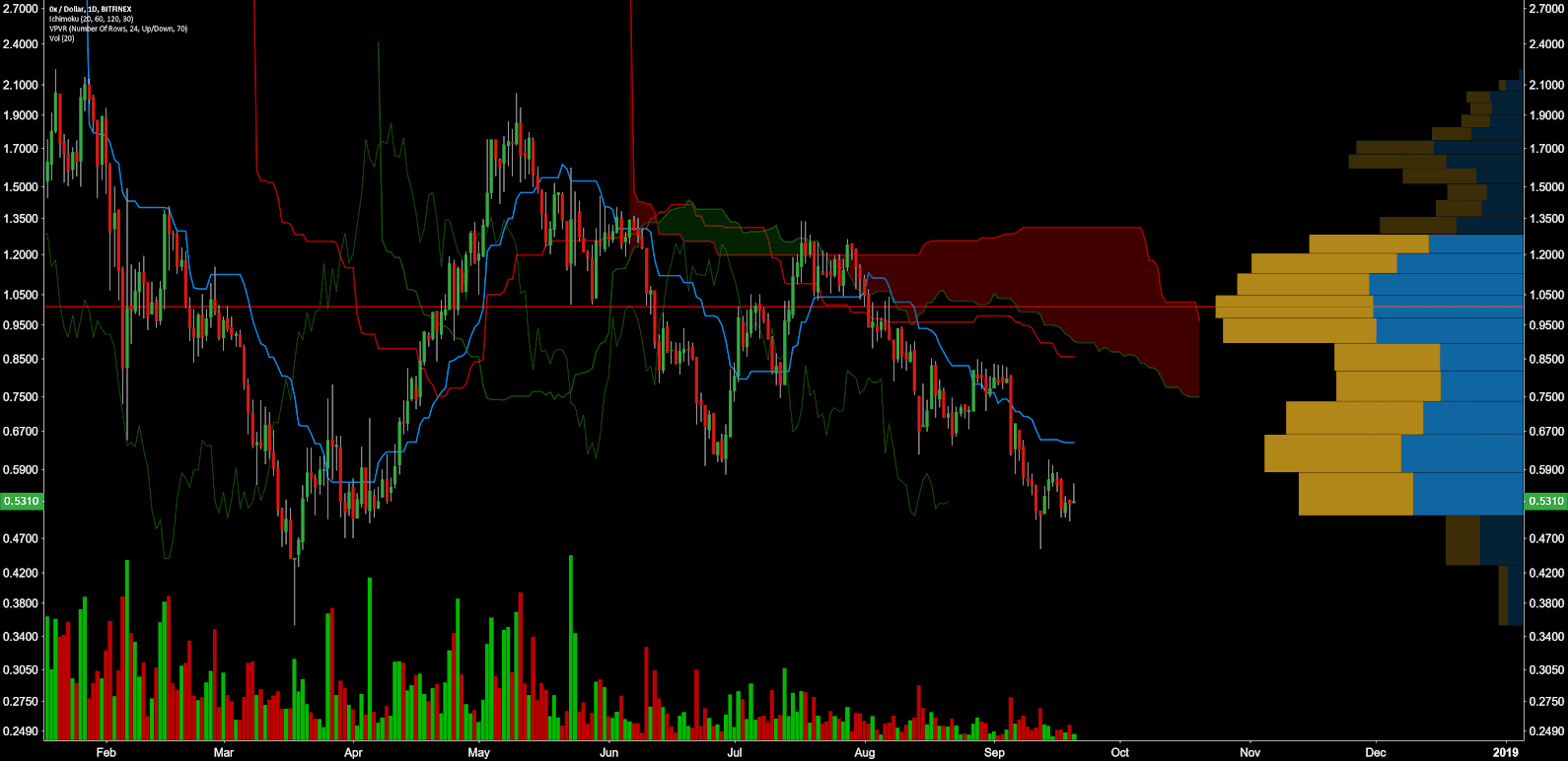

The status of the current Cloud metrics on the daily time frame with double settings (20/60/120/30) for more accurate signals are bearish; price is below Cloud, Cloud is bearish, TK cross is bearish, and Lagging Span is below Cloud and price. A traditional long entry will not trigger until price is above the Cloud. The TK lines currently display signs of a C-clamp, similar to conditions found in late June and early July, which suggest oversold conditions. This TK disequilibrium suggests a long position is favored over a short position, with targets of US$0.65 and US$0.86.

