As the Bitcoin Halving Approaches, Traders Are Wary

The Bitcoin halving is expected as soon as next week. But a worsening macro climate, and uncertainty around whether the halving will be a sell-the-news event is playing on trader’s minds.

Bitcoin is sitting at $69,764, after an unsuccessful attempt to push past the key $70,000 earlier in the week. The path ahead looks uncertain, with a worsening macro climate, and uncertainty around whether the halving will be a sell-the-news event playing on trader’s minds.

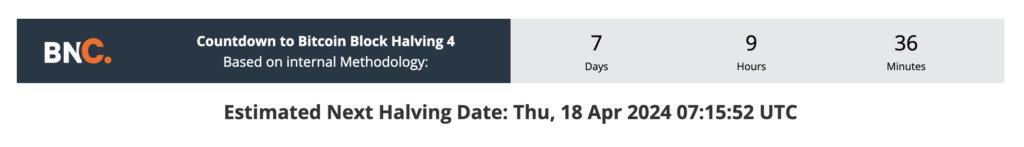

Source: BNC

One of the reasons for the market jitters was disappointing new US Inflation data released on Wednesday. The Consumer Price Index (CPI) for March increased above expectations, casting doubt on the possibility of a Fed rate cut this summer. The CPI for March rose 0.4%, surpassing the anticipated 0.3%. Year-over-year CPI increased to 3.5%, exceeding the expected 3.4%.

Following the CPI data release, the price of Bitcoin (BTC) dipped more than 1%, S&P 500 and Nasdaq 100 futures plummeted by approximately 1.5%, and the 10-year U.S. Treasury yield surged by 13 basis points to 4.50%. Gold, which has been posting new record highs, declined to $2,352 per ounce.

With the Fed making it clear that it won’t consider easing monetary policy until a sustained downward trend in inflation, traders have adjusted expectations. The CME FedWatch Tool now points to September as the most likely time for rate cuts.

Buy the Rumor, Sell the News?

Arthur Hayes, co-founder of BitMEX and market analyst has predicted a market-wide slump around this month’s Bitcoin halving. While many traders anticipate a bullish surge, Hayes offers a contrarian view: Bitcoin will experience selling pressure in the days leading up to and following the halving. Hayes wrote that the halving narrative suggests that Bitcoin’s price tends to rally after the event. However, Hayes points out that this expectation is now widely accepted, which often leads to unexpected outcomes in markets. Hayes notes that the halving also coincides with a period of reduced dollar liquidity – tax season. As tax payments drain dollars from the financial system, risk aversion could trigger a fire sale of risk assets, including cryptocurrencies, before the bull market resumes in the months following the halving.

It’s not just Hayes who is expecting a “Buy the Rumor, Sell the News” event around the Bitcoin Halving. Steno Research analysts predict that the upcoming halving will mirror what happened around the 2016 halving. They see a short-term surge in BTC’s value leading up to the halving. However, within the first 90 days post-halving, the value could dip below its pre-halving price. After the 2016 halving, Bitcoin’s price remained below its pre-halving level for the entire 90-day period. Specifically, on the 90th day post-halving, Bitcoin was priced 8.4% lower than before the halving.

Source: BNC

The next Bitcoin Halving will take place in approximately 7 days. The number of new Bitcoins created via the block reward is reduced by half every four years. This is known as the Bitcoin Halving. The next halving will be the Fourth Bitcoin Halving (H4). This is when the current block reward of 6.25 Bitcoins will be reduced by half to 3.125 Bitcoins.

The halving will reduce the amount of Bitcoins produced each day from 900 to 450. This supply shock and accompanying media narrative is expected to provide strong tailwinds for Bitcoin later in 2024. In the short term, expect volatility.

Don’t miss out – Find out more today