Cardano hardfork – buy the rumor, sell the news?

2021 was the year of the platform blockchain. Ethereum, Avalanche, and Solana deployed ecosystem updates that led to strong price growth. Now Cardano is set to undergo one of its biggest updates ever in the coming month. What impact will this have on price?

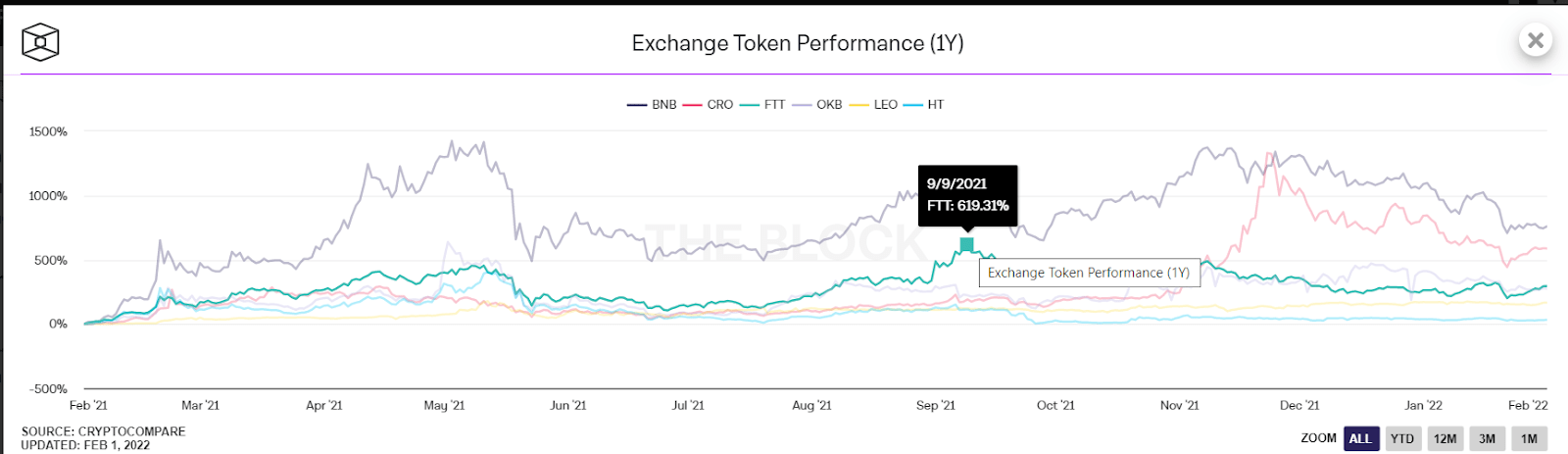

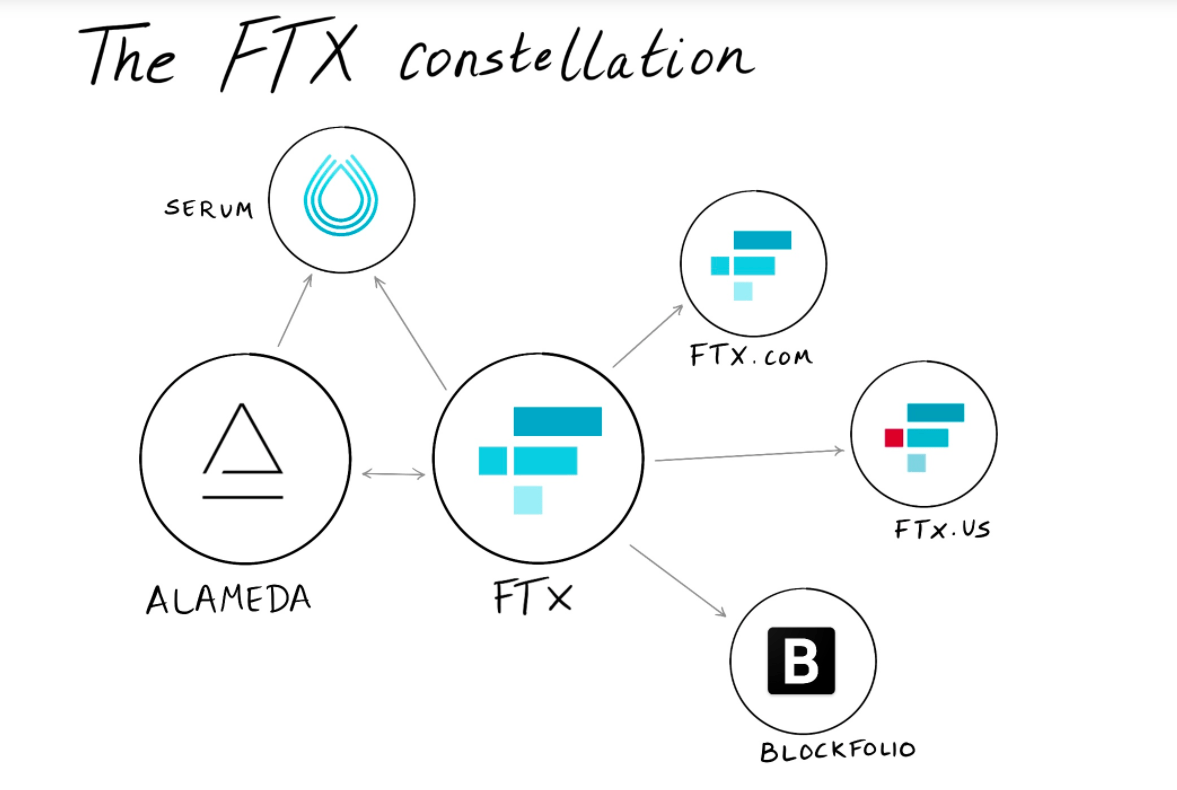

In 2021, smart contract platform blockchains such as Ethereum, Binance Smart Chain, and Solana, outperformed Bitcoin. Each has successfully upgraded its blockchain, leading to an increase in network activity and token prices. The following article looks at the growing Cardano ecosystem, examines some of the factors behind its strong performance in 2021, and its pullback in 2022, and examines what the technicals say about the Cardano price.

