Bitget Token (BGB) is Becoming the New Crypto Staple

While the broader markets heavily focus on the 'Bitcoin back to US$50K' narrative, we are excited to see Bitget Token (BGB) outperform the billion-market cap club with new ATH records.

While the broader markets heavily focus on the ‘Bitcoin back to US$50K’ narrative, we are excited to see Bitget Token (BGB) outperform the billion-market cap club with new ATH records – YES it’s plural. Bitget’s native token breached the US$1 mark within less than 50 days into the new year and only around two years after relaunch.

TL;DR: BGB is becoming the new crypto staple

Seeking An Explanation For BGB’s Breakthrough Series

Upon analysing the weekly and monthly performance of BGB, we have come to the conclusion that this token has the ability to withstand market difficulties and leverage any bullish signs to get back in the spotlight. It’s time to take a closer look at this phenomenon in an attempt to find the answer.

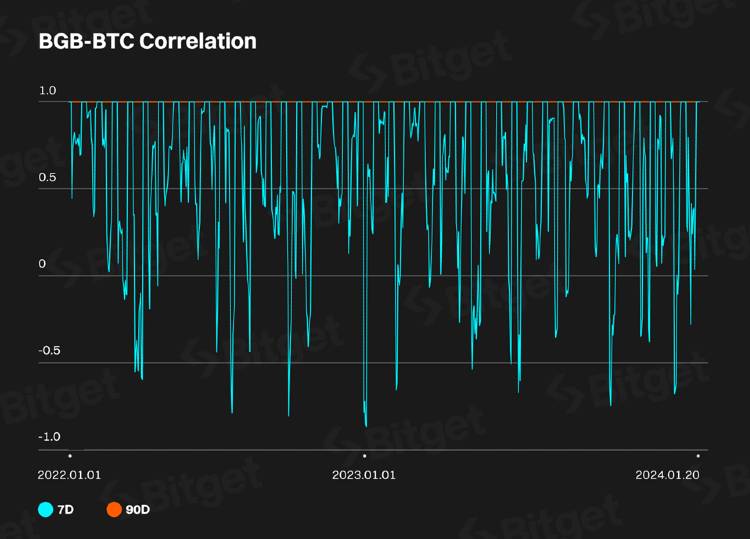

Below is the correlation chart between BTC and BGB. You may ask why Bitcoin and not Ethereum (the mother of all ERC-20 tokens) or any other CEX tokens? At its lowest, Bitcoin dominance was still above 30% or one-third of the entire crypto market; that’s not to mention Bitcoin’s status as an asset is less often challenged than Ethereum and the gate to Wall Street is finally opened for Bitcoin with the recent spot BTC ETF launch.

Source: Bitget Academy, Yahoo Finance

The chart only shows the 7D and 90D rolling correlations between BTC and BGB’s closing prices since the BGB upgrade (from BFT) in early 2022 for several reasons:

- The issue price of BFT and BGB are different because of the change in plans and benefits for holders;

- The BGB-BTC correlations for longer time frames (30D, 60D, and 90D) eventually converge, so we select the 7D and 90D correlation data to showcase the contrast between short-term and mid-term numbers as well as for the sake of visualisation;

- Long-term analysis is not available considering the 2022 timestamp.

The key point here is: BGB performance in mid-term follows that of BTC, but that’s not necessarily the case for its weekly performance. It’s important to note that correlation goes up as the examined period gets longer (30D correlation is higher than 7D, 60D is higher than 30D, and 90D is the highest), even though the 30D figure does not show as a clear positive relationship between the two cryptocurrencies as the 60D and 90D charts. The implications of these findings include:

(1) It’s easy for new BGB investors to rake in some good returns regardless of their entry date as the token is likely to break away from Bitcoin’s weekly ups and downs, thus creating numerous decent entry points on a regular basis. At the same time, a bounceback or breakthrough may happen very shortly afterwards, allowing for profit realisation within a short period of time.

(2) Holding BGB should be no less rewarding than holding BTC.

