Bitcoin and the Debt Ceiling: How the asset reacts to Washington

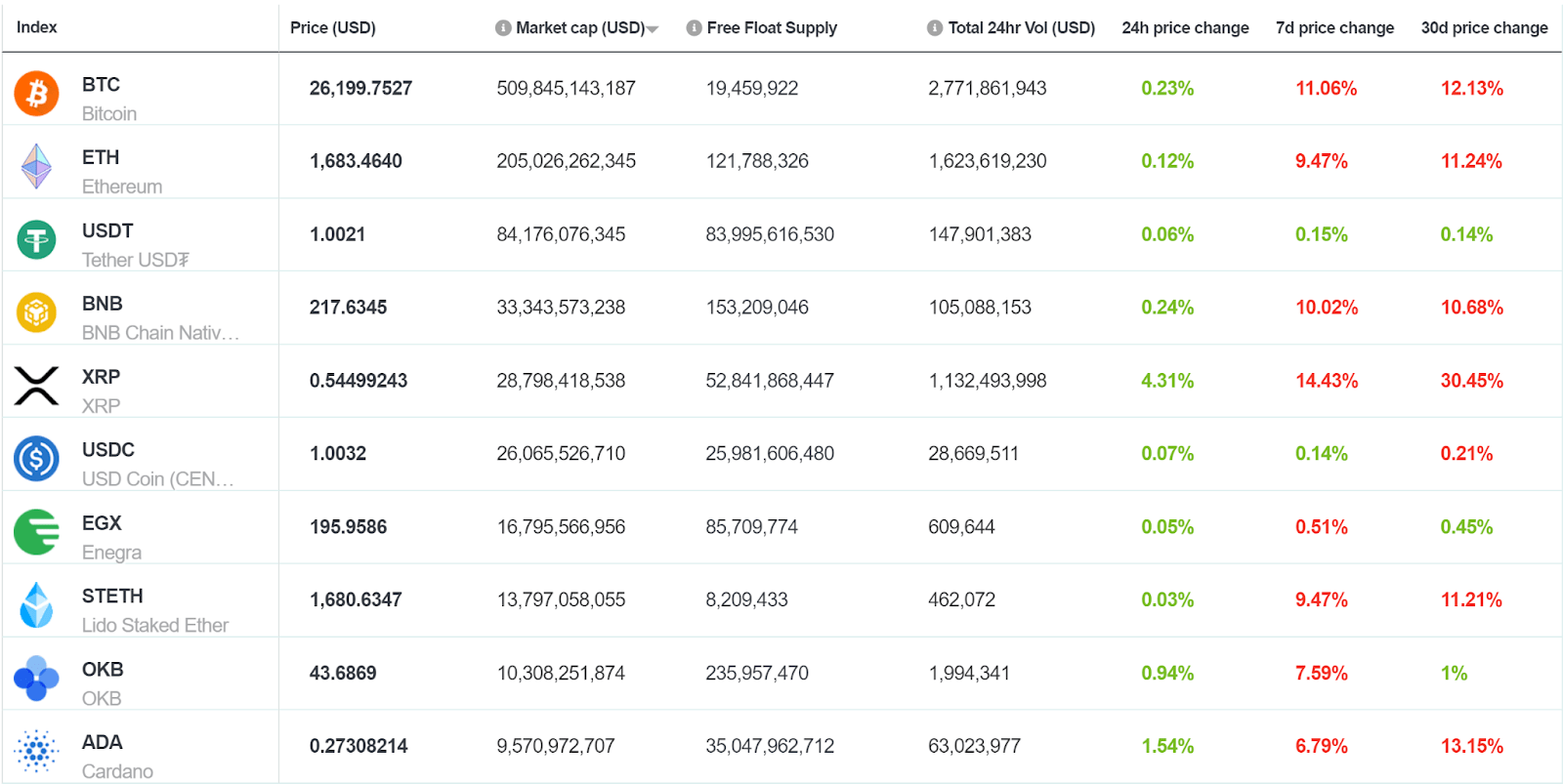

The White House and the US House of Representatives have reached a tentative agreement to raise the US government debt ceiling. This article explores the implications for Bitcoin and crypto assets.

