Crypto Market Forecast: Week of August 21st 2023

A curated weekly summary of forward-focused crypto news that matters. This week, Bitcoin suffers its worst weekly percentage loss since the collapse of FTX. Influencing factors include rumors of Space X selling its BTC holdings and the bankruptcy filing of Chinese property giant Evergrande.

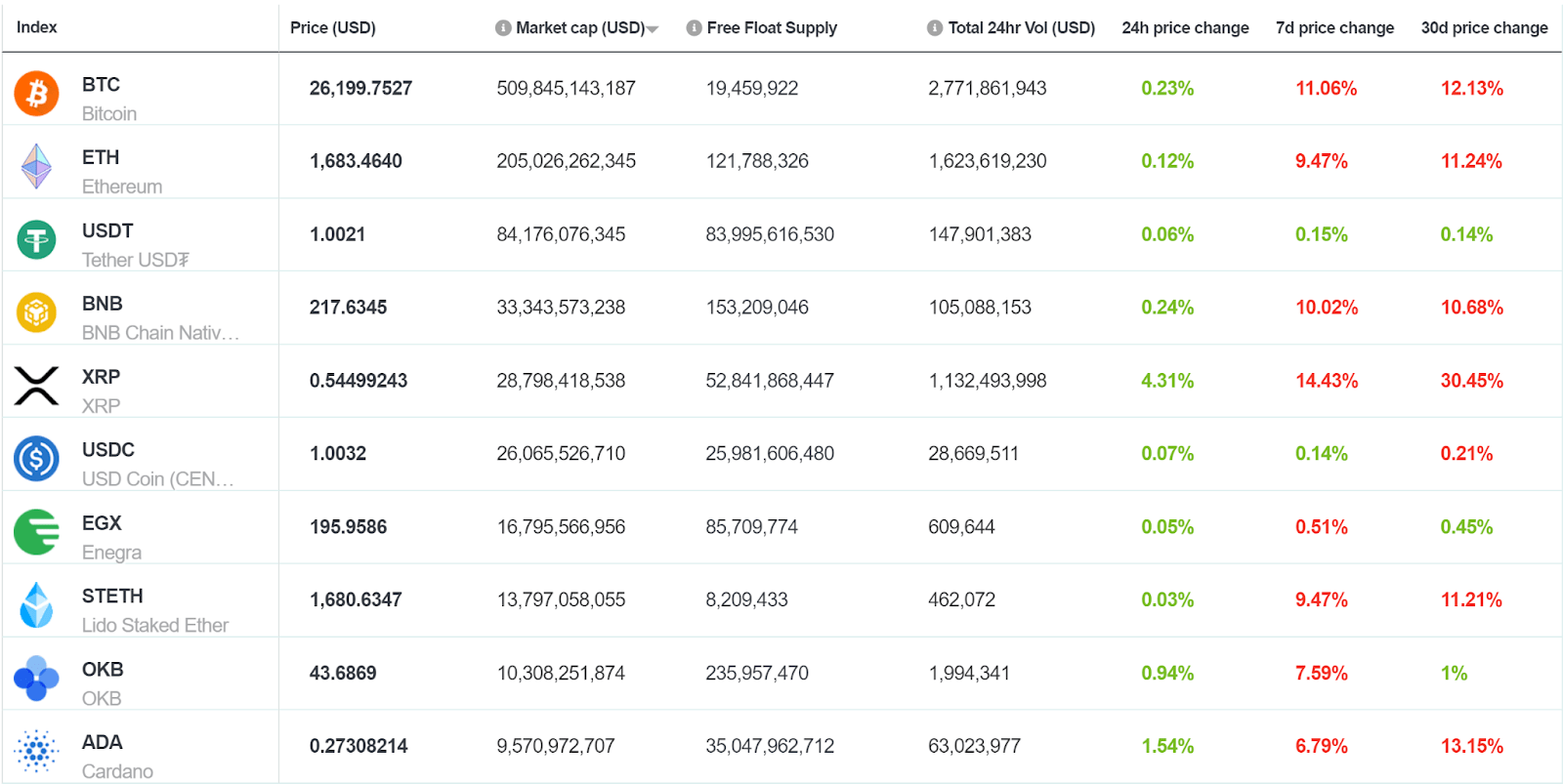

The price of Bitcoin (BTC) has fallen by ~11.2%, to around ~US$26.2k. The asset has experienced its worst week since the collapse of FTX in November 2022. The rest of the asset class did not fare much better. Ether (ETH) fell by ~9.5% to ~US$1.7K. Binance-coin (BNB) dropped by ~9.8%/ to ~US$217.

A combination of factors contributed to the price drop. These included rumors that SpaceX wrote down the value of its BTC holdings, the bankruptcy of property developer Evergrande in China, and surging yields in the United States.

Late last week, The Wall Street Journal reported that Elon Musk’s space travel firm SpaceX wrote down the value of the Bitcoin held on its books by US$373 Million in 2022 and 2021. It says the company also sold some of the BTC it held at some point in the last two years. The news agency has cited documents that it says provide rare insights into the company’s financials.

The claims made by the WSJ cannot be verified because SpaceX is a private company. During a panel appearance in 2021, Musk did state that SpaceX did own BTC but how much, or when the asset was bought, has not been confirmed.

Over the weekend it was revealed that Chinese property giant Evergrande had filed for bankruptcy protection in the United States. This was done so that the indebted company could protect its assets, as it continues to try to find ways to manage creditors.

Evergrande had a public meltdown and defaulted on its debt in 2021 before announcing an extensive off-shore debt restructuring program. The company now appears to be on life support.

Investors in the region are concerned that China’s massive property sector will face contagion. Other major developers like Country Gardens are also failing to make debt payments and the sector, which is believed to contribute as much as 30% of Chinese GDP, is desperate for support from the government.

