Arguments for Bitcoin maximalism are starting to falter

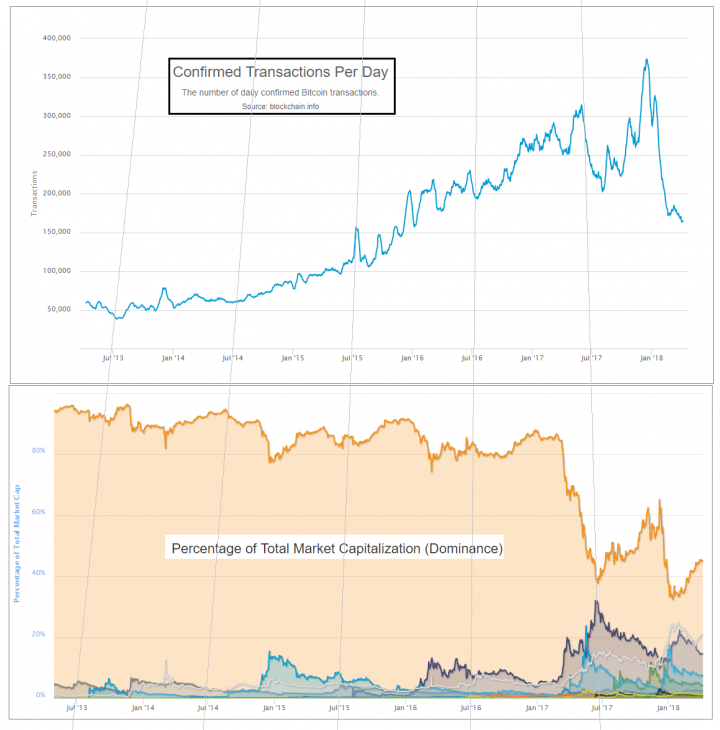

Since Bitcoin's share of the total crypto market capitalization has dropped from over 90 percent to years ago to lows of around 50 in the past 12 months it's timely to reassess the Bitcoin maximalist tenets. How have they stood the test of time?

In the past I’ve been very dismissive of Altcoins and endorsed the philosophy of “Bitcoin Maximalism” (that Bitcoin is all you need).

Here were three of my biggest reasons:

- Network Effects – In the past, Bitcoin had 90+ percent of the crypto market, and the remaining 10 percent was distributed among many terrible projects. Thus, Bitcoin’s network effect effectively shielded it from competition.

- Utility – With a few important exceptions, no Altcoin offered anything new to the user. Instead, the alternative explanation (that the Altcoin-creators were just taking people’s money) was overwhelmingly accurate.

- Sidechains – I assumed sidechains would be eventually invented. At which point, they’d absorb features of rival blockchains.

The first reason, in particular, has not held up well over time.

1. Network effect collapse

The market share (among investors) of “Bitcoin Core” (the healthiest candidate) has fallen to 45 percent or so.

Many people, myself included, believe that this downturn is only temporary. But as new data rolls in, it is time to take seriously the alternative theory: that the “network effect shield” has departed – or at least significantly weakened. These data are: that it has now been over two years since Bitcoin was last above 90 percent; it has been 12 months since it was above 80 percent; it has been under 50 percent for 7 of the last 12 months, including the most recent three months, during which it reached its all-time low (of 32 percent under a third).

Most perplexing is the relentless, stable, multi-year progress of the “Others” category. This is a direct challenge to the logic of network effects.

Furthermore, many of Bitcoin’s strongest defenders have jumped ship and a few of these are even socially secure enough to admit so openly. Roger Ver, indefatigable promoter and angel investor, owner of the Bitcoin.com domain, now favors Bitcoin Cash. Brian Armstrong, CEO of the $1 billion unicorn company Coinbase, now favors Ethereum.

Reasons 2 and 3 have not done as well as I’ve hoped, either.

2. Rising Altcoin utility

The Altcoins of today do offer their users a real value proposition – two in fact.