Introduction

This week global markets received some breathing room as news trickled out of Washington D.C that The White House and the US House of Representatives had reached a tentative agreement to raise the US government debt ceiling. This potential solution to the impending debt crisis, confirmed by both House Speaker Kevin McCarthy and President Joe Biden, buoyed markets and boosted Bitcoin’s performance. The next stage for investors will be absorbing what the debt ceiling deal will mean for BTC, and to consider the other factors that may affect the performance of the asset in the medium to long term.

The Weekend’s major macro news event

On Saturday, it was revealed that the White House and the US House of Representatives had reached a tentative agreement to raise the US government debt ceiling, alongside spending cuts to accommodate these changes. Speaker Kevin McCarthy and President Biden have both confirmed this, leading to renewed market optimism that the US has delayed a potential debt default.

Bitcoin and stocks both moved strongly on Friday, following murmurs that a deal to extend the debt ceiling would be reached. Bitcoin, an asset with markets open 24/7 then carried this momentum over the weekend with a solid Sunday (up 5.24% over the day) after it became clear that the debt ceiling was likely to be raised.

The dust, however, has not completely settled. While Biden and House Speaker McCarthy may be on the same page, a deal will need to be reached across the government. Republicans control the House and Democrats control the Senate. Allies of Biden and McCarthy will need to work across the aisles to secure a deal that works for both parties.

The Debt Ceiling Background

The US government debt ceiling is the limit on the total amount of national debt that the Department of the Treasury can issue to the public or to other federal agencies. The ceiling is an aggregate that applies to gross debt, this is all debt in the hands of the public and the government. Interestingly, no other major economies have a debt ceiling.

This US national debt ceiling generally always gets closer and closer to being breached. Governments tend to borrow more from creditors than they earn through taxation or save through reducing spending. They have a straightforward vehicle in the form of US government bonds, also known as treasuries, to access creditors. During the covid-19 pandemic, however, this debt accrual heavily accelerated beyond normal levels.

To make up for the economic slowdown caused by emergency lockdown measures, the US government aggressively borrowed more without sacrificing spending.

Source: Tradingeconomics.com

While the level of debt has somewhat stabilized, the seemingly enormous US$31.4 debt ceiling has been breached. The chickens are coming home to roost for the US government, and now there is ongoing scrambling to ensure that the government does not default on debt payments.

Speaker McCarthy said the tentative deal to extend the debt ceiling will be transformational for the American public. McCarthy, a senior Republican, was complimentary of President Biden, a Democrat, in comments and he said he was positive that the deal will make the majority of both party’s representatives happy. “We know at any time when you sit and negotiate with two parties that you have to work with both sides of the aisle,” McCarthy said. “So it’s not 100% of what everybody wants, but when you look, the country is going to be stronger.”

The debt ceiling deal is said to include special provisions including — work requirements to receive benefits, maintaining green energy funding, a system to reclaim unspent COVID-19 relief funds, a cut to the US$80 billion of funding allocated to the IRS last year, and budget cuts across federal sectors.

The Debt Ceiling Rises

The debt ceiling is set by the US Congress and has risen over time as the economy has expanded. Janet Yellen, the US Treasury secretary, said last week as the debt ceiling approached, that the US financial system could run out of money by early June and warned of the dangers of the debt ceiling being hit.

If the debt ceiling is reached and is not either extended or removed, there are likely to be severe consequences for the US and global economy. The Treasury would no longer be able to issue bonds to fund government spending. All spending would have to come through incoming tax revenue and any held cash/liquid assets. This could lead to a collapse of economic activity and key spending in areas such as public services.

Additionally, the other major consequence is a rise in future borrowing rates. If the US does default it would mean that lenders will likely view it as more unstable/risky than before. They will likely want a premium on any interest paid to them.

As one of the key powerhouses of the global economy, a US debt default will likely have repercussions across the global market. It would affect the US’s ability to import from countries like China and the developing economies that buffer themselves with US dollar reserves.

