Crypto Market Forecast: Week of August 16th 2021

A curated weekly summary of forward-focused crypto news that matters. This week, the realized cap of Bitcoin hits a new all-time high, bulls enter accumulation mode and Cardano rises 50% to become the third-largest crypto asset by market cap.

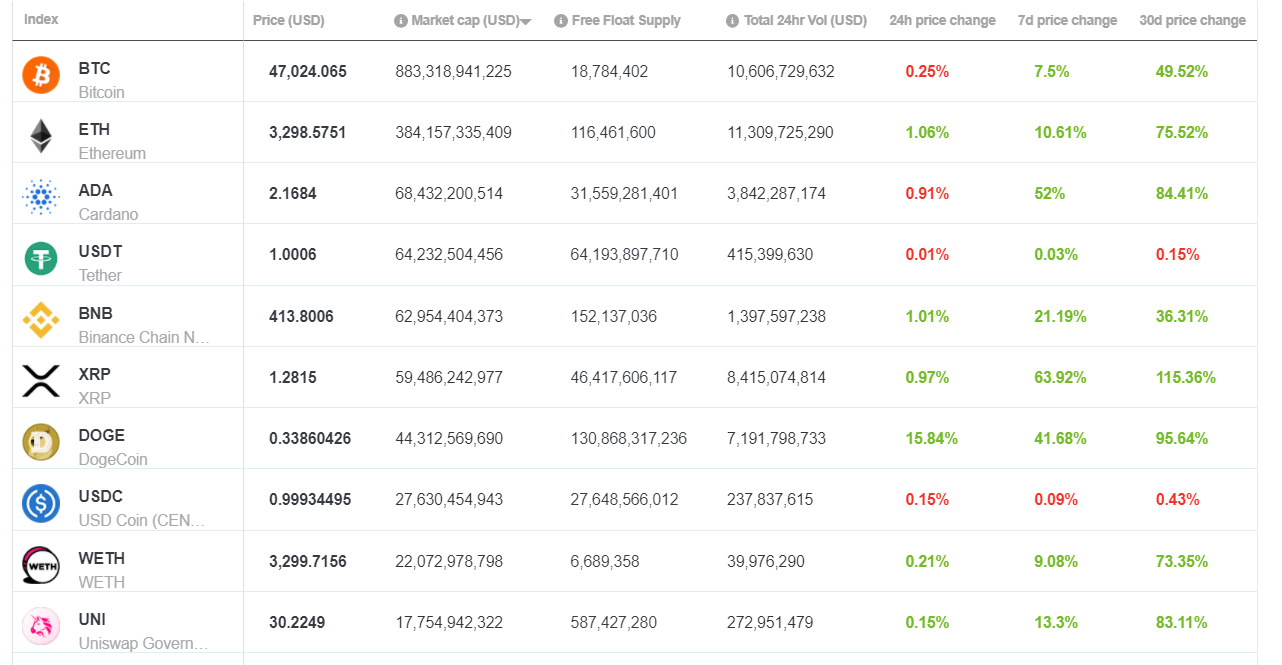

It was another bullish week for trading in the digital asset markets with strong gains across the board for large and mid-cap crypto assets. The two largest assets on Brave New Coin market cap table, Bitcoin (BTC) and Ethereum (ETH), were up ~10% and ~14% respectively. These gains were overshadowed by even stronger performances from large cap assets, Cardano (ADA) and XRP (XRP), which rose ~52% and ~66%.

The crypto market price drops of June, triggered by the severe ‘Fear, Uncertainty and Doubt’ (FUD) surrounding the Chinese mining ban and Elon Musk’s environmental concerns, are now in the rearview mirror. Bitcoin is some way off from reclaiming a new all-time high, however, a new milestone, the realized cap of BTC, hit a new all-time high on Friday.

Realized cap is an alternative measurement to a traditional market cap that assesses the value of a blockchain asset, based on the price at which each coin last moved. The realized cap hitting a new all-time high, means more money has been invested into Bitcoin now than in April when the price of BTC was US$64,000.

This suggests there has been a willingness for new buyers since April to buy BTC at higher price levels, despite the negative market sentiment. The network is more resilient than it was in May, Hashrate has been steadily rising since early June, and Bitcoin miners are proactively looking for solutions to manage the environmental impact of crypto mining.

The price of Bitcoin and the cryptocurrency market continues to rise in August despite a US$600 million hack of a cross-chain DeFi protocol, the advance of stifling crypto regulation within a major infrastructure bill in the United States, and major fines paid to American regulators by cryptocurrency exchanges Poloniex and Bitmex.

Cardano has risen through the ranks to become the third-largest asset on the Brave New Coin market cap table. Bullish tailwinds were generated after confirmation that smart contracts will go live on the network as part of the Alonzo hard fork that is set to be implemented on September 12th, 2021. After years of anticipation, the network looks set to allow Dapps to be launched on it using the project’s unique, self-built programming language Plutus. The proof-of-stake blockchain will expand its utility and allow users to access DeFi, gaming, and Non-Fungible-Token applications.

Trading set-ups for the week

Pro trader Josh Olszewicz explores trading options and signals for BTC and ETH – and lays out the trading setups he’s watching for the upcoming week. Start your week off right with Josh’s thoughts on trading strategies on a weekly basis.

Crypto news for the week ahead

August 17th – Reserve Bank of New Zealand Interest Rate Decision

New Zealand is set to become the first major country to raise interest rates to mitigate the effects of the COVID-19 pandemic on the global economy. The hike is expected as the country begins a process of normalizing and containing inflation concerns following aggressive monetary policy through 2020 and 2021 to help support the economy. With an advanced economy in the Asia Pacific region beginning to move forward from COVID, it will be important to observe the signals this sends to participants in markets around the globe.

August 21st – Verge block reward halving

Verge (XVG) is a privacy-focused blockchain originally known as DogecoinDark. This Saturday the network will execute a halving that will reduce the number of XVG offered to miners as a block reward from 100 to 50. A halving typically leads to higher prices because a halving event tightens supply, drives scarcity and reduces miner selling pressure. The price of XVG has risen ~58% in the last week.

Top 10 Crypto Summary

It was a strong week for large-cap assets on the Brave New Coin market cap top 10. Many enjoyed a week of double-digit gains. XRP (XRP) ripped upwards, rising more than 60% last week. However, analysts have advised caution if trading the asset. Technical trading indicators such as the RSI and Bollinger Bands suggest the asset is overbought. There were concerns raised when a large amount of XRP was moved to an exchange with the most likely intention being to sell or liquidate.

Bitcoin Price Chart

The Bitcoin markets enjoyed a strong second half of the week with a push towards the US$48,000 price level. BTC continues its strong medium-term trend and is now up ~50% in the last month. Glassnode reports that investors are in accumulation mode with BTC flowing out of exchanges in August at a rate between 75k and 100k per month. This pattern of BTC flowing into private wallets has historically been bullish because it means less bitcoin is being sold and more is being held.

Don’t miss out – Find out more today