Crypto Market Forecast: 2nd March

The last week has been a difficult one for all global financial markets as uncertainty around the impact of the coronavirus continues to create havoc. In the short term many participants have moved to cash positions as they watch to see what the market will do next.

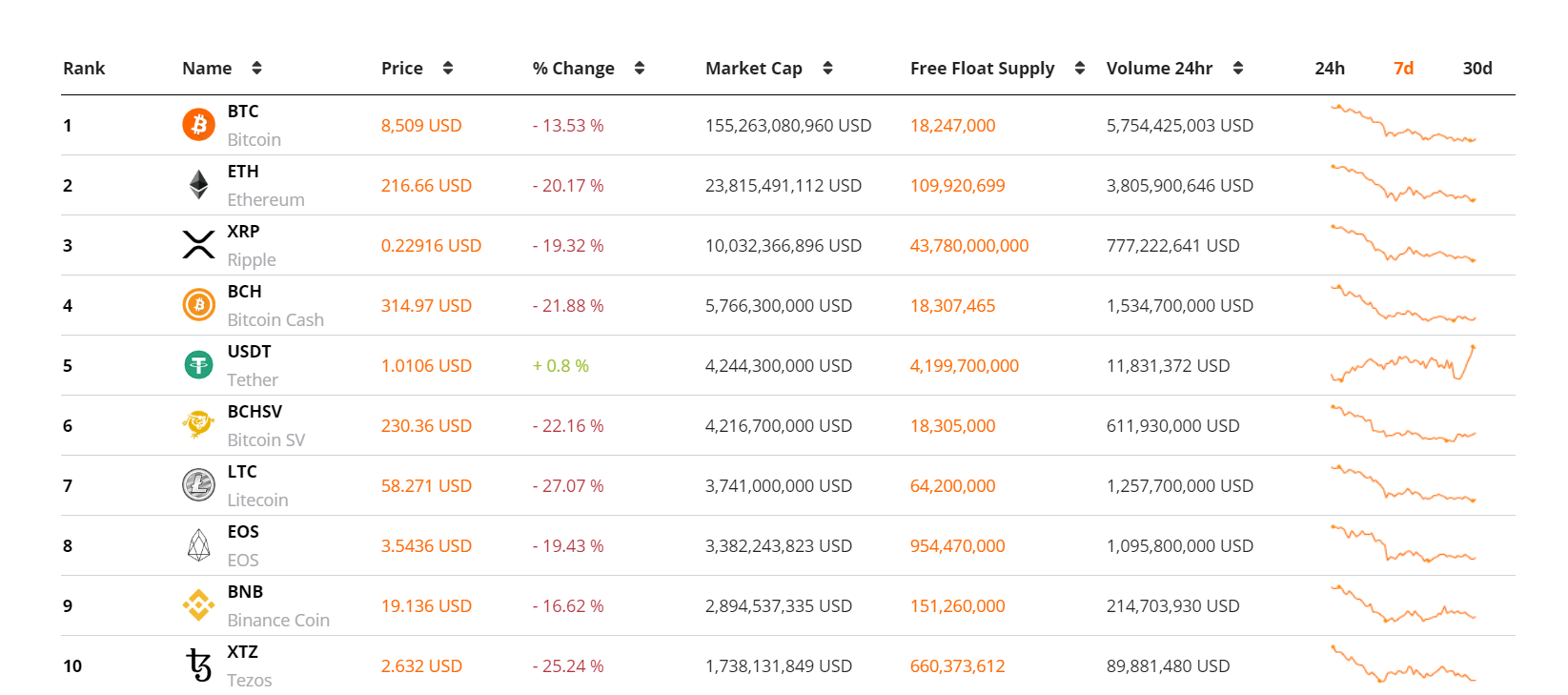

It was another difficult week in the crypto markets, as ongoing fears around the impact of CO-VID19 continue to ravage the global financial markets. The price of the crypto market’s top asset Bitcoin(BTC) slid ~13%. The number two and three crypto assets on Brave New Coin’s market cap table, ETH and XRP, fell ~20% & ~19% respectively.

