Crypto Market Forecast: Week of September 12th 2022

A curated weekly summary of forward-focused crypto news that matters. This week, Bitcoin has a strong Friday as the global investment community turns on risk-on, Russia works on building cross-border stablecoin payment solutions, and Ethereum moves closer to transitioning to Proof-of-Stake.

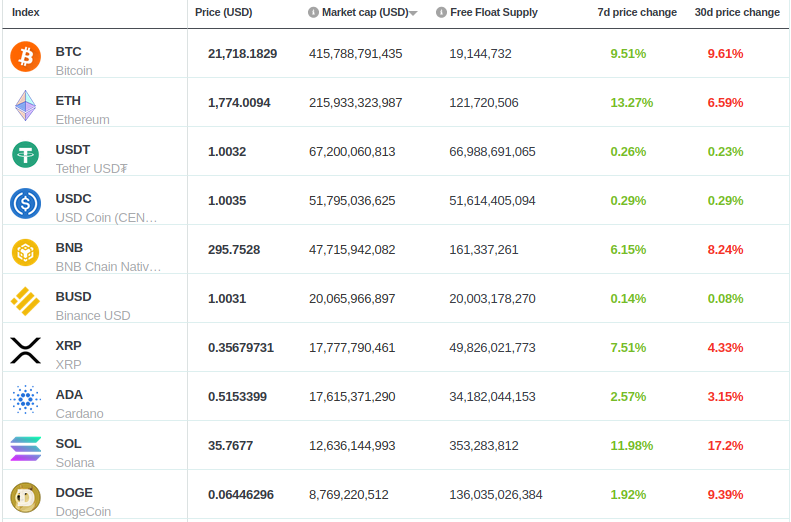

Bitcoin (BTC) closes the week up 9.5% after a late surge and is currently priced at just under US$22K. The Ethereum price has risen over ~13% and sits at ~US$1.8K, while Binance-coin (BNB) gained ~6%, and is currently trading at ~US$296.

Bitcoin had one of its strongest days of the year on September 9th, rising by 10.1% in 24 hours. The rally appears to have been driven by a perception that it is now safer to re-enter perceived risk markets. Alongside the rise in crypto markets, Asian stock indices, the S&P500 and the Dow Jones index all had strong pickups on Friday. The Dollar index, a safer investment favoured by savers, fell on the same day.

Banking giant ING released a note on Thursday stating that the chance of interest rate cuts in 2023 are high. The bank says it is penciling a rate cut in June with “further easing through the second half of 2023.” A lower interest rate environment favours investors over savers.

On September 13, at 8am EST, the U.S. Bureau of Labor Statistics will release the US Consumer Price Index (CPI) report for the month of August. This will be a key event for traders in financial markets. High CPI numbers could trigger a sell-off in perceived risk markets like crypto and equities because it would increase pressure on the Federal Reserve to raise interest rates. High interest rates constrain the ability of investors to access capital and strengthens the appeal of saving.

The Nigeria Export Processing Zones Authority (NEPZA) has announced a partnership with Binance to launch a “Virtual Free Zone” within the country. NEPZA’s CEO Adesoji Adesugba says the zone would attempt to mirror an equivalent in Dubai and aims for “flourishing virtual free zones to take advantage of a near trillion dollar virtual economy in blockchains and digital economy”. Nigeria ranks among the highest in the world in terms of crypto adoption. A cached (but now-removed) press release from Binance likened the move to similar Binance activities in South Korea and Cameroon.

Russian news agency TASS announced last week that the Russian government is in the process of working with friendly nations to develop stablecoin-based clearing platforms for cross-border settlements. Russian Deputy Finance Minister Alexey Moiseyev stated that the objective would be to avoid using US dollars and euros, and instead, the stablecoins could be pegged to “some generally recognized instrument” such as gold.

TASS reported that the Finance Ministry and Bank of Russia have come to an agreement that “it is impossible to do without cross-border settlements in cryptocurrency” in light of recent events. Whether the final product, if launched, would resemble something of an asset-backed CBDC or a privately-run asset-backed initiative (such as a “gold-backed Tether”) that the Russian government could also leverage for its own purposes remains to be seen.

The Indonesian government plans to launch a crypto exchange (bourse) before the end of 2022. The exchange will list the 25 cryptocurrency exchanges that the Indonesian Commodity Futures Trading Regulatory Agency has already awarded licenses for.

Deal Street Asia cites “efforts to protect consumers amid rising interests in digital currencies” as the reason for the Indonesian government’s bourse launch. The initiative was first scheduled to be completed by end-of-2021, then by Q1 2022, before postponing yet again.

Crypto news for the weeks ahead

14-16 September

Binance Blockchain Week will take place this month in Paris and via live stream. The theme will be Web3 and will host 60 plus industry speakers including Binance CEO Changpeng Zhao.

15 September

The Ethereum blockchain is projected to launch its mainnet proof-of-work (PoW) to proof-of-stake (PoS) transition (“the Merge”) on 15 September.

22 September

After a couple of months of delays, the Cardano blockchain has confirmed a new projected date for the Vasil hard fork, which will increase the block size in an effort to lower transaction fees.

Top 10 Crypto Summary

A strong recovery this week across the board for the top ten crypto assets by market cap. Before an end-of-week recovery to almost US$22K, Bitcoin (BTC) dipped to its lowest price (below US$19K) since the Terra-LUNA debacle in May. Ethereum (ETH) and Solana (SOL) soared by 13% and 12% respectively. Ethereum’s recovery precedes the upcoming “Merge” from proof-of-work to proof-of-stake.

Bitcoin Price Chart

Onchain Bitcoin analytics company Glassnode noted some interesting activity in its report last week. Volume to and from exchanges for whales with >1K in BTC has been flat since around July. The “liveliness” indicator, which (when up) suggests an increase in spending from cold storage, has had a “strong downturn” in the present bear market (meaning people are not spending). Meanwhile, the total BTC supply held by long-term holders is presently at its all-time high. While the long-term holders seem unfazed by the present bear market, short-term holders are holding large unrealized losses. Glassnode suggests paying close attention to these short-term holders due to their key role in driving near-term price action.

Don’t miss out – Find out more today