Countdown to ETF: Bitcoin surges as Fee War Begins

Bitcoin surged to US$47,000 on Monday on expectations that spot ETFs will be approved on Wednesday. ETF providers have announced shockingly low fees in their bid to win customers.

It must now be a matter of when, and not if, the large group of Bitcoin Spot ETF providers will be approved and able to begin trading in the U.S.

Late Monday, the Spot ETF applicants began to file the outstanding 19b-4s from Friday after market close, and then one by one they were published on the SEC website. This process can take a few days and is a clear signal the SEC is accelerating things for this week.

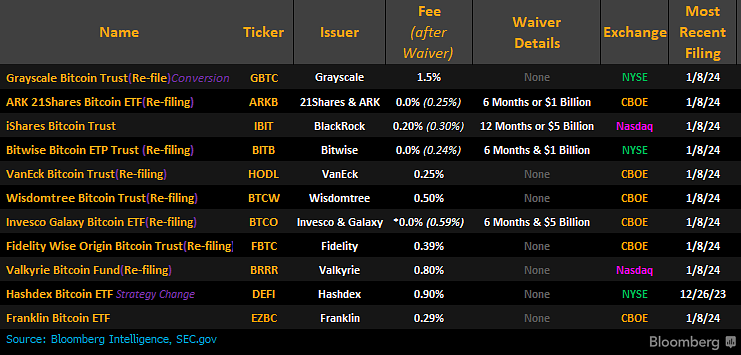

Just two days before the Securities and Exchanges Commission (SEC) is expected to approve one or more U.S. spot Bitcoin exchange-traded funds (ETFs), potential issuers have finally disclosed their fees.

The ETF Fee War Begins

There are 13 proposed ETFs awaiting SEC approval, and the fees they charge are the primary way they compete with each other.

Charging the least is crypto-savvy fund manager Bitwise, with a fee of just 0.24% after a 6-month waiver period of no fees. Ark, VanEck, and 21Shares are next with a fee of 0.25%. Franklin is at 0.29%.

BlackRock, the world’s largest asset manager, has set its fee at 0.30%. This is much lower than many had predicted, given BlackRock’s brand power and market size.

Source: Bloomberg

Bloomberg ETF analyst James Seyffart wrote on X that, “The Bitcoin ETF fee war has sharp elbows. These fees are sooo low and the ETFs will trade ABSURDLY tight (penny wide bid-ask spreads) and without any commissions on most platforms.”

Grayscale, however, which plans to convert its Grayscale Bitcoin Trust (GBTC) into an ETF, has the highest fee at 1.5%. However, they have included a clause about the ability to waive fees. Plus, Grayscale already has $28 billion of assets under management (AUM) whereas the other applicants are starting from a position of zero.

What’s clear is that the lower-than-expected Bitcoin ETF fees are good news for investors, and they will put pressure on crypto exchange fees. U.S exchanges such as Kraken and Coinbase will now be competing with the ETF providers, and for those wishing to invest in Bitcoin, the ETFs look very attractive indeed.

Gary Gensler Sounds a Warning

Finally, today, SEC Head Gary Gensler published a thread on X, stating that “Those offering crypto asset investments/services may not be complying w/ applicable law, including federal securities laws. Investors in crypto asset securities should understand they may be deprived of key info & other important protections in connection w/ their investment.”

Gensler wrote, “Investments in crypto assets also can be exceptionally risky & are often volatile. A number of major platforms & crypto assets have become insolvent and/or lost value. Investments in crypto assets continue to be subject to significant risk.”

Gensler’s thread concluded with “Fraudsters continue to exploit the rising popularity of crypto assets to lure retail investors into scams. These investments continue to be replete w/ fraud- bogus coin offerings, Ponzi & pyramid schemes, & outright theft where a project promoter disappears w/ investors’ money.”

The thread is being interpreted as another signal that the SEC will indeed approve one or more ETFs, this week.

Don’t miss out – Find out more today