Performance Review: Basket Indices vs Individual Assets

Research shows the BNC-BTSE basket indices have outperformed their individual assets and delivered better total and risk-adjusted returns even in the most volatile trading environments.

The fractured global landscape of crypto exchanges creates almost constant price disparity between them. While this may be an arbitrageur’s dream, the lack of trusted third-party industry pricing standards in the crypto sector has long been an obstacle to building derivative products such as futures, funds and even an ETF.

In the legacy markets, indices are created and maintained by recognized index providers such as S&PDJI, and from a standards perspective, the International Organization of Securities Commissions (IOSCO) sets global criteria for indices and benchmarks for the capital markets.

In recent years, a self-indexing trend has emerged among some fund and financial product providers. By creating their own indices derived from their own prices they have attempted to reduce management and transaction fees and cut out other third-party costs.

However, this benchmark-setting approach has regulators concerned for a range of reasons – including potential conflicts of interest and issues around the robustness of pricing data. This risk applies equally to crypto trading platforms and indices.

The global digital markets remain fragmented with no international standard setter, as it is yet too nascent an industry for established market participants to fully embrace.The issue is not one of data procurement – as nearly all price and asset data is available through public APIs – but of data curation.

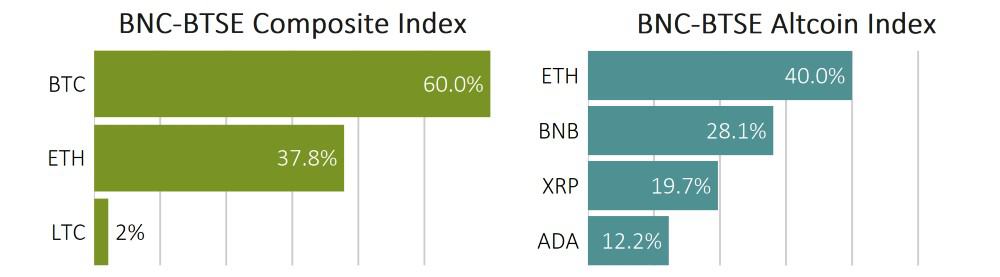

Brave New Coin has taken the initiative to align its LX indices-series with appropriate IOSCO standards from the start, and in 2019 launched the major asset BNC-BTSE Composite Index (BBCX) for the BTSE exchange, followed soon after by the BNC-BTSE Altcoin Index (BBAX).

Each index series is administered by Brave New Coin, and functions as the underlying asset for the associated futures contract on BTSE. The current asset constituents and their weights are shown below.

Indices outperforming their largest constituents

Analysis from Brave New Coin shows that both the BNC-BTSE Composite Index and the BBAX Altcoin Index have provided better total and risk adjusted returns and lower max drawdowns than their largest constituent assets through the year to date.

Indices are robust to market stress

Both the composite indices themselves, and the price indices that support them are part of BNC’s High Frequency Pricing Service. Real time pricing is pulled from the orderbooks of five or more exchanges, providing price updates at least 15 times per second, and up to 30 during peak trading sessions.

Exchanges that diverge from the cohort are de-weighted in real time due to outlier detection methodology. This results in an index which is robust to market stress. Crashes that are contained to a single platform, as in the case below, will not affect the underlying index, and so avoiding undue liquidations in the futures market.

Use index perpetuals to build market neutral strategies, and target risk profiles.

Index perpetuals allow traders the ability to hedge out unwanted exposures, such as the broad crypto market or a particular sector. Combining a long position in an asset perpetual, with a short position in the BBCX or BBAX can hedge out any directional market risk, leaving only exposure to asset risk.

The holder will profit as long as the single asset outperforms the broader market, regardless of the direction (market neutral). In this way, participants are able to lower volatility and better target risk profiles.

For example, as ETH approaches a 2k resistance at the close of Q1 2021, a trader believes that it will have a strong quarter compared to other crypto assets. But he is worried that the crypto market as a whole could be overbought, and fears a correction in the near future. In order to hedge out this broad market risk, he can take a proportionally sized short position (hedge ratio) in the BBCX perpetual, along with a long position in ETH.

Over a 2 month period (April, May 2021), this strategy outperformed ETH, owing mostly to the short position softening the market wide drawdown in mid May. Outperformance isn’t necessarily the goal in applying this strategy though, and as we can see in the chart below, the strategy underperformed ETH over a longer period (Jan-May 2021). The more important feature is the lower volatility and lower max drawdowns.

Index futures enable the ability to remove exposure to the broader market whilst still profiting from the performance of a particular asset. This same type of strategy can be applied to a bearish thesis of a particular asset, where a short position in the asset would be paired with a long position in the index perpetual.

The importance of separation

Keeping a separation between an index and an exchange is important as protects against bias, making the BBCX and BBAX objective and transparent indices that represent the overall market movement of crypto’s top assets, condensed into one price.

This arm’s length relationship between the index builders and the exchange aids price objectivity ensuring that traders can trade an index with confidence.

Don’t miss out – Find out more today