Crypto Market Forecast: The week ahead, 15th October

Interested in staying up to speed with the events that will impact crypto prices in the week ahead? Then bookmark Crypto Market Forecast for a curated weekly summary of forward-focused crypto news that matters

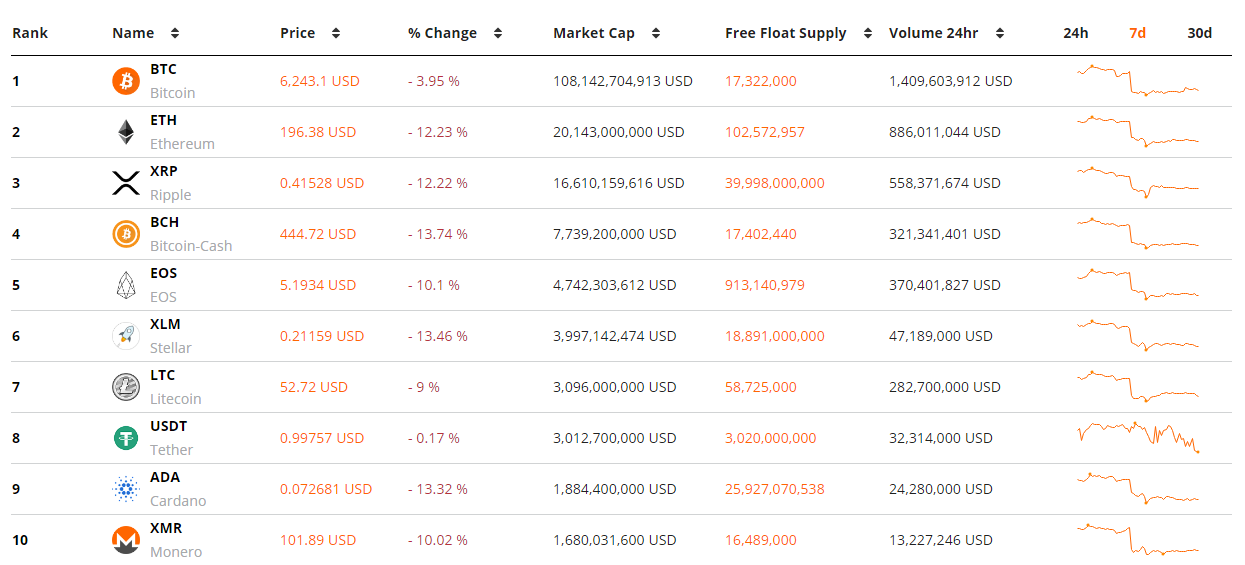

After weeks of low volatility and general price stability, the digital asset market made its first big move of Q4 2018. Unfortunately for crypto investors and HODLer’s, it was a downward one. BTC ended the week trading down ~3.5%, while popular large cap alts ETH, XRP, BCH, and XLM had particularly challenging red trade weeks, down ~11%, ~11%, ~13% and ~12% respectively. The overall crypto market cap diminished by ~7%, reflecting the market wide wave of selling pressure.

A potential factor for the crypto sell off was the concurrent, and pre-emptive, sell-offs within the US stock market. The NASDAQ composite was down over 5% in the last week, while the market leading technology FAANG stocks, witnessed market value losses of over $500 billion in the same period.

Long shot theories for the correlations between the crypto and US equity price drops include, crypto traders mass withdrawing from their portfolios to try and catch the falling knife in US stock markets.

These symmetrical movements go against the general intuition that crypto markets are a ‘radical’ substitute to US stock markets, offering unique value propositions and fewer barriers-to-entry.

A simple explanation for the ongoing movements, is that the timing of the respective drop-offs is purely coincidental. Even if this the case, the ongoing downturn in both markets adds another chapter to the theory connecting traditional finance and crypto.

A select few alt-coins have managed to buck the short term bear, for example, news aggregator Cryptocurrency Newsfeed identified Tron CEO Justin Sun’s tweet of a "partnership with a ‘Tens of Billions USD Valuation Industry as significant. In the wake of this announcement TRX, Tron’s native token, rose ~14% in under three days. While the move may be purely speculative, it is an indicator of the strong underlying belief the TRON community has in the project, appearing to buy heavily based off a non-specific signal.

