Crypto Market Forecast: Week of January 10th 2022

A curated weekly summary of forward-focused crypto news that matters. This week, risk markets grapple with possible interest rate hikes, Kazakhstan's miners struggle with an internet blackout and Ethereum's largest layer-2 solution goes offline.

Bitcoin and the digital asset markets have just snapped a 6-day losing streak following a dire start to the year for the sector. Bitcoin (BTC) ends the week down ~9% and trading near US$42,600. Ethereum (ETH) and Binance coin (BNB), the second and fourth largest assets in crypto, fell by ~15% and ~16% respectively.

The losing streak is the worst for BTC since July 2018 with the Bitcoin price now down ~39% from its all-time high of US$69,000 in November. Risk markets are continuing to consolidate and sell-off after a strong 2021.

Last week the markets were shaken by the release of new Federal Reserve minutes from December 14th-15th which revealed that U.S. policy makers are considering an aggressive interest rate hike to combat rising inflation in the country. The Fed is also discussing quantitative tightening, the opposite of quantitative easing, which will involve attempting to reduce the amount of money in circulation.

It appears that the Fed will stop bond purchases and the pumping of new money into the US economy by March. It will then start rising interest rates between March and June.

The crypto sector has benefitted from the Fed’s dovish monetary policy during the pandemic era. This has pushed interest rates drastically low and devalued the US dollar through 2021.

Why would an investor park his wealth in an investment vehicle that while safe, only offers a 0.1% interest rate? Borrowing to invest in high risk assets like crypto and equity becomes far more appealing in this environment.

However, the Fed is now signaling that it is set to raise rates. This will make borrowing more expensive and investing in risk assets less enticing. Investors are now reading the signs and making the call to start shifting preferences towards safe, steady return assets. That means an unwinding of positions in high-risk high-return assets.

Similar to the crypto sector, the equity markets and high growth, high risk tech stocks have shed heavily after the release of the latest Fed minutes. The Ark Innovation ETF, which invests in stocks in emerging sectors like AI and DNA technology, is down ~11% so far this year.

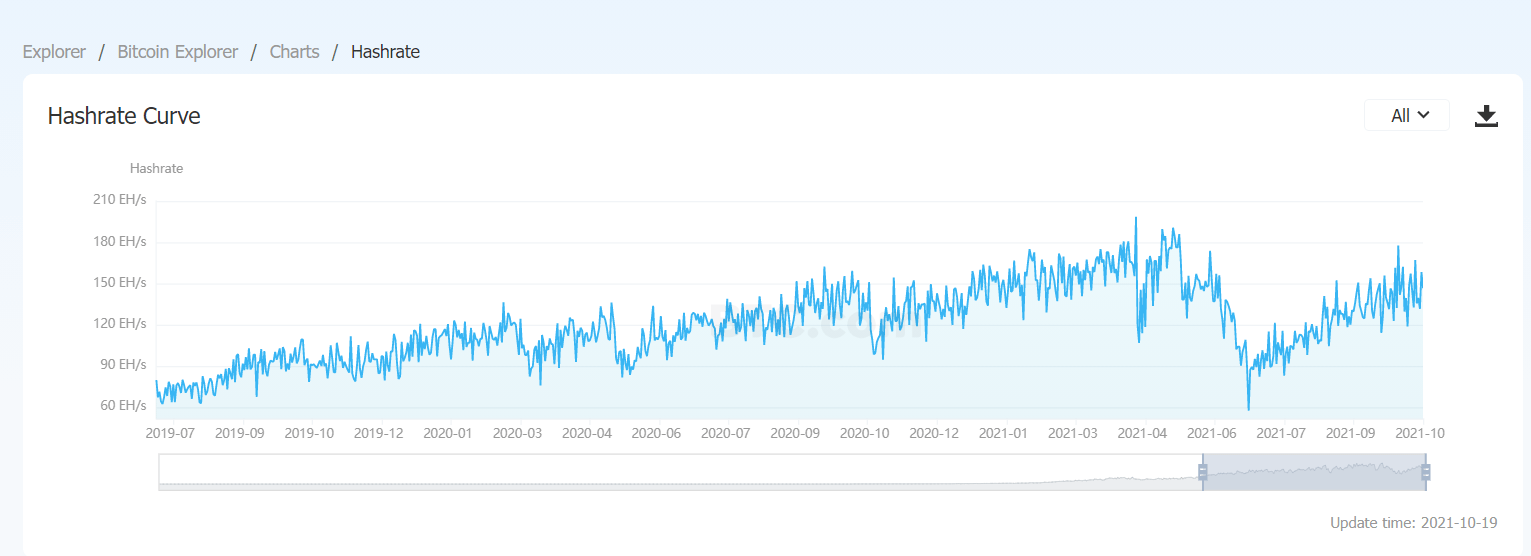

On the fundamental side, the Bitcoin network has had to cope with a loss of hashrate from Kazakhstan, now the second largest producer of hash power in the world. The country is grappling with a nationwide internet blackout and protests. With the internet down, mining farms cannot connect to mining pools and sources on the ground like Didar Bekbau of the Xive mining farm have confirmed that “no internet, so no mining.”

Top mining pools like F2pool, Antpool and Binance pool were all affected by the outage and saw their percentage of Bitcoin hashrate slip. Violent protests in Kazakhstan have erupted in 2022 after the doubling in price of liquified petroleum gas in the country. This led to the declaring of a state of emergency, the internet blackout and the Kazakhstan president sacking the government.

Crypto news for the week ahead

10th January- Zcash network upgrade

This Monday, privacy focused network Zcash (ZEC) will undergo a mandatory upgrade to its new 4.6.0 version. Any 4.5.0, 4.5.1, and 4.5.1-1 Zcash nodes will reach End of Service on or about January 10th, 2022 and all miners must update to the latest version of the network. The new update will contain wallet changes, new APIs and updates to Remote Procedure Calls (RPCs). Zcash is down ~6% in the last week

11th January- Ravencoin (RVN) block reward halving

Ravencoin (RVN) is a blockchain forked from Bitcoin and designed to enable the issuance of security tokens. On Tuesday the network will execute a halving that will reduce the number of RVN offered to miners as a block reward from 5000 to 2500. A halving typically leads to higher prices because a halving event tightens supply, drives scarcity and reduces miner selling pressure. The price of RVN has risen ~4% in the last 2 weeks and has outperformed the rest of the crypto market.

Top 10 Crypto Summary

It has been a difficult week for large cap crypto assets with most suffering heavy double digit losses. On Monday, Ethereum’s largest layer 2 solution, Arbitrum, went offline for more than a few hours. The network is now back to being operational with a blog explaining that the outage was due to a hardware failure. Because of the high gas charges on the base layer, Ethereum users turn to solutions like Arbitrum for cheaper and faster transactions. The struggles of a key Ethereum ecosystem arterial solution are a blow to the overall ecosystem.

Bitcoin Price Chart

BTC’s difficult start to the year has been accompanied by neutral fundamentals which suggest that the recent pullback has been driven more by short term negative sentiment as opposed to any performance related flaws. Data from Glassnode indicates that the amount of BTC on exchanges actually fell during the most recent price drop. This indicates a desire from long term bitcoin holders to hold on to their coins during the recent price drop as opposed to joining in the selling.

Don’t miss out – Find out more today