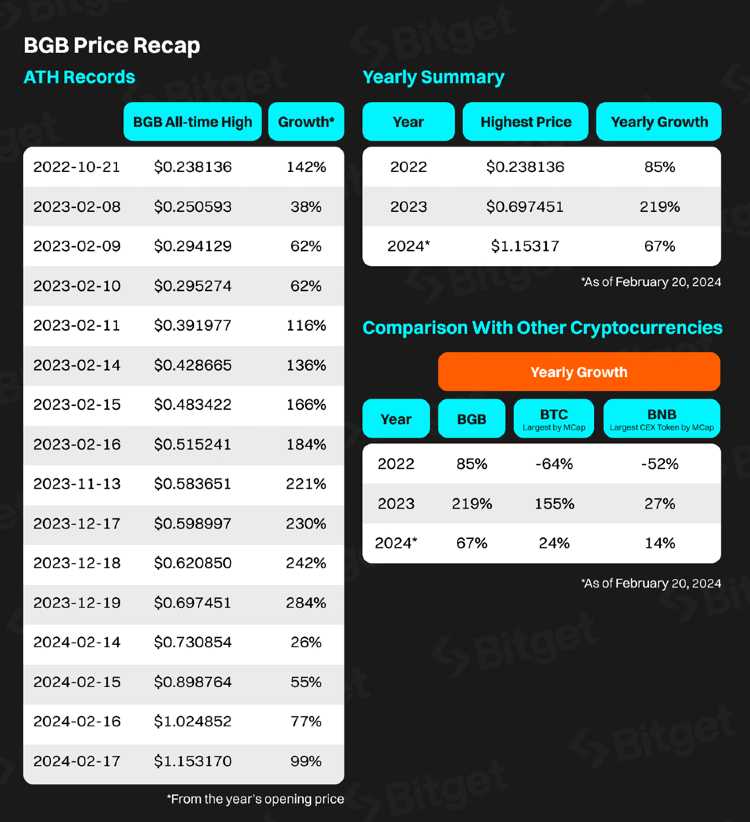

Need some proof? Check this BGB price recap:

Source: Bitget Academy, Yahoo Finance

Despite tough times caused by 2022’s black swan events, BGB was still able to make a new all-time high in October, which is almost 2.5 times that year’s opening price. 2023 came with the bears hippity hopping around, but BGB made 11 new ATH records that year, with many new ATHs reached overnight. The highest ROI of this token since 2022 stands at 284% when it hit US$0.697451 on December 19, 2023; the yearly return (the year’s closing price divided by the year’s opening price) of 2023 is 219% compared to BTC’s 155% and BNB‘s modest 27%.

