Crypto Market Forecast: Week of June 26th 2023

A curated weekly summary of forward-focused crypto news that matters. This week, the optimism surrounding the Blackrock Bitcoin ETF application and other filings fuels market bullishness, a leveraged Bitcoin ETF is set to open for trading this week, and on-chain data offers insights into blockchain halving cycles.

The price of Bitcoin (BTC) has surged by over 15% since last week, to ~US$30.6K. Ether (ETH) climbed by 8.6% to ~US$1.9K. Binance-coin (BNB) dropped by 3.8% amidst the SEC’s crackdown against it, it currently trades at ~US$240.

Bitcoin’s price still benefits substantially by the recent news of BlackRock’s spot Bitcoin ETF application. As reported last week, NYC-based investment firm BlackRock Inc applied for a Bitcoin spot exchange-traded fund (ETF) on Friday June 16th.

According to the U.S. Securities and Exchange Commission (SEC), BlackRock has $8.6 trillion of “assets under management” (AUM), as of December 2022. As if BlackRock’s own application wasn’t a bullish enough news event for BTC, subsequent applications were filed by WisdomTree, Invesco, and Bitwise. With BlackRock’s stellar record of getting SEC approvals for ETFs (suggesting a positive relationship with regulators), additional applications by these latter three firms suggest that the market perceives that BlackRock must be confident of the SEC’s likelihood of approving it, or they wouldn’t have bothered.

As Bloomberg reported: “Given BlackRock’s status as the world’s biggest money manager with roughly $9 trillion, the filing is being taken as a sign that the SEC might finally give the green light to a physically-backed [spot] Bitcoin ETF — a structure the regulator has repeatedly rejected, citing risks such as fraud and manipulation in the spot market for the token.”

All previous (30+!) applications for Bitcoin spot ETFs have been denied. Bitcoin futures ETFs, however, have already been approved.

Cameron Winklevoss of Gemini wrote that “Anyone watching the flurry of ETF filings understands the window to purchase pre-IPO bitcoin before ETFs go live and open the floodgates is closing fast. If bitcoin was the most obvious and best investment of the previous decade, this will likely be the most obvious and best trade of this decade”. Clearly, hype drives upward price movement.

As a separate but related matter, a company named Volatility Shares was successful in getting a leveraged Bitcoin futures ETF greenlighted by the SEC, not by the regulator’s explicit approval but rather by its non-denial. The ETF will go by the name of “2x Bitcoin Strategy ETF”, under the ticker symbol BITX.

The ETF will allow investors to gain exposure to Bitcoin without having to take custody of the actual digital asset itself, and as a 2x, they will only have to put up 50% of the value. The fund drew criticism from Custodia Bank CEO Caitlin Long (a critic of fractional reserve) who argued that “leverage & #bitcoin do not mix, period”.

Volatility Shares’ leveraged Bitcoin futures ETF will begin trading on June 27th.

Crypto news for the weeks ahead

June 30

The US Bureau of Economic Analysis’ (BEA’s) release of March’s Personal Consumption Expenditures (PCE) numbers will be released. This is one of the primary indicators used by the FOMC when considering interest rate levels.

July 12

The Consumer Price Index data for June will be released – one of the indicators the Federal Open Market Committee (FOMC) watches when considering interest rate hikes.

July 26

The FOMC will be meeting. Futures markets are strongly leaning towards a prediction of another 25 bps hike, thus bringing the interest rate target to 5.25 – 5.5%.

August 2

Litecoin’s (LTC’s) block reward will halve, dropping from 12.5 LTC per successfully-mined block to 6.25.