Value 1: Cheap Blockspace

At minimum, Altcoins offer users “cheap blockspace”.

Some users rely on “round trip” transactions. I define these as situations where:

- User wants to buy something, for (say) $20.

- User then spends $20 on “crypto”, and immediately spends that crypto on their desired end-product.

- The merchant receives the crypto and immediately sells it for $20.

For such transactions, cheap blockspace is ideal.

Value 2: New Ideas

Today’s Altcoins do more than just offer cheap payments. They also offer permissionless innovation. Certain ideas, such as Monero, Siacoin, Namecoin, and Zcash, cannot efficiently be tested in any other way. Many ideas that I originally felt were laughable, such as Dash’s “marketing budget”, have nonetheless proven to be effective.

Of course, these experiments should have been done on sidechains (which we will turn to in a moment).

In Comparison to Bitcoin

As to the first value proposition (cheap payments), much has already been said. I have written an article with my views on the subject.

More important is to discuss the second value proposition. For, while the Altcoins try 1001 new ideas a day, (most bad, but occasionally one or two good), Bitcoin instead has retreated into an overcautious and highly-pretentious paternalism. I can count on three hands, the number of times I have been personally given the “we need to make sure the airplane doesn’t crash” metaphor, by extremely-senior members of our industry. Somehow, these people are oblivious to the fact that 1. they don’t own the plane in question, 2. it is being flown via remote control from the ground, and 3. the plane’s owner can freely make a near-infinite number of copies.

The Altcoin ideas are judged, appropriately, by the user. Bitcoin, in contrast, is now tending to choose its ideas based on how impressive they are to other members of a pseudo-academic pseudo-bureaucracy. The emphasis is not on scientific progress, it is instead on racketeering – in other words, on generating a need for “experts” (paid consultants), and building a justification for an endless series of prestigious “conferences” (all-expense-paid parties in exotic locations).

Let me be more constructive with my criticism.

Scientific peer review departing from Bitcoin

A scientific environment requires Karl Popper’s demarcation for science: that in addition to looking for confirming evidence of theories, we must try to falsify(or break) our favorite theories.

Altcoins represent one method of falsification – trying the idea and watching to see if it fails. Sidechains are an even better method. “Peer review” is only science if the peers are helping the author meet some objective external criterion – one that exists independently of the peers and their opinions. Otherwise, peer review becomes a self-referential popularity contest. The point of peer review is to be a cheaper realistic “simulation” of reality. It is not a popularity contest!

Unfortunately, for the significant questions, the atmosphere of science is departing from Modern Bitcoin.

A Contempt for Measurement

One smoking gun is the reaction of both LargeBlockers and SmallBlockers to the idea of fork futures.

Futures prices, (unlike “tweets” or “conference presentations), have the unique ability to speak for everyone, and not just their author. For that very reason, they have the unique ability to singlehandedly predict the fate of any fork. Despite this, there was no interest in creating such markets. When they were created anyway, the losing side refused to acknowledge them as legitimate.

This disinterest parallels the shameful behavior concerning the “bitcoinocracy” numbers and is a root and branch rejection of the value of experimental testing that acts to establish a “technocracy” of ruling bureaucrats accountable to each other, and not to the customer.

