Crypto Market Forecast: The week ahead, 19th November

Interested in staying up to speed with the events that will impact crypto prices in the week ahead? Then bookmark Crypto Market Forecast for a curated weekly summary of forward-focused crypto news that matters

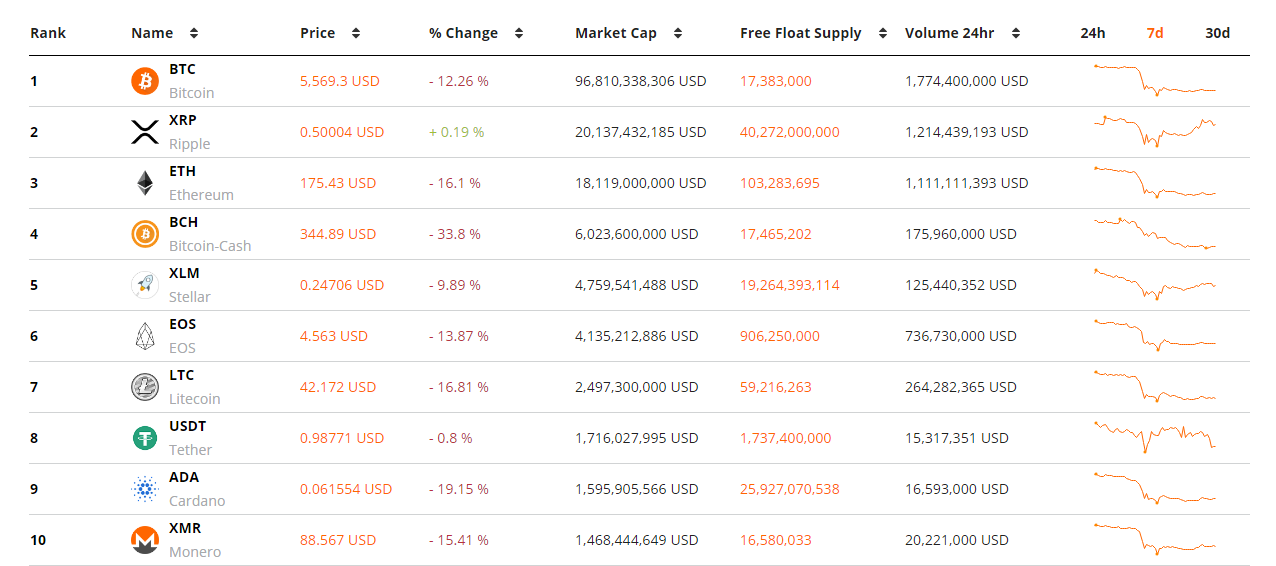

A challenging week of trading in crypto markets ended with BTC down ~12%, ETH down ~15% and the overall market cap for digital assets down ~12%. Following months of sideways price movement, price floors were broken and yearly lows were hit. The apparent trigger for this selling pressure was uncertainty created by the disruptive ‘impending doom’ narrative surrounding the recently concluded Bitcoin Cash hardfork.

With fighting words exchanged between the respective warring BCHABC and BCHSV factions, and players like BCHABC’s Craig Wright threatening to torpedo the crypto ecosystem if his side didn’t win, it appears many traders chose to reduce their crypto positions and avoid the drama.

Other speculative factors behind the price drop have included; a leading sell-off of tech stocks in traditional equity markets, BTC movements by long dormant Mt.Gox whales, and a deleveraging of crypto positions by institutional funds. The Occam’s razor argument is that the re-emergence of price volatility within crypto markets was inevitable following a long period of stability.

However, the week did end with good news, as a weighted cryptocurrency exchange traded product (ETP), which will be known as ‘HODL’ was approved for trading on the Switzerland-based Six exchange.

The product will let traders buy a share in a basket of leading crypto assets at a regulated price with a built-in custody solution. The security and accessibility of this new crypto on-ramp may have implications for the mainstream popularity of crypto in Europe once launched.

Upcoming Events in Crypto

November 20th- Elastos return ELA coins to Angel Investors

The ambitious Elastos project, which is building a blockchain powered internet where users have complete control of digital assets exchanged across the network, releases a large chunk of previously locked ELA tokens back to early Angel investors. In the past, these unlocks have caused price volatility because of recipients immediately liquidating — intensified because ELA prices have fallen by 93% since February 24th. Thus, there is likely to be ELA selling pressure immediately following the release.

November 26th – Beyond Blocks Summit Bangkok

This major Asia focused conference out of Thailand features an impressive list of speakers including Charles Hoskinson of Cardano & IOHK, Ryan Gaylor of Ripple and Prinn Panitchpakdi the governor of the Thai Stock exchange. Agenda topics include ‘Silicon Valley vs Asia: The path to crypto redemption’. Useful insights on crypto regulation in Asia and the state of the growing blockchain ecosystem in the region should be gleaned from the event.