The US has never actually defaulted on principal or interest payments on the national debt. It has, however, had incidents in the past which can be considered technical or temporary defaults. A number of these incidents occurred in the 20th century.

In 1979, the Treasury missed payments on roughly $122 million in Treasury bills. They blamed the incident on a variety of technical issues including a backlog of paperwork because of word processor software breaking. The Treasury bounced back quickly in this case and was able to fulfill the back payments with back interest.

In 1933 when Franklin Delano Roosevelt (FDR) was president of the US, it was decided that lenders would not be paid out with gold as was first agreed under the conditions of the treasuries issued. They instead offered them US dollars. This was seen by many as a clear default.

There was a period in 1971, known now as the Nixon Shocks. There was no default but the administration of the president at the time, Richard Nixon, pushed a series of drastic policy initiatives that essentially reset the national debt and the US currency system. On August 15th, 1971, Nixon announced a 90-day freeze on wages to counter inflation, a 10% surcharge was added to imports to protect US manufacturers, and a closure of the gold window was implemented. US dollars could only be exchanged for gold on the open market.

The gold standard set a rule where national currencies needed to be backed and redeemable for gold. The US refusal to stick to these standards has been viewed by many observers as an example of default.

The 2nd and 3rd incidents particularly were difficult for the US economy to come back from. Emergency measures, even if they are not complete defaults, can still lead to sharp economic cutbacks that will affect the output of the country.

In a newsletter, Austrian economist, Peter St Onge argues that perhaps Washington should simply default on its debt. St Onge says “the choice isn’t between default and “Full faith and credit. It’s between a clean default that only takes down the government’s financial enablers and the same dirty default we’ve been doing for a hundred years that takes the US dollar, and all Americans, down with it.”

He argues that a clean default will punish the entities the US government and Treasury have been bailing out. He argues that this will not have the same widespread effects as an emergency debt ceiling extension that will involve spending cuts and more taxation, which will hurt more across the board.

Is Bitcoin Macro?

For a number of reasons, BTC is considered to be an asset that is driven by macro tail or headwinds. The asset doesn’t generate cash flows and cannot be easily assessed using metrics like a future cash flow that has been traditionally used for stock investments. Unlike equities where periods like earnings season can heavily influence buying and selling pressure, the crypto asset class’s value drivers are often driven by speculation.

In a report for the Federal Reserve of New York, however, staffers Gianluca Benigno and Carlo Rosa argue that there is a disconnect between Bitcoin and macro. Their robust empirical analysis finds that BTC does not respond to macro news as one may expect. They write, “Bitcoin is an asset with no intrinsic value whose current value depends on the discounted value of its future price, so we should expect Bitcoin to respond to monetary policy news as it is reflected in changes in current and future real interest rate.”

They find that while other US asset prices respond to both the target and the path of monetary policy news, Bitcoin is unresponsive to unexpected changes in the short-term rate while its reaction to news about the future path of policy is not robust. In their conclusion, they do acknowledge that they are using a small dataset.

These results suggest that either Bitcoin is not particularly responsive to macro events, or that the asset may have more intrinsic value than the study expected. Additionally, bitcoin often does move based on macro news events like the passing of bills in major economies, like the USA or China, to ring-fence or open economies to crypto asset investment, It is not simply interest rate decisions or inflation rate announcements that affect price.

It remains unclear how BTC will respond to the debt ceiling extension. The price of the asset has risen this week following a sign that a deal is in place to extend the ceiling and avoid a national debt default. This intuitively makes sense. Bitcoin is popular with retail investors and is growing in popularity amongst institutions. A national debt default is likely to be the precursor to a recession and this would affect spending ability across all income groups and the ability for them to pursue discretionary, riskier investing. A recession would likely lead to a fall in all speculative investments, BTC included.

In 2023, Bitcoin has shown an ability to be resilient in the face of macroeconomic chaos. Year-to-date the price of BTC is up ~67.4%.

Bitcoin was built to be a decentralized payment network that removed intermediaries and counterparties from transactions. It has a purposefully built hard-coded, predictable monetary supply. It has found renewed support during the recent banking crisis in the United States and Europe.

