Augur Price Analysis: The decentralized prediction platform experiment

Augur (REP) has observed an extended period of positive price performance since bouncing of bear market bottoms - backed by a unique value proposition and expectations surrounding an upcoming major network update. Core updates and periphery applications have improved Augur’s clunky UI/UX - but falling user activity and Dapp transaction volumes suggest these band-aid fixes are not enough to boost adoption.

Augur (REP) is the leading decentralized prediction platform built on the Ethereum blockchain. It is designed to forecast and communicate the outcome of real-world events based on a majority consensus principle.

Traders participate in peer-to-peer prediction markets based on real-world events. Augur’s intricate reward and dispute model is designed to create a system where market odds naturally align with true, real-world sentiment. Augur utilizes the “wisdom of the crowd” phenomenon, which suggests that the collective predictions of a group of people will be more accurate than predictions made by single experts.

Since hitting an apparent bear market bottom in mid-December 2018, the price of REP has risen ~139%. REP has a market cap of ~USD 156,633,630 and is the 49th largest digital asset on the Brave New Coin market cap table.

In a podcast interview with crypto influencer Anthony Pompliano, Augur co-founder Jeremy Gardner said that Augur’s vision was to build a “decentralized, global source of truth and forecasting.”

The idea of using prediction markets as a tool for forecasting is not new. In the early 2000s, the Defense Advanced Research Project Agency (DARPA) experimented with using prediction markets using the intelligence community. It wanted to determine appropriate policy responses to questions such as ‘what are the implications of Iraq’s purchase of specialized aluminum tubes?’ based on intelligence community responses. Other examples of community predictions include forecasting box office success and the US presidential elections.

As a decentralized, permissionless, blockchain based, wisdom of the crowd platform, Augur has several unique advantages, including:

- Users have the freedom to create any market they wish. Other users will determine if it is a feasible betting opportunity.

- Utilizing blockchain based smart contract settlements to substantially reduce the cost and time of settling multiple bets across numerous marketplaces.

- The permissionless nature of Augur (funds and transactions are secured and confirmed based on the Ethereum global account) lets users in any region participate in previously unavailable marketplaces. For example, an ETH holder in Asia can make speculative bets on US stocks cheaply, with minimized friction, in a way not possible before marketplaces like Augur existed.

Augur mechanics

The Augur platform functions with a smart contract that matches opposite orders. Users who want to make opposing bets on the outcome of specific betting markets are connected and interact with each other.

For example, on the currently open Augur market, “Will Serena Williams be the 2019 Wimbledon Women’s Singles winner?” there is ~$4,462 worth of open interest. It currently leans 51% “Yes”, meaning if a trader wants to buy a 100 ETH stake in “Yes”, they would do so at those odds. They would also require a counterparty willing to match the stake at 49% odds that “No” Serena will not win for the order to be filled.

If a user buys an outcome that ends up being true (based on oracle reporting) in their favor, they will profit based on their stake. If the selected outcome ends up being false then the user loses their stake.

As all markets are open until the oracle finally reports on an outcome, users can cash out their stakes; hedging risk, minimizing losses and more quickly accessing profits if they are no longer interested in participating in the market.

Source: Augur Casino. Colored lines represent the changing odds of respective outcomes.

This open market also reflects Augur’s inherent forecasting properties. Anyone can observe an Augur open market to determine the platform’s predictions for upcoming real-world events and utilize the wisdom of the Augur crowd for insights.

This highlights Augur’s potential as a layer to build Dapps on. An example is the PdotIndex, which lets users invest in people (celebrities) the same way they might with companies. A Pdot index value for a public figure like NBA player LeBron James, consists of multiple individual Augur operated speculative markets (how many points per game will he average, how many games will his team win this season, etc) that combine to give a weighted score for each listed public figure.

The individual’s score changes based on the differing odds given to the outcomes of events related to the public figure, based on assessments by the Augur betting crowd. Traders can bet ETH to make profits based on a change in public sentiment.