Partisan Media

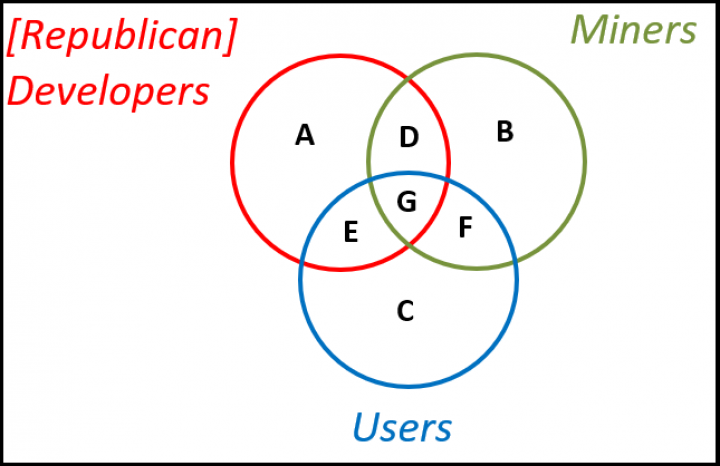

As the scientific atmosphere declines (and, please, do not confuse science with engineering), standards of discourse have declined as well. Today, it is impossible to express any view on “scaling” without it being immediately pigeonholed into a “Republican” (SmallBlocker) or “Democratic” (LargeBlocker) category. We even have our own RNC and DNC, and our own party leaders and campaign managers.

Clever Altcoiners have noticed these deficiencies (and the insecurities they inspire) and exploited them. Buterin, for example, is careful to back the minority side in the BTC BCH conflict; and Dash started up a meme about their “governance” solution (whatever that was) to profit off of dissatisfaction with Bitcoin governance. One can dismiss these maneuvers are mere campaigning, but they are only possible because of real flaws that actually exist in the Bitcoin community.

3. Sidechain apathy

Finally, what of the hope that sidechains will obliterate the Altcoins? After Blockstream gave up on sidechains in 2015, I wrote my own idea in November of that year. My view is that the scaling conflict is important, and that sidechains are the best way to resolve it. In fact, my current view is that sidechains are the only way to resolve the conflict. This is because the disagreement is actually about “node costs”, and not about transaction throughput.

Blockchain technology is inherently consensus-based. But since each person is different, there is a limit to how large a community can grow before there is infighting. Sidechains resolve these issues.

Despite this, interest in Drivechain has consistently been low, so what explains this profound apathy for sidechains?

"Optimistic" reasons for sidechain apathy

1. Sidechains Are Hapless / Useless

Perhaps sidechains are just a bad idea? And, since there’s no point wasting time talking about a useless feature, people rightly don’t talk about it. I think that the causality here is reversed: people become disinterested first, and this disinterest drives them to make lazy, error-prone comments.

2. Sidechains Are Inherently Boring

Perhaps sidechains are inherently boring. But this does not square with the attention they get from Bitcoin Media, and their disruptiveness to the competitive landscape and to people’s investments.

3. People are Busy

Perhaps people are just too busy with everything that is going on. But this explanation would apply equally well to every new idea. And drivechain is a very old idea, it is much older than SegWit and was published in 2015.

So the potential for interest in sidechains is there, but the inherent interest is just disproportionately low.

So, then, why is that? Here I present what I feel are the real reasons.

"Pragmatic" reasons for sidechain apathy

1. Reputational downside/different risk profile

Crypto-commentators care a lot about their reputation, as it can lead to lucrative job offers (in every sense – paid well and no work required), access to capital, invitations to luxurious conferences, and personal fame/prestige.

And sidechains, along with their benefits, do present a scary new risk. Unlike the “code risks” in, for example, P2SH or CLTV, these risks can not be systematically hunted down and eliminated. So, commentators may see themselves as in a similar situation to the FDA [in the US], or an academic IRB: they will be disproportionately blamed if something goes wrong, but will not disproportionately benefit if everything goes well.

- Training one’s replacement

For existing Bitcoin Core developers specifically, the above position might be taken even further. Instead of the example of the FDA commenting on a drug, we might instead give an example where some of the world’s most prestigious doctors are asked to comment on a “magic infinite health pill” that was invented by a non-doctor.

It is a clear conflict of interest – if society adopts the pill, the doctors will be out of a job. Hence it really is true that the scaling debate is “about control”. Since sidechains take control away from current elite Core developers, we would expect them to oppose sidechains.

3. Extreme polarization

Human disputes, of all kinds, will reliably collapse onto a single dimension. This is simple math: a large unified group has the muscle to sequentially crush a set of smaller uncoordinated groups.

