Cannabis and blockchain Pt II: The future of commodities

In Part I we looked at both sides of the argument for using blockchain in the cannabis supply chain and whether it makes sense. Here we look at the potential future of trading a new commodity.

There is crusade underway by many big names in food and retail to improve the accuracy of provenance and hygiene across the supply-chain.

IBM has partnered in food safety blockchain projects with Nestlé and Walmart to reduce the 420,000 deaths due to contaminated foods each year, estimated by the World Health Organization (WHO). In the same report, WHO adduces that every year one-in-10 people fall ill (600 million) globally from foodborne diseases caused by bacteria, chemicals, viruses, parasites and toxins.

Crypto mangoes and smart chickens

At the end of 2017, Walmart released results of a blockchain project to track the mango fruit sold at its stores using a form of smart contracts. It had been doing this off the chain years before but apparently gave up on the project due to data and logistical problems, so the company compared the off-chain to on-chain efficiency.

Off the chain, it took six days, 18 hours, and 26 minutes to trace mangoes back to its original farm. On the chain, this information reportedly took only 2.2 seconds to retrieve, which could be invaluable in the case of a disease outbreak.

“There’s no question about it, blockchain will do for food traceability what the internet did for communication,” Frank Yiannas, Walmart’s vice president for food safety and health announced in a grandiose statement to Bloomberg.

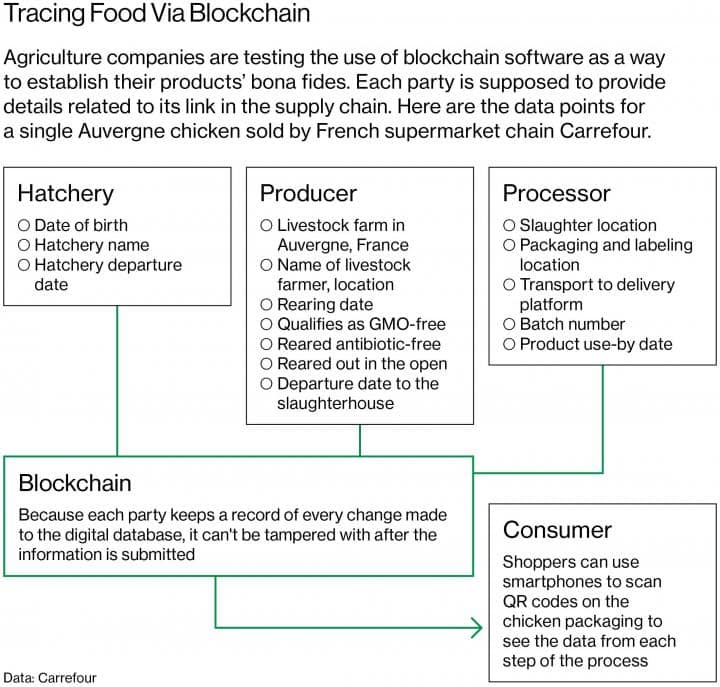

Carrefour, Europe’s largest retailer, has also started tracking the origin of its chickens on the blockchain so customers can scan the barcode and learn its life story. It plans to put eight other products on the chain including its eggs, honey, cheese and milk.

Is blockchain really a ‘truth machine’?

Blockchain, the much-vaunted “truth machine”, has been heralded as a cure for food contamination, food waste, industrial productivity and even fraud.

Still, the technology is becoming a parody as a solution to everything – like a futuristic integrity wand to wave at any problem and magically validate it.

If it’s going to implemented properly in the supply chain wouldn’t it require a mango farmer to download the blockchain from a broadcast node and decrypt the Merkle root from his Linux command line to independently verify a transaction?

This impracticality is the reason seed-to-sale platform Ample Organics hasn’t converted to blockchain and still runs its own servers. Blockchain systems do not make the data in them accurate or the people entering the data trustworthy, they allow users to audit whether it has been tampered with, says Ample CEO John Prentice. “It’s really just an alternative way of keeping records.”

So a person who sprayed pesticides on a mango, or a cannabis plant, can still enter onto a blockchain system that the mangoes were organic. How can it help determine the purity or provenance of anything fluid or chemical in natural products when they can be so easily tampered with?