The raising of the debt ceiling will lead to the issuance of new US dollars. This will likely put more inflationary pressure on the US and may perhaps increase the appeal of Bitcoin. An asset that is not connected to backchannel political moves, or a Treasury that hits a brick wall because it has issued too much debt.

Bitcoin’s correlations with other assets

The narrative that Bitcoin may outperform other asset classes if the US economy faces a crisis is backed by correlation data.

Source: Coinmetrics data dashboard

The chart above indicates the dropping correlation between BTC and the S&P 500 index over the course of the last year. The Standard and Poor’s 500, or simply the S&P 500, is a stock market index tracking the stock performance of 500 of the largest companies listed on stock exchanges in the United States. It is one of the most tracked stock indices and is generally considered a good indicator of the overall health of the US equity market.

Since the end of last year Bitcoin is not moving alongside the S&P 500, and has not appeared to take cues from it. This is not necessarily a bullish indicator but is something to keep in mind given that the S&P 500 is closely connected to the wider US economy and interest rates.

Source: Coinmetrics data dashboard

The price of BTC has also evidenced a mild negative correlation with the US dollar over the last year. Again this is something to be wary of given the potential chaos and loss of value to the currency if the national debt crisis in the United States continues to unravel.

Source: Brave New Coin and Glassnode

The above chart represents Bitcoin’s relationship with Gold (XAU). What is most notable is how much the gold and BTC correlation has triggered in 2023. Overall the correlation between BTC and gold is inconsistent and there have been periods in the last 3.5 years where the correlation has disappeared.

In 2023, however, the relationship between gold and BTC has been tight, this is reflected in a Pearson correlation coefficient that is ~0.8 year-to-date.

This is considered, by the rule of thumb, to be a strong correlation. Visually, it appears that around mid-2022, the two assets began moving in lockstep with each other.

Both assets have so far been strong hedges against global macroeconomic uncertainty and banking crises. They both have a limited supply and accepted value across their investor markets. BTC has shown a higher beta and has had oversized returns in comparison to gold.

What else is going on with BTC

2023 has been an excellent year for Bitcoin (BTC) bulls. In the first four months of the year, the BTC price has risen by 67.4%.