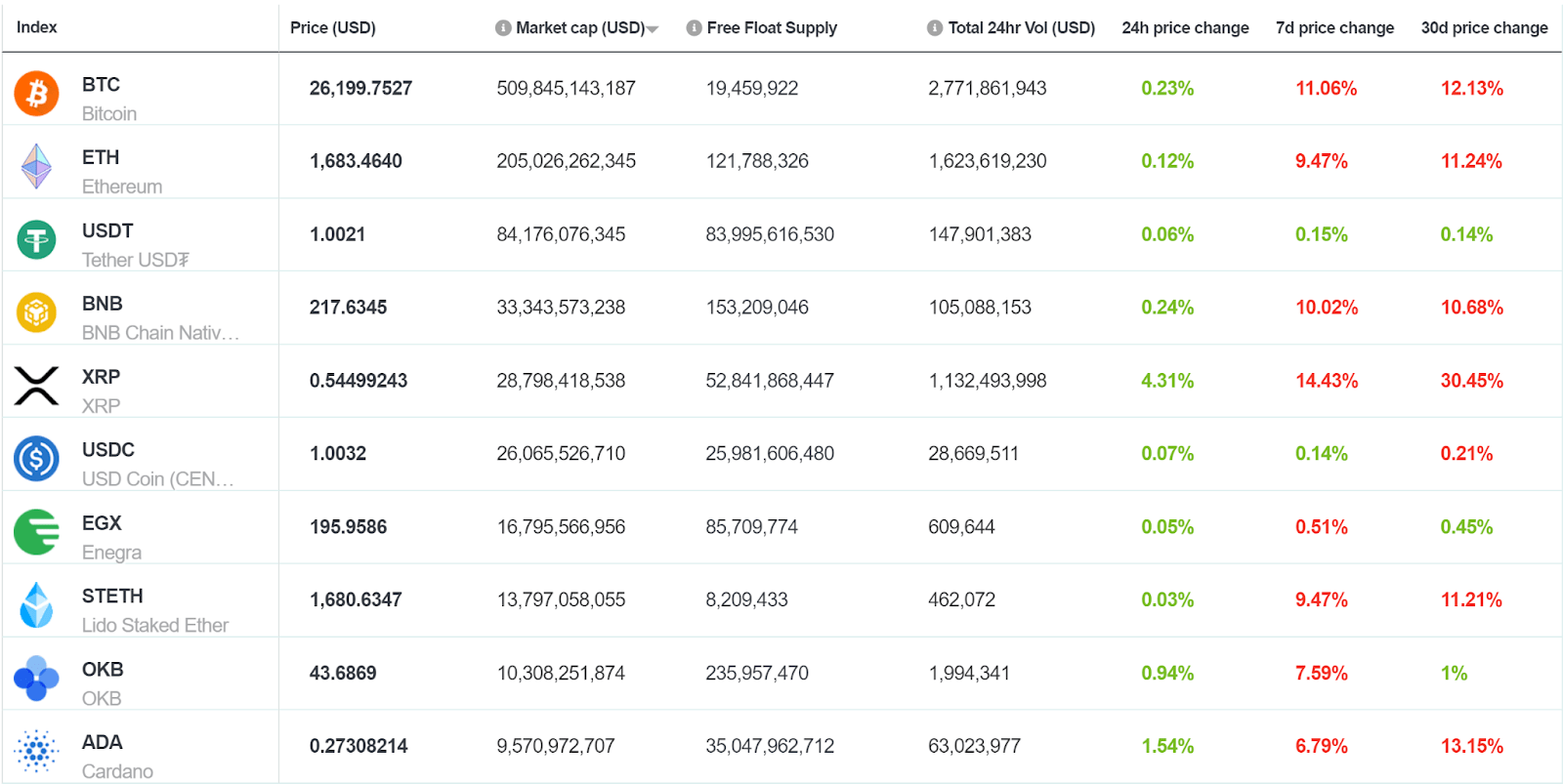

Top 10 Crypto Summary

Another bullish week (for non-stablecoins) almost across the board this week for BNC’s top 10 digital assets by market cap. Bitcoin (BTC) was the biggest winner, up over 15% since last week, riding the news of BlackRock’s application for a BTC spot ETF. Binance-coin (BNB) dropped by almost 4% as the exchange still struggles with regulators in the US.

Bitcoin Price Chart

In light of Bitcoin’s upcoming halving (or “halvening”) event expected in April 2024 (when the block reward will drop from 6.25 to 3.125 Bitcoins every ~10 minutes), it is also interesting to look at price performance leading up to each halving event.

GLASSNODE published a recent chart showing price performance, starting 305 days from each halving event (or “epoch”, roughly 4-years apart). While epochs 1 and 2 (with halvings in November 2012 and July 2016 respectively) saw substantial gains, epoch 3 (ending in May 2020, the 3rd halving) was negative: -6.4% with a -53% max drawdown in March 2020, with the “exogenous shock of March 2020”. Epoch 4’s price performance will be eagerly observed in April 2024.

Don’t miss out – Find out more today