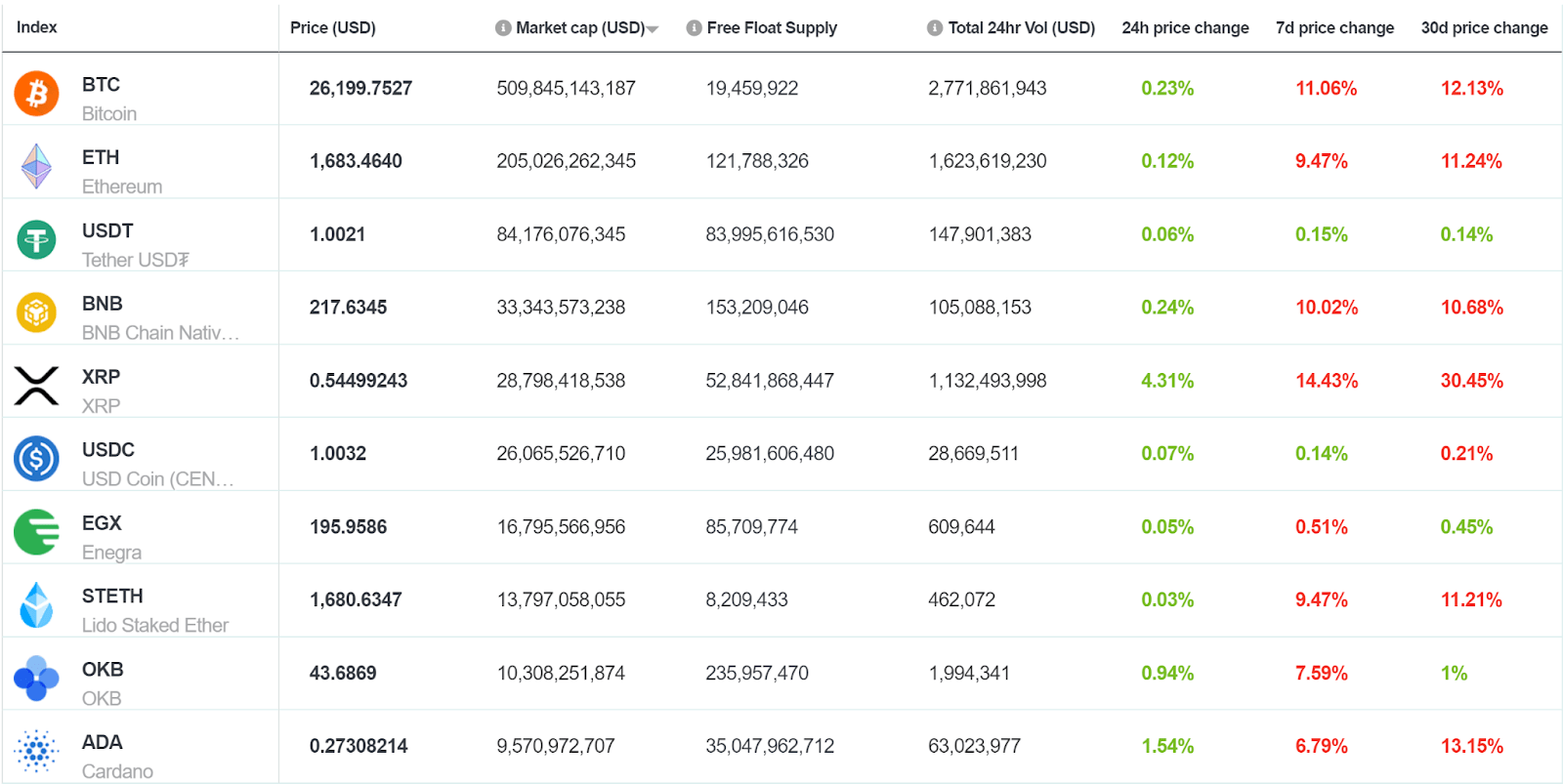

At the beginning of 2021, Cardano (ADA) was the 8th largest digital asset by market capitalization with a market cap of US$6.4 billion. The ADA price was US$0.205. Today Cardano is the 7th largest asset in crypto with a market capitalization of US$15.3 billion and the ADA price is $0.460. The market cap and token price have risen ~139.1%, and ~124.4%, since the beginning of 2021.

A factor in Cardano’s growth over the last two years is the project has finally launched a working product. In September 2021, via the Alonzo hard fork Upgrade, Cardano deployed capabilities for technical and non-technical users to create smart contracts and decentralized applications.

The upgrade meant Cardano could finally compete as a viable Ethereum alternative and be a platform that could attract developers, users, and entrepreneurs by offering use cases like Decentralized Finance, Non-Fungible Token (NFT) minting, and decentralized identity.

Source: DefiLama

DeFi data aggregation platform DefiLama, lists Cardano as the 27th largest smart contract platform by TVL. The Cardano platform currently has US$141.5 million worth of assets locked into it. The TVL on Cardano peaked in March 2022 when it hit US$326 million.