A number of Augur apps exist that make the base prediction market easier to interact with (such as user experience tools), or present Augur’s “wisdom of the crowd” data in alternative forms. These include:

- crystalball.be collects a number of Augur performance metrics and charts live data trends

- Veil is an Augur derivative market that makes trade execution more straightforward. It was built using 0x

- The Augur Insider calculates volatility for Augur markets

- Augur dispute crowdsourcer lets users check the outcome states of different markets

Markets on Augur can either be binary (Yes/No or one/or the other markets), categorical (multiple different fixed outcomes), or scalar (variable, with opportunities to go short or long).

The REP token represents ‘reputation’. Users/Oracles are rewarded REP if they report an event and it matches up to the agreed consensus of other reporters. They must ‘work’ (report events, participate in dispute resolution) to keep their REP stakes and inactive REP accounts are punished.

This is an incentive-based system. If an oracle misreports an event, an objective output, then the rest of the market takes note (seamlessly through a smart contract) of this bad reporter and they are punished by losing REP. If a REP holder doesn’t participate in a fork (when the network has a very large dispute over an outcome), they lose 5% of their REP.

Value of the REP token is derived based on quality and quantity of activity on the Augur platform which defines the demand for Oracle services.

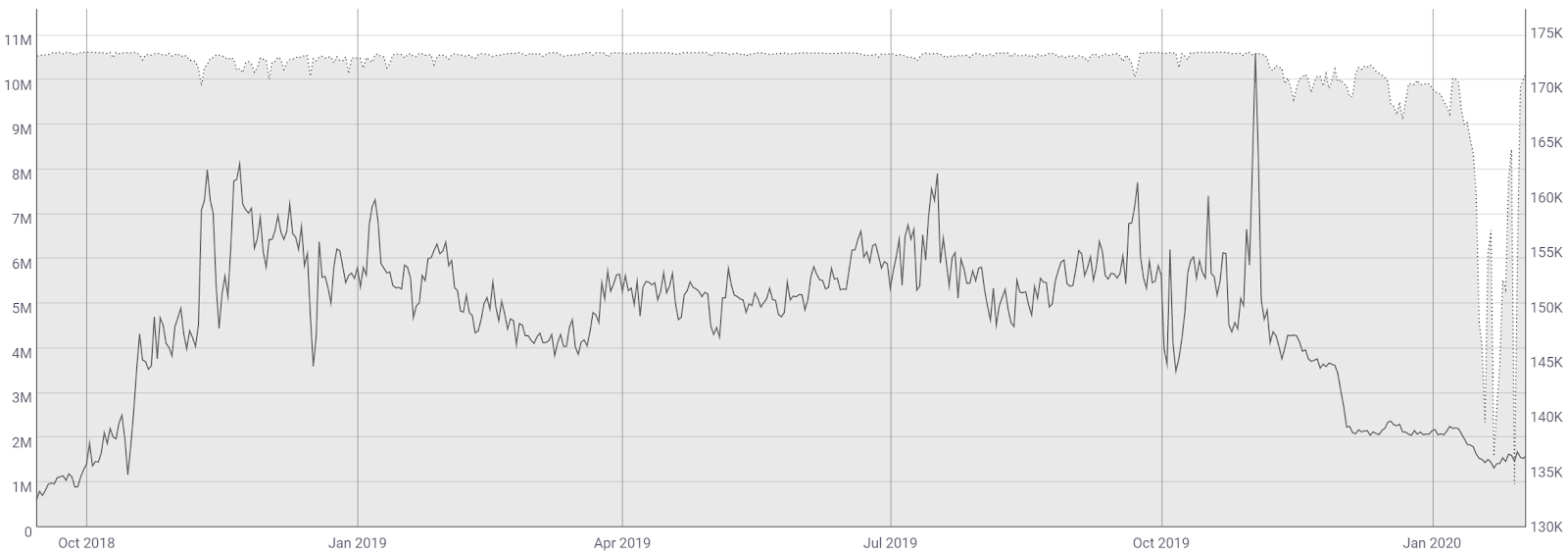

All bets/trades on Augur are made with ETH, not the native token. As such, the majority of unique addresses on the Augur platform are trading accounts (order creators or fillers) and most of the economic activity on the platform is carried out with ETH and not its native token REP. Since the start of the year, there appears to have been a fall-off in the number of unique users, a bearish indicator suggesting users may be a turning away from the platform.

