Crypto Market forecast: 25th November

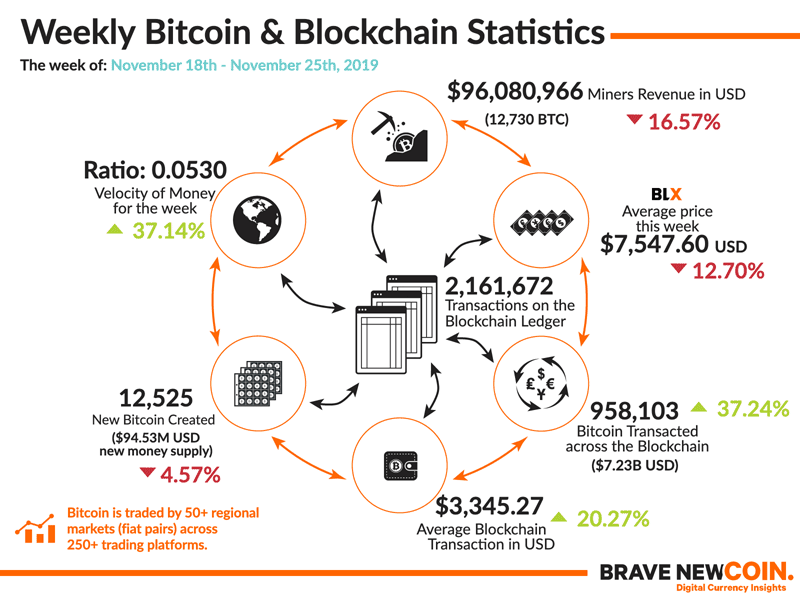

The crypto markets continued to grind down this week. The price of market benchmark, Bitcoin, fell by almost 20% following an announcement from the PBoC stating that the Chinese government remains opposed to the risks around cryptocurrency investment. Another factor in the bearish price action is the apparent market exit of a number of private mining operations.

The crypto market had one of its worst weeks in 2019. Most crypto assets are trading heavily in the red following a week of consistent sell pressure that concluded with a sharp, sudden price fall on Friday. Market benchmark BTC fell ~19% over the week. The number two and three assets, ETH and XRP, fell ~24% and ~18%, respectively, while the overall crypto market cap fell ~20%, a loss of over US$45 billion in value.

On Friday the People’s Bank of China (PBoC) issued a public warning against any form of Bitcoin or cryptocurrency trading. A translated version of the statement reads “Once [bitcoin or cryptocurrency trading] is discovered, it will be disposed of immediately, and it will be prevented from happening early.”

The statement also warned the Chinese trading community against relating the country’s interest in blockchain technology with any possible deregulation of crypto asset trading or investment. “Recently, in the process of promoting blockchain technology, virtual currency speculation has shown signs of rising. Investors should be careful not to mix blockchain technology with virtual currency,” it said.

Statements made in late October by Chinese Premier Xi Jinping suggesting that the nation should seize the “opportunity of blockchain” appeared to be the driving factor behind a BTC price run that pushed BTC prices up above $9500. Last week’s clarification by the PBoC has likely removed most of the bullish trading sentiment attached to Xi’s blockchain comments.

Another potential factor for the sharp price fall was the market exit of some small BTC miners once prices began to drop below the US$8,000 level. At price levels around $7900, data suggests the profitability of individual BTC mining rigs like the popular Antminer S9 begins to flip red.

While many large BTC mining pools will be able to ride through the current bearish market conditions, smaller miners may be choosing to cut their losses. On-chain data suggests there was a sharp uptick in BTC outflows over the weekend, much of it coming from unknown non-pool mining accounts.

Smaller miners may also be incentivized to stop operations more quickly than they normally might due to the upcoming Bitcoin network block reward halving. The event, which will take place in May 2020, will increase the processing power and hardware requirements of BTC miners.

This week in crypto

29th November- CME BTCV19 contracts last trade date

This Friday the latest round of CME quarterly Bitcoin futures ends. The nature of futures contracts means they need to be settled on a set date, based on a contract. All CME contracts will have to be traded, or settled, before this date. There is generally a fall in the trading volume of futures around expiration. This can tend to coincide with a rise in volatility and the potential for short/long squeezing. With BTC markets currently going through a period of higher than usual volatility, the Friday contract close may trigger another weekend of intense price moves.

2nd December- Launch of new Decentraland creator contest

Decentraland, a major Ethereum virtual reality project will launch a contest that allows users to create and display custom VR creations using Decentraland’s own internal building tool, with Decentraland tokens to be won. The contest will demonstrate how far Decentraland’s building capabilities have progressed over the last two years of development. The price of Decentraland’s native token, MANA, has fallen ~25% in the last month.

Nearly all large cap crypto assets bled heavily over the past weekend with only US dollar Tether trading marginally green. Demand for the safe haven asset increased as the markets tumbled. The worst performer in the top 10 was EOS, dropping by 29% despite announcing a major industry partnership with Game development giant Ubisoft, the group behind the Assassin’s Creed series.

It has been a sobering month for BTC traders. After BTC/USD prices rose nearly ~28% on the 25th of October, jumping from ~US$7442 to ~US$9552 in just one day, over the next 30 days markets have gradually slid ~30%, ending this week trading at the US$6700 level. There appears to be a general mood of apprehension from crypto traders and investors, with the Crypto Fear and Greed index now hitting ‘extreme fear’ after being neutral at the start of November. Hopes of a bullish Q4 appear to be firmly off the table for now.

Don’t miss out – Find out more today