A Brave New Coin data deep dive: Futures Volumes sink as Bitcoin stagnates

With Futures Trading volumes dwindling against the uncharacteristically low volatility crypto markets, we take a deep dive into Crypto Derivatives.

Introduction: What are Crypto Derivatives?

A derivative is a type of financial contract whose value is dependent on an underlying asset, group of assets, or benchmark. Derivative contracts like Options, Futures, and Swaps are all actively traded within the digital asset-financial ecosystem. The emergence of a thriving derivatives market has fundamentally changed how Bitcoin is priced and the dynamics of the crypto market.

Derivatives are often used by traders to lock in the future price of an asset and protect themselves from volatility. Traders do this in order to hedge themselves to ensure there is some insurance if the price of an asset moves in an unexpected direction. Finally, because derivatives can be purchased with margin they can be used to make speculative bets for oversized gains.

What Is The Impact Of Bitcoin Price Stagnation?

After a strong beginning to the year, volumes across major crypto derivative markets have fallen away. The key factor in this drop-off has been price stagnation and volatility compression. The price of Bitcoin has been locked into a range between US$25,000-US$30,000 since the middle of March 2023.

The Bitcoin volatility indicator hit a new all-time low in early August 2023. Because derivatives are based on predicting the price of an asset in the future, when the price is static there is less incentive to bet on future prices.

Source: buybitcoinworldwide.com

30-Day Bitcoin volatility is currently at an all-time low. It has been sliding all year and is now touching fresh bottoms.