Source: Crystallball.be

Challenges to bootstrapping

A major obstacle in Augur accessing new users is the platform’s complex user experience. It’s a challenge for non-technical traders to understand buy and sell outcomes or calculate profits. Additionally, dispute resolution and market settlement within Augur can take an extended period of time, which affects how long it takes to receive payouts.

Dapps such as Exist and Veil, categorized as ‘overlays’, make it easier to interact with the base Augur protocol. Other solutions similar to Veil are beginning to emerge like Guesser, which uses Augur’s order book but presents odds in the traditional European betting format within a cleaner interface. Overlays like Guesser may help mitigate some of Augur’s UI/UX clunkiness but these are not yet capturing user attention. Leading REP overlay solution Veil announced they will end support for current Augur products.

Another clear issue with Augur in its current form is liquidity. Of the 208 live markets on Augur, only 23 meet the minimum liquidity threshold set by Augur market data aggregator predictions.global. This means that just over 10% of Augur markets are worth trading, or able to satisfy counter matching requirements.

The platform’s counter matching model has lead to difficulties in growing the Augur user base because of the nature of two-sided marketplaces and the chicken-and-egg problem.

With Augur the number of order creators drives the number of order fillers (market makers/counterparties) and without fillers available, traders are not willing to create orders, and without creators creating trading opportunities, fillers opt out. This means that Augur’s two-sided marketplace solution has faced challenges achieving scale in its early form. Augur’s mission of becoming a ‘decentralized, global source of truth and forecasting’ is limited by the current lack of a global forecasting community.

Source: Crystalball.be

Source: Crystalball.be

Coinciding with the falling active addresses, there has also been a steady decline in Augur trading volumes, and falling levels of open interest for most of 2019. These numbers suggest that the current version of Augur is failing to capture or retain the interest of users. This pattern of falling network activity is a bearish signal.

The Augur platform may be able to turn this around and attract new users by leveraging the upcoming release of the network’s first major update, Augur 2.0. The update seeks to incentivize greater on-chain participation from passive REP holders, mitigate against deliberately ambiguous user created markets, and improve liquidity options for traders.

Specific features are designed to solve one of Augur’s largest practical challenges, invalid attacks. A recently released blog, titled Defeating Augur’s Largest Attack describes the nature of these attacks and Augur’s approach for mitigating them.

These attacks are driven by market creators who may create a YES/NO market. A Trader may buy shares for either YES or NO outcomes. If the market resolved YES then each YES share pays out one Ether, and each NO share pays out nothing. If the market resolved NO, then each NO share pays out one Ether, and each YES share pays out nothing. However, if the outcome was ambiguous or unverifiable, the market is deemed “Invalid,” and YES and NO shares each pay out .50 Ether.

Invalid scams involve creating markets that may appear valid on first viewing but are deliberately set to lead to an invalid outcome. Traders who do not realize the market is Invalid or do not understand how Invalid markets work then buy these shares and the scammers net a profit when the market resolves by buying cheap shares of the less unlikely outcome. Market creators do pay a validity bond when they create a market, which they only get back if the market is valid. The validity bond, however, has been lower in some cases than needed to deter Invalid market creation.

Augur V2

The code for the platform’s next major update, Augur V2, was released in early April. The update partially addresses some of the issues around the creation of ambiguous markets on the platform. The update will allow “Invalid” to be a tradeable outcome like any other, enabling traders to hedge the risk of Invalid outcomes and gauge the likelihood that one may occur. For example, a trader viewing a market with a lot of money staked on invalid may choose not to participate in the market.

The update also includes a new sort feature designed to organize the market by spread and liquidity depth to favor liquid, valid markets. A new Invalid filter that excludes markets that have no bids or asks that would incur a loss for the order creators in the case of Invalid resolution has been added.

