Crypto Market Forecast: Week of September 13th 2021

A curated weekly summary of forward-focused crypto news that matters. This week, Crypto markets drop as leveraged long positions get squeezed, JP Morgan predicts another market-wide pullback, and Cardano begins its smart contract era.

It was a difficult week of trading in the crypto markets with a number of large-cap assets suffering double-digit losses. Bitcoin (BTC) ended the week down ~10%, trading around US$45,100, while Ethereum (ETH) was down ~15% and trading near US$3,300.

The week had gotten off to a poor start after a significant long squeeze crashed the price of BTC down to US$42K and the price of ETH to US$3K.

The aggregated open interest of BTC and ETH futures and options has surged since July with traders seeking to take advantage of a euphoric market. Opportunistic whales noticed this overleveraged market forming and likely triggered an attack to take advantage of it.

In cases like this whales will engineer a price drop by creating sell pressure that pushes long positions underwater. Last Tuesday, panicked traders were forced to dump tokens at discounted prices as their positions began to bleed following a price drop. Whales were happy to sweep up freshly sold crypto assets at reduced prices.

Over 50% of the open interest posted since July was wiped out last week. US$1.2 Billion worth of Bitcoin positions were liquidated on September 7th, almost all of them were long positions. Skew reports that across markets the total amount of liquidations may be around US$2.1 billion.

The bounce back following the price drop has been muted. Some analysts are suggesting the market’s bearish performance this week is due to the high prevalence of retail traders and weak hands within crypto.

Wall Street giant JP Morgan sent out a warning last week over what it said was "froth and retail investor mania" in the digital asset markets. JP Morgan managing director Nikolaos Panigirtzoglou said that retail markets have been pushing up the values of lower cap altcoins to new all time highs over the last month and that this was pushing Bitcoin’s share of the overall crypto market to uncomfortably low levels by historical standards.

He cited the rising level of altcoin trading (cryptocurrency trading that does not include Bitcoin). Altcoins now represent about 33% of the crypto asset market, a significant uptick from 22% in early August. Peak interest in altcoins is a potential top-signal for crypto markets.

JP Morgan cited Solana (SOL), Cardano (ADA), and Binance Coin (BNB) as potentially overbought assets.

Panigirtzoglou compared the bullish trend in markets to the run-up between January and mid-May 2021. From the peaks of May, the price of assets like Ethereum and BNB had more than halved by the third week of July. During this period the price of ETH dropped from ~US$4183 to a bottom of ~US$1795.

During the last week, the Central American nation of El Salvador became the first country to adopt Bitcoin as legal tender. Its neighbour Mexico, however, quashed any rumours that it may do the same. On Thursday, Mexico’s Central Bank Governor Alejandro Diaz de Leon Carrillo, said Bitcoin was more like a means of barter than an evolved form of fiat currency. He called BTC a high risk investment and a poor store of value.

Trading set-ups for the week

Pro trader Josh Olszewicz explores trading options and signals for BTC and ETH – and lays out the trading setups he’s watching for the upcoming week. Start your week off right with Josh’s thoughts on trading strategies on a weekly basis.

Crypto news for the week ahead

September 12th – Alonzo hard fork

Cardano, the third-largest asset in crypto, is now ready to implement smart contracts with the Alonzo hard fork now deployed. After a four-year wait, developers are able to build dapps on the chain. The launch was celebrated as the end of a long journey for the project and was met with excitement across its stakeholder community. ADA ends the week down ~16% with Alonzo likely already priced in.

September 14th and 15th – Blockworks Digital Asset Summit – New York

Major in-person conferences are returning to the blockchain industry. This week the Digital Asset Summit commences in New York. Key speakers at the event include Dan Morehead of Pantera Capital and Bart Smith of Susquehanna, one of the biggest Algorithmic trading firms in the world. Key topics of discussion include institutional lending and market access, the rise of crypto banks, and Bitcoin mining.

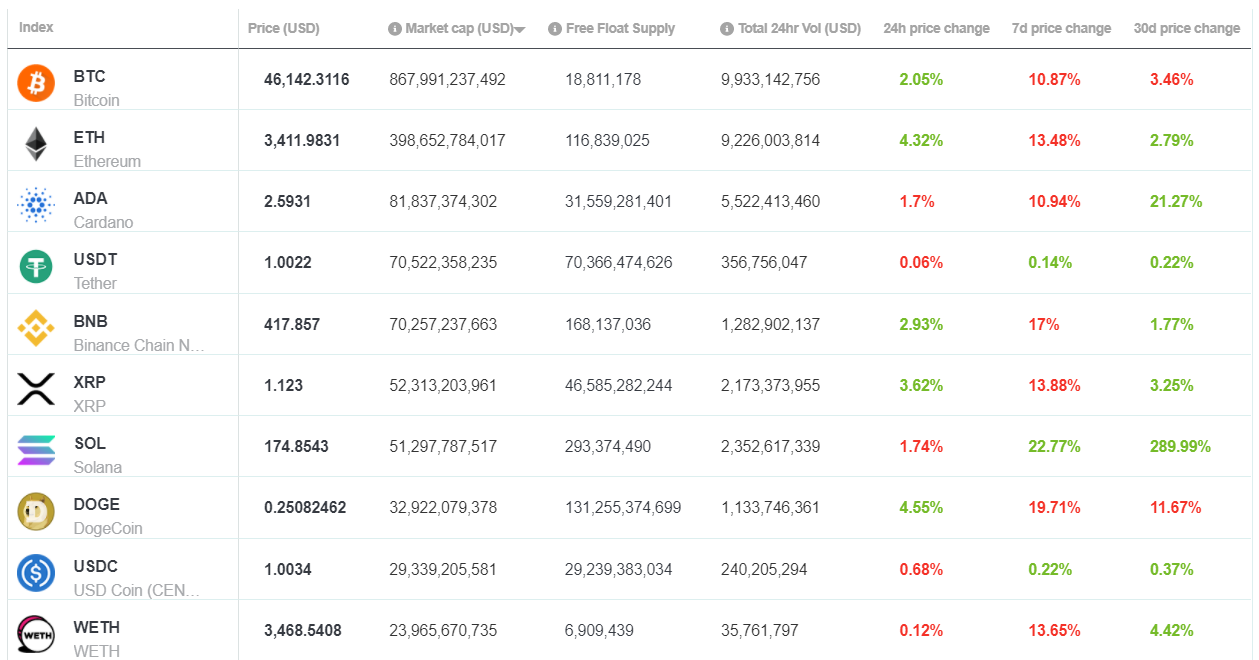

Top 10 Crypto Summary

It was a difficult week for large cap crypto assets with only Solana (SOL) offering any sort of meaningful return. Dogecoin (DOGE) was the biggest loser in the top 10 as it continues to lose steam against other altcoins and copycat projects. A coin called Dogecoin 2.0 has surged in the last month much to the chagrin of the Dogecoin foundation that requested the project go by a different name. DOGE is down ~12% in the last month.

Bitcoin Price Chart

The price of Bitcoin has been ranging between US$44,000 and US$47,000 since the sell-off on Tuesday. Glassnode reports that Bitcoin purchased between Q1-Q2 2020 remains tightly held suggesting underlying strength amongst holders in the crypto market and a willingness by even new holders to see out major drawdowns.

Don’t miss out – Find out more today