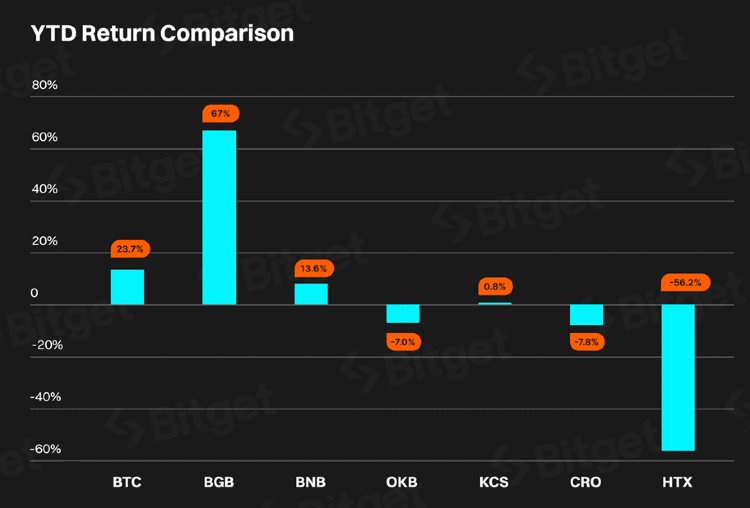

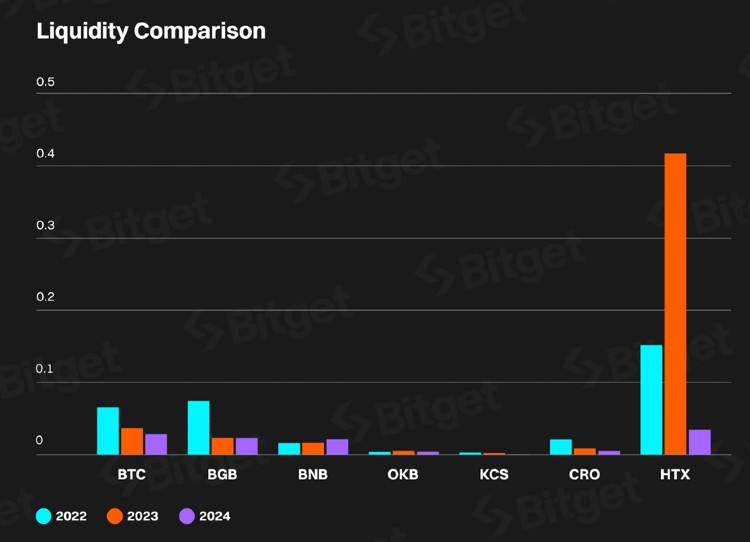

Going into the new year 2024, BGB continued to record new all-time highs – it has officially crossed the US$1 mark recently. The YTD return of BGB leaves Bitcoin and others in the CEX token category way behind, whereas its liquidity is roughly on the same levels as BTC and also outpaces other CEX tokens. Except for HTX, but consider HTX returns performance.

Source: Bitget Academy, Yahoo Finance

Source: Bitget Academy, CoinGecko

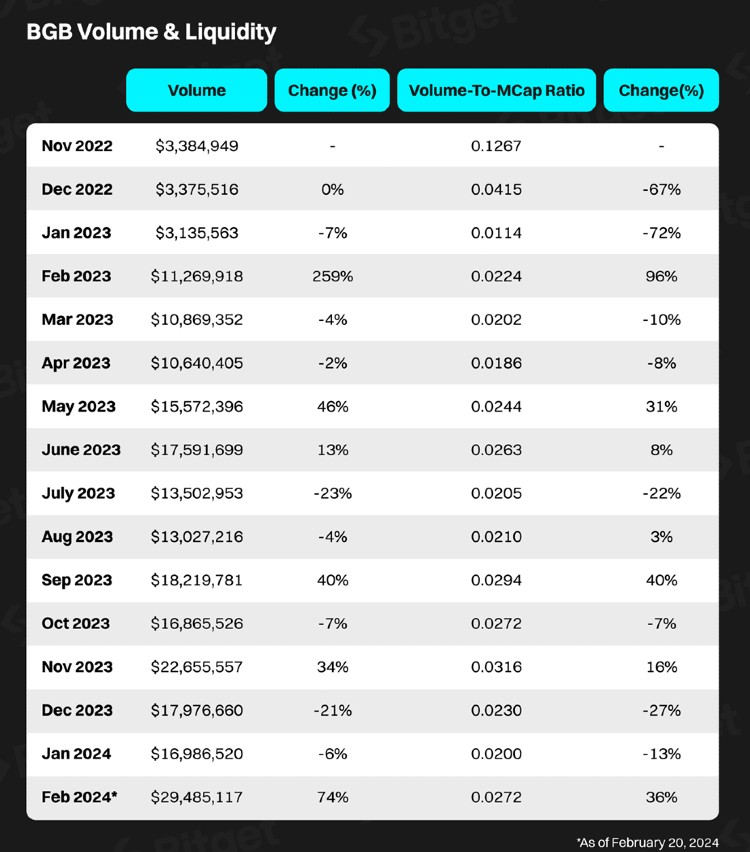

Logically speaking, higher prices lead to higher demand, and consequently activities in the market (liquidity). We can observe the gradual increase in BGB’s average volume as well as in the average volume-to-mcap ratio (a measure of liquidity ) every month. Better liquidity and more activities are signs of a healthier market, where any large order is less likely to affect prices in a significant way.

Source: Bitget Academy, CoinGecko

BGB Growth Sustainability: Bitget Is At The Forefront Of Crypto Adoption

Bitget celebrated its 5-year anniversary last year with even more devotion to the mainstream adoption of crypto. The core crypto values revolve around the idea of freedom, which should obviously be granted for every single individual. And so Bitget never stops striving for improvement in all aspects to lower the entry barrier for the novice and guarantee the best experience for all crypto users. BGB value is a direct result of Bitget’s exponential growth, combined with its well-planned roadmap.