Another significant V2 update is DAI denominated markets. Augur V1, only allowed traders to use ETH for trading activity. ETH was a natural choice for a token, given that Augur is an Ethereum based platform. However, ETH is a highly volatile asset prone to frequent price changes, affecting the willingness of Augur traders to participate in markets.

DAI is a stablecoin that aims to hold a 1-to-1 peg to the USD. After enabling DAI denominations and payments, the Augur markets will be less volatile and more accessible. In the official V2 documentation, Augur refers specifically to multi-collateral DAI capabilities. This version of DAI has not yet been released, which hints that Augur V2 may only be released post the launch of multi-collateral DAI.

Augur V2 will change some of the core utility built into the REP token. Post-V2 launch, if a market in Augur V2 forks (remains disputed or unresolved after several rounds of dispute resolution), the user has 60 days to participate (make a decision on the outcome of a forked market) or they will lose their REP.

This protocol means that Augur should become more difficult to fork because more users and more REP will be incentivized to participate in fork consensus. This means more barriers for a bad actor to try to cross to be on the right side of an Augur wide fork.

This protocol was controversial because many present day REP holders are investors or traders who accumulated the token for speculative purposes. They do not actively participate within the Augur marketplace or keep track of markets that are unresolved or close to forking. Two months of on-chain inactivity would lead to the loss of all held REP tokens.

Making the correct decision on an Augur fork may also require monitoring community discussion on platforms like Reddit or Twitter to determine who bad actors may be, a process many current REP holders are uninterested in.

Adjusting fees paid to reporters (in REP) by traders is one of the main mechanisms that keeps Augur secure. The fee is adjusted based on the total open interest (OI) on the platform and the price of REP. In V1, Augur used a centralized price oracle to report the market price of REP so a fee could be calculated. This oracle price feed was often buggy and for a while did not adjust fees paid to reporters.

V2 fixes the bug and will introduce a built-in double auction that will act as the price feed. Two double auctions will take place each week where a pot of DAI and REP are sold for one another, and a REP price is calculated from the sale prices. The platform will mint a small amount of REP weekly to compensate for any losses from the auction. This introduces a small amount of inflation to REP in exchange for a decentralized price feed used to maintain platform security.

Augur, in contrast to other blockchain projects, may be choosing to increase the friction involved with holding native tokens, with the goal of building a more robust platform. The minting of REP to support the price feed auction means individual tokens may lose real value and purchasing power over time with inflation, possibly disincentivizing long term value investors. However, the minting will help improve and develop a new price feed model.

The “no fork participation-lose all your tokens” protocol may mean REP becomes a risky investment for some. 60 days of not observing what is happening on-chain and within Augur markets means a user risks losing all held REP, but it creates a more robust “if Augur forks protocol” and may incentivize more users to participate in the Augur ecosystem.

It is unclear when Augur V2 will be released but development appears to be moving along well and the code for the update is being audited.

Santiment recently tracked and listed the most active ERC20 token projects by development in June and listed Augur (REP) fifth behind Storj (STORJ) and Status (SNT). Development activity on Augur in the last month has revolved around building and supporting new UI/UX features set to launch as part of Augur 2.0 and addressing comments from external network auditors.

Objective on-chain indicators

NVT Signal

Derived from the NVT ratio, the NVT signal is a responsive blockchain valuation metric developed by Willy Woo and Dmitry Kalichkin.

Crypto markets are prone to bubbles of speculative purchasing that don’t reflect underlying network fundamentals. The NVT signal provides insight into what stage of this price cycle a token may be at.

A high NVT signal is indicative of a network that is going through one of these bubble periods and may move towards a position of becoming overbought/overvalued, as the market’s speculative momentum slows.

REP’s NVT signal leans marginally bullish. NVTS has appeared to bounce off a floor hit in mid-April 2019 which was reflected in some positive price activity. If NVTS continues to rise in the coming weeks and approaches levels near ~60 points then this will create some positive forward price pressure.

Augur remains an immature project and the creation of some network activity, however small, has been impressive to some.

