Crypto Market Forecast: Week of March 28th 2022

A curated weekly summary of forward-focused crypto news that matters. This week, Bitcoin bursts past the US$45,000 price level, the Terra foundation begins its purchasing of up US$2.5 billion worth of BTC, and Ethereum surges forward as progress towards the switch to proof-of-stake continues.

Bitcoin’s (BTC) bullish fortnight continues with the price now hovering around the US$45,000 price level. The asset is up ~10% in the last week. Ethereum (ETH) and Binance-coin (BNB), the second and third largest assets on the Brave New Coin market cap table, are up ~12% and ~7% in the last week.

Last week’s late price push was driven by speculation that Russia will begin to accept bitcoin for natural gas and other hard asset exports. During a press conference, Pavel Zavalny, the country’s Congressional Energy Committee Chairman, said that Russia would be open to accepting a variety of different currencies for exports to ‘friendly’ countries. These currencies would include the Ruble, BTC, gold and local fiat.

Zavalny referenced accepting BTC from ‘friendly’ countries such as China and Turkey for exports while discussing the challenges Russia faces because of Western sanctions as punishment for its invasion of Ukraine.

“If they want to buy, let them pay either in hard currency, and this is gold for us, or pay as it is convenient for us, this is the national currency,” Zavalny explained. “The set of currencies can be different and this is normal practice. You can also trade bitcoins,” he said.

The other key driver of BTC momentum last week is an aggressive bitcoin treasury implemented by the Terra blockchain that is designed to add a security layer to Terra’s native UST stablecoin.

A proposal from the Terra foundation explains that US$2.5 billion will be used to create a pool of Wrapped Cosmos Bitcoin. The tokens can then be used to recapitalize UST when it loses its peg.

Signals on social media suggest Terra founder Do Kwon is buying US$125 million worth of BTC every day to build the reserve. If the trend continues then Kwon may almost single-handedly push up the price of BTC for at least two weeks.

A Bitcoin address that is suspected to be owned by the Terra foundation currently has 24,954BTC deposited into it, this is currently worth ~US$1.1 billion. This implies that the foundation still has plans for another billion dollars worth of BTC to market buy.

Terra’s daily magnitude of purchasing is making it more difficult for bears to continue shorting and may be leading to some seller exhaustion. With the price of BTC threatening to push past US$45,000 Terra’s short-term buying volume should mean seller resistance is weakened for the next week.

The current price of BTC is well above its current 50-day moving average, which sits around US$40,500. In traditional technical analysis, an asset being this much higher than its 50-day MA generally means it is “overbought” and due for a pull-back.

BTC is different, however, and historically it has often pushed higher when it has been “overbought” according to its 50 day MA. For BTC it appears to be a sign of momentum. When Bitcoin has been in the ninth decile of its spread versus its 50-day average (and well above it), it has historically risen 16% in the next month, is up 100% six months later, and has gained 274% after a year, according to data compiled by research firm Bespoke Investment group.

Crypto news for the week ahead

28th March to 30th March- Binance Blockchain Week Dubai

One of the blockchain industry’s largest exchanges and brands, Binance, hosts its annual conference this week in Dubai. The speaker list includes high-profile thought leaders from the Bitcoin and blockchain space, including Polygon founder Sandeep Naliwal and Binance’s own Changpeng Zhao. The event will likely be a platform for Binance ecosystem and its native token BNB may benefit from some hype-related price effects.

1st April – US unemployment rate date for March released

On the back of data released last week which indicated that the number of Americans applying for unemployment benefits has fallen to its lowest level in 52 years, new monthly unemployment rate data is set to be released this week. Unemployment is forecast to be slightly lower than it was last week, down to 3.7% from 3.8%. A strengthening US economy may mean rising interest rates but it is also a signal that the retail crypto market may be regaining strength.

