Crypto Market Forecast: Week of February 21st 2022

A curated weekly summary of forward-focused crypto news that matters. This week, digital asset investors play it safe as the US warns of a Russian invasion, the Ethereum network hashrate hits a new all-time high, and investors prepare themselves for the latest round of inflation figures from the US.

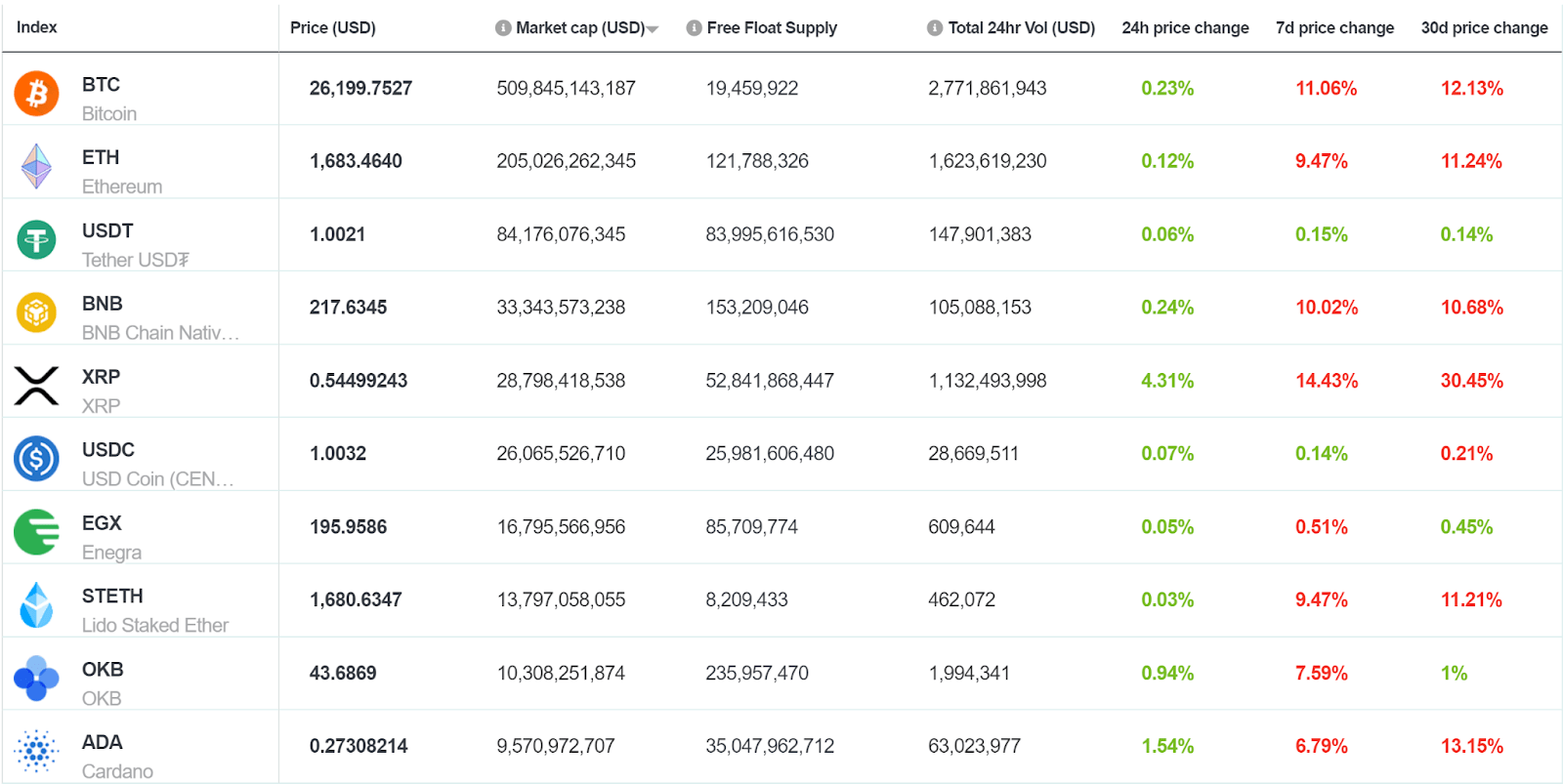

Digital assets slid last week as geopolitical headwinds created fear for investors across financial markets. Bitcoin (BTC) ended the week down ~8%. Ethereum (ETH), and Binance-coin (BNB), the 2nd and 3rd largest assets on the Brave New Coin market table, were down ~7%, and ~3%.

