Awakening the Argentine Lion: The Javier Milei Revolution

The Argentine public has made a bold move electing economic maverick Javier Milei into office. His term heralds hope a new era of radical economic reform.This article is written by Analysts at Volcan Capital. Volcán Capital, an avant-garde boutique fund and asset management firm nestled in the heart of El Salvador.

Introduction

Argentinian politics has a reputation for being chaotic, volatile, and unpredictable. This trend continued in November 2023, with the election of self-proclaimed anarcho-capitalist and libertarian, Javier Milei. Milei is an economist who has won favor with the Argentinian public for his commitment to dollarizing the economy.

His plan to make the US Dollar Argentina’s native currency and shut down the country’s Central Bank has been viewed as one of the only viable options to escape the plague of growing poverty and an ever-inflating peso. 40% of the country’s population lives in poverty.

Milei’s ideology of Anarcho-capitalism advocates for the elimination of centralized state control of money and instead favors a system where transactions are voluntary, private, and based on market principles.

In an op-ed for The Economist, Milei stays true to these philosophies and is brutal in his assessment of Argentina’s Central Bank, government, and the negative effects these institutions have on the population.

“Eliminating the central bank is essential. There is no future for Argentina with the peso. The tyranny of the status quo is defended by corrupt politicians, abusive businessmen, union leaders who betray workers, journalists addicted to state advertising and paid-for articles, and pseudo-intellectuals who provide support to this government-sponsored Ponzi scheme.”

Introducing Volcan Capital – a LATAM Focused Fund Builder

Volcan Capital, a fund-builder for El Salvador and the LATAM region, is closely watching developments in Argentina. Milei’s focus on decentralizing the Argentine economy to awaken South America’s second-largest economy resonates with our own vision.

The motivation to build Volcan Capital has been El Salvador’s non-traditional growth plan and the radical steps it has taken to move away from a political and economic pattern of corruption, debt, and disappointing economic growth. Milei’s intention to change a broken status quo may be exactly what Argentina needs.

On the other hand, Milei’s dollarization plan may be a flawed escape route from constant inflation. This is evidenced by El Salvador, where dollarization has shoved public debt higher, led to a reliance on remittances, and left the economy with no room to maneuver.

In El Salvador, Bitcoin, a more private form of money than the USD, has been adopted as an alternative legal tender, to free the economy. Perhaps dollarization is the step before Bitcoinization for Milei.

Javier Milei galvanizes the nation by offering something different

Javier Milei is often compared to the wave of Right-Wing Populists that have risen to power in other Latin American countries. This includes Jair Bolsanaro in Brazil, José António Kast in Chile, and Guido Manini Ríos in Uruguay.

Milei, however, has social policies that differentiate him from hardcore right-wingers. He advocates for the legalization of drugs and has liberal views on family, sexuality, and marriage. These views align with his libertarian ideals and can be considered to be broadly left-wing policies.

He is also not a military man, unlike many of the other populists in the region. While he does have policies that mirror the likes of Bolsanaro, for example, a pro-gun stance, Milei is more defined by free-market liberalism than any of his periphery right-wing positions.

On the reopening of trading markets following Milei’s win, Argentina’s dollar-denominated government bonds rose 1.7-2 cents each to 29-34 cents on the dollar. Additionally, the share price of US-listed Argentine energy company YPF, rallied after Milei said he would privatize it. Markets appear to expect some form of a relief rally for the Argentine economy if Milei is allowed to push forward with his free-market vision.

During his campaign, Milei promoted a strong individualistic position. He has spoken about liberating the lion within each Argentinian citizen and releasing them from the shackles of being collectivist lambs.

Milei is an economist known for his strong Austrian view. He was elected into parliament in 2021 as an outsider who was a part of the newly formed Libertarian Party. From this position, he has quickly become a growing force within the world of Argentinian politics.

He is known for his fiery television appearances where he described the Central Bank as a ‘scam’ that has duped ordinary citizens with fiat, unbacked money. He discussed tearing down corrupt, elitist government departments and challenged Argentinians to question traditional government procedures and operations. He often criticizes Argentina’s political elite which he describes as “The caste.”

Milei’s infectious cult of personality is buffered by his throwback mutton chop facial hair and love of anime.

Javier Milei

Milei’s opposition warned the Argentinian public of his plan to eliminate key ministries, privatize public services, and cut welfare programs. Despite this, he won the recent presidential run-off election heartily.

