Crypto Market Forecast: Week of June 19th 2023

A curated weekly summary of forward-focused crypto news that matters. This week, a heavily backed Blackrock bitcoin ETF application creates market optimism, Binance.US finds a middle ground in its ongoing battle against the SEC, and Bitcoin Ordinals are not making the Bitcoin blockchain unsustainable to download.

The price of Bitcoin (BTC) rose by 1.6% in the last week to establish a price position above ~US$26K. There were mixed results across the altcoin market. The second largest asset in digital assets, Ether (ETH) dropped by 1.2% to ~US$1.7K, while the BNB Chain Native Token (BNB) rose by ~4.4%.

A key factor in BTC’s outperformance was optimism around the filing of a spot Bitcoin ‘ETF’ by asset management giant Blackrock. Immediately before the filing of the financial product, the price of Bitcoin was hovering around US$25,000 before receiving a leg-up to push it to higher heights over the weekend.

The new Blackrock product is technically a trust, however, many experts suggest it will have a similar functionality to a spot Bitcoin Exchange Traded Fund (ETF). Senior ETF analyst at Bloomberg Eric Balchunas described the Blackrock Bitcoin trust as the ‘real deal’.

He compares it favorably to SPDR’s Gold Trust, which in most investment circles is considered an ETF and at various points was described as the largest ETF in the world. He said many structures fall under the ETF definition umbrella.

In further tweets he backed the Blackrock BTC trust for approval, pointing to Blackrock’s impressive 575 to 1, approval vs decline ratio when making filings with the SEC.

Speculation around whether a bitcoin ETF would be approved has been a key driver of price action since initial applications began in 2013. Other asset managers including Van Eck, Ark Invest, Bitwise, and Grayscale have all had applications rejected in the past. Balchunas said the Blackrock filing has breathed new life and optimism into the BTC ETF race.

On Friday it was announced that a Federal Judge had signed off on a temporary agreement between the SEC and mega-exchange Binance and its US affiliate. The agreement will have Binance.US take steps to ensure only local employees will be able to access customer funds as the regulators and companies progress on a lawsuit that the SEC has filed against Binance.

The deal follows an SEC motion to freeze all of Binance.US’s assets while it pursued securities fraud charges against the exchange. The SEC said it believed there was a possibility that Binance may move funds or destroy them if there wasn’t a restraining order against the exchange. Binance.US’s lawyer’s say the order would destroy the exchange.

The new agreement proposes that Binance.US will take steps to ensure that no one from Binance Holdings, the Binance parent company, will have access to private keys for Binance.US’s crypto hot or cold wallets, or root access to the company’s Amazon Web Service tools. Binance US will also have to share information about its business expenses in the coming weeks.

Crypto news for the weeks ahead

June 30

The US Bureau of Economic Analysis (BEA) March Personal Consumption Expenditures (PCE) numbers will be released. This is one of the primary indicators used by the FOMC when considering interest rate levels.

June 22

Federal Reserve Chairman Jerome Powell testifies in front of the US Senate Banking Committee. This testimony will be a part of the required twice-yearly reports the Fed has to make to Congress on the state of US monetary policy.

June 22

The release of US current account data. This data reflects the combined balances of trade in goods and services and income flows between US residents and residents of other countries. The US current account has been in a widening deficit for some time.

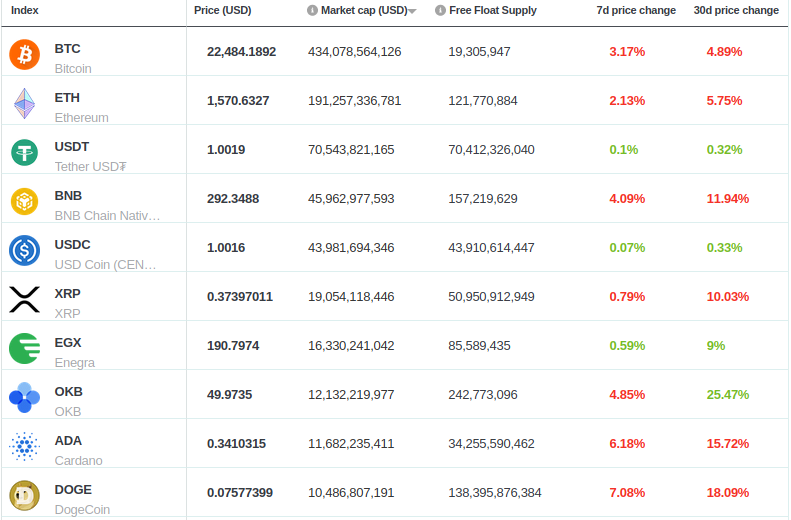

Top 10 Crypto Summary

While the majority of the large-cap asset market has struggled, BTC and BNB moved bullishly backed by specific tailwinds — An ETF by a major asset manager and a key legal win. OKB (OKB) also had a strong week that may have been driven by the recent coin burn announcement.

Bitcoin Price Chart

GLASSNODE’s Twitter account reported that concerns that the popularity of the Ordinals protocols chain size would severely affect the initial Bitcoin download for future node runners are exaggerated. The Onchain data provider has said that the Bitcoin block size is still growing at a manageable rate of 1.89MB per block.

Don’t miss out – Find out more today