Crypto Market Forecast: Week of October 31st 2022

A curated weekly summary of forward-focused crypto news that matters. This week, Bitcoin and crypto rise while stocks falter, DOGE surges on the back of Elon Musk completing the purchase of Twitter, and Mastercard announces Paxos partnership.

Bitcoin (BTC) jumped by nearly 8% this week and currently trades at ~US$20.7K. Ether (ETH) skyrocketed by 21.5%, currently situated at ~US$1.6K. Binance-coin (BNB) also surged by 15.5% and now trades for US$313 (a nice recovery following a major hack of its Smart Chain about three weeks ago).

After several weeks of Bitcoin behaving like a sideways-trading stablecoin, it finally rallied as tech stocks fell. Facebook’s parent company META reported this week, for example, that it suffered $9.4 billion in losses related to its metaverse project — named Reality Labs — so far this year. This comes after a $10 billion loss in 2021. META’s stock currently trades at $99.20, down from $313 at the start of the year. Alphabet (Google), Amazon, and Microsoft all had similarly poorly-performing weeks.

Block, Coinbase, MicroStrategy, PayPal, and Robinhood are also expected to announce Q3 earnings over the coming week.

Analysts have noticed, at least over the short-term, what may be the beginning of a long-awaited decoupling of Bitcoin away from tech stocks.

On-chain analytics company Glassnode has warned that Bitcoin’s relative price stability over the previous weeks could be a “calm before the storm”. At least for the near-term, until a sustained decoupling is certain, it remains important to continue following the same macro indicators as are usually followed for the traditional stock market — including the Consumer Price Index, unemployment, interest rate hikes, etc.

Dogecoin (DOGE) found itself surging “to the moon” (sort of) as Elon Musk finally completed his acquisition of Twitter this past week — spiking by 96% over that timeframe.

Cardano’s founder Charles Hoskinson has speculated that the digital asset, which began as a joke “memecoin” back in 2013, could “merge” with the Twitter platform. Musk has defended his support of Dogecoin in a podcast with Lex Fridman and said in an appearance at the Qatar Economic Forum in Doha earlier this year that “I just know a lot of people who are not that wealthy who, you know, have encouraged me to buy and support Dogecoin… I’m responding to those people”.

Watch for upward price pressure if Musk indeed pushes for a DOGE-Twitter “merge” in the future.

MasterCard announced a couple of weeks ago that it had partnered with Paxos to enable financial institutions such as banks to provide access to crypto services to their customers. With the move, MasterCard hopes to fill in the gap that banks have historically cited for not getting involved with crypto: regulatory compliance and security.

Interesting to note is that it was Paxos that partnered with PayPal back in 2020 to enable PayPal’s crypto offerings.

Crypto news for the weeks ahead

2 November

The Federal Open Market Committee (FOMC) will be meeting. Possible additional interest rate hikes will be announced. Markets are projecting a high probability of a (fourth consecutive) 75 bps rate hike, which would raise the target rate from 3.75-4.0%. If crypto assets remain seen by traders as risk-on, this would mean downward price pressure.

10 November

The US Bureau of Labor Statistics will release its Consumer Price Index (CPI) numbers for the month of October. This is a key indicator the Fed will look to when it considers even further rate hikes going forward.

1 December

The Theta Network will launch its v4.0.0 upgrade on November 2nd and will launch its “Metachain” on December 1st.

Top 10 Crypto Summary

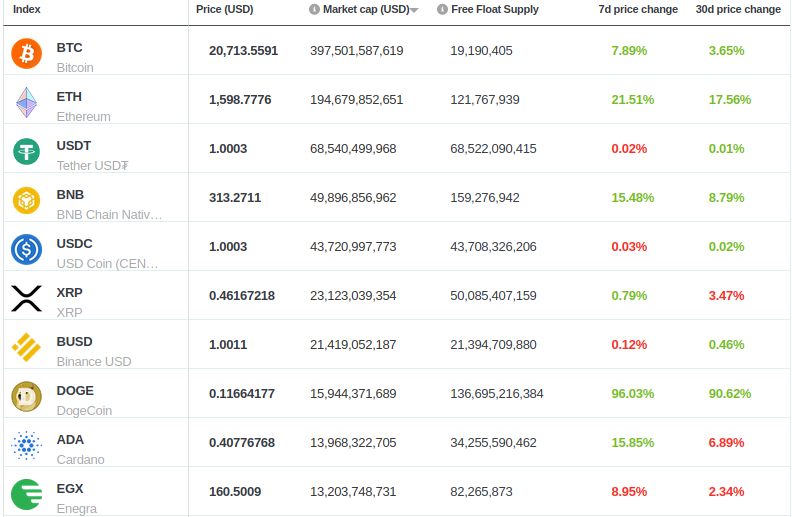

BNC’s top 10 digital assets by market cap reveal an incredibly bullish week with DOGE taking the lead: a huge 96% growth versus the previous week as Elon Musk (the “Chief of Twit”) completes his acquisition of Twitter. Ether (ETH) climbed 21.5% over the week, Cardano (ADA) by 15.9%, Binance-coin (BNB) by 15.5%, and Bitcoin (BTC) by 7.9%.

Bitcoin Price Chart

After weeks of sideways trading (in)action for Bitcoin, Glassnode makes the case for both pending bull and bear scenarios for this dominant digital asset. In the bear case, we see that on-chain activity is low; exchange balances have declined, and Bitcoin’s network difficulty and hash rate being at all-time highs mean that miners are stressed and could find themselves having to capitulate in a mass-selling event in order to stay afloat (meaning downward price pressure). Meanwhile, HODLers remain largely unphased in the present market conditions; in fact, we are presently at an all-time high for coins held by “older hands”.

Don’t miss out – Find out more today