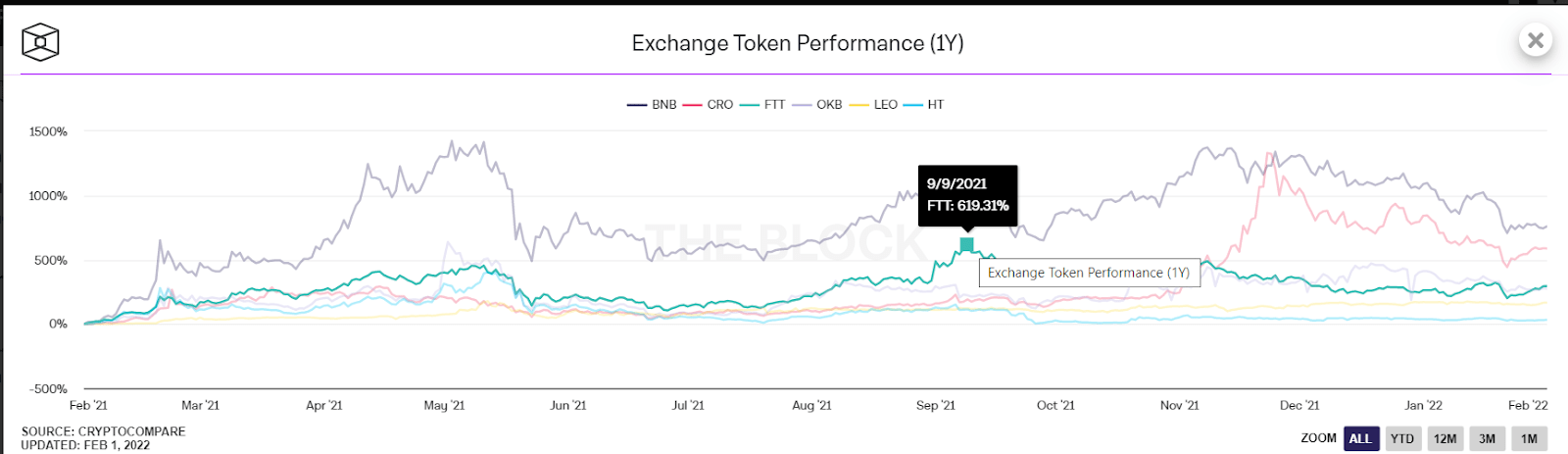

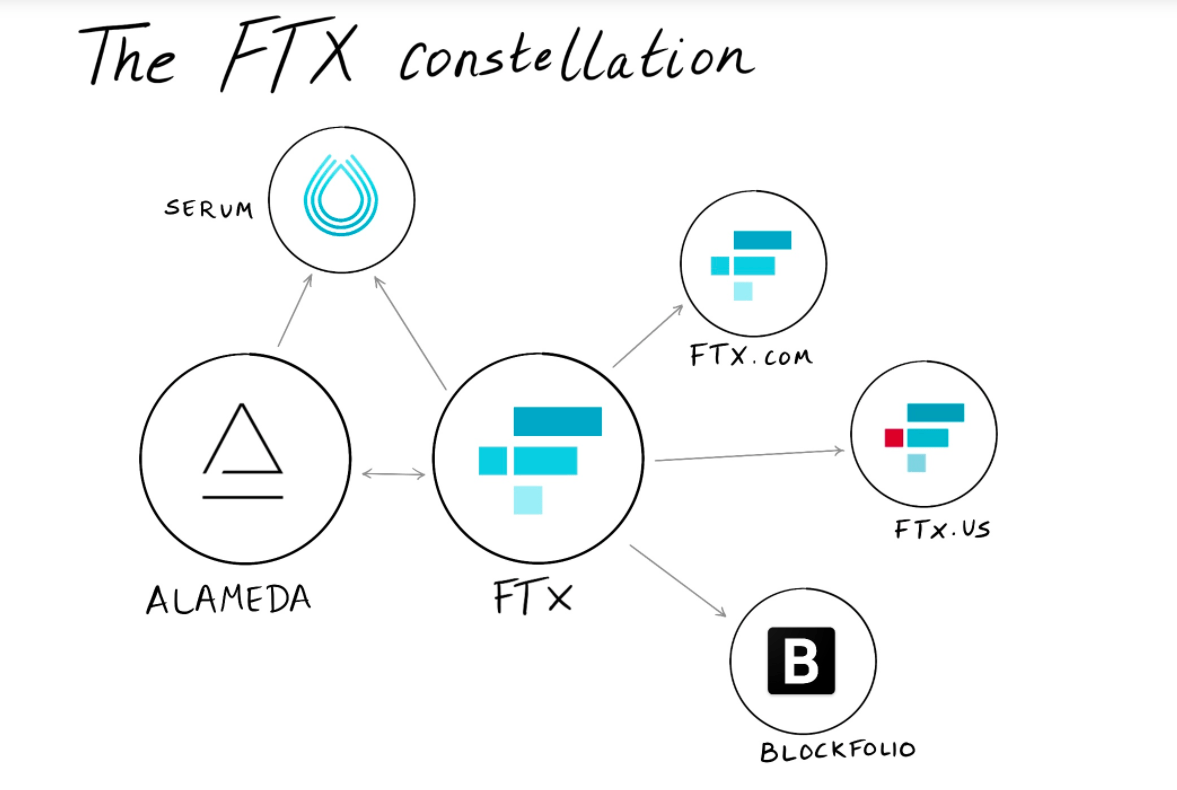

Performance this year contrasts starkly with 2022 which was a difficult year for BTC and the digital asset class in general. The collapses of Terra and FTX, alongside a slumping global economy that was struggling with inflation and reactionary interest rate hikes, were a recipe for a downward price trajectory and disillusioned investors.

