Crypto Market Forecast: Week of June 20th 2022

A curated weekly summary of forward-focused crypto news that matters. This week, Crypto continues to suffer from the effects of the Celsius collapse, The Fed introduces a significant rates hike and Cardano prepares itself for the Vasil Hard Fork.

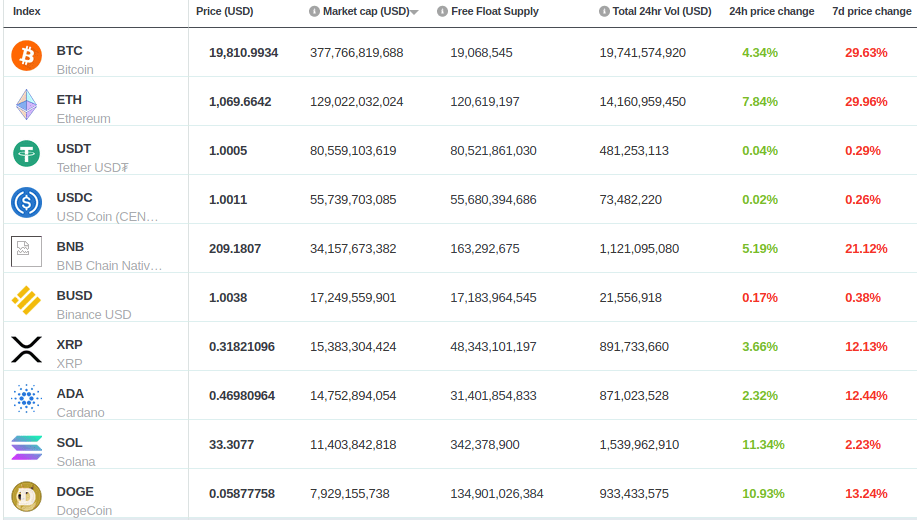

Bitcoin (BTC) and Ether (ETH) both dropped by ~30% over the previous week and currently sit at ~US$20K and ~US$1.1K respectively. Binance coin (BNB) fell by ~21% and currently sits at ~US$209.

On Sunday, June 12, the Celsius Network, a crypto lending platform, announced that it would be “pausing all withdrawals, Swap, and transfers between accounts… [d]ue to extreme market conditions”. Following the already shaky market in the aftermath of the May 8 TerraUSD/LUNA collapse, Bitcoin’s price fell as low as US$21K within a day after the Celsius announcement.

Also, not unlike Terra’s Anchor Protocol, Celsius Network promised (and still promises, as of the time of this writing) its users high yields — up to 18.63% APY. The Anchor Protocol promised as high as 20% for TerraUSD (UST) staked.

And, it seems, Celsius and Terra are more directly linked than we might have thought. Blockchain analysts have noted both funds sent to Terra’s Anchor protocol (before the Terra crash) and over a half a billion dollars worth of funds withdrawn from it.

A Bitcoin Magazine deep dive into the Celsius business model and white paper last week questioned the need for Celsius to have its own blockchain and native token at all, concluding that both were used as marketing hype to attract token sales.

State-level security regulators in Alabama, Kentucky, New Jersey, Texas and Washington are now investigating Celsius following the announcement to pause withdrawals.

These recent events follow a 2021 round of funding in which Celsius raised US$400 million — including from Canada’s second largest pension fund (Caisse de dépôt et placement du Québec) and WestCap. Shortly thereafter, it was announced that Celsius would use US$300 million of that to mine bitcoins for its lending business.

Also last week, the US Federal Reserve Chair Jerome Powellannounced that the Federal Open Market Committee (FOMC) would raise interest rates by 75 basis points — from 0.83 to 1.58% — and would continue to “significantly” reduce its balance sheet in an effort to control inflation. Note that in the few months preceding the March 2020 massive global response to COVID, interest rates hovered between 1.58 and 1.59%, so the FOMC’s decision is the first time in over two years interest rates reflect some sense of normality (albeit still falling far below interest rate levels before the 2008 Global Financial Crisis).

If crypto asset prices continue to maintain their correlation to NASDAQ tech stocks, expect private companies to proceed with more caution, weathering the storm. And as such, expect stock prices to drop (as they have, following the FOMC announcement of last week).

Crypto news for the weeks ahead

24 June

The Einsteinium community will be launching an upgrade and “Komodo hardfork” this week to stay up to date with security standards.

End-of-month in June

The Cardano (ADA) community awaits the “Vasil hard fork” of its blockchain. The upgrade will increase the block size limit (allowing for more transactions per block) and hopes to achieve lower transaction fees.

19-21 July

The Ethereum community will launch a major event in Paris in July: the upcoming Ethereum Community Conference. It will host “more than 100 speakers… from all over the world, multiple side events, meetups, panels and parties”.

Top 10 Crypto Summary

There was a major drop this week, across the board, for assets in the market cap top 10. Bitcoin (BTC), Ether (ETH) and Binance Coin (BNB) were each down by more than 20 percent. As we have seen since the birth of alt-coins, the price of one digital asset affects all others, especially (and more noticeably) for digital assets with the highest market cap.

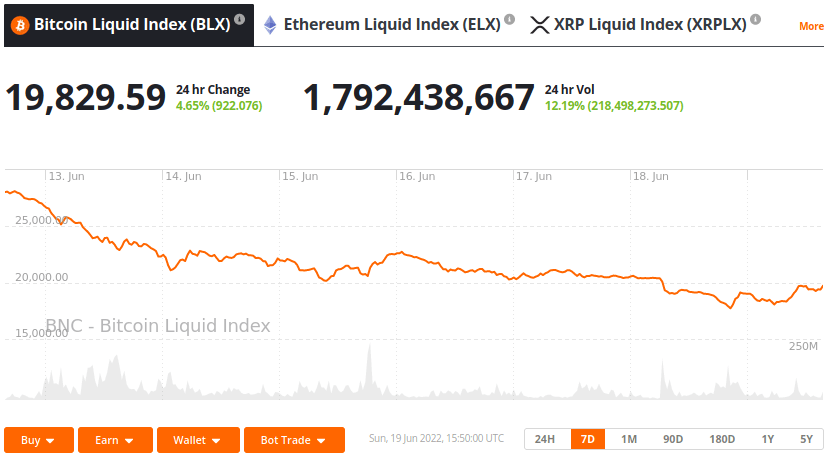

Bitcoin Price Chart

This week we saw significant downward pressure on the Bitcoin price as sell offs occurred without the “HODLer class” able to keep prices around the US$30K price point, where it sat for several weeks — despite still being in “accumulation mode”. Glassnode’s most recent special report noted that “even the long term holders, the smart money, the people who have a long term time horizon, are now getting to the point of underperforming the aggregate market”.

Don’t miss out – Find out more today