Bitget quickly rose to the occasion after the FTX fall, providing a secure platform for spot trading with nearly 700 coins that are constantly monitored and reviewed. We have talked about the credibility of Bitget before: Crypto’s Epitome Of Credibility: Bitget | Trust Is What Brings People To Bitget. Bitget has continued to share monthly transparency reports and has successfully kept its Proof of Reserve ratio at much higher levels than the industry’s bare minimum of 100%, especially for growing-value assets like Bitcoin and Ethereum.

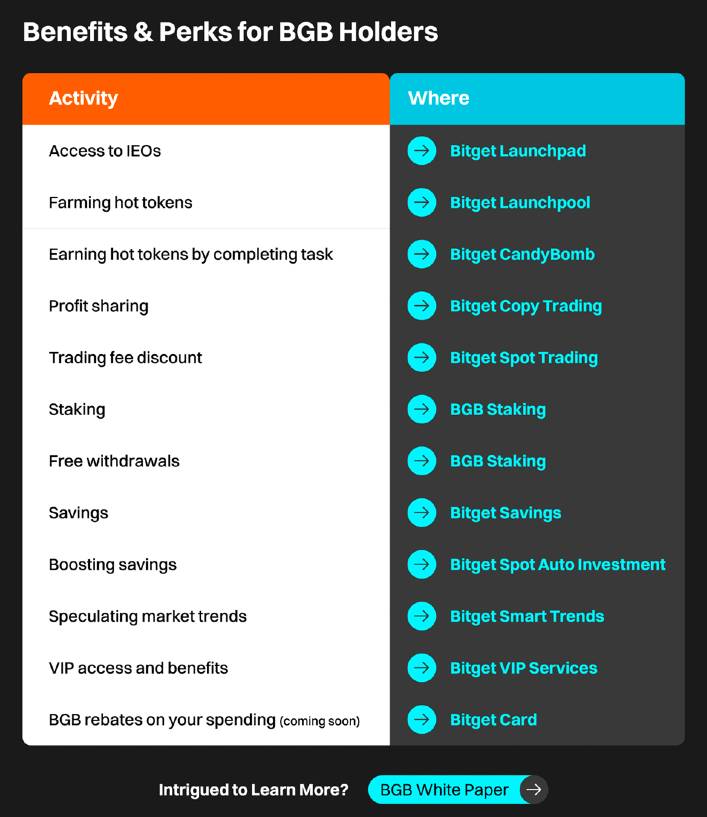

BGB also contributes to the reliability and performance of Bitget. 10% of BGB’s total supply is allocated to the Bitget Protection Fund , BGB is used for growth and marketing purposes, and BGB for holders to enjoy exclusive benefits and perks on our platform.

Source: Bitget

All in all, BGB is designed to maximise success for all parties involved as per our win-win philosophy. There’s no reason for you to miss out on this powerful token – the one that has been recognised as the new blue-chip cryptocurrency for its utilities and growth potential.

Learn more in the BGB Whitepaper or see how you can take part in BGB promotions.

Disclaimer: The opinions expressed in this article are for informational purposes only. This article does not constitute an endorsement of any of the products and services discussed or investment, financial, or trading advice. Qualified professionals should be consulted prior to making financial decisions.

About Bitget

Established in 2018, Bitget is the world’s leading cryptocurrency exchange and web3 company. Serving over 20 million users in 100+ countries and regions, the Bitget exchange is committed to helping users trade smarter with its pioneering copy trading feature and other trading solutions. Formerly known as BitKeep, Bitget Wallet is a world-class multi-chain crypto wallet that offers an array of comprehensive Web3 solutions and features including wallet functionality, swap, NFT Marketplace, DApp browser, and more. Bitget inspires individuals to embrace crypto through collaborations with credible partners, including legendary Argentinian footballer Lionel Messi and official eSports events organiser PGL.

For more information, visit: Website | Twitter | Telegram | LinkedIn | Discord | Bitget Wallet

For media inquiries, please contact: [email protected]

Don’t miss out – Find out more today