Source: Bravenewcoin.com

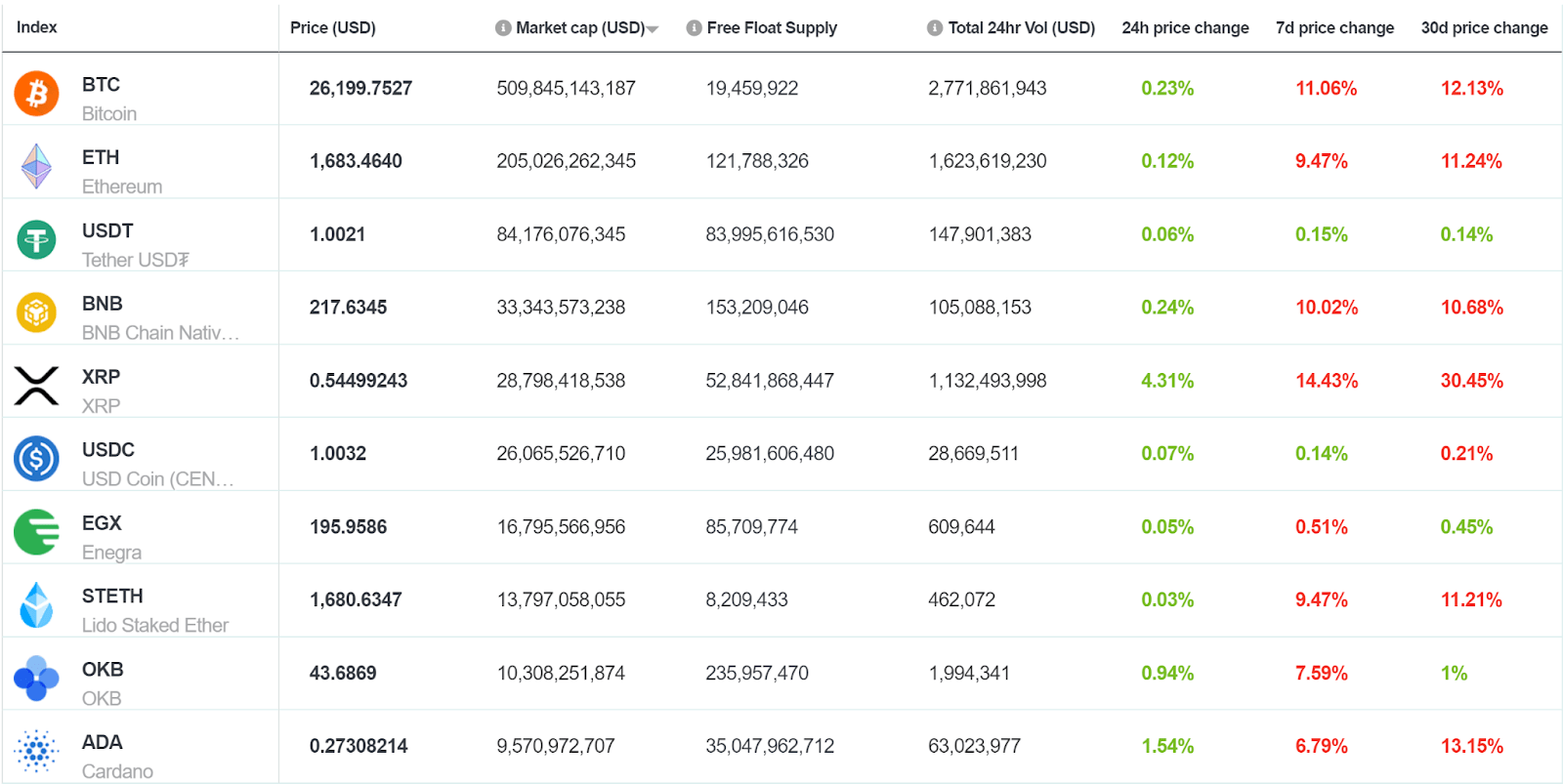

This trend of very little bi-directional price is becoming more and more apparent. In the last three days the price of BTC has been stuck tightly around the US$26,000 price level.

Exploring Bitcoin futures data

The data for the charts and tables used in the next section are sourced from the Brave New Coin Market Data team. For the purposes of this report, Volume and Open Interest data from major futures crypto exchanges was collected. It should be noted that there are some instances where data reported from some exchanges appears missing or incomplete. This is particularly noticeable with data from Binance and LedgerX.

A futures contract is a legal agreement to buy or sell a particular commodity asset, or security at a predetermined price at a specified time in the future. Futures are often preferred by crypto traders over options because of their simplicity, higher liquidity and lower risks.

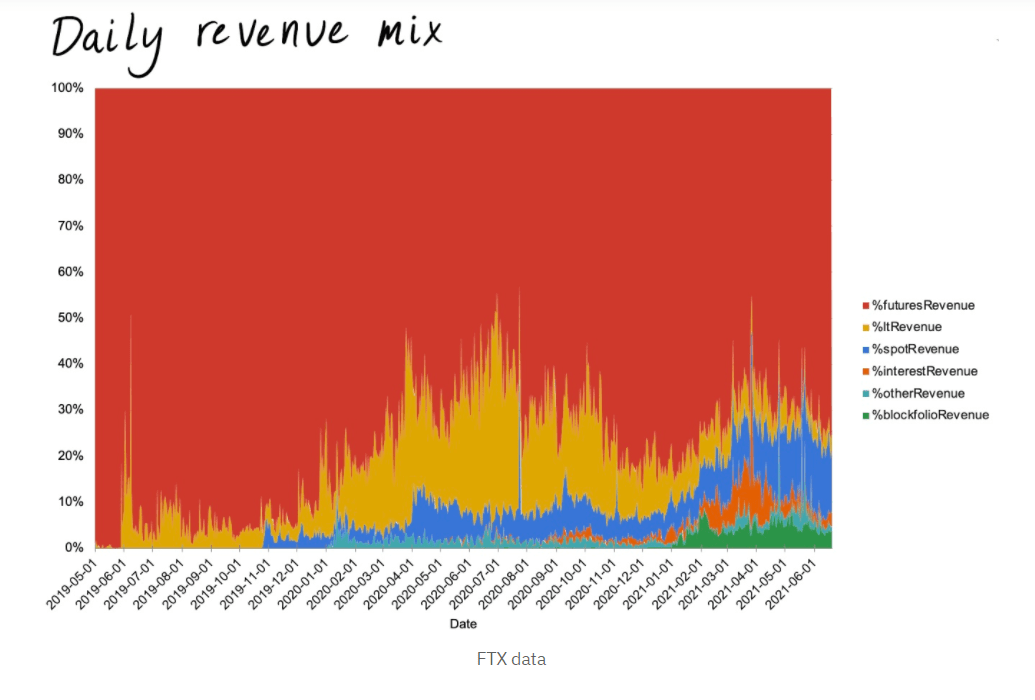

Source: Brave New Market data

Compared to the first four months of the year, volumes have been much lower across all Bitcoin Future exchanges in the last four months. This intuitively makes sense. With the price of BTC fluctuating less in recent months, traders don’t need to protect themselves from volatility as much, and are less active in the futures market.