November 27th- Consensus Invest: NY

Likely the biggest event on the Q4 crypto calendar, Consensus Invest features one of the deepest and most influential crypto speakers lists ever. Jay Clayton, chairman of the SEC, John Tornatore, director of CBOE global markets, Mark Yusko, CEO of Morgan Creek Capital and many others within the finance & digital asset sector will be speaking at the event. With a major focus on the evolution of crypto in 2019, crypto markets may receive a strong boost in positive sentiment post the event.

Top 10 Crypto Summary

In a week of heavy losses for most assets in the Top 10 market cap table, XRP’s ability to recover from midweek losses, overtake ETH as crypto’s number 2 asset and end the week trading green make it the clear stand out in large-cap markets. As highlighted by Cryptocurrency Newsfeed, news events like PetrolDollars (PDX) decision to Implement Ripple’s xCurrent and xRapid payment system, have helped create buying interest in spite of the enveloping short term bear market. Outside of the top 10, platform based blockchain NEM also ended the week trading strongly after re-listing on major Japanese exchange Coincheck, following a major hack on the exchange back in January which ultimately saw Coincheck taken over by Monex Group.

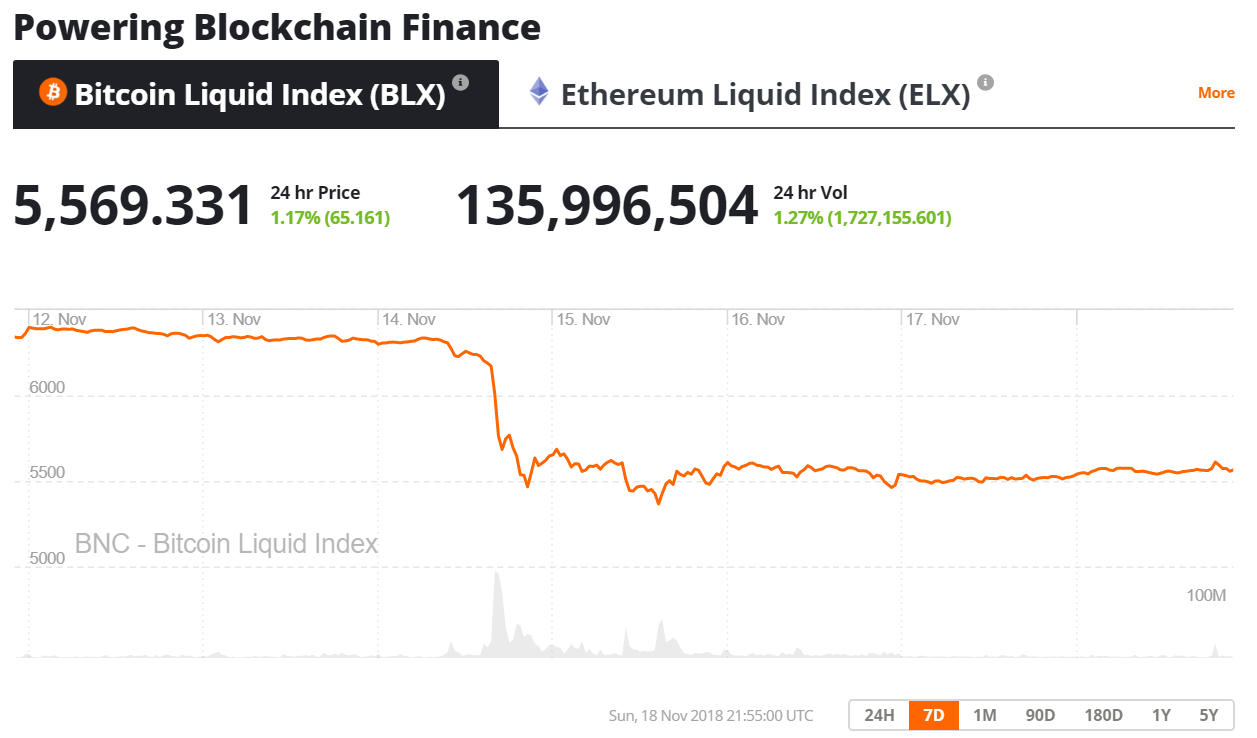

Last week’s sharp price dump ended an extended period of BTC trading in the $6300 to $6600 price range, beginning in early September and ending last week. Despite Bitcoin hitting new yearly lows with its price falling by 12%, some crypto traders have viewed the week’s price action as an opportunity to re-engage with what had been a stagnant market.

The return of volatility in Bitcoin pricing may provide a chance for near term trading profits. With positive factors like looming institutional participation in crypto, and the growing use of the Segwit and the Lightning Network not fully reflected in the BTC price, there is the possibility of a strong bounce soon.

Don’t miss out – Find out more today