Those who are audacious enough to vote third party have a vague awareness of this, and usually know that they are “throwing their vote away” and hurting their own causes. If you join one of the two major groups, your influence will be very small. But if you join neither it is likely to be zero.

To support a largeblock sidechain would be to oppose the party leadership. But as I’ve just explained, this leads to one being rejected by one’s own party, and being unable even to join the rival party. So commentators (wisely) downplay their interest in a sidechains solution.

4. Free rider problem

This one is very simple. The free rider problem is a one of immense practical importance. For Altcoins, of course, there is no free rider problem, because there are alt-owners who profit (disproportionately to everyone else) from the success of the Altcoin.

But with sidechains, we have a situation where someone must do the work, at some cost to themselves, and yet the benefits are diffused across all Bitcoin owners. But this problem is common to all Bitcoin R&D, so I don’t see why it should apply especially to sidechains.

Misaligned incentives in Bitcoin generally

Incentives in Bitcoin are not always perfectly aligned.

Below I present some Bitcoin ideas/events/projects, and sort these into the groups that support them: Miners, Users, and [Republican] Developers.

G – All Bugfixes; “Scaling Bitcoin” 1 and 2; CheckLockTimeVerify; Fraud Proofs (?) Some Alignment D – High txn fee-revenues9 (see here); the unending scaling conflict (think 1984 “War is Peace”, and govt ‘racketeering’) E – Lightning Network (miners prefer on-chain); “Scaling Bitcoin” III; Blockstream/ChainCode/etc; soft forks (miners prefer hard, although I honestly don’t know why) F – Decentralized Sidechains (devs prefer bitcoin-dev-based permission, and federation/subscription); SPV/SPY Mining (devs prefer FIBRE) Less Alignment A – Federated/subscription-based sidechains ; “Scaling Bitcoin IV” ; high txn fee-rates (?) B – [SegWit-Incompatible] ASICBoost (although I/others strongly dispute the relevance); SegWit2x Project (users prefer 1x, according to data from futures markets) C – Low fee-rates; The SegWit UASF; Fork Futures; Spinoffs/Altcoins (empirically) I could have included more groups, especially “Industry”, “Democratic Developers”, and “Cults of Personality”, but of course a two-dimensional figure simply cannot capture all of that. My point is that incentives do not always align.### Network Effects as “Rule of the Average”

The fact of the matter is that anything with network effects is going to ultimately be ruled by the middle of the bell curve: the average people.

The centrality of timing

The centrality of timing

In these analyses, timing is important: every project starts with zero users, so networks effects are small (and meritocratic effects dominate). But as time goes on, the project will attract more users, and so the network effects will become more important. Eventually, the network effects outweigh the meritocratic effects.

Now, I’m just guessing here, but I think we have reached the post-expert phase.

Secondly, the marginal meritocratic effects do not seem to be that significant. By this, I mean that the “Bitcoin vs Altcoin” differences are very tiny compared to the “Bitcoin vs Traditional Money” differences. Someone who needs financial sovereignty must abandon modern fiat currencies, but whether they transact in BTC or LTC or ETH will make no difference to them, and investors will need to invest in whichever money is the most recognizable. The differences in node cost, or in privacy, are not as relevant (most lay users care about neither).

Conclusion

“Post-Maximalism” doesn’t need to mean “Altcoin Pluralism” – instead it can just mean “two competing Bitcoins”. So we don’t need to go from 1 to infinity, we can stop at 2. And perhaps we only stop at 2 for a short time, before returning back to 1 (for example if sidechains do, in fact, eliminate Altcoins).

The emphasis on two competing projects reminded me of Karl Popper’s argument in favor of a two-party state. He argues that a system can become healthy, as long as the losing team becomes desperate upon their loss, and willing to take risks and make changes. Pretty good advice!

As Bitcoin’s price resurgence has reignited the belief in the "one coin to rule them all" orthodoxy, or Bitcoin maximalism, it is important to look at the reasons behind the stance in the first place and see how they hold up against the ever-growing Altcoin community.

Don’t miss out – Find out more today