Crypto Market Forecast: Week of August 29th 2022

A curated weekly summary of forward-focused crypto news that matters. This week, digital asset markets tank as Fed Chairman says significant interest rate rises are coming, progress on bipartisan crypto bills are paused because of upcoming US midterms, and Tether announces a new monthly reporting schedule.

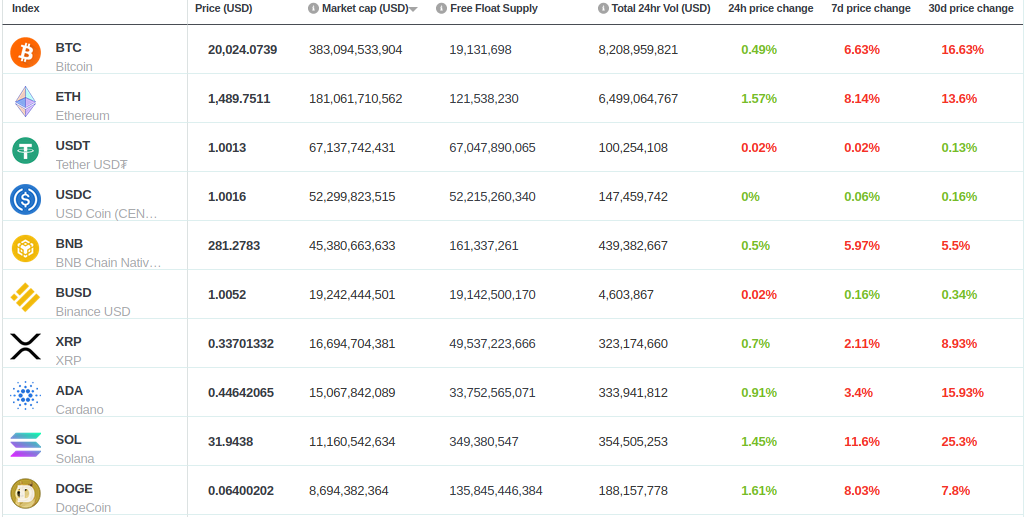

Bitcoin’s (BTC) price fell by nearly 17% in the last week and currently trades around ~US$20K. Ethereum‘s (ETH) price also dropped by almost 14%, and sits at ~US$1.5K. Binance-coin (BNB) also lost momentum, down nearly 6%, currently trading at ~US$280.

Fed Chair Jerome Powell spoke this past Friday (August 26) in Wyoming and hinted at the potential for “another unusually large increase” in the federal funds rate for September — just as he had previously signaled in July’s FOMC meeting. Powell, however, didn’t indicate the further “large increase” to be a sure thing but instead stated that it “will depend on the totality of the incoming data and the evolving outlook”.

Bitcoin’s price had recovered to nearly US$25K over the past month but had dipped to a level between US$21K-22K for about a week in the days preceding Powell’s Friday speech. But in the two days thereafter, Bitcoin’s price fell further and even dipped below US$20K. Share markets also saw steep declines.

Regulatory uncertainty continues as no crypto bill is expected to pass before the US midterm elections and markets wait to see the electoral outcome of the House and Senate. Proposed bills such as the bipartisan Lummis-Gillibrand “Responsible Financial Innovation Act” seem to have made their way to the sidelines because of this.

Meanwhile, the industry awaits the outcome of OFAC’s (until recently) unprecedented sanctioning of smart contracts (in the case of Tornado Cash) and whether Securities and Exchange Commission (SEC) Chair Gary Gensler’s assertion that most digital assets fall under the SEC’s jurisdiction will carry weight over the long-term.

Gensler recently argued in a WSJ op ed that crypto should be treated like any other capital market — despite its new technological foundation. Gensler’s op ed received criticism this last week from the likes of Mark Cuban and Republican Congressman Tom Emmer who accuses the SEC of “[needing Congressional] oversight badly” and not wanting to give up jurisdiction: “even jurisdiction they don’t have”.

The Catawba Indian Nation, a federally-recognized, sovereign Indian Nation government based in South Carolina, has published a draft for how Decentralized Autonomous Organizations (DAOs) could be recognized and regulated under the Catawba Digital Economic Zone (CDEZ). The CDEZ requests feedback from the public before September 10th and has set up a Discord channel as part of a public forum.

The draft regulation makes provisions for recognition of two types of legal entities: “Decentralized autonomous unincorporated nonprofit association” (“DAO UNA”) and “Limited liability decentralized autonomous organization” (“DAO LLC” or “LAO”).

With a regulatory framework geographically situated within North America and innovation-friendly regulators (in states like Wyoming), we may see exciting DAOs based out of the CDEZ in the future.

Crypto news for the weeks ahead

Unknown date – monthly reports for Tether

Tether has announced that it has hired top accounting firm BDO Italia and will start publishing monthly reports (formerly quarterly).

Week of September 15th

The Ethereum blockchain is projected to launch its mainnet proof-of-work (PoW) to proof-of-stake (PoS) transition (“the Merge”) on 15 September.

Top 10 Crypto Summary

Asset prices in Brave New Coin’s top-ten market cap list have dropped significantly across the board (excluding stablecoins) with Solana (SOL) and Bitcoin (BTC) hardest hit: down ~25% and ~17% respectively versus the previous week. In both cases, the drop followed Fed Chair Jerome Powell’s Friday speech.

Bitcoin Price Chart

This week Glassnode looked at various indicators on the Bitcoin blockchain to see if there may be some fundamentals in place that could carry the market upward. Glassnode found no such evidence. For example, Bitcoin’s 30-day monthly average of new addresses is lower than the 365-day average (low market demand). Miner revenue from fees is down (currently at about 2% total transaction value). The sum of transactions valued at below US$1M has declined since Q1 2021, while the sum of transactions valued above US$1M has moved sideways over the same period (indicating a relative decline in retail activity, yet a new institutional dominance). Further, the inflow and outflow of funds to exchanges are also down. And lastly, when we look at 90-day net realized profit/loss, we notice that present losses are at the same level of historically high realized losses as they were back in 2018 and the first part of 2019.

Don’t miss out – Find out more today