“You would have to have 100 percent market share for that blockchain to serve as a single source of truth for compliance and traceability. What would the advantage be if you’re a blockchain island unto yourself?”, Prentice asks. And ,like any market that is 100 percent controlled by one entity, whether it’s private or public, that leaves it open to manipulation.

Tracing cannabis genomics

There is one area of the cannabis industry where the consensus is that blockchain is useful, and that’s genomics. Just as DNA traceability is sacrosanct in the breeding of racehorses so is the purity of a strain of cannabis in the crossbreeding of plants.

“DNA is the only barcode that ends up in the consumer’s hand whether the sample is mislabeled, counterfeited, or diverted,” according to Medicinal Genomics, a company whose software tracks cannabis DNA on the blockchain. “In an opaque world of underground names and folklore medicine, a blockchain-based genetic catalog of all cannabis varieties in a given market provides transparency.”

“In an opaque world of underground names and folklore medicine, a blockchain-based genetic catalog of all cannabis varieties in a given market provides transparency.” Medicinal Genomics

They estimate that there are over 560 compounds found in cannabis and analytical labs are only measuring about 30 of them.

“Cannabis genomes are 10 fold more variable than human genomes. A given cannabis strain has the capacity to cross with other strains that are very different from itself. This is the near equivalent of humans and chimpanzees being capable of having productive offspring.”

WeedMD, one of Canada’s biggest licensed medical marijuana producers, also recently ventured into blockchain DNA sequence technology when it acquired Blockstrain.

In the case of the WeedMD, Ample’s Prentice can see how the technology makes more sense. “Taking the genetic sequence of specific strain and committing it to an immutable record could serve as a source of truth for the purity of the strain and when a company is trying to devise a new strain to prove how novel that strain actually is.”

The future of commodities

In the complex infrastructure of the commodity markets, buying and selling involves a web of intermediaries which is ripe for counterfeiting, tampering, duplicating and counterparty risk.

In late 2016, the world’s first live settlement of a physical commodity on a blockchain was facilitated by Australian grain software company AgriDigital on their private blockchain network.

Using private nodes on Ethereum’s blockchain a smart contract auto-executed the transaction by first valuing the delivery, then assessing whether the buyer had sufficient funds to pay the grower for the order, and then secured the funds in the name grower pending delivery of the order. Upon delivery the title to the grain was transferred to the buyer and the funds released to the grower. AgriDigital claims that its technology eliminates counterparty risk

It also functions as a payment platform and inventory manager and it has completed three blockchain pilots, including one that tracked the provenance of organic oats from farm to packet.

The startup company has also entered the Canadian market and is working on bringing commodities and inventory management into the Internet of Things with its software.

The future of cannabis? Futures

It’s not surprising that commodity-reliant economies like Canada and Australia – where medicinal marijuana is going off – have been looking at ways to diversify their markets dominated by resources and fossil fuels with a more sustainable and cleaner commodity.

The medical cannabis industry is growing rapidly in Australia and is a target market for seed-to-sale companies like Canada’s Ample Organics and US startup Tokes.

Both companies have in fact been working on their own cannabis exchanges.

The AmpleExchange, launching in July, will sell cannabis spot and futures and will primarily used by buyers, sellers and growers who want to lock in a price and see it through to delivery.

Asked why the exchange will be built in the “traditional way”, without blockchain, he said "given that the [traditional] exchange is controlled by one third party the trust sits with them. Blockchain isn’t solving a problem there because there isn’t a distributed trust situation occurring – you still have the one trusted neutral third party sitting in the middle.”

After Tokes’ recent acquisition of the hemp exchange software company Chex, Tokes’ CEO Michael Wagner envisages a decentralised exchange for forwards, futures and spot trading of cannabis and cannabis derivatives using smart contracts. Being a complex project “there are still regulatory obstacles to overcome with CFTC before it launches,” Wagner says.

But whether on or off the blockchain, the future of cannabis is moving fast.

In Part 1 we looked at the two sides of the argument for using blockchain in the cannabis supply chain and whether it makes sense to decentralize or at least distribute the data in the seed-to-sale process.

Don’t miss out – Find out more today