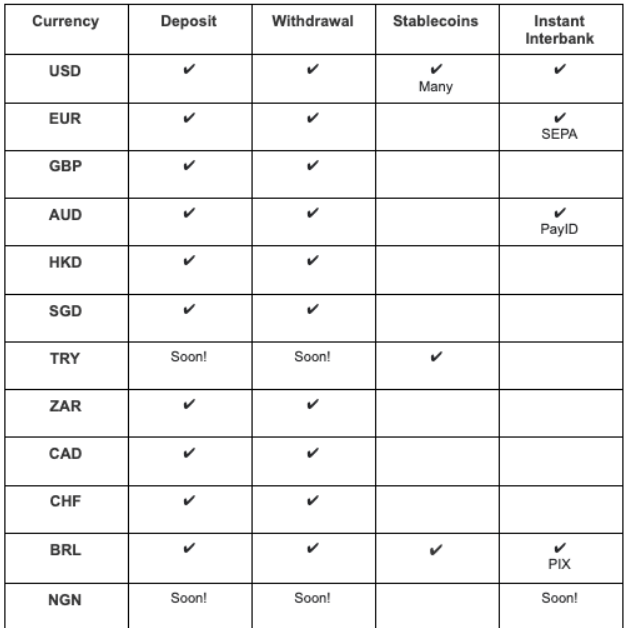

| Exchange | Total Entries | Total Volume | Average Open Interest | Unique Periods | Unique Settlements |

| Binance | 4,339 | 2.82B | 556,861.5 | Quarterly | PHYSICAL, CASH |

| BitMEX | 14,840 | 120.35B | 33,891,710 | Quarterly, Monthly, Weekly | PHYSICAL, CASH |

| Bybit | 11,280 | 511.34B | 8,864,401 | Quarterly | PHYSICAL |

| Deribit | 3,143 | 3.97B | 13,983,380 | Monthly, Quarterly, Weekly | PHYSICAL |

| Kraken | 6,198 | 2.24B | 2,936,735 | Monthly, Quarterly | PHYSICAL |

| LedgerX | 388 | 285 | 9.23 | Monthly | PHYSICAL |

| OKX | 14,166 | 3.55B | 307,505.5 | Weekly, Quarterly, Daily, Monthly | CASH, PHYSICAL |

The table above summarizes the data that will be used for the comparison study.

Bitmex is the largest exchange by open interest and number of contracts. Bitmex is one of the oldest specialist derivative exchanges in crypto. It was founded in 2014 and while it has had regulatory challenges in its nine years of operation, it remains one of the most popular crypto derivative exchanges in the world.

Bybit, another specialist derivatives exchange has the highest overall volume over the observation period. Bybit is a much newer exchange than Bitmex and was founded in 2018. The exchange is currently based in Dubai. It should be noted that Bybit has one of the sharpest drop off in volumes of any exchange measured.

