Cardano Price Analysis – Bullish trend with weakening momentum

The ADA/USD and ADA/BTC pairs both show bearish divergences on volume and RSI suggestive of weakening bullish momentum.

Cardano (ADA) is a smart contract platform focused on peer-review and scientific study, marketed as a “third generation blockchain.” The Cardano price is down 89% from the all-time high established in January 2018. The market cap is ranked 8th on the Brave New Coin market cap table and currently stands at US$3.92 billion, with US$179 million in trade volume over the past 24 hours.

Development on Cardano coin began in 2015. A token presale raising US$62 million occurred in Asia, mainly Japan, from September 2015 to January 2017, where a total of 26 billion tokens were sold at US$0.0024 each. Public trading of the tokens began on October 1st, 2017. There is a hard cap of 45 billion ADA tokens, 13.88 billion of which will be issued through staking rewards.

Source: IOHK Blog

The team initially included three conglomerates which held 5.18 billion ADA between them; the Cardano Foundation which aimed to standardize, protect, and promote ADA; Emurgo which aimed to develop, support, and incubate commercial ventures; and Input Output Hong Kong (IOHK), founded in 2015 by Charles Hoskinson and Jeremy Wood. IOHK also works on Ethereum Classic development and focuses on research and development in cryptography and distributed systems.

In October 2018, IOHK released a detailed blog post explaining several issues IOHK and Emurgo have had with the Cardano Foundation, including lack of strategic vision or plan, lack of transparency regarding operations, and misrepresentation of the Cardano trademark. Several members of the Cardano Foundation have since been replaced after restructuring in December 2018.

Earlier this year, the Cardano Foundation announced legal proceedings initiated by Z/Yen Group Limited. According to the post, “The proceedings relate to an alleged agreement between the Z/Yen Group Limited and the Cardano Foundation dated July 2017. The Cardano Foundation voided/terminated the agreement for various reasons. The Cardano Foundation fully rejects the claims raised by the Z/Yen Group Limited. Due to the ongoing nature of this judiciary process, no further information will be given while proceedings are in progress.”

In November 2018, Hoskinson announced IOHK would be leaving Hong Kong and incorporating in Wyoming. Then in February 2020, IOHK donated US$500,000 to the University of Wyoming and established a Cardano research lab, which will focus on writing code in ADA’s smart-contract language. The lab is also said to be designing a hardware tool for authentication and anti-counterfeit measures on Cardano. Hoskinson also mentioned future work with BeefChain, a livestock traceability platform, according to CoinDesk.

In September 2019, Hoskinson announced a partnership with the New Balance shoe company to authenticate counterfeit goods. Despite teasing the news before an official announcement, an official press release from New Balance regarding the matter could not be obtained. Other reported partnerships include Polymath, StudEx, ScanTrust, Finkda Advisors, Dust Identity, PriceWaterhouseCoopers, the Priviledge Project, the government of Ethiopia, and the Berkman Klein Center of Harvard University

The ADA development roadmap includes five distinct phases; Byron, Shelley, Goguen, Basho, and Voltaire with three eras; testnet, bootstrap, and reward. Although currently in the bootstrap era, development occurs concurrently between all five phases.

The blockchain will eventually have two layers, the Cardano Settlement Layer (CSL) and Cardano Computation Layer (CCL). The blockchain will also support two scripting languages, Simon and Plutus, as well as sidechains. Currently, all ADA nodes are controlled by IOHK, Emurgo, and the Cardano Foundation, in a centralized manner.

Cardano 1.5.0 Mainnet was released in March 2019. Allowing for support of ADA’s consensus algorithm Ourobouros, which uses Byzantine Fault Tolerant-Proof of Stake (BFT-PoS). PoS allows for social consensus and decentralized governance, as well as secure voting on peer-reviewed protocol proposals with a decentralized treasury to fund those proposals, similar to EOS (EOS), Tezos (XTZ), Dash (DASH), Decred (DCR), and PIVX (PIVX).

A quick comparison between coins using a staking mechanism shows ADA first in market cap and total daily transaction volume. ADA is towards the middle and rear of the pack in total daily fees, transactions per day, daily active addresses, and git commits on the main repo over the past year. EOS was excluded from the on-chain data comparison due to a lack of currently available reliable on-chain data.

A Shelley testnet launched in June 2019 with a Shelley Incentivized Testnet (ITN) launch in December 2019. The ITN allows users to delegate ADA to various stake pools in the Daedalus or Yoroi wallet. According to adapools.org, earlier this week there were currently 417 active pools with 13 billion ADA being staked, representing 42% of the circulating supply.