Over the weekend numerous reports suggest that the US has warned allies of an imminent invasion of Ukraine by Russia. America says there will be multiple target cities including the capital Kyiv, Odessa in the South, and Kharkiv in the North West. US intelligence believes that the attack will happen in the next few days.

US intelligence is reportedly making its assessments based on the types of forces and capabilities Russia has set up near the Ukrainian border. The invasion is expected to involve air support and may begin with cyber attacks.

Moscow, however, has rubbished any claims that strikes on Ukrainian cities are imminent. Russian leaders say that they are pulling troops back from the border and have mocked Western intelligence services for claiming that an attack is planned.

Despite the denials from Russia, investors are pulling their money out of assets that are perceived to be high risk to leave it on the sidelines or reallocate to safe havens and low-risk options. If the US is right and there is an invasion in Ukraine, there are likely to be severe civilian casualties. Russia would almost certainly be hit with strong sanctions from most Western countries. This would affect global supply chains and the European economy negatively and some investors are likely preparing for this type of worst-case scenario.

For the cryptocurrency industry, the USA and Russia are the 1st and 3rd largest producers of hashrate in the world, so the war in Ukraine may have direct consequences on the fundamentals of Bitcoin and other proof-of-work assets such as Ether.

Even if the odds of a major hashrate dip are low, the chances of another sharp crypto pullback if the environment in Ukraine worsens is high. Crypto markets have a history of sharp knee-jerk reactions to macro events, often well before the real implications are fully understood. Trading with high leverage is always prevalent in crypto, so long traders trying to buy a dip and getting caught out may create a squeeze.

The Crypto Fear and Greed Index, which assesses the sentiment and optimism of crypto markets currently hovers between ‘Fear’ and ‘Extreme Fear’.

Following a period where optimism returned to Crypto in early February following price gains, sentiment improved to a point where the Crypto Fear and Greed Index had pointed to neutral. Sentiment hitting Extreme Fear may be a sign of seller exhaustion and potential reversal but given the bearish macro conditions traders are advised to proceed with caution.

Crypto news for the week ahead

22nd February- BitTorrent File System (BTFS) 2.0 launches

This Tuesday BTFS, a protocol and web application that powers the Bittorrent decentralized file-sharing network is set to begin a major upgrade after a successful testing period. BTFS nodes are to be airdropped BTT tokens as part of the transition process. The price of BTT is down ~10% in the last 7 days.

25th February- Monthly Core inflation data is released

This week’s attention again turns to the US Federal Reserve, as core inflation data for January gets released mid-way through the next week. The core inflation metric excludes food and fuel, and economists are predicting that it is set to jump by as much as 5.2%. If inflation, as predicted, is high then the pressure for the Fed to increase interest rates and tighten monetary policy quickly is likely to ramp up.

Top 10 Crypto Summary

Most large-cap crypto assets pulled back alongside Bitcoin as the rush to safety affected volatile assets across financial markets. Despite the bearish price action the fundamentals of crypto projects show signs of strength. The hashrate of Ethereum hit a new all-time high yesterday. This indicates long-term confidence in the value of the network by miners and a willingness to deploy capital into it despite the price of ETH dropping.

Bitcoin Price Chart

Bitcoin (BTC) trading continues to be choppy in the short term. After a strong start to the week that pushed the Bitcoin price up to US$44,000, the escalating tensions in Ukraine dragged markets back in the second half. Glassnode reports that active address activity on the Bitcoin network is well below bull market high, indicating that new entrants are slowing down usage. It is explained, however, that the active address activity floor is rising – indicating longer-term network effects are playing out.

Don’t miss out – Find out more today