This year the price of Bitcoin has surged, backed by its position as a banking crisis hedge. Other factors in the upward trend have also been the Bitcoin halving event being a year away and strong fundamental demand to use the network because of emerging utility.

The bitcoin halving is pivotal in crypto markets because of the strong positive effect it has on the price of BTC. It occurs approximately every four years and cuts the supply rate of new Bitcoin in half. The halving reduces the rate of inflation and like clockwork, creates upward price pressure for Bitcoin.

At block height 840,000 expected to occur in April 2024, Bitcoin’s block reward, for successfully-mined blocks, will halve from 6.25 coins to only 3.125. This will continue at the same rate for another 210,000 blocks. Roughly another four years.

Bitcoin bulls generally tout the halving as a powerful bullish tailwind and often focus on investing around this four-year cycle. Generally leading up to halvings Bitcoin enjoys bullish momentum, as investors prepare for the supply shock. In simple supply and demand terms, if demand stays constant and supply receives a shock like a halving that makes the creation of new supply slower, the price should rise. Historically, this is how the price structure of BTC has played out.

With the halving now less than a year away (April 2024), Bitcoin bulls likely have one eye on their calendars in preparation for the event.

Bitcoin (BTC), is dealing with a controversial new feature that may be dividing community opinion but is leading to a surge in demand to use the blockchain. The Bitcoin Ordinals protocol introduced in 2023, has caused an increase in transactions on Bitcoin. Described by some as Bitcoin NFTs, Ordinals bring a new type of utility to the Bitcoin network that has immediately resonated with users.

Ordinals were enabled by November 2022’s Taproot upgrade. Taproot enabled the Ordinals protocols and has opened the door for fungible or non-fungible tokens to be issued directly on the Bitcoin network, uniquely identifiable by a number signature on the smallest unit of BTC, a satoshi.

There are a number of different use cases Ordinals can power. They have primarily been used to create non-fungible tokens (NFTs) but they are now gaining popularity as a way to issue fungible tokens. Ordinals power the BRC-20 standard which resembles Ethereum’s popular ERC-20 standard.

Across a number of key metrics (Transaction count, hashrate, BTC on exchanges, Address activity), it appears clear that the Bitcoin network is booming.

Bitcoin transaction count, Source: Glassnode

Bitcoin transaction count, source: Glassnode

BTC balance on exchanges (less BTC on exchanges means more BTC onchain or in cold storage, an indicator of reduced selling pressure), Source: Glassnode

BTC addresses with non-Zero balances, Source: Glassnode

The emergence of Ordinals has had a clear impact on the wider Bitcoin protocol. While it has boosted transaction activity and increased demand to interact with Bitcoin, the protocol, however, has bloated the network and fees and wait times for transactions have become a pain point for users of the network. This has put pressure on layer-2 solutions like the Lightning Network to supplement and support the network.

Glassnode has recently reported that, for only the 5th time in history, the average fee per block exceeded the block subsidy. The last instance of this occurring was the 2017 market peak. In all five of the historical cases, high fees eased and the network normalized. Glassnode says that the fee boom was driven by the popularity of the BRC20 standard, enabled by the Ordinals protocol.

Transaction fees reached 6.66BTC, well above the 6.25BTC block reward. This made the total miner reward a staggering 12.9BTC per block or ~US$348,000.

Conclusion

The likely agreement to raise the U.S. debt ceiling is a backstop to stave off a potential financial crisis. The political backchanneling to reach a deal has had a ripple effect on the markets, Bitcoin included. whose price has been positively impacted by the news. Despite the initial positive response, the future of Bitcoin remains uncertain due to the potential macroeconomic shocks that may occur if the U.S. were to default on its debt, or perhaps if making extreme concessions to avoid default leads to even worse outcomes.

The events of the past week have once again emphasized Bitcoin’s complex relationship with traditional markets, and how political events can directly impact the performance of the cryptocurrency market. Will BTC prove to be a resilient asset in the face of potential economic chaos or will it cave under pressure? The asset has characteristics of both a risk and safe haven and holders will hope it can keep finding the right market narrative.

Don’t miss out – Find out more today