Crypto bulls are being forced to watch the gains from a strong start to the year – and the associated positive price momentum – be eaten away by an unforeseeable black swan event. The total market cap for crypto assets fell by ~16%, a loss of US$25 billion in value.

Even so, the crypto losses have been dwarfed by those in the traditional markets. The US-based S&P 500 stock index had its worst week since the global financial crisis in 2008, falling ~11%. The rest of the world was also affected with the DAX in Germany falling ~12%, the Nikkei 225 in Japan falling ~11%, and the KOSPI from South Korea falling ~5%.

Federal Reserve chairman Jerome Powell issued a statement reaffirming market suspicions that the fed will use external stimuli and monetary policy tools to “act as appropriate to support the economy.” Mr. Powell, while noting that the “fundamentals of the U.S. economy remain strong,” also stated that “the coronavirus poses evolving risks to economic activity.”

The option for the fed to lower interest rates appears inevitable. Market participants like Scott Minerd, Chief Investment Officer of Guggenheim investments have suggested that while the current short term funding requirements for Wall Street and the interbank funding market are manageable, this position could easily worsen if investor panic continues.

Minerd believes the federal reserve may also have to encourage banks to continue funding repo markets despite coronavirus fears and also take advantage of the fed discount window. Minerd says a recession is possible and that US stocks could tumble by a further 20-30%.

Currently, bulls in both the digital asset and traditional markets will hope the investor-led ‘fear & panic’ caused by the coronavirus subsides. The US dollar index and cash have been recent winners as markets have observed a run into liquidity.

March 2nd- Founders AMA w/ChangeNow and Callisto Network

This AMA with a pair of key Ethereum Classic/Commonwealth developers is the most upvoted and ‘confident is real’ event this week on Coinmarketcal with 100% confidence, 335 votes and 553 page views since being added on the 27th of February. Positive dev contributions like the development of the Callisto internal network and ChangeNow exchange platform adds to the fundamental value of ETC. The price of ETC fell by ~20% last week during the coronavirus led market bearishness.

It was a very difficult week for large-cap assets on Brave New Coin’s market cap top 10, with double-digit red trading across the board. The largest percentage loser in the top 10 last week was Tezos(XTZ). The asset has been one of crypto’s biggest winners in 2020 so it is not surprising to see a pullback as ‘in the green’ investors take profits out of successful long positions.

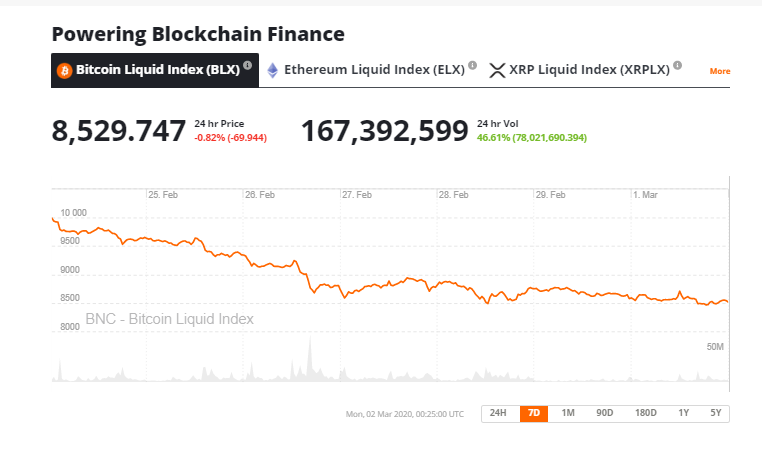

The price of BTC was depressed throughout the week as bulls struggled against strong selling pressure that hit the markets particularly hard last Wednesday. Some of the most popular Technical Analysis content on Crypto Twitter over the last few days appears to be assessing BTC’s most recent dip as a potential buying opportunity (1,2,3).

Don’t miss out – Find out more today