Time on the Cardano blockchain is divided into epochs and slots. A slot has a 20-second duration, while an epoch contains 21,600 slots, or five days in total. Stake pools will earn transaction fees and a share of the 13.88 billion ADA earmarked for staking rewards.

Subsequent protocol updates have also recently included a complete redesign of Byron, in preparation for the Shelley mainnet release. On February 12th, the CSL completed an architecture redesign of the Cardano Node and the Cardano Explorer Backend and Web API. Ourobouros was also updated on February 20th, allowing for core node migration.

Source: IOHK Blog

Big Cardano news this week has been a hardfork on July 29th and the implementation of the Shelley update, after which earned staking rewards will be transferred to the mainnet. The network will also then rely on consensus through PoS rather than nodes controlled by IOHK, Emurgo, and the Cardano Foundation.

Last month, IOHK announced dates moving forward with the Shelley release. ITN rewards will become available on August 3rd and the first mainnet staking rewards will be sent on August 18th.

Source: forum.cardano.org/t/shelley-rollout-an-important-day/35147

Turning to developer activity, the ADA project on GitHub has 292 repos, over 15 of which have been highly active in the past 90 days. Most coins use the developer community of GitHub where files are saved in folders called "repositories," or "repos," and changes to these files are recorded with "commits," which save a record of what changes were made, when, and by who. Although commits represent quantity and not necessarily quality, a higher number of commits can signify higher dev activity and interest.

Source: GitHub – input-output-hk/cardano-ledger-specs

Source: GitHub – input-output-hk/cardano-node

On the network, the total number of transactions per day (line, chart below) had ranged between 1,000 and 4,000 since April 2018. Transactions per day nearly quadrupled from January to February this year and reached nearly 7,000 on July 5th. Average transaction values (fill, chart below) had decreased dramatically from early 2018. In May, average transaction values began to rise and are currently at a multi-month high of US$131,000. The causes for a spike in average transaction values in March and July 2018 are unclear, but likely related to large holders splitting coins between wallets and not necessarily economic value transfer.

Source: CoinMetrics

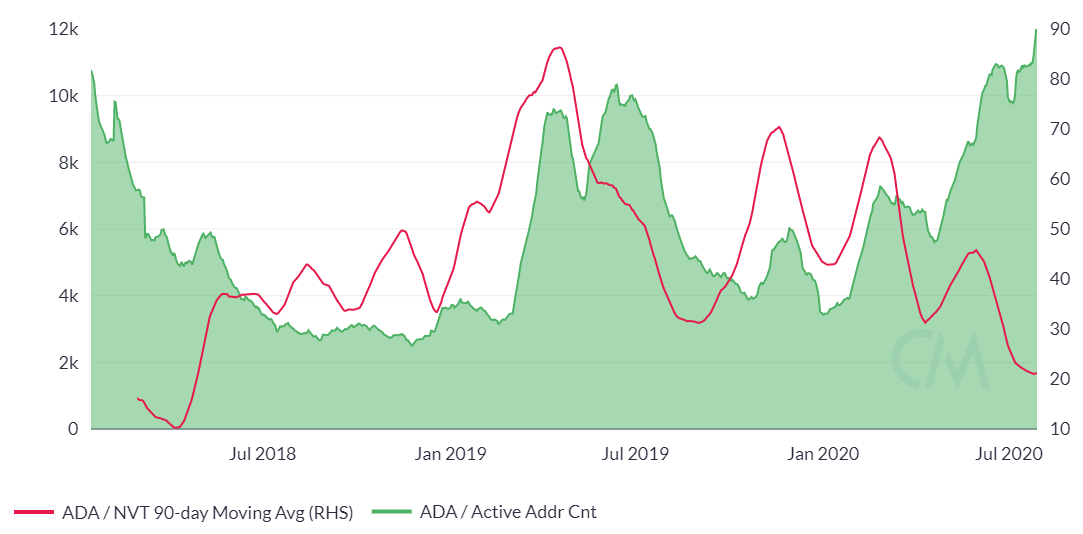

The 30-day Kalichkin network value to estimated on-chain daily transactions (NVT) ratio (line, chart below) has decreased to 21, representing a new multi-year low. Inflection points in NVT can be leading indicators of a reversal in an asset’s value. An NVT held below 30 should signify bullish market conditions. A clear uptrend in NVT suggests a coin is overvalued based on its economic activity and utility, which should be seen as a bearish price indicator, whereas a downtrend in NVT suggests the opposite.

