Crypto Market Forecast: Week of March 27th 2023

A curated weekly summary of forward-focused crypto news that matters. This week, the Federal Reserve looks set to pause interest rate hikes. differences between federal and state-level views on crypto begin to form and Senators seek to pass banning CBDCs in the United States.

The price of Bitcoin (BTC) experienced a slight 0.5% drop this week to ~US$27.9K. Ether (ETH) and Binance-coin (BNB) also fell by ~2.6% and ~3.0%, trading at ~US$1.77K and ~US$328 respectively.

Quantitative tightening (QT) is over. After Fed chairman Jerome Powell stated in 2021 that inflation was “transitory”, his central bank quickly found inflation out of control and in need of aggressive tightening. Interest rate increases were announced at each FOMC meeting beginning in March 2022, and last week’s FOMC meeting is looking like it may be the last interest rate hike for the foreseeable future. The Fed now looks to have de-prioritized inflation control in lieu of rescuing the banking system from the crisis it created with its 2020-2021 era of “free COVID money”.

CME Group’s FedWatch Tool shows that markets are strongly predicting no further interest rate hikes in light of the present banking crisis at the FOMC’s next meeting scheduled on May 3rd. This signals that quantitative tightening is likely over. Since Silicon Valley Bank collapsed on March 10th, the Fed began aggressively increasing its balance sheet – in one swoop, undoing most of the gains it had achieved during its tightening efforts.

As it turns out, Jerome Powell won’t go down in history as another Paul Volcker as he might have liked.

In light of the recent regulatory crackdown on crypto companies, there has been a series of state-level pushback efforts in the United States. Former Coinbase CTO Balaji Srinivasan highlighted a few interesting points in a Twitter thread over the weekend. One point drew from a conversation with Cathie Wood in which she addressed a rumor that Florida governor Ron DeSantis may empower Florida banks to expand their offerings to crypto companies and would protect such state banks against backlash (to the extent possible) from the Federal Reserve. Wood stated that “I think you would see a huge migration of the crypto/digital asset world into Florida and into Florida banks”.

Srinivasan commented that “If [the Fed] didn’t like Florida crypto, [it] could in theory try cutting off FedWire/ACH/SWIFT/CHIPS/RTP/etc access to Florida banks. Some of those it runs itself, some via partners… But doing that would prove how totalitarian FedNow or a CBDC would be”.

US Senator Mike Lee (Rep., Utah) introduced a so-called “No CBDC Act” to amend the Federal Reserve Act to disallow it (the Fed), “the Board, the Secretary of the Treasury, any other agency, or any entity directed to act on behalf of the Federal reserve bank, the Board, the Secretary, or other agency” from minting or issuing a central bank digital currency (CBDC).

In a press release on Senator Lee’s website, he criticized China’s implementation of its own CBDC, arguing that the Chinese government used it to “[cancel] its citizens’ money after a set period, forcing Chinese citizens to spend their savings at the compulsion of the government”. He went on to say that the No CBDC Act would protect Americans against similar intrusions and prohibit the Fed “or any federal government agency from minting or issuing a CBDC, whether through a direct-to-consumer or intermediated model”.

Crypto news for the weeks ahead

April 12

The Consumer Price Index data for March 2023 will be released – one of the indicators the Federal Open Market Committee (FOMC) watches when considering interest rate hikes.

April 2023

Ethereum’s next major upgrade since the Merge, the ‘Shanghai’ hard fork, will allow stakers to withdraw staked ETH. The Shanghai upgrade was scheduled for March but is now targeted for April.

March 21-22

The FOMC will be meeting. In light of the banking crisis, further rate hikes are less probable but worth watching here.

March 31

The US Bureau of Economic Analysis’ (BEA’s) release of February’s Personal Consumption Expenditures (PCE) numbers will be released. This is one of the primary indicators used by the FOMC when considering interest rate levels.

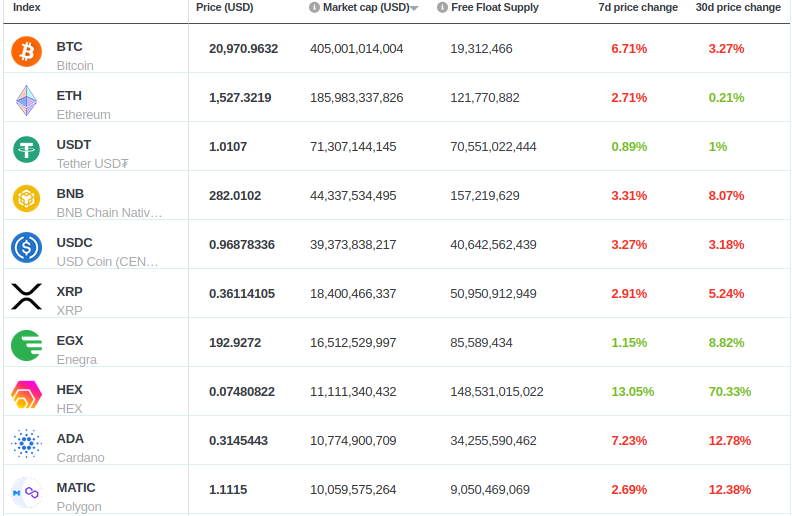

Top 10 Crypto Summary

Most crypto assets in BNC’s top 10 market cap stabilized this week (with mostly minor price drops) after previous weeks of bullish behavior. XRP was one notable exception, up by almost 15% versus the previous week, as hopes that it may win its major case with the SEC continue.

Bitcoin Price Chart

With the rise of ordinals and inscriptions, miners are enjoying new revenues. Transaction fees (in USD terms) on Thursday of last week (March 23rd) were the highest they have been in over a year. Meanwhile, Bitcoin still sees a spike in onchain activity, as measured by its mempool transaction count, valid UTXOs, and a general upwards trend in unique addresses.

Don’t miss out – Find out more today