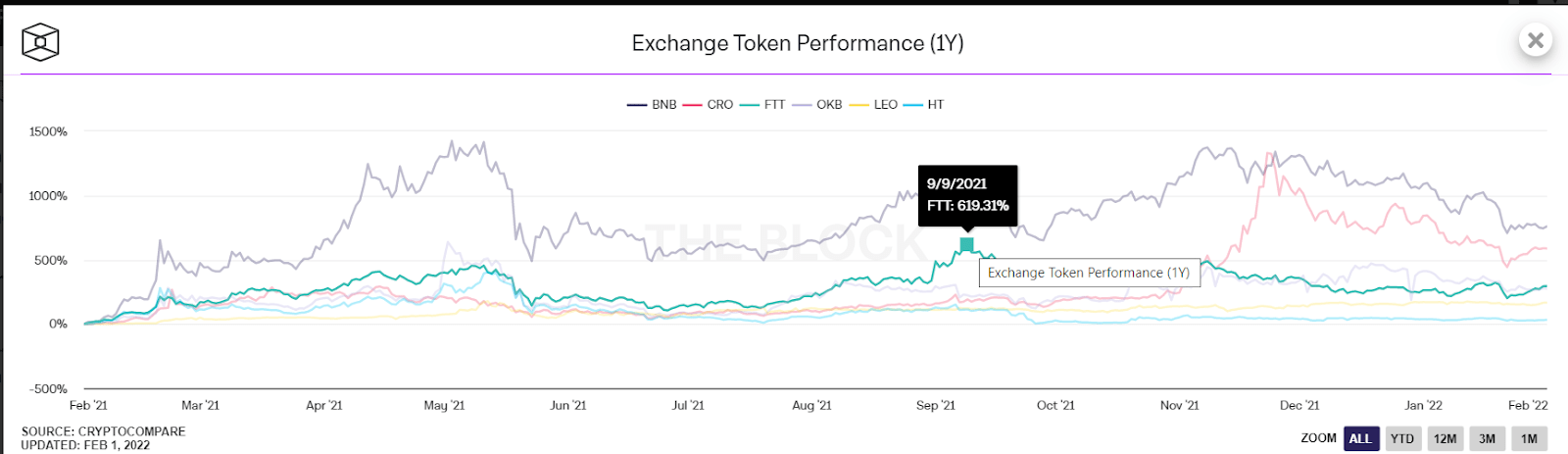

Many of the exchanges listed above are more well known for their spot crypto trading services. Binance, OKX and Kraken are all exchanges that have focused on building spot trading capabilities before launching derivatives products. Volume-wise, they lag behind specialist crypto derivatives exchanges—Bitmex, Bybit and Deribit.

| Unique Periods | Exchanges | Total Entries | Total Volume | Average Open Interest | Unique Settlements |

| Quarterly | BitMEX, OKX, Kraken, Deribit, Binance, Bybit | 44,350 | $640.95B | 14,990,750 | PHYSICAL, CASH |

| Monthly | Deribit, Kraken, BitMEX, LedgerX, OKX | 2,872 | $1.41B | 1,738,339 | PHYSICAL, CASH |

| Daily | OKX | 6 | $13.44M | 51,910 | CASH |

| Weekly | OKX, Deribit, BitMEX | 7,126 | $1.90B | 287,761 | CASH, PHYSICAL |

Quarterly contracts are by far more the most popular type of derivative contracts, both in terms of number of contracts and by volume.

Source: Brave New Coin Market Data

It is notable that over time, quarterly contracts have faced the largest drop-off in volume. These results further endorse the narrative that a drop in volatility of the BTC price has led to fewer traders willing to bet on future prices.

While volumes have dropped across other contract lengths (Monthly, Weekly) the other contract types have shown some signs of recovery and life. This points to traders indicating that they are more willing to make shorter term bets, where it is easier to predict which direction the price of the asset will move in.

Source: Brave New Coin Market Data

Open Interest is the total number of outstanding derivative contracts for an asset that have not been settled. In this case we are only observing futures contracts for BTC from major centralized exchanges. Unlike volume, there are some signs, particularly from OKX and Deribit, that Open Interest is beginning to recover following an extended period of flat activity.

Rising Open Interest and low volume is often considered to be a sign of a market in consolidation. Consolidation occurs when the price of an asset oscillates between a price range over an extended period of time. Consolidation is often interpreted as market indecisiveness. It ends when the price breaks out above or below key support or resistance levels. In this case US$25,000 has been the support price and US$30,000 has been the resistance level.

The rise in Open Interest indicates that traders are preparing for a breakout and are setting up positions but not making many more active moves.

Why has the price of BTC been so flat?

There may be a number of potential factors for why the price of BTC has been so flat and trendless.

The strongest price catalyst is yet to kick in – The next Bitcoin halving is set to occur between May and April 2024. The bitcoin halving is pivotal in crypto markets because of the strong positive effect it has on the price of BTC. It occurs approximately every 4 years and cuts the supply rate of new Bitcoin in half. The halving reduces the rate of inflation and like clockwork, creates upward price pressure for Bitcoin.

At block height 840,000 expected to occur in April 2024, Bitcoin’s block reward, for successfully-mined blocks, will halve from 6.25 coins to only 3.125. This will continue at the same rate for another 210,000 blocks. Roughly another four years.

Bitcoin bulls generally tout the halving as a powerful bullish tailwind and often focus on investing around this four-year cycle. In simple supply and demand terms, if demand stays constant and supply receives a shock that makes the creation of new supply slower, the price should rise.

Historically, the price of BTC has risen post halving but in the lead up to the halving, price activity is inconsistent. This trend is particularly notable before the last halving (the 3rd one).

Source: Bravenewcoin.com

Source: Bravenewcoin.com

This suggests that while Bitcoin has a strong track record of rising post-halving, price performance before the halving is patchy.

This implies that the Bitcoin halving is not the catalyst, pre-halving, that many expect and while it is expected to occur in 8-9 months, it is not yet creating the buying momentum to break through this currently trendless market.

Saving has become more appealing than speculation – US treasury yields are soaring. This is pushing investors away from risk markets and towards saving. The rate of bond yields rising has coincided with the drop in Bitcoin futures.

Yields have risen this week with expectations that US interest rate hikes will continue as hot US economic data continues to emerge. The 30-year US treasury yield is at its highest level since 2011.