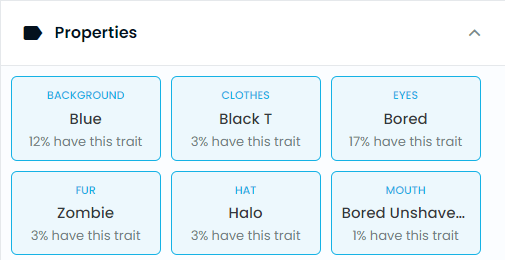

In terms of the Cardano NFTs, according to data aggregator cfnt.io the largest Cardano NFT project by 7-day volumes are Cornucopia’s Land Sale and EIKONIKOS-Genesis Passports. Each project generated 7.2 Million ADA and 1.0 million ADA in 7-day trading volume respectively. In US dollar terms, this equate to US$3.3 million and US$470,000.

In comparison, based on data from OpenSea, the two largest Ethereum NFT projects by 7-day trading volume are ‘We Are All Going to Die’ and ‘goblintown.wtf’. Respectively, the projects generated 9,828.59ETH and 9,321.41ETH in trading volume in the last 7 days. In US Dollar terms, This equates to US$11.7 million and US$11.1 million in general, the Ethereum NFT ecosystem is larger and more diverse than the Cardano one.

The platform held an ICO in 2017, raising almost US$62 million to fund its roadmap and development. Between 2017 and 2021 Cardano surged in value on the back of positive speculation and a vocal community of supporters that were always ready to defend the project from criticism and celebrate any win it achieves.