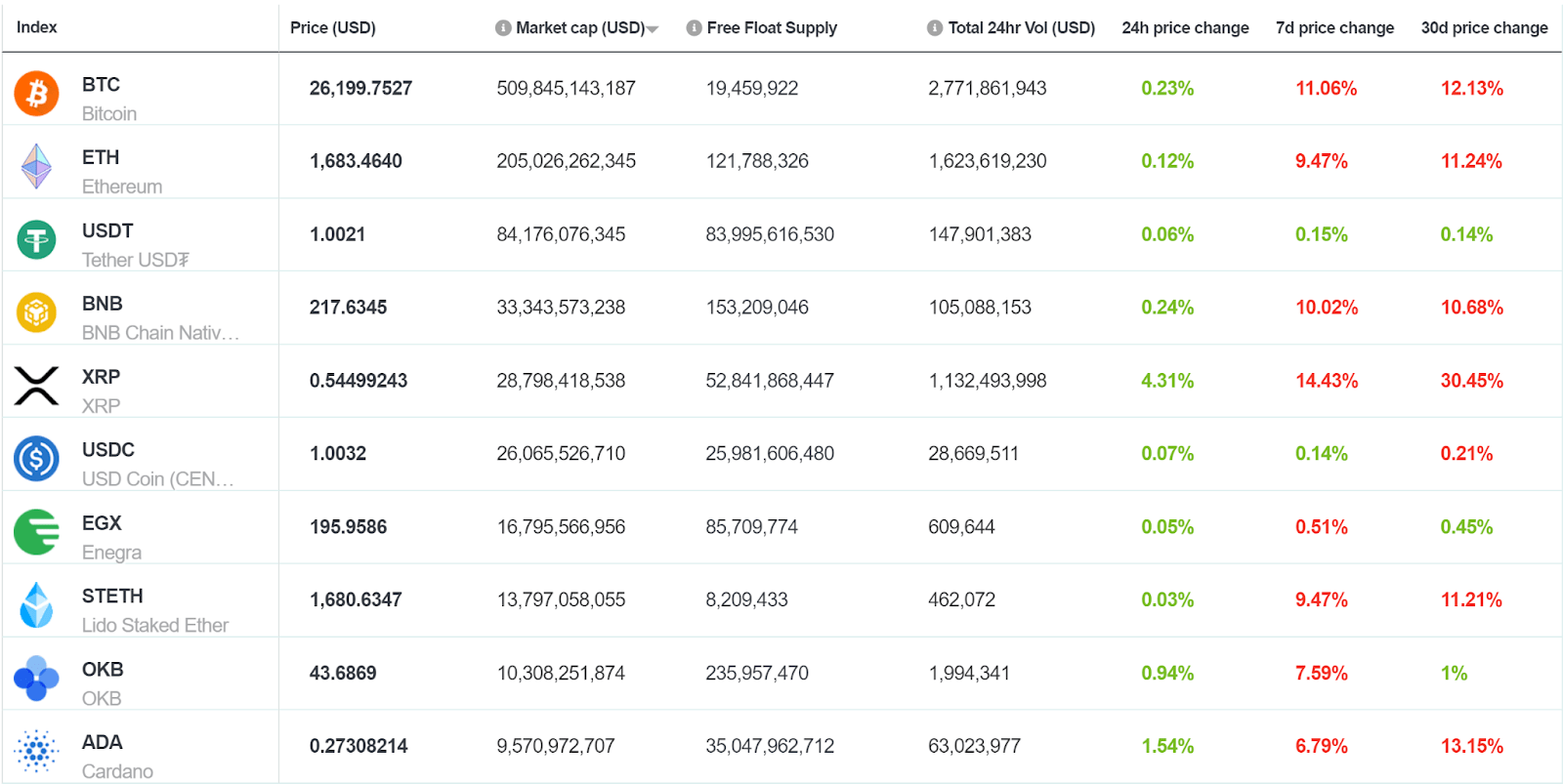

Top 10 Crypto Summary

It was another strong week of solid gains for large-cap assets in crypto. Ethereum (ETH) continues to outperform BTC in the short term. Recent momentum has been driven by optimism surrounding the blockchain’s upcoming transition to Proof-of-Stake as part of this year’s merge update. Last week a shadow fork successfully updated Goerli, one of Ethereum’s oldest testnet, to PoS. The amount of ETH being locked for future staking is also rising rapidly creating supply side pressure.

Bitcoin Price Chart

With some tailwinds like the Terra foundation’s buying momentum set to push the price of BTC higher this week, key battles are set to play out between bulls and sellers at price support and resistance levels. Data provider Glassnode reports that the next major price resistance for BTC will be at US$45,900 as this was the average price paid for by investors after BTC’s all-time high late last year. Bulls will have to push past short-term holders who may soon be selling now that they are profitable.

Don’t miss out – Find out more today