Upcoming Events in Crypto

17th October – CBOE Bitcoin futures Expiry

This Wednesday the latest round of CBOE BTC futures (XBT) expires. All CBOE contracts will have to be traded, or settled, before this date, to avoid having to deal with the complication of having to deliver on the underlying asset. There is generally a fall in the trading volume of futures around expiration dates, as traders prefer cash settlement over an expired contract, and having to deal with delivery hassles. Recently, CFTC chairman, Christopher Giancarlo, has backed the dampening effect CME and CBOE futures markets have had on BTC prices, with this in mind, the price effect of the latest futures expiry may be understated.

18th October – Monero Scheduled Network Upgrade

Leading privacy network, Monero, launches a significant upgrade to its network this Thursday. The core of the update will be deeper implementation of a form of range proofs called Bulletproofs, that will aim to reduce transaction times and fees. There will also be a tweak to Monero’s POW model designed to make the network more ASIC resistant. The Monero privacy solution has a number of admirers, and the upcoming upgrade may be a bounce off point for XMR, post a challenging trading week.

19th October – Cobinhood Margin trading launch

Up and coming Taiwanese zero fee trading platform, Cobinhood, launches margin trading infrastructure for ETH, BTC and COB pairs Friday. The high risk, high reward nature of trading with borrowed funds is likely to be appealing to some crypto traders, particularly on a zero-fee platform, and may bring in a surge of new volume to the exchange. The exchange will also begin offering XRP and XMR spot trading pairs on the same day.

Top 10 Crypto Summary

It was a challenging trading week for the majority of large cap altcoins. Top 5 tokens XRP and BCH, saw their recent price gains mostly wiped off. Bitcoin has continued to maintain its ‘safe haven’ appeal in crypto markets, performing admirably in comparison to competitors, with price falling by less than 5%, and BTC dominance rising to close to 55%. Number 2 crypto, ETH, faced fundamental challenges last week, as a failed testnet for the Constantinople hardfork appears likely to cause significant delays to future network upgrades.

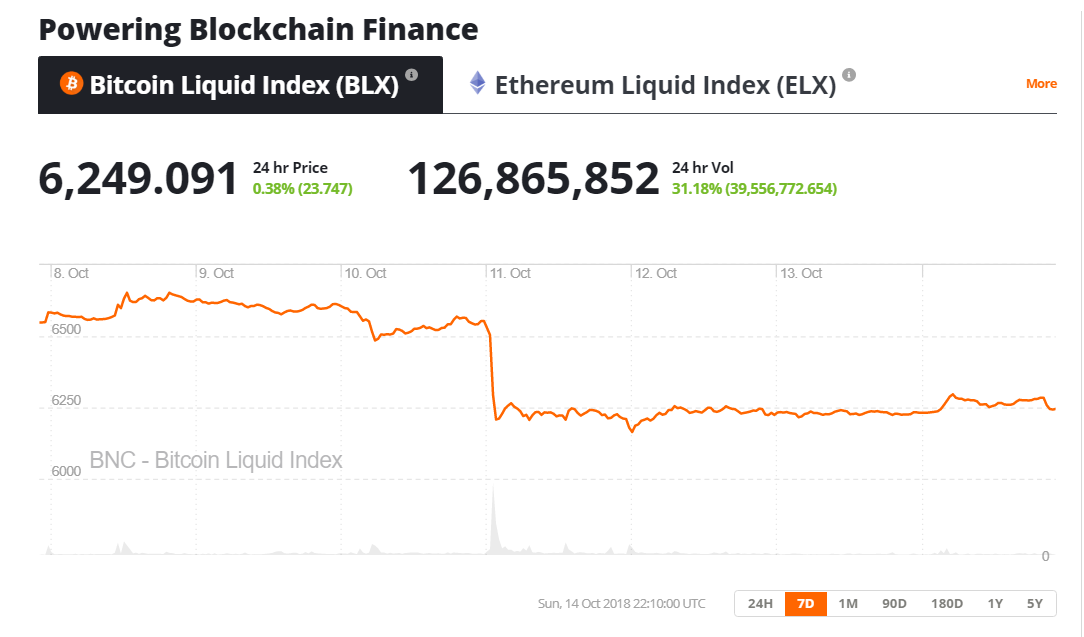

BLX 7 Day report

This week the BTC market finally ended its love affair with the $6550 price level but unfortunately for BTC longers the transition away from the point was downwards. Following a dump on the 11th October, price has maintained stability and found buyer resistance, around the ~$6250 level.

Onchain, Bitcoin fundamentals continue to trend upwards, while recent analysis from Bitmex Research, indicates the continued adoption and usage of the Segwit protocol through the last year.

Don’t miss out – Find out more today