Bitcoin in Numbers: Currency Wars and Bitcoin

China sneezes and the world catches a cold, while Bitcoin proves immune... for now

Modern Portfolio Theory, introduced in 1952, explains that a diversified portfolio has low-correlation assets. These assets should react differently to market forces, providing an optimal risk/return relationship, and low volatility. Investors traditionally invest in a mix of assets including stocks, bonds, mutual funds, and property, or “traditional assets.”

On a regular basis we are asked, "what is the correlation between traditional assets, global markets and bitcoin?" Our first response is always, go sign up, and read the incredible report attached to our Wednesday morning newsletters.

It is a complicated question to answer. The bottom line is that Investors are looking at this new Asset-Class and are attempting to squeeze it into a familiar box. We’ve heard comparisons to Stocks, Bonds, Commodities, and Currencies. The common theme is the comparison to gold, and commentators commonly describe bitcoin as a ‘safe-heaven’ during times of market-turmoil, which is partly true.

The ‘comparing bitcoin to X’ debate is still unanswered. We have seen the price of bitcoin spike during several global events, including the ‘Bail-ins’ during the Cypress Fiasco in 2013, and to a much lesser extent the recent Greek Crisis. However, with bitcoin comes the Blockchain, and it’s many applications, which provide a diversified portfolio of it’s own, and makes a straight comparison to any single Asset impossible.

Bitcoin & the Blockchain are Inseparable and thus bitcoin is a not just a:

- Currency

- Store of Value

- Payment Network/Protocol

- Software

It is all of the above, and that’s the reason why it’s currency component has a separate behavioural pattern to standard markets and all other assets. Let’s take a look at the recent Yuan devaluation news and the price of bitcoin in a few charts:

Yuan Devaluation:

The unexpected devaluation triggered fear and panic across global markets. The effects were immediately felt across economies that depend on a stable Yuan, or trade with the worlds largest economy, which is the majority of the planet.

Bonds, Gold & Stock Markets Reaction:

The reaction in the Bond, Gold and Stock Markets comes at no surprise with each moving in predictable ways.

Bitcoin on Yuan News:

Bitcoin does very little after the announcements. Late last week the price dipped 5.83%, in comparison to the preceding seven days, on the news that the NY BitLicense is driving companies out of New York State.

Bitcoin Vs All Other Asset-Classes In July:

Interesting to note is that bitcoin has out-performed all major Asset-Classes during the month of July, further strengthening the idea that bitcoin market-forces have a stand-alone behavioral pattern.

We are seeing a pattern between industry specific news and the price of many Digital Currencies’ that we track, including bitcoin, far more often than we do with global events. Unlike Gold, Oil, Bonds or Stocks, one thing we can rely on with Digital Currencies is trust in it’s mathematics. We can predict with great accuracy how many bitcoin there will be in circulation at any time in the future. How many shares in AAPL or units of USD will exist in 2050? This is just one more reason we are excited about the possibilities of the age of Programmable-Money.

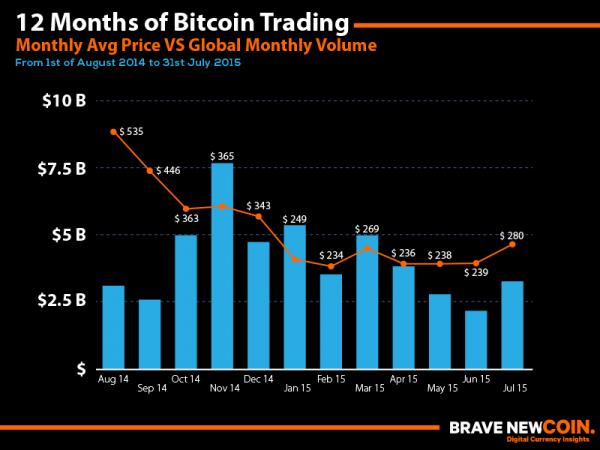

Lastly, a 12 month overview:

BNC Data Tracks Market Activity 24/7 and from around the globe. If you require Market Data or an Index Feed for Settlement, Trading or Research, of any grade, granularity or time frame, get in touch by dropping us a line on [email protected]

Don’t miss out – Find out more today