Crypto Market Forecast: Week of February 7th 2022

A curated weekly summary of forward-focused crypto news that matters. This week, digital assets recover as Bitcoin surges on the back of strong US jobs data, crypto investors seem unconcerned by potential interest rate rises, and the Ripple legal team scores some wins in its ongoing court case with the SEC.

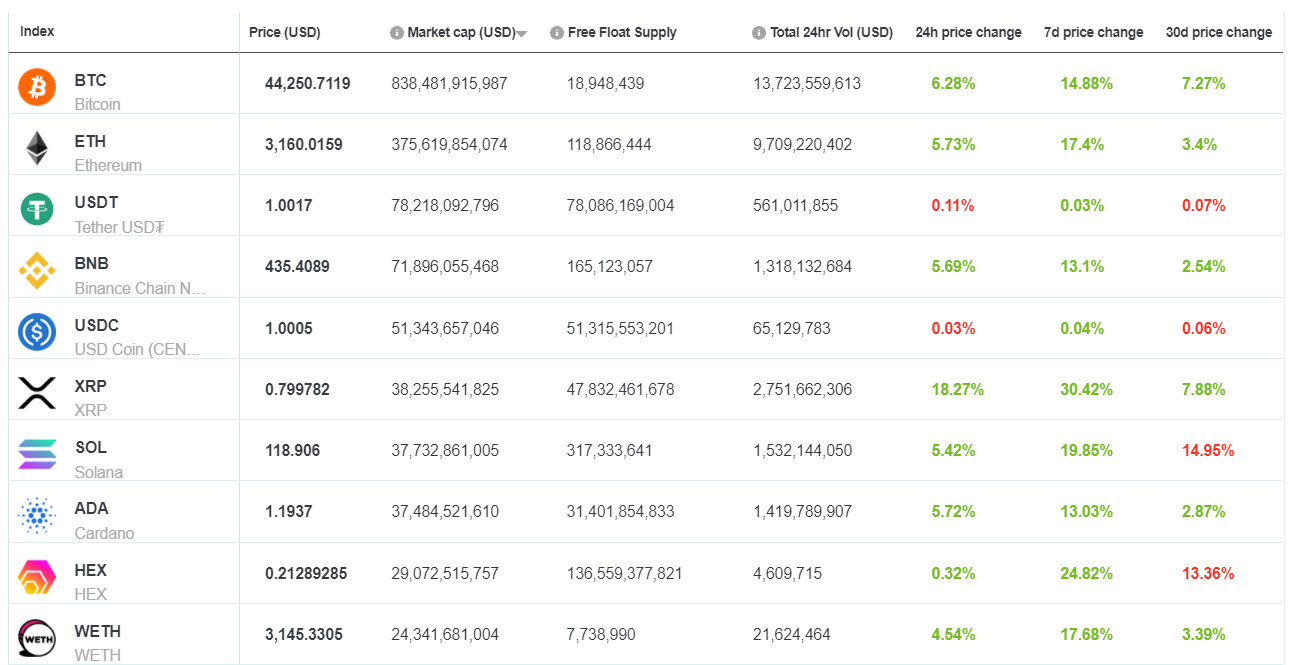

Crypto markets have had a positive start to February. A strong close to the week saw the price of Bitcoin (BTC) shoot through resistance at US$40,000 and on to above US$44,000. The price of BTC is up an impressive 14% for the week, while Ethereum (ETH), and Binance Coin (BNB), the 2nd and 3rd largest assets on the Brave New Coin market cap table, were up 17% and 16%, respectively.

The Friday uptick in markets followed stronger-than-expected US job market data. A surge in jobs was unexpected because of the rising number of Omicron COVID-19 cases in the country. The employment momentum and rising wages are building pressure on the Federal Reserve to raise interest rates to protect against the potential of an overheating economy.

There was a broad-based 467,000 gain in nonfarm payrolls, a number that exceeded most economists’ predictions. Alongside the impressive job creation data, the unemployment rate has improved and wages are rising.

The digital asset market recovery–despite signals of an impending interest rates hike–indicates a swing in investor sentiment. This week investors have backed BTC and other crypto assets to rise despite a potential bearish turn in the wider economy.

While crypto boomed, equity market indices like the S&P500 and Nasdaq were flat and marginally down in the last week. Investors in these markets appear to be circumspect as they wrestle with the implications of monetary tightening.

So far in 2022, the correlation between digital assets and the traditional risk market has been high. The break from the relationship this week may indicate a shift towards Bitcoin temporarily being considered more of an uncorrelated/safe haven asset akin to gold.

Markets also received a boost early this week, after it was announced that the Canadian arm of global accounting giant KPMG has made its first allocation of crypto assets to its corporate treasury. KPMG will add Bitcoin and Ether to its corporate treasury.

“Crypto assets are a maturing asset class," explained Benjie Thomas, Canadian Managing Partner, Advisory Services, KPMG in Canada.

