Crypto Market Forecast: Week of April 18th 2022

A curated weekly summary of forward-focused crypto news that matters. This week, Bitcoin trades horizontal amid macroeconomic concerns, Luna outperforms the rest of the altcoin market, and selling pressure emerges in the perpetual markets.

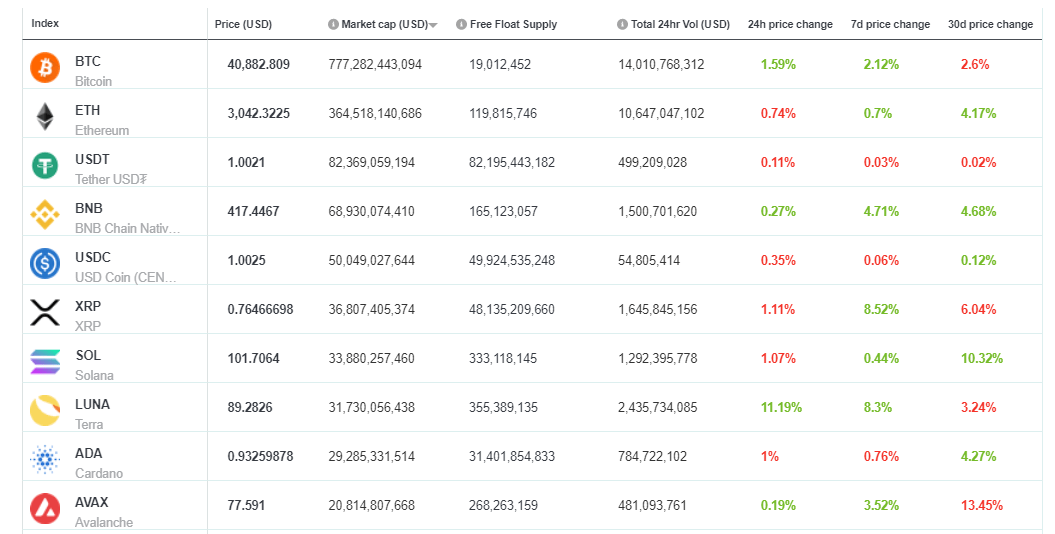

Digital asset markets were flat last week with most large cap assets ending the week close to where they started. Bitcoin (BTC) ended the week up ~2% and trading just above US$40,000. Ethereum (ETH), and Binance-coin (BNB), the 2nd and 4th largest assets on the Brave New Coin Market Cap table, were up ~1% and ~4% respectively.

The cryptocurrency market dropped towards the end of the week as concerns surrounding the US macro environment grew amongst forecasters and economists. The chief economist at Goldman Sachs, Jan Hatzius, said that the Federal Reserve faces a difficult task tightening the monetary supply enough to cool inflation without causing a recession — an extended period of negative economic growth.

“Taken at face value, these historical patterns suggest the Fed faces a hard path to a soft landing,” Hantzius explained in the note. US inflation hit 8.5% last month. To hit the Fed’s 2% target, strong and tight monetary policy is likely required. A large scale financial restriction like this, however, will inevitably create unemployment and potentially a recession. Goldman Sachs assesses the likelihood of a recession in the next two years at 35%.

The bearish macro sentiment led to a drawdown in US stocks which coincided with the drop in crypto markets. So far in 2022, the correlation between BTC and US stock indices (the Nasdaq composite and S&P 500) has been strong and positive. The 30 day Pearson correlation coefficient between the BTC price and the Nasdaq Composite price reached as high as 0.92 on April 14th.

Conversely, the 30 day Pearson correlation coefficient between BTC price and gold price hit -0.61 on April 14th. This means that as the price of BTC is dropping the price of gold is rising and vice versa when the price of BTC is rising.

This suggests that presently, Bitcoin is behaving more like a tech stock than a safe haven. It is behaving like a speculative asset, despite signs that the number of long term BTC hodlers is rising. If this high correlation between US stock indices and BTC holds, then crypto markets are likely to drop and rise based on US recession signals and moves made by the Federal Reserve. The 30-day Pearson correlation coefficient between BTC and ETH currently sits at 0.90 suggesting that the majority of the altcoin market will likely continue to take its cues from Bitcoin.

On April 14th, the US Federal Bureau of Investigation (FBI) attributed the US$630 million of the Axie Infinity bridge to North Korean government affiliated hacking groups Lazarus and APT 38. The Treasury department, a key branch of the US government, has sanctioned the address that received the stolen funds.

The reveal adds a new layer of concern to the exploit and implies that DeFi exploits have become national security threats because they are helping to fund one of the most repressive and aggressive governments in the world.

Crypto news for the week ahead

19th April- NEAR lists for trading on FTX

Near (NEAR) is a fast, cheap, developer friendly smart contract platform that has been one of crypto’s big winners in the last year. This week the token will be listed on major global exchange FTX. The token will open for trading with USD and USDT pairs. There has been some recent buzz surrounding the project because of rumors that it will soon launch its own native stablecoin, USN.

20th April – Jerome Powell speaks out

This week Federal Reserve Chairman Jerome Powell may confirm speculation that the United States is going to raise interest rates by half a percentage point during their next meeting on May 3rd-4th. Powell speaks at an event Thursday and then later the same day sits on a panel hosted by the International Monetary Fund.

Top 10 Crypto Summary

It was a mixed week for large cap assets on the Brave New Coin market Cap top-10 with a few assets breaking out of a sideways trend and surging upwards. Terra (LUNA) is up over ~8% in the last week as the popularity and demand of partner stablecoin UST grows. Last week, UST surpassed BUSD as the 3rd largest USD stablecoin in crypto. LUNA is burnt when UST’s peg moves above (over demanded) creating a supply shock and building positive price pressure for LUNA.

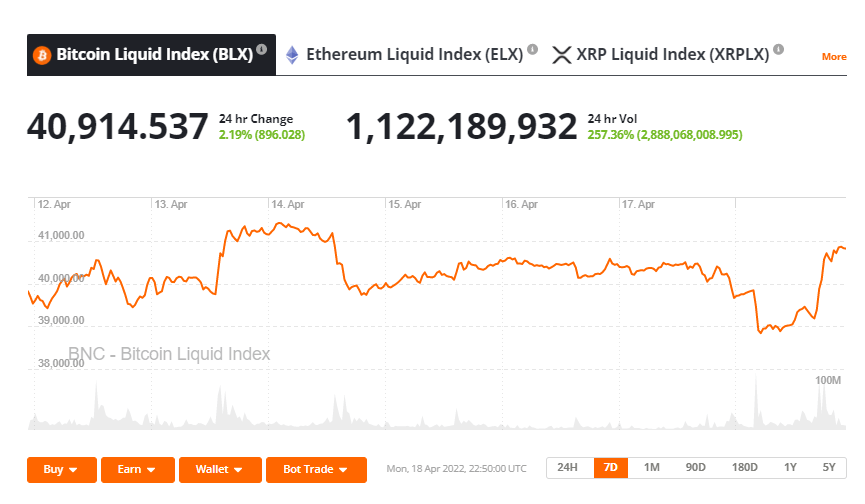

Bitcoin Price Chart

Last week, the price of BTC hovered in a tight range between US$41,000- US$39,000. Data provider Glassnode reports mixed bearish and bullish BTC signals emerging from future and spot exchanges. It reports that there is strong selling pressure in the perpetual markets despite bullish indicators like BTC on exchanges hitting almost 2-year lows. Less BTC supply on exchanges suggests less sell pressure for the asset from the spot market.

Don’t miss out – Find out more today