On November 20, with 99.4% of votes tallied in the presidential runoff, the Argentinian electoral authority announced that Milei had 55.7% of the vote and Economy Minister Sergio Massa had 44.3%. This was the widest margin of victory for an Argentinian President since the country returned to democracy.

Dollarization: Can it work?

During his campaign, Milei promised that he would liberalize the Argentinian economy by giving merchants and customers the option to pay or receive with either pesos or US dollars. This is likely because of the popularity and accessibility of the US dollar in Argentina. Critics of the policy have suggested that the country does not have the foreign reserves to fund such a policy.

There is also the obvious issue of dollarization tying Argentina to the US economy. It would leave Argentina without a monetary policy, which some argue is a good thing. This is because it removes any temptation the South American country may have to print money or use stimulus for political reasons.

This doesn’t, however, stop American Central Bankers from printing money devaluing the US dollar and affecting Argentina’s economy indirectly. The removal of the peso and the Central Bank has other consequences as well, like the loss of a lender of last resort that could step in and save systemically important sectors such as banking when something goes wrong.

In El Salvador, there has been some frustration surrounding dollarization policies, which have been in place in the Central American country since the early 2000s. Salvadoran economist and politician Roberto Cañas said the Salvadoran government promised that dollarization would bring abundant investment, more exports, and quality. He said that these effects “never came”.

Instead, imports continually exceeded exports, and debt ballooned in El Salvador post-dollarization.

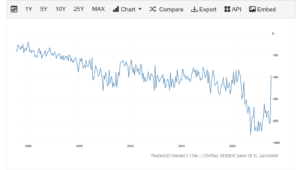

The graph above displays El Salvador’s Balance of Trade, the difference between the value of a country’s exports and imports. For most of the 21st Century, the value of El Salvador’s imports far exceeded its exports. It currently sits at about 41% of the country’s GDP.

Many who have experienced dollarization in El Salvador have said that it is not an instant fix for economic struggles. It does not generate jobs or create an export industry. In El Salvador, remittances became a lifeline for many citizens, with thousands of Salvadorans determining that irregular migration to the United States would be the best way to earn USD, their home nation’s legal tender. Irregulation migration is the practice of crossing an international border without official permission.

It has been reported that many Salvadorans choose to enter roles in banking and imports, to more easily access international money transfer operations.

El Salvador’s Total Gross external debt, or, the total debt that the country owes to foreign creditors, has also risen rapidly in the 21st century. The chart above evidences this pattern. The scale for the right-hand axis is US$ million.

This is Argentina’s second attempt in the last 30 years to tie its economy to the US dollar. In the early 1990s, Argentina pegged the Peso to the dollar, 1-to-1, as part of the “Convertibility Plan”. While, initially the strategy had some success, eventually the economy was weighed down by the peg.

When it was first introduced, the convertibility plan brought down inflation and stabilized Argentina’s interactions with foreign investors. These factors helped generate foreign investment.

Eventually, however, the 1-to-1 peg with the US dollar led to an enormous overvaluation of the Peso. Argentina had to keep pace with the rising US economy and strong US dollar, which made Argentinian exports more expensive and less competitive than rival nations, eventually leading to stalling trade.

This all came to a head in the early 2000s when the economy reached a point of crisis. There was a massive public debt default that led to significant social and political upheaval. The peg was abandoned in 2002. This led to yet another period of high inflation as the peso was again devalued.

Can Milei make dollarization work? History suggests that this task will be challenging. What is encouraging, however, is the call out of inefficient Central Banking in Argentina and its tendency to press the money printer button. Additionally, in the short term, Argentines will be more than happy to have a break from the ever-inflating peso.

Milei’s cult of personality

Milei is massively popular with young, disenfranchised Argentines who have suffered from a stuttering economy for most of their lives. They hear tales of past times when Argentina was one of the richest countries in the world. Milei’s plans to return Argentina to its former greatness through something radically different has resonated with the youth.

This is another way Milei differentiates from the right-wing populists he is compared to. While the likes of Brazil’s Bolsanaro rely on older votes, Milei regularly leads polling amongst 18-35 year olds.

Argentina’s troubles with inflation began in the 1940s when socialist-aligned Juan Domingo Perón rose to power. Perón nationalized production, built out a large expensive welfare program, set up trade barriers, and empowered worker unions. These policies shackled the Argentine economy. Milei is a near polar opposite of Perón and Argentines are in the mood for something different.