While BTC is banned unequivocally in Mainland China, buyers from the country are still thought to be major contributors to price action through off-shore avenues and tools like VPNs.

In the background of these factors, US treasury yields are soaring. This is pushing investors away from risk markets and towards saving. Bond yields have risen as the US federal reserve has continually raised rates over the past year to get to a target rate of just over 5%.

Yields have risen this week with expectations that US interest rate hikes will continue as hot US economic data continues to emerge. The 30-year US treasury yield is at its highest level since 2011. The high, safe return offered by treasury bonds, is pulling value away from asset classes such as equities and crypto.

Crypto news for the weeks ahead

August 31

The US Bureau of Economic Analysis (BEA) will release July’s Personal Consumption Expenditures (PCE) numbers. This is the primary indicator used by the FOMC to measure inflation and is considered carefully when considering interest rate levels.

September 13

The Consumer Price Index data for August will be released – one of the indicators the Federal Open Market Committee (FOMC) watches when considering interest rate hikes.

September 20

The FOMC will meet. Futures markets are strongly leaning towards a prediction of no further rate hikes, thus leaving the federal funds rate target at 5.25 – 5.5%. Fed Governor Christopher Waller, however, hinted in mid-July of additional rate hikes.

Top 10 Crypto Summary

Like Bitcoin, ETH, and BNB, most large-cap assets faced heavy selling pressure that led to price losses. ETH dropped sharply despite reports that US securities regulators are set to approve a futures-based ETF very soon. Bitwise and VanEck are amongst the firms that have applied for such a product.

Bitcoin Price Chart

A key factor in the aggressiveness of the price drop was a long squeeze. Long squeezes occur when long traders are forced to close their positions (at a loss) due to a sudden price drop. These traders are forced to cover their positions quickly by selling before the price goes even lower, creating a waterfall effect. It has been reported that over US$1 billion worth of longs were liquidated in a 24-hour period. The market has observed an intense flush of both spot and derivative traders expecting the price of BTC to rise higher.

Don’t miss out – Find out more today