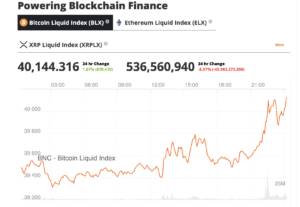

Bitcoin Price Surges to $42,000, Sparking Speculation of Bull Run

Bitcoin soared to $40,105 on Sunday, marking its highest valuation in nearly a year and a half. The surge is attributed to growing optimism among investors, fueled by speculation that U.S. regulators are set to greenlight stock-market traded bitcoin funds.

Bitcoin briefly soared to $42,066 on Monday, marking its highest valuation in nearly a year and a half.

The current surge follows Bitcoin’s more than doubling in price this year, successfully recovering from the aftermath of the 2022 collapse of the stablecoin terraUSD and the FTX exchange.

Despite the recent rally, Bitcoin remains below its record high of $69,000, established in November 2021. Mainstream adoption has also proven elusive, with most large investors and companies exercising caution when considering Bitcoin as an investment.

Industry insiders, however, see a promising future. Cryptocurrency executives are heralding the beginning of a new bull run, with an increasing number predicting fresh all-time highs for Bitcoin in 2024.

Bitget Research Chief Analyst Ryan Lee says $40,000 “might serve as the new starting point for the forthcoming bull market”. He says given the potential for a recession in the US economy, fund managers are predicting an 80% consensus level for a trend of interest rate reduction in 2024, marking the highest consensus level ever recorded – and it appears the crypto market has already factored in this positive news.

Bitcoin has surpassed US$40,000 without encountering significant resistance and over 24 hours, short positions on Bitcoin contracts worth US$54 million were liquidated, significantly weakening the bearish forces. The market may undergo an overall accelerated upward revision. Furthermore, a new asset category within the Bitcoin ecosystem, ORDI, surged over the weekend, indicating a strong speculative sentiment in the market.

The industry has weathered its share of challenges, including the collapse of major exchanges and legal issues involving key figures like Sam Bankman-Fried (FTX) and Changpeng Zhao (Binance). Many now view these cases as a turning point, symbolizing the resolution of long-standing problems that plagued the crypto market.

With these issues behind them, investors are now focusing on positive developments. The potential approval of a bitcoin exchange-traded fund (ETF) is generating excitement, as it could attract larger traditional investors previously hesitant to engage with crypto.

Another crucial development on the horizon is the bitcoin halving scheduled for May 2024. This event, occurring every four years, involves cutting rewards for miners in half, thereby limiting the supply of bitcoin. Historically, such halvings have triggered new rallies.

Despite these positive indicators, there is still an air of caution. Analysts warn that the rally, driven in part by expectations of ETF approval, could falter if regulators reject the product.

Don’t miss out – Find out more today