Source: Google

Worldwide Google search trends showed that in 2021, searches for the term ‘Cardano’ surged sharply past those for other rival large-cap cryptocurrencies, ‘Ripple’, ‘Litecoin’, and ‘Chainlink’, in the last year. ‘Cardano’ is searched twice as much as each of the other terms individually.

Cardano is particularly popular in the Latin regions of Europe and the Americas.

Source: YouTube

Charles Hoskinson, the founder of Cardano, and the CEO of IOHK, the main Cardano development house, hosts a popular YouTube channel with 314,000 subscribers. More impressive than the high subscriber count is the channel’s view-to-subscriber ratio. An average ratio for a YouTube channel tends to be around 12-15% with anything higher considered impressive. Hoskinson has ratios as high as ~35% on his popular vlogs. Most of his vlogs have above 30,000 views. A recent vlog titled, ‘A Few Musings’ has 217,000 views. The video is not focused on project updates, it is simply Hoskinson discussing the current global economic and financial climate and Cardano’s position within it.

These vlogs are posted every few days. Hoskinson comes across as intelligent, authentic, proud of his project, and even a little arrogant but his cult of personality has almost certainly been a factor in Cardano’s recent success. While he has his detractors, to his fans, Hoskinson’s charisma is undeniable.

Hoskinson’s marathon 5-hour interview with popular podcaster Lex Fridman has been viewed 597,000 times on YouTube. The feedback for the interview is mostly positive with many commentators noting Hoskinson’s intelligence.

Source: YouTube

Cardano outperforms as hard fork approaches

June has so far been a brutal month for digital asset trading. A combination of internal and external factors have caused fear, selling and margin calls in the crypto market. Record high inflation in the United States, the collapse of the Celsius borrowing and lending protocol and a chaotic bond market have combined to push down the price of Bitcoin (BTC) down ~31% so far in June. Ethereum (ETH), Cardano’s biggest smart contract rival, is down ~42% over the same period.

Cardano generated strong alpha in the last fortnight. ADA is down ~17% over the course of the last 2 weeks, while the rest of the market has sold off more heavily.

A key factor behind ADA’s divergent performance is anticipation around the upcoming Vasil hard fork that is set to be implemented at the end of June. With Vasil, Cardano will finally take a significant step toward improving performance and becoming more prepared for mass adoption. Leading Cardano development house Input-Output tweeted on June 7th that everything is on track for the scheduled rollout on June 29th.

The Vasil upgrades key feature is diffusion pipelining, a feature that will increase block size and more efficient block propagation. The intended effect is higher throughput with only minor changes to the underlying protocol.

A major factor of Vasil will be to enable more fluid DeFi activity by enabling more lending & borrowing protocols to deploy on Cardano. There are few Lending and Borrowing platforms on Cardano, the top-5 DeFi protocols on the network are all Dexes and there are no major Aave or Compound-like protocols established on the platform. On other smart contract platform blockhains, lending and borrowing platforms are major drivers of TVL.

The upgrade also includes a number of Cardano Improvement Proposals (CIPs). They include CIP-31 – a change to Reference Inputs, CIP-32 – Inline Datums, CIP-33 – Reference Script upgrade, and CIP-40 – a change to Collateral Outputs.

Vasil falls under the Basho era of Cardano development, which is focused on scaling and performance optimization of the network. The wider plans of Basho include increasing block size on the network and utilizing more layer-2 solutions. Following Vasil, Cardano will launch Hydra, a layer-2 solution that will enable much faster Cardano-based transactions.

What is Cardano?

The development of the Cardano blockchain began in 2015. The token had a US$62 million presale which was run in Asia. The sale ran from September 2015 to January 2017, with funding primarily sourced from Japan. A total of 26 billion tokens were sold at US$0.0024 each. Public trading of the tokens began on October 1st, 2017. There is a hard cap of 45 billion ADA tokens, 13.88 billion of which will be issued through staking rewards.

The Cardano development team includes three contributing companies; the Cardano Foundation, which aims to standardize, protect, and promote ADA; Emurgo, which aims to develop, support, and incubate commercial ventures; and Input-Output Hong Kong (IOHK); a development team founded in 2015 by Charles Hoskinson and Jeremy Wood.

