Crypto Market Forecast: Week of May 8th 2023

A curated weekly summary of forward-focused crypto news that matters. This week, Binance closes BTC withdrawals citing congestion, Montana signs a new bill to establish cryptocurrency friendliness, and Americans are worried about the safety of their money stored in banks.

The price of Bitcoin (BTC) has fallen by 2.3% since last week, to ~US$29K. Ether (ETH) rose by 0.2% to ~US$1.9K. Binance-coin (BNB) also rose by a moderate 0.7, by just 1.4%, to ~$326.

Binance announced on Sunday, May 7th that it had “closed” BTC withdrawals citing congestion on the Bitcoin network. It stated that the company “is currently working on a fix until the network is stabilized and will reopen $BTC withdrawals as soon as possible… Rest assured, funds are SAFU” (slang for “safe”).

The paused withdrawals in the context of the series of events in 2022, when many “crypto” companies went under after announcing that users could no longer withdraw funds, has a sense of familiarity. It is, however, worth noting an upward spike in Bitcoin transaction fees: both on a per-megabyte and per-USD value basis – the likes of which have not been seen since 2021. As it turns out, we are seeing an unprecedented level of successful on-chain transactions – never seen before in Bitcoin’s history – as well as over 400K unconfirmed transactions in the mempool. Withdrawals have now been resumed.

The governor of the State of Montana signed into law Senate Bill 178 on Tuesday of last week, which establishes the state as generally friendly to crypto assets and companies.

Among the more notable parts of the new law are (1) a prohibition on local levels of government within the state from passing laws discriminatory against “digital asset mining”, (2) a prohibition on taxes applied to digital assets used as a method of payment, and (3) the legal recognition of digital assets as property. The law defines digital assets as “cryptocurrencies, natively electronic assets, including stablecoins and nonfungible tokens, and other digital-only assets that confer economic, proprietary, or access rights or powers”.

A new Gallup poll conducted in April shows that about half of Americans polled are worried about the safety of money held in banks. The poll showed that 19% are “very worried” and 29% “moderately worried”. But important to note, the poll was conducted between April 3rd – 25th – after the collapse of Silicon Valley Bank and Signature Bank but before the collapse of First Republic, which suggests that the “worried” categories would be only higher at this point.

As the traditional banking sector continues to show itself on increasingly shaky ground, the value proposition increases for alternative assets such as gold or Bitcoin and even to move capital to jurisdictions outside the United States or Europe.

Meanwhile, the Federal Reserve still insists that “The U.S. banking system is sound and resilient”.

Crypto news for the weeks ahead

May 10

The Consumer Price Index data for April 2023 will be released – one of the indicators the Federal Open Market Committee (FOMC) watches when considering interest rate hikes.

May 26

The US Bureau of Economic Analysis’ (BEA’s) release of March’s Personal Consumption Expenditures (PCE) numbers will be released. This is one of the primary indicators used by the FOMC when considering interest rate levels.

June 14

The FOMC will be meeting. Futures markets are presently predicting no further rate hikes to be announced on that meeting.

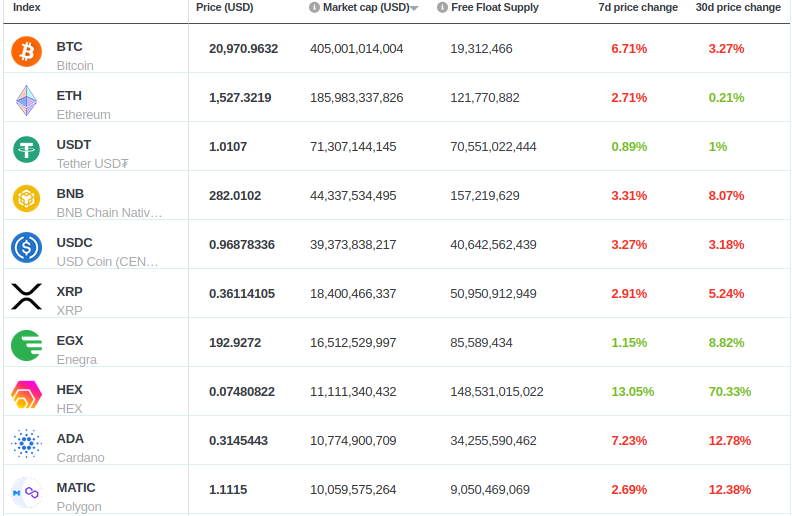

Top 10 Crypto Summary

Digital assets in BNC’s top 10 market cap mostly traded sideways this past week. The FOMC’s 25 bps target rate range hike on Wednesday of last week, which now sits between 5.0 to 5.25 percent, seems to have had little effect on price. Before the rate hike announcement, Bitcoin was trading at $28.2K and rose to as high as $29.7K on Friday before correcting down to $28.5K the day after.

Bitcoin Price Chart

In GLASSNODE’s most recent weekly report it analyzes the sell off event from the previous week of what it argues was “false rumours related to distributions by the Mt Gox Trustee, and the US Government” combined with approximately 3.2K “ancient” (aged over seven years) BTC being “revived” on the Bitcoin blockchain. GLASSNODE’s research concludes that Mt. Gox’s remaining stash of ~138K BTC remain (for now) unmoved since the first distributions in 2018. Meanwhile, large balances of US-gov seized BTC (at ~206K) remain stable, with the exception of ~10K BTC (seized from Silk Road) sent to a wallet believed to belong to Coinbase in March.

Don’t miss out – Find out more today