Many were introduced to Milei through his Economics lectures and speeches that he conducted before he became a popular politician. To them, Milei is an academic rebel different from the “political caste”.

Milei, the academic rebel

He is known for theatrical rants where he targets the likes of Pope Francis, an Argentine himself. Milei, not one to mince words described the Pope as an “imbecile who defends social justice,” a ‘“son of b****h who preaches communism,” and “The representative of the evil one on earth.”

His fans have described liking the “effusive” Milei” and the Milei “who gets mad when he’s faced with lies, faced with dishonest people.” Other voters say they first caught the Milei bug when he mentioned returning Argentina to its golden age of the 20th Century.

Milei has galvanized the younger generation and other frustrated Argentines by leaning into numerous anti-establishment, anti-status quo, and pro-disruption stances. It’s a strategy that’s paid off and now sees him in the top job where he can affect economic policy, with the backing of Argentine masses.

Milei and crypto

As soon as it became clear that Milei was set to be the next President of Argentina, crypto markets immediately rallied. This is likely because he has expressed pro-Bitcoin and crypto sentiments. In the last year, he said Bitcoin represents the “return of money to its original creator, the private sector.”

Additionally, Milei is an Austrian economist and libertarian. Both camps have lauded the creation of BTC and advocated for its secure, unaffected-by-politics, hard-coded, monetary structure.

Mauricio Di Bartolomeo, the Venezuelan co-founder of the crypto firm Ledn, spoke to crypto news agency The Block to shed light on why Milei’s ascension may be positive for the sector.

“Milei plans to dollarize the Argentine economy by killing the Peso and shutting down the Argentine Central Bank. He also plans to get rid of ‘legal tender’ laws, meaning that Argentinians will be able to freely pick whichever currency (or digital asset) they want to deal in for their everyday use,” Di Bartolomeo explained.

Numerous on-the-ground surveys have indicated the popularity and relevance of Bitcoin and crypto in Argentina. In 2022 Argentina was among 15 countries surveyed by Morning Consult, a data firm based in Washington. Nearly 60 percent of Argentines believed that Bitcoin would hold the value of their savings over the next two years. When asked the same question in relation to Argentine pesos stored in a bank account, just one-third thought that this method could hold the value of their savings.

Argentinians have embraced crypto because of their country’s inability to manage peso inflation and provide a stable savings environment. As a Bitcoin-aligned populist with a willingness to break away from tradition, Milei is viewed as a leader like El Salvador’s Nayib Bukele, who may be more open to crypto.

Jameson Lopp, on X, referencing the Milei win, asked — “Is this the next domino to fall for nation-state adoption of Bitcoin?” former Blockstream executive Samson Mow, also hinted on X, that Argentina could be the next nation to adopt BTC as legal tender.

Conclusion

As Javier Milei takes on the challenge of Argentina’s presidency, his victory signals a new era in Argentine politics and economics. His election is not just a reflection of a populace yearning for change, but an experiment in implementing unique anarcho-capitalist principles at a national level.

Milei’s bold plans for dollarization, the elimination of the Central Bank, and the adoption of free-market liberalism represent a drastic departure from Argentina’s traditional economic policies. This shift, while filled with hope, carries the potential to redefine Argentina’s financial landscape and its role in the global economy.

His unique blend of economic and social policies has resonated deeply with the younger generation. They view him as a symbol of rebellion against the entrenched political elite and a promise of a revitalized Argentina. Whether or not his dollarization plan works, Milei has left an indelible mark on Argentine politics.

Milei’s presidency has already ignited a spark of hope among many Argentinians, a hope for a future where their country regains its lost glory and charts a new course toward prosperity and freedom.

This article is written by Analysts at Volcan Capital.

Volcán Capital, an avant-garde boutique fund and asset management firm nestled in the heart of El Salvador.

The country is emerging as one of the most exciting and asymmetric investment markets in the world. It offers a blossoming economic landscape powered by Bitcoin and Digital asset-forward economic policy. The BSP and DASP licenses are set to unleash the potential of a new wave of Blockchain forward businesses free to access banking and infrastructure partners without either side fearing regulation.

We offer discerning investors a unique opportunity to tap into one of the world’s most promising emerging markets by building investment vehicles for the next generation of funds and services tailor-made for the Bitcoin era.

Don’t miss out – Find out more today