IOHK provides the core developers who execute the ongoing Shelley updates. The company is a technical engineering company that works with academic institutions, government entities, and corporations. Although it was founded by Wood and Hoskinson, IOHK has a decentralized philosophy, and the team is distributed across the globe.

Cardano uses Ouroboros, a Proof-of-Stake model, for network consensus. Proof-of-Stake consensus algorithms use a pseudo-random selection process, where the allocation of blocks is weighted based on the size of a node’s stake.

Stakingrewards.com currently lists Cardano as the 2nd largest PoS blockchain by total value of assets staked. The website reports that ~71.7% of the ADA tokens available for staking have been allocated for staking. For institutions willing to run their own Node or Staking pools, Cardano offers a 5.26% staking reward. For smaller holders, they can delegate their holdings to a staking pool and earn up to 4.98%. Staking pools normally charge ~5% of earnt rewards for their services (staking on behalf).

The Cardano website claims that the core innovations of Ouroboros are modularity and flexible design. The modularity allows for features such as delegation, sidechains, subscribable checkpoints, better data structures for light clients, different forms of random number generation, and different node synchronization assumptions.

The Cardano platform consists of two layers. The Cardano Settlement Layer (CSL) is used to settle transactions that use ADA. The Cardano Control Layer will be used for smart contracts and decentralized applications. The system is designed to simplify privacy and network interactions as smart contract information is kept separate from transaction information.

The blockchain will also support two scripting languages, Simon and Marlowe, as well as sidechains. The Haskell programming language is the basis for Plutus, Cardano’s smart contract language, and it also powers Marlowe, the domain-specific language for financial smart contracts.

The ADA development roadmap has five phases;

- Byron – The foundational phase

- Shelley – The decentralization phase

- Goguen – The smart contract phase

- Basho – The scaling phase

- Voltaire – The governance phase

The work for each of these phases can happen in parallel with current development focused on Shelley and Goguen. According to the project, the Shelley phase is designed to encompass “the critical early steps in Cardano’s journey to optimize decentralization.” The update will see Cardano switch from a federated network to a more decentralized one, with nodes distributed across members of the community.

Shelley introduced Ouroboros Praos in July 2020, enabling stake delegation and stake pools. Following this update, every Cardano node has the right to participate in the protocol producing blocks, prior to this consensus was closed off and nodes were pre-selected. Token holders can either run their own nodes or assign their tokens to a staking pool.

In December 2020, the Allegra hard fork introduced a token locking mechanism that allows users to lock up tokens in preparation for the Voltaire stage of Cardano.

Alonzo, which is the beginning of the Goguen development phase, was rolled out in stages. Alonzo Blue was a testnet that introduced smart contracts to around 50 expert participants, mostly stake pool operators (SPOs). The next testnet phase, Alonzo White, introduced more participants and features that needed to be stress tested. The final testnet, Alonzo Purple, was launched on August 7th with two phases -: light purple for simple smart contracts, and dark purple for more complex smart contracts.

Cardano’s pragmatic approach to compliance

The Cardano team has been proactive in ensuring it maintains regulatory compliance for the Cardano ecosystem and the ADA token. On August 24th, the Cardano Foundation announced that it was partnering with Confirm, a blockchain analytics firm, to build up its anti-money laundering capabilities.

According to the press release, the partnership will allow Cardano to be compliant with Financial Action Task Force (FATF) guidelines as well as “other supranational and national regulations.” The statement went on to explain that, “the tools and services provided by Coinfirm enables every exchange, custodian, and all other third-parties to clearly track the history of ADA held in their wallets.”

Cardano has been criticized by some observers for its partnerships. Weiss Crypto, a subsidiary of financial ratings agency Weiss Ratings, wrote, “While still a free and decentralized network, this brings Cardano closer to becoming a censorship-prone, politicized, and manipulated network.” Weiss Ratings suggests that Cardano may become so regulated, it will more closely resemble the banking sector, than a decentralized blockchain.

Hoskinson responded to these criticisms on his YouTube channel. He said that cryptocurrencies need to interact with other regulated entities such as exchanges. These entities need to be compliant and therefore Cardano, an asset used by these regulated actors, needs to be KYC/AML compliant as well. Hoskinson said this does not mean a KYC/AML process is a prerequisite to using the Cardano protocol.

