Crypto Market Forecast: Week of April 17th 2023

A curated weekly summary of forward-focused crypto news that matters. This week, Bitcoin surges as Montana passes a "right to mine" bill, a CBDC for International Central Banks is set to be launched, and court documents reveal the Bhutan Investment Funds.

The price of Bitcoin (BTC) shot up by nearly 9% since last week, to reach ~US$30.3K. Ether (ETH) rose by 14% to ~US$2.1K. Binance-coin (BNB) spiked by 11.4% to ~$346. A key factor in the momentum was lower inflation and more jobless claims in the US, which suggest interest rate spikes from the Fed may cool.

Montana has passed a “right to mine” in both its Senate and House. Montana Senate Bill 178, referred to by some as a “right to mine” bill, solidifies Proof of Work mining-friendly wording into potential law – pending only the signature of the state’s Governor Greg Gianforte.

The bill forbids “a rate classification for digital asset mining, digital asset mining businesses, or home digital asset mining that creates discriminatory rates”. The bill also prohibits taxation on cryptocurrency when used for payment as well as establishes digital assets “as personal property”.

The State of Arkansas has also worked along a similar front with House Bill 1799, which establishes that digital asset mining businesses should be treated as data centers. The bill “protect[s] data asset miners from discriminatory industry-specific regulations and taxes” and even makes special provisions for individuals mining at home (“in areas zoned for residential use”).

At a recent IMF meeting, an organization called the Digital Currency Monetary Authority (DCMA) announced that it has launched a central bank digital currency (CBDC) for international central banks. DCMA’s website refers to itself as “a world leader in the advocacy of digital currency innovations for monetary authorities”. If you have not heard of this “authority” before, you are not alone. Wayback Machine’s website cache tool shows no record of DCMA’s website existing even two years ago.

A press release provided by the DCMA calls its new CBDC for central banks “Unicoin” or “Universal Monetary Unit” (UMU) and claims to use AI technology for its store of value. Whether Unicoin can deliver on the promise of “algorithmic stability” just one year after TerraUSD (UST) failed at the same endeavor remains to be seen.

BlockFi and Celsius bankruptcy court documents reviewed by Forbes reveal that the South Asian nation Bhutan’s investment fund Druk Holding & Investments held cryptocurrencies with the two crypto lending companies.

According to Forbes, BlockFi complained to Druk Holding & Investments for defaulting on a $30 million loan from BlockFi, whose terms were payable in USD Coin (USDC). BlockFi reportedly alleges that Druk left an unpaid balance of $820K; however, Druk responds that the matter has been “settled”.

Crypto news for the weeks ahead

April 28

The US Bureau of Economic Analysis’ (BEA’s) release of March’s Personal Consumption Expenditures (PCE) numbers will be released. This is one of the primary indicators used by the FOMC when considering interest rate levels.

May 2-3

The FOMC will be meeting. Futures markets are predicting a high probability of a 25 bps interest rate hike.

May 10

The Consumer Price Index data for April 2023 will be released – one of the indicators the Federal Open Market Committee (FOMC) watches when considering interest rate hikes.

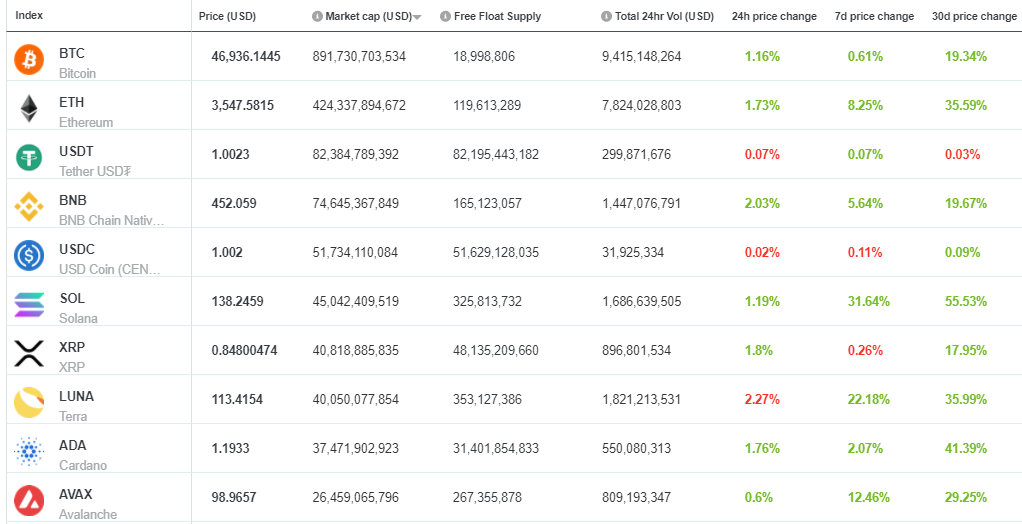

Top 10 Crypto Summary

Brave New Coin’s top 10 digital assets by market cap had a good week – with every single asset (other than stablecoins) trading at higher price points. Ether (ETH) trades 14% higher versus the previous week after a relatively smooth ‘Shanghai’ hard fork (“Shapella”), now allowing users to withdraw staked ETH.

Bitcoin Price Chart

GLASSNODE on-chain analytics for Bitcoin show that in the aftermath of November 2022’s FTX collapse, the percent of all coin supply in profit dropped to as low as under 46% as Bitcoin’s price fell below $16K. With Bitcoin’s price now sitting at over $30K, we see nearly 78% of all coins presently in profit, with a steep climb since the November event.

Don’t miss out – Find out more today