The high, safe return offered by treasury bonds, is pulling value away from asset classes such as equities and crypto. Traders are deploying less capital into speculating on derivatives and this is affecting the markets. Why build up a complex futures trading strategy to deal with risky crypto markets, if you can with minimal risk earn a high yield?

There continues to be a great deal of anticipation surrounding every Federal Reserve meeting or major appearance by Fed chairman Jerome Powell. The market is fearful of higher rates making markets even more risk averse.

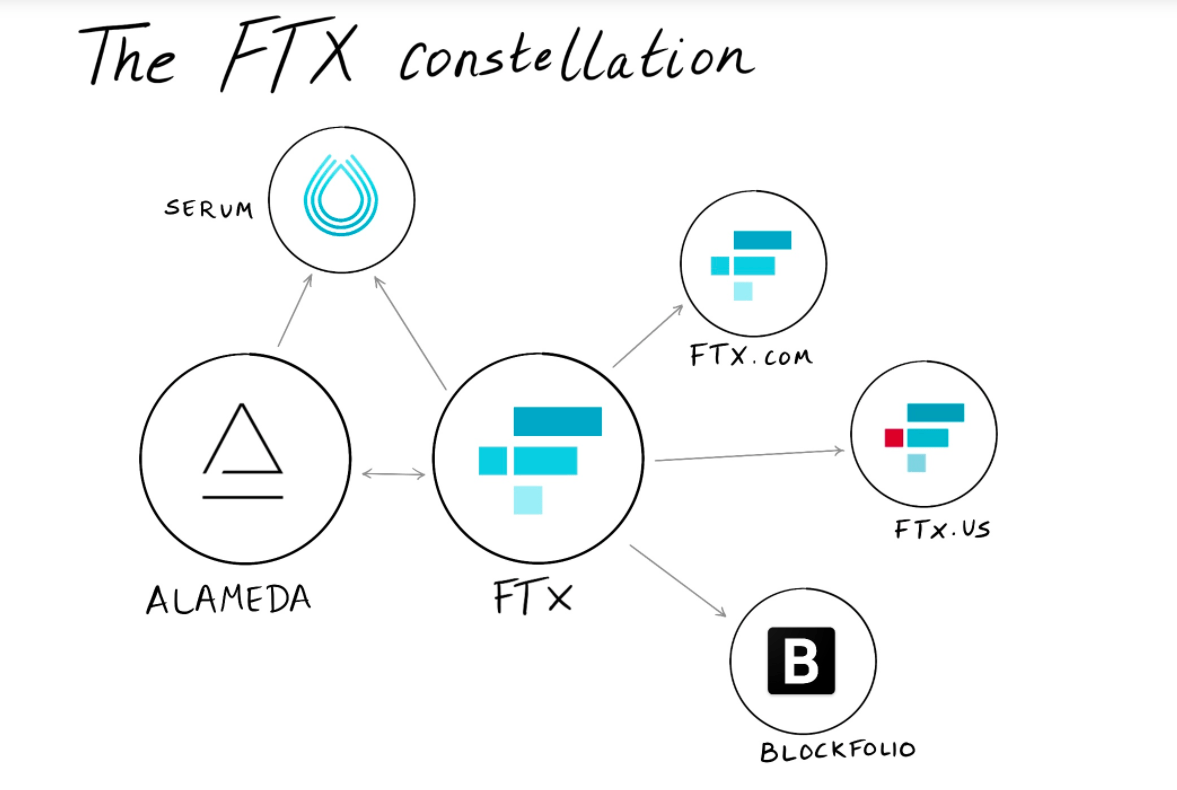

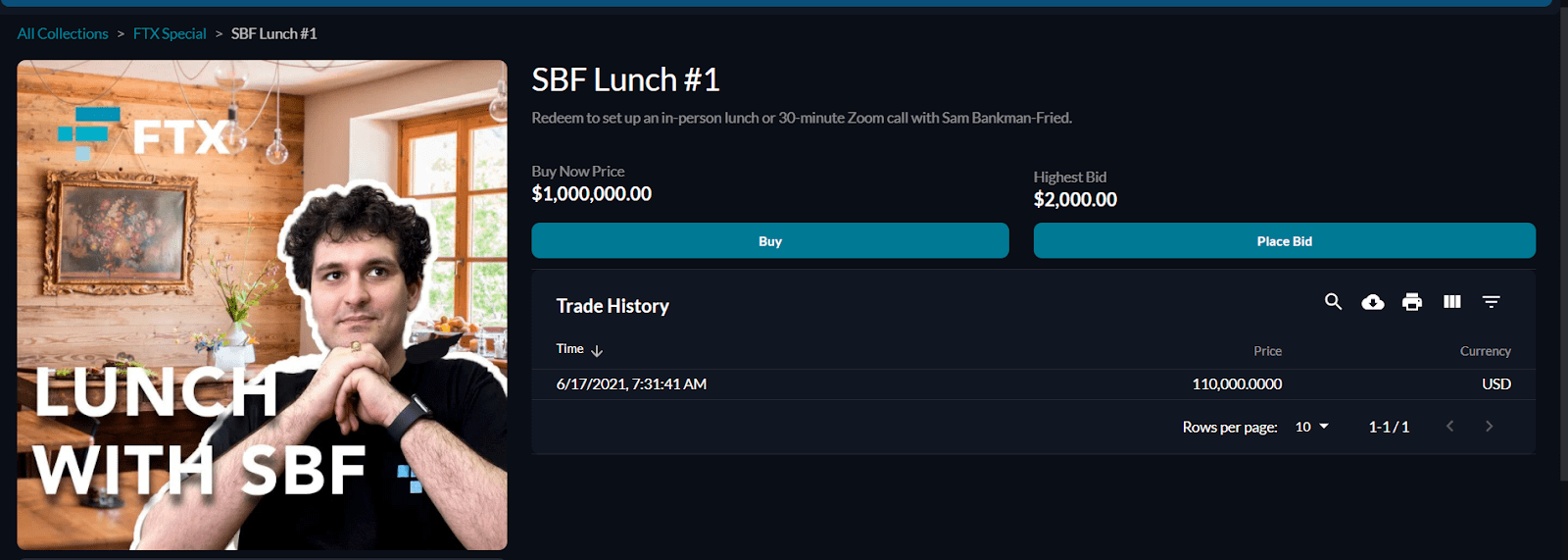

An uncertain regulatory environment – Litigation against crypto companies and individuals has been a constant through 2023, particularly in the United States. It started with FTX and regulators continue to catch more bad actors hidden in plain sight.

Writing for Global Legal Insights, authors from the Paul, Weiss, Rifkind, Wharton & Garrison law firm explain that particularly in the last two years, the US Treasury Department’s Office of Foreign Assets Control (OFAC), and the US government more generally, have become more active in applying US sanctions laws to cryptocurrency companies.

They write that the US government’s application of sanctions to the crypto sector is ‘nascent and still evolving’ and it is likely that it will continue to set new precedents in the short term. These efforts were shaped by President Biden’s crypto executive order, which asked government agencies to prepare reports and recommendations about different aspects and risks posed by crypto.

The SEC has filed lawsuits against major entities in crypto including Binance, Coinbase, Kraken and Ripple Labs. There are concerns across the market that the SEC or another major legal action against a key crypto infrastructure provider could cripple the industry. This has created some skepticism around whether it is worth deploying capital until it is clear what the legality of the asset class is in the United States.