"When product usage is growing despite a mediocre UX, it is typically a good idea to start paying attention if you’re an entrepreneur or investor," says 1confirmation founder Nick Tomaino. "It is still quite early, but it feels like Augur is on to something." Augur will hope to turnaround the short term trend of falling unique user activity to ensure this hypothesis remains valid.

PMR

Metcalfe’s law is a measure of the connections in a network, as established by Robert Metcalfe, the founder of Ethernet. It has subsequently been used to analyze the true value of network-based financial products like Facebook and Bitcoin. By comparing it to price, it can provide a useful tool to assess whether a token is over or undervalued.

It is also a more straightforward metric to assess when compared to on-chain transaction volume, which can be challenging to measure accurately in USD terms. Addresses are measured as the number of unique sending and receiving addresses participating in transactions daily.

The PMR value of the REP token has historically been high, ranging between 6-8 natural log points since the launch of the token and currently hovers just above 8 points. This means that the token value/market cap far exceeds the number of active REP addresses.

This suggests any potential network effects caused by positive externalities like improved liquidity when organic user growth creates more counterparties for trading, are minimal.

As such it appears as though the relationship between price and PMR is not a useful indicator and is purely driven by token value and not active addresses, with only a few 100 active rep users each day.

A cryptocurrency’s network effects increase when new users join and strengthen the network, making it more valuable for existing users. The most direct network effects are improved liquidity and utility. More daily active users can be indicative of higher demand for trading market creation. Once Augur publicly launches version 2.0, and some of the inherent UX flaws are addressed, the value of the token may rise.

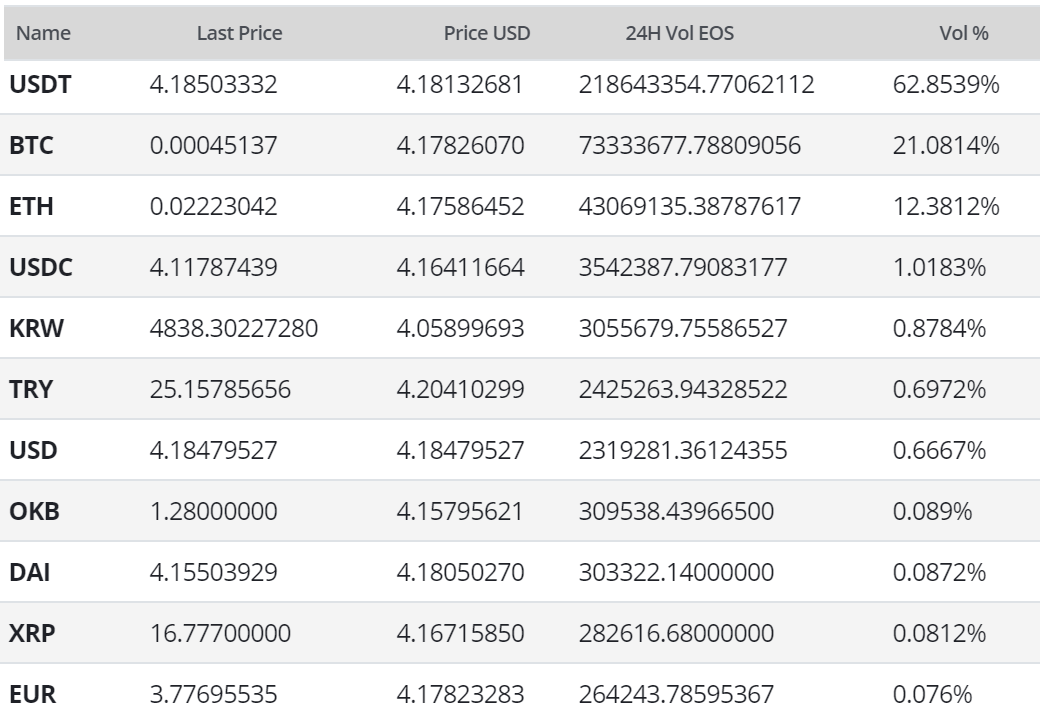

Exchanges and Trading pairs

The most popular trading option for REP is BTC with the pair handling close to ~66% of daily trading volumes. The second most popular market is the REP/USD fiat pair, which suggests that the token has strong liquidity options. Together the top two pairs make up over 80% of daily trading volume. The total USD value of daily volume of the entire REP trading market is just ~USD 6.5 Million.