"Investors such as hedge funds and family offices to large insurers and pension funds are increasingly gaining exposure to crypto assets,” Thomas continued, citing the driving reasons behind KPMG Canada’s new treasury policy. The accounting giant believes blockchain technology will continue to grow and will become a regular part of the institutional asset mix.

It was revealed via SEC filings this week that the fair market value of Tesla’s bitcoin holdings as of December 31, 2021, was $1.99 billion.

The mainstream appeal of Bitcoin and crypto received a further boost as Nasdaq approved the Valkyrie Bitcoin Miners Exchange Traded fund (ETF) for trading on its platform. The ETF will offer exposure to the stocks of companies associated with bitcoin mining. It will trade under the ticker symbol “WGMI”. On crypto social media, this is a commonly used acronym that stands for “We’re all going to make it.”

Crypto news for the week ahead

10th February- Release of US Inflation data for January 2022

After impressive US job market data last week, all eyes will turn to the impending release of US inflation data this week. Investors and traders are trying to read how aggressively the Fed will switch to a more hawkish, tight monetary policy. If it is announced that inflation is high, then this would signal a need for the Fed to increase the pace of its rate hikes and may cause a downturn in risk markets.

13th February- Release of Mystique on the Ethereum Classic mainnet

Following successful testnet demos, the launch of a major ETC upgrade, Mystique, is set to occur on the 8th of January. The Mystique upgrade will mirror the milestone London upgrade that occurred on the Ethereum network. It will begin the burning of ETC tokens generated through transaction fees and may increase the store-of-value appeal of the token because of the new deflationary implications. ETC is up an eye-catching ~31% in the last 7 days.

Top 10 Crypto Summary

Large-cap crypto assets continued their recovery, backing up strong gains from two weeks ago, with even larger returns this week. XRP was the best performer in the top 10, rising by close to 30% in the last week. The remittance token’s impressive gains appeared to be driven by events in an ongoing legal case where the SEC is accusing Ripple of selling XRP as an unregistered security. A judge ordered the unsealing of three documents in connection to the case as requested by Ripple. Observers viewed this as a major win for the Ripple team.

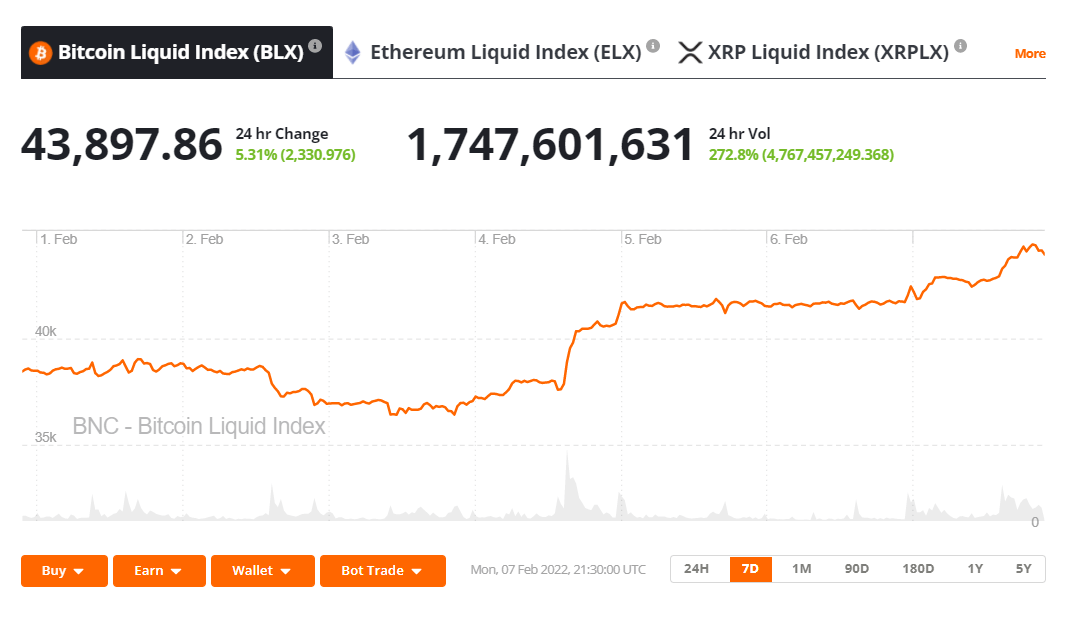

Bitcoin Price Chart

Bitcoin has enjoyed its first major rally of 2022 and onchain data providers Glassnode report that the momentum is backed by tangible fundamentals. Glassnode writes in its weekly report that this rally is the first that has a lot of short-term holders in profit. Many of these new buyers were not shaken out during January’s price drop and have shown a commitment to holding BTC. In a similar vein, based on fundamentals, much of this recent price pickup has been driven by natural capital inflows.

Don’t miss out – Find out more today