Crypto Market Forecast: Week of May 9th 2022

A curated weekly summary of forward-focused crypto news that matters. This week, crypto prices dip as New York state bans mining, the Bank of England warns of a recession, and the correlation between crypto and stocks surges to new highs.

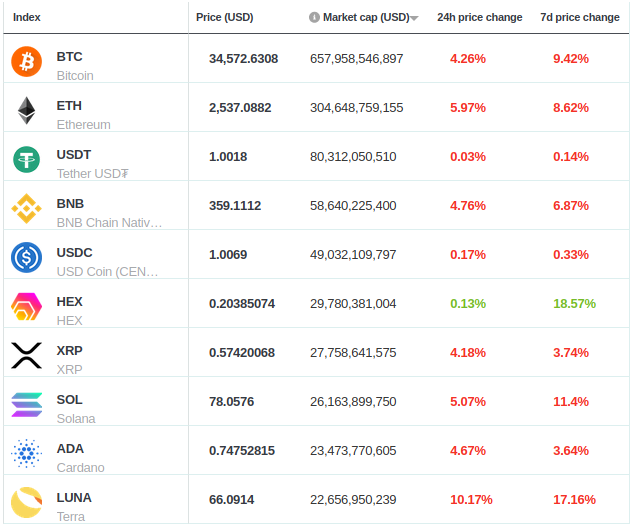

Bitcoin (BTC) dropped more than 9% versus the previous week and currently sits under US$35K. Ether (ETH) and Binance coin (BNB), the second and third largest assets on the Brave New Coin market cap table, dropped by almost 9% and 7% respectively.

Along with Bitcoin, US equities also slid last week as concerns surrounding an incoming global recession continue to grow. On Thursday, the Bank of England increased interest rates in the UK and raised concerns about an impending recession.

These statements combined with concerning job data from the USA, pulled investors away from risk markets. US payroll reports indicate jobs are being created, but, few are being filled. This pattern may push employers to raise wages, adding inflationary pressure to the dollar, and speeding up the interest rate hikes by the Fed required to cool down the economy.

Bitcoin is currently behaving like a cyclical risk asset. The correlation between Bitcoin and stock market indices is hitting multi-year highs with both markets being battered by concerns about how higher interest rates and more expensive capital will affect future prospects. The 30-day Pearson Correlation Coefficient between Bitcoin and the Nasdaq composite has just hit 0.96, suggesting that the two markets are moving together in close sync.

This week’s drop in prices follow a sharp spike in Ethereum’s gas fees after an NFT auction for digital land impacted the entire blockchain (more below) and after the State of New York proposed a two-year ban on the mining of proof-of-work cryptocurrencies. The NY moratorium bill passed already in the State Assembly but has not yet been passed at the Senate level.

While the proposed bill would allow for mining with 100% renewable energy sources, it still faces heavy opposition. Opponents argue that, if passed, it would kill jobs, work against financial inclusion, that it would not make any meaningful environmental difference, and that the state’s 2015 “BitLicense” law already places New York as the most hostile in the country. The BitLicense law is generally seen in the industry as the primary reason that cryptocurrency services will either not accept New York-based customers or at least not make certain products available to them (examples range from Crypto.com to BlockFi).

We need not look far back to see the consequences of such regulations. In 2021, when the Chinese government banned cryptocurrency mining, the majority of the hash rate moved from China (previously with up to 65% hash rate) to the United States, where mining is regulated on a state-by-state level, with Texas, Wyoming, and and Illinois being the most mining-friendly states. The China mining ban follows a series of other crypto-related bans. Before the ban, the China-led hash rate was often cited as a threat to Bitcoin’s decentralization.

Crypto news for the week ahead

9 May 2022

Mist, a Binance Smart Chain-based, NFT action role playing game will do a pre-alpha release this week. The game uses the MIST token for in-game currency, but the token can be farmed and staked inside and outside the game. Details about the game can be found on the Mist website.

11 May 2022

The XT.com exchange will be listing Puli (PULI) tokens beginning on 12 May. Puli is the token used in the Puli P2E (play-to-earn) NFT-based mobile gaming ecosystem.

Top 10 Crypto Summary

With the exception of HEX, we have reached clear bear market territory across the board for the top 10 crypto assets by market cap. And as usual, the alt-coins tend to follow the general price cycles of Bitcoin.

Luna’s drop was the sharpest of the week, arriving at ~17% below the previous week. Luna (LUNA) operates as the native staking token of the Terra protocol and (according to the Terra website) exists to absorb price volatility of Terra’s algorithmic stablecoins.

For Ether (ETH), the digital asset is still affected by ongoing major development work on the Ethereum blockchain (a switch to proof-of-stake). But more specific to the past week, the Ethereum blockchain experienced a spike in gas fees — about 100-200 times higher than normal — after NFT users competed in a bid for digital land in the Bored Ape Yacht Club metaverse.

Bitcoin Price Chart

Glassnode’s technical presentation this week sought to explore what the possible bear market floor for Bitcoin (BTC) might be. In order to do this, Glassnode looked at what happens if 10% of bitcoins that are currently held at a profit suddenly move into loss territory. Said another way, what price would we need to reach for existing supply to be at an unrealized loss? With the current total supply of bitcoins at just over 19M, Glassnode concludes that this would put us at the ~US$33K price point.

While this isn’t necessarily indicative of the near-future price floor, it is indicative of what we might consider “pain territory” — especially because ~US$33K turns out to be a similar pain threshold to the previous bear market (in January, at ~US$35K).

Glassnode also notes that a significant number of those 1.9M bitcoins (the 10% total BTC supply) are held by short-term holders, “the most reactive to price”.

Don’t miss out – Find out more today