Bittrex joins booming OTC market – but who is driving demand?

Bittrex launch an OTC platform as the value over-the-counter trading surges to be on a par with retail exchanges - but where is the demand coming from?

Bittrex has joined top exchanges Coinbase, Circle, and Bitfinex with an over-the-counter (OTC) trading platform that will offer nearly 200 crypto assets.

This is a significant increase from the limited selection of cryptocurrencies that can be traded with OTC firms like Circle, Coinbase, and Cumberland, and reflects the continued development of a market that has seen a resurgence as prices have fallen.

A return to the future

Before crypto exchanges existed, the first bitcoin trades were made directly between two parties — a type of transaction known as "over-the-counter" as it happens without the assistance of an exchange.

Since then, the OTC marketplace has evolved from simple chatroom solutions like #bitcoin-otc, to institutional platforms facilitating trades by professional brokers and dealers. These offer a way to minimise counterparty risk, reduce fees, and avoid slippage — making them particularly attractive to those with deep pockets.

As the crypto market matures and attracts more sophisticated investors, OTC solutions have flourished, reporting astronomical trading volumes even as the volume traded on exchanges has significantly fallen.

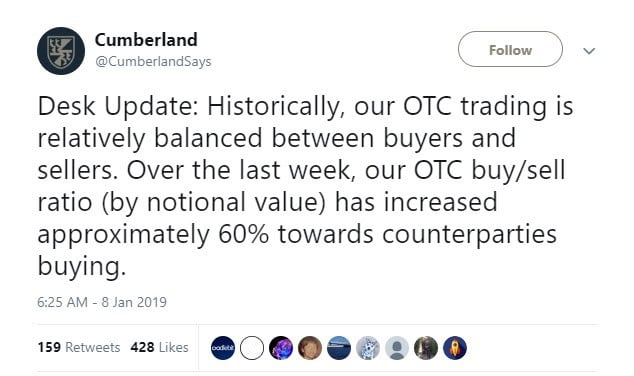

Cumberland trading, the crypto OTC branch of high-frequency trading firm DRW, took to Twitter last week to report that a lack of sellers has tipped the buy/sell ratio to 60 percent buyers:

Such reports are not uncommon, with crypto finance firm Circle — backed by Goldman Sachs — claiming earlier this month that it executed 10,000 OTC trades in 2018, accumulated $24 billion in notional volume, and took on a record number of new institutional clients despite facing "significant headwinds in the price of crypto assets".

This data confirms the findings of a report released by the Tabb group in April 2018, which estimated that global daily bitcoin OTC volumes had reached $12B — a figure matching the $12B traded daily by crypto exchanges at the time.

Where are all the whales from?

The classic explanation for such high levels of volume, according to Dow market theory, is that when the market is down, the insiders — the hedge funds, the high net-worth individuals, and the institutions otherwise known as whales — are quietly accumulating in preparation for another push up.

But, OTC trading is not only popular with institutional investors, and several alternative sources of demand could explain the high levels of volume.

In countries like India and China, whose governments have taken a dim view of cryptocurrency, OTC trading is often the only way for crypto enthusiasts to buy bitcoin, regardless of whether they are a whale or small fry.

Data from LocalBitcoins shows that OTC activity in China surged on news of the ban in September 2017, beyond the bullish global increase in volume on exchanges at the time.

Exchange traded volume [Data from CoinCheckup]

Bitcoin traded in Chinese yuan on LocalBitcoins [Data from Coindance]

This, along with similar data from Indian trading, suggests a portion of global OTC demand could be driven by traders unable to use exchanges because of their location. Ray Youssef, CEO of peer-to-peer bitcoin platform Paxful, says that countries with strict regulations could be global hotspots for OTC trading:

"These customers are like anyone else, buying quantities large and small in hopes of storing or transferring wealth beyond the regulatory grasp of the countries in which they live."

Along with the ban, there is another factor driving demand for OTC services in Asia, which according to DRW CEO Bobby Cho, accounts for a third of DRW’s transactions.

Chinese mining firms, which are thought to be responsible for around 70 percent of all bitcoin mining, have set up their own OTC operations to help get the best price for the fruits of their labour. This "clean bitcoin" is more sought after by institutional investors because it cannot possibly have been involved in money-laundering operations, and according to Ikigai hedge founder Travis Kling, can be sold at a 20 percent premium.

Although sales from mining and purchases by the banned might account for a portion of OTC activity, many platforms — like Circle and Coinbase — have a minimum ticket size in the region of $100k to $250k that prevent anyone but institutions and high-net-worth individuals from participating.

While this restriction might be criticized for "professionalising" bitcoin, the manner of purchase is at least consistent with the ideology underpinning the crypto, according to Yousef:

"OTC trades are more in line with the traditional ideology of bitcoin," he said. "Scaling issues have forced many transactions off chain onto privately owned and centralized exchanges, however, the future of bitcoin will always lie in OTC trades for the reasons with centralization comes corruption, always."

Don’t miss out – Find out more today