A mix of exchanges dominates the REP trading marketplace, with 5 different entities operating the top 5 REP trading pairs. The REP/BTC market on LAToken is the most active market in the ecosystem. REP is also tradeable on high profile exchanges such as Binance and Coinbase Pro.

Technical Analysis

Moving Averages and Price Momentum

On the 1D chart, a golden cross has been intact for REP since early April. However, since mid-May, price has consistently drifted lower. Recently, price failed to break above both 50 and 200 day EMAs (black circle), which has REP sitting below both at the time of writing. Furthermore, a death cross (black circle) appears imminent. A death cross confirmation will likely see REP fall to at least $12 or lower, which would be at least a 19% decline from its current price of $14.75.

On the 1D chart, REP has moderately followed the Fibonacci retracement levels in 2019. Price consistently failed to break above the key $23.67 level, which resulted in 0.236 level of $19.40 being used as support. Since then, Fibonacci support levels of 0.236 and 0.382 have faltered, and 0.5 looks to be the next one to fail; especially if the death cross is confirmed. If the aforementioned occurs, price falling to 0.618 or $12.43 is almost certain with the possibility of retracing back towards 0.786 or $9.37 still on the table.

Lastly, on the 1D chart, the volume flow indicator (VFI) is still well above 0 with a linear trend intact. However, the VFI has steadily been declining with periods of ‘rolling over’ curves. If the current decline persists, price will undoubtedly suffer.

Ichimoku Clouds with Relative Strength Indicator (RSI)

The Ichimoku Cloud uses four metrics to determine if a trend exists; the current price in relation to the Cloud, the color of the Cloud (red for bearish, green for bullish), the Tenkan (T) and Kijun (K) cross, Lagging Span (Chikou), and Senkou Span (A & B).

The status of the current Cloud metrics on the 1D frame with singled settings (10/30/60/30) for quicker signals are bearish: price is below the Cloud, Cloud is bearish, the TK cross is bearish, and the Lagging Span is below Cloud and price.

A traditional long entry would occur with a price break above the Cloud, known as a Kumo breakout, with price holding above the Cloud. From there, the trader would use either the Tenkan, Kijun, or Senkou A as their trailing stop.

Since early-June, price has remained beneath the Cloud, meandered lower, and failed at key resistance levels (black circle). Even with an oversold RSI, the odds of REP completing a new Kumo breakout in the coming weeks or months, seem like a longshot currently. Key resistance levels to break above are $16.47 and $19.70, while key support levels are $13.18 and $11.40.

The status of the current Cloud metrics on the 1D time frame with doubled settings (20/60/120/30) for more accurate signals are bearish: price is below the Cloud, Cloud is bearish, the TK cross is bearish, and the Lagging Span is below the Cloud and price.

The slower settings yield a similarly grim outlook for a fresh Kumo breakout for REP.

Conclusion

Augur, while presenting a unique and disruptive value proposition, is still an immature platform. UX challenges have held back the platform’s growth, while a lack of users and liquidity on Augur has affected the core utility of the REP token, reducing the importance and demand for its oracle service.

However, what has been built by Augur is impressive on many levels. It is a functioning, permissionless, decentralized prediction market that is rapidly adapting its code to adjust to market challenges. The soon to be released Augur V2 may help satisfy a number of the core criticisms of the platform and help Augur connect with a new user base.

The technicals for REP are currently bearish. On the 1D chart, both the fast-setting trader (10/30/60/30) and slow-setting trader (20/60/120/30) will await a Kumo breakout above $20 before entering a long position. Failure will highlight support levels of $13.18 and $11.40

Don’t miss out – Find out more today