Crypto legal expert Jeremy Hogan endorsed Cardano (ADA) for completing its ICO in Japan before the token shifted to exchanges where Americans could access it. Hogan says, for this reason, it is unlikely that Cardano will be targeted by the SEC.

Other key factors affecting the value of ADA

African partnerships- Cardano is well known for its partnerships with nation-states. Cardano has established a clear ‘Africa Strategy’. They explain their first goal is to partner with local stakeholders in delivering projects that solve real issues in the market. The second goal is to train & educate local developers to create solutions for local problems.

An example of a local issue targeted is the supply chain. Cardano has partnered with the Ethiopian agricultural industry to provide blockchain-based systems to identify the origins of Coffee. In the future Cardano aims to use smart contracts to incentivize farmers to adopt more productive farming practices.

Another exciting initiative is the Memorandum of Understanding (MOU) signed between IOHK and the Ethiopian government to train and hire junior software developers and use Cardano in its agricultural industry.

Cardano’s presence in Africa is exciting because it is such an underserved, bubbling market for tech. Africa has a population of 1 billion and a median age of 19. The continent is also underserved by its banking sector. Africa is young and has poor financial services, this has meant products like mobile money services like M-pay have been incredibly successful in the continent. Crypto seems like a perfect fit for Africa, and Cardano is leading the charge for Cryptocurrency to establish a presence in the region.

The Concurrency problem and development- The Cardano blockchain uses the extended Unspent Transaction Model (eUTXO) to track user funds. The UTXO model was popularized by Bitcoin, it tracks individual coins, instead of tracking account balances like Ethereum. Using Ethereum is like using a bank card that lets you make multiple purchases at the same time from the same shop. With Cardano & Bitcoin, the bank card makes you wait for the change to be returned before letting you make the next purchase. Users and researchers have described the limitations of Cardano’s UTXO based transaction model and the concurrency problem. Concurrency in computing terms, is the ability to execute more than one program or task at the same time, without it affecting outcomes.

Cardano developers were able to build a system to enable smart contracts capable of working within the UTXO framework, through the eUTXO model. eUTXO allows for additional data to be handled within the UTXO system.

The network, however, has still had issues with slow throughput. UTXO essentially only allows for single transactions per block and users need to wait for other transactions to be confirmed before they can push through their own transactions. Multiple users interacting with the same smart contract, at the same time, should not be possible with the Cardano UTXO based transaction model.

What can and has happened with Cardano dApps like AMM based decentralized exchanges is that more than one user will attempt to interact with a single smart contract and only a single user’s transaction will be successful. Other users will be told that their transaction has failed and they can keep trying to get their transaction approved or they just give up. AMM-based dexes like Uniswap work because they are built on top of the Ethereum global account based model which allows multiple users to interact with the same smart contract at the same time.

Cardano applications have developed some unique ways around the concurrency challenge that often involve shifting transactions off-chain. Ergodex uses offchain bot, run by 3rd parties, which collect user order – sequence them and then transmit them on chain as a single order. Maladex uses a ‘programmable swaps’ model. Maladex splits processes into a commit and execution phase. When users sends commits to blockchain to perform a certain action, this is represented by an NFT that contains all of the triggers built into a transaction. The different NFTs are designed to support many different types of trades.

The difficulty building smart contracts on Cardano is compounded by the project’s unique choice in programming language. Building on Cardano requires knowing how to use Haskell, a notoriously difficult and often shunned programming language. This often makes the barrier to enter Cardano high. Platform blockchains like Solana and NEAR have overtaken Cardano, in terms of developer adoption, because they use more popular programming languages like C and Rust.

Source: Electric Capital

While Cardano developer growth grew between 2020 and 2021, it is dwarfed by the growth in developers on the Solana, NEAR and Polygon ecosystems.

Conclusion

In an otherwise bleak cryptocurrency market, platform blockchain token ADA has shown some signs of life. Its upcoming Vasil hard fork, promises to make the blockchain more scalable and efficient. This will allow more DeFi protocols to deploy on Cardano and could potentially lead to the first borrowing and lending protocols being launched on the network. ADA believers will hope if markets turn around and some macro momentum returns, the token will be able to be a standout altcoin performer in the next bull run

Don’t miss out – Find out more today