Monthly active addresses (fill, chart below) have increased substantially since the beginning of the year, recently hitting a new monthly all-time high just under 12,000. Daily active addresses hit an all-time high of 45,000 in February 2018. Active and unique addresses are important to consider when determining the fundamental value of the network based on Metcalfe’s law. The data for total unique addresses could not be obtained. The top 100 addresses on the network currently hold 40% of the circulating supply.

Source: CoinMetrics

In the markets, exchange traded volume is led by Tether (USDT) and Bitcoin (BTC) pairs on Binance and Huobi. ADA was listed on OKEx in July 2018, Bittrex in August 2018, Kraken in September 2018, Huobi in May 2019, and Binance.US in October 2019. No ADA pairs are currently listed on Bitfinex or Coinbase. In July 2018, Coinbase announced the possibility of adding ADA to the platform, but a listing has yet to materialize. Earlier this year, Huobi added an ADA/USD perpetual swap with up to 75x leverage and OKEx added ADA/USD and ADA/USDT perpetual swaps with up to 20x leverage.

Aside from a brief period in late 2017, Google Trends data for the term "Cardano" has mostly been pinned to the floor. The increase in 2017 likely signaled a large swath of new market participants at that time. Recent increases in Trends are likely due to the protocol changes and surrounding press. A 2015 study found a strong correlation between the Google Trends data and Bitcoin price, while a 2017 study concluded that when the U.S. Google "bitcoin" searches increase dramatically, Bitcoin price drops.

Technical Analysis

Potential roadmaps for upcoming price movements can be found on high timeframes using Exponential Moving Averages, volume profiles, Pivot Points, and Ichimoku Cloud. Further background information on the technical analysis discussed below can be found here.

On the ADA/USD daily chart, the 50-day Exponential Moving Averages (EMA) and 200-day EMA bullishly crossed on May 16th. The key EMA cross is typically a strong indication of bullish momentum to follow and the 200-day EMA, currently at US$0.075, should now act as support. Significant volume support (horizontal bars, chart below) also sits at the US$0.036 – US$0.047 zone, with upside resistance at US$0.146 and US$0.177 based on yearly pivots. Price has also formed a growing bearish divergence on volume and RSI, suggestive of weakening bullish momentum.

Turning to the Ichimoku Cloud, four metrics are used to indicate if a trend exists; the current price in relation to the Cloud, the color of the Cloud (red for bearish, green for bullish), the Tenkan (T) and Kijun (K) cross, and the Lagging Span. The best entry always occurs when most of the signals flip from bearish to bullish, or vice versa.

The status of the current Cloud metrics on the daily time frame with doubled settings (20/60/120/30), for more accurate signals, are bullish; the spot price is above the Cloud, the Cloud is bullish, the TK cross is bullish, and the Lagging Span is above the Cloud and above the current spot price. The trend will remain bullish so long as the spot price remains below the Cloud. Kijun support sits at US$0.117.

For the ADA/BTC pair, the daily chart also shows bullish trend metrics ever since the spot price moved above the 200-day EMA and daily Cloud in mid-May. Upside resistance sits at 1,865 sats and 2,500 sats based on a previous local high and yearly pivots. VPVR and Kijun support spans from 1,000 to 1,100 sats. Additionally, there is a bearish divergence on volume and RSI which suggests weakening bullish momentum.

Conclusion

After years in development, Cardano has recently enabled a staking testnet and mainnet, Shelley. If a mainnet launch with staking is successful, exchange listings and exchange staking pools will likely follow. Multiple additional phases of future protocol upgrades are also being released concurrently over time, with a very active development team relative to other blockchains. On-chain fundamentals and Google Trends have increased dramatically over the past few months, along with the rise in token price.

Technicals for both ADA/USD and ADA/BTC reveal a bullish trend, as the spot prices are currently above both the 200-day EMA and the daily Cloud. The ADA/USD and ADA/BTC pairs both show bearish divergences on volume and RSI suggestive of weakening bullish momentum. Both pairs will likely pullback to support at US$0.09-US$0.11 and 1,000 to 1,100 sats. Over the next few months, ADA will also be competing with ETH 2.0 phase 0, Bitcoin’s 1.8% inflation rate post block reward halving, and a myriad of other PoS coins. The over 31 billion ADA circulating supply and ITN staking reward release on August 3rd will likely hamper any sustained bullish rallies in the near future past this token unlock date.

Don’t miss out – Find out more today