This fear is further magnified by the lack of crypto regulatory structure in the United States. We have observed legal frameworks like MICA in Europe and LIDA in El Salvador launched in the last year but no such framework in the United States. Once crypto law is consolidated in the United States, more traders may be more open to buying crypto derivatives.

Conclusion

The cryptocurrency market has shifted to a different pace in recent months. The once-volatile Bitcoin, a flagship digital asset, has experienced an unusual period of price stagnation, resulting in a palpable decrease in trading volumes across major crypto derivative markets. Data from the Brave New Coin Market Data Engine clearly paints the picture of a beleaguered market.

Despite Bitcoin’s historical precedent of appreciating post-halving, the anticipation of the forthcoming event hasn’t generated enough momentum to break the prevailing market inertia.

On the other hand, the allure of soaring US treasury yields driven by rising interest rates has made traditional savings instruments more attractive, pulling investors away from speculative assets like crypto. Lastly, an ambiguous and evolving regulatory framework, especially in the United States, has cast a shadow of uncertainty, making market participants hesitant to deploy significant capital into the crypto derivatives sector.

The interplay of these factors underscores the intricate and multifaceted nature of the crypto market. As traders, regulators, and institutional players navigate these currents, the derivatives market stands as a barometer, reflecting broader sentiments, aspirations, and concerns within the digital asset-financial ecosystem. As with all financial markets, only time will reveal the next chapter in the evolving saga of cryptocurrency derivatives.

Don’t miss out – Find out more today