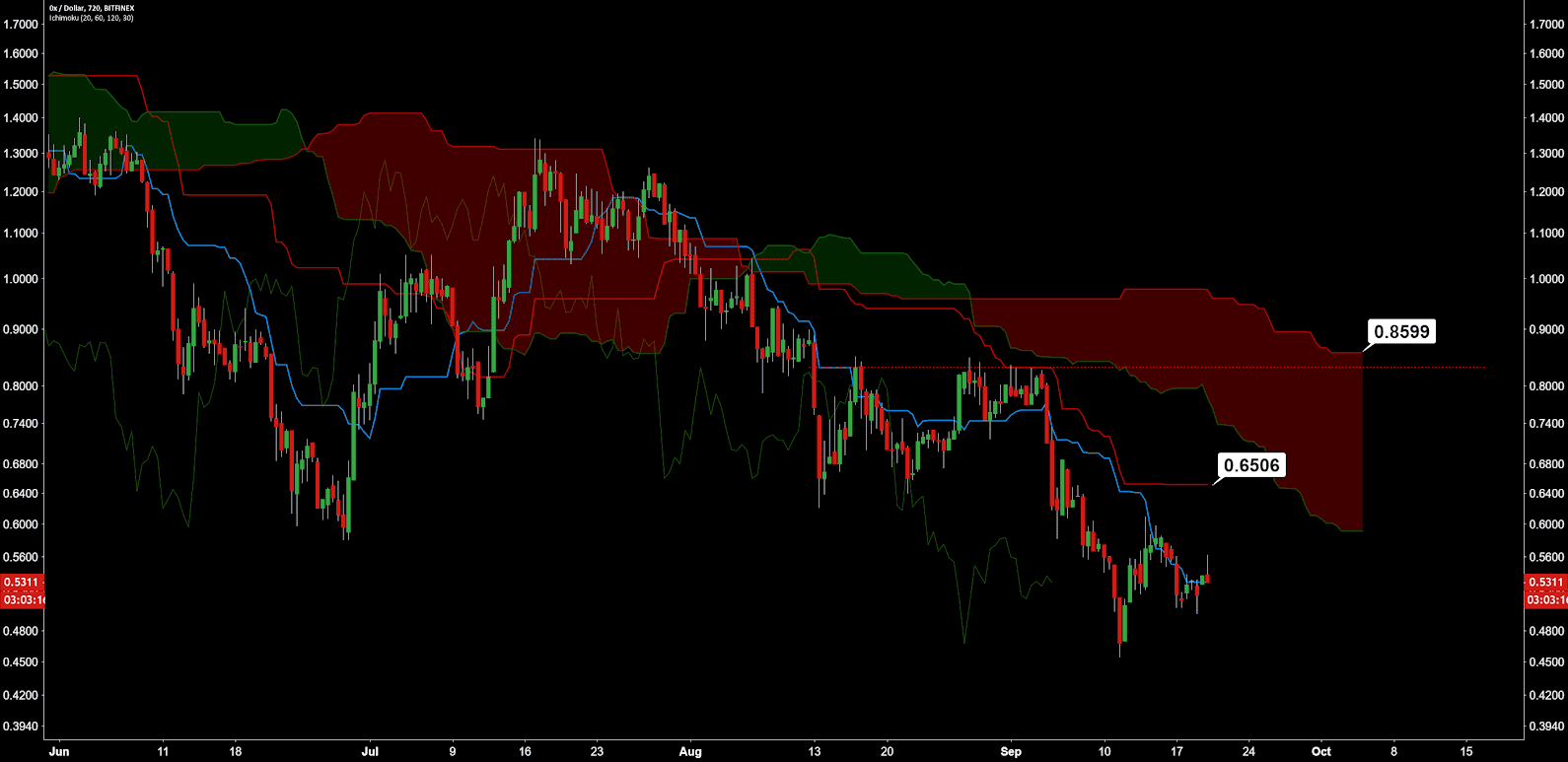

The status of the current Cloud metrics on the twelve hour time frame with double settings (20/60/120/30) for more accurate signals are bearish; price is below Cloud, Cloud is bearish, TK cross is bearish, and Lagging Span is below Cloud and price. Again, a traditional long entry will not trigger until price is above the Cloud. Price has broken the Tenkan resistance, hinting at complete mean reversion to the Kijun, which should act as resistance. If price enters Cloud resistance, a target of US$0.86 is likely.

Conclusion

Fundamentals show that the quantity of Relayers continues to grow, while the order flow of those relayers has remained relatively flat over the course of the year. On balance, an increase in low-risk options for traders through DEXs is incredibly healthy for an industry plagued with exchange hacks on a regular basis.

Unfortunately for the ZRX token, an increase in Relayers does not correlate with an increase in token value, as the Relayers themselves have issued their own native tokens for exchange fees. Any ZRX held by Relayers is likely quickly sold to avoid volatility risk. Additionally, the one billion in token supply will continually apply selling pressure on the value of the token.

At the moment, there is very little purpose in holding the ZRX token outside of a speculative capacity, which becomes very apparent when viewing network metrics. This dynamic is not unique to ZRX and is a characteristic that predominates most ERC-20 tokens. The bullish case for ZRX continues to rely on a listing or partnership with Coinbase in some capacity.

Technicals suggest oversold conditions, as is the case with most ERC-20 tokens. Although the trend will remain bearish for the immediate future, a mean reversion to US$0.65 is likely. The strength of bullish price action based on a Coinbase announcement in Q4 will likely relate the strength of the crypto market overall. If speculative demand remains high, returning to the psychological level of US$1.00 is likely within the next six months.

Don’t miss out – Find out more today