Crypto Market Forecast: Week of September 18th 2023

A curated weekly summary of forward-focused crypto news that matters. This week, the market readies itself for the next Fed interest rate decision, DCG offers a recovery plan for out-of-pocket Genesis creditors, and a large chunk of short-term BTC holders are holding at a loss.

The price of Bitcoin (BTC) has dipped by 0.9% this week and presently sits at ~US$25.8K. Ether (ETH) rose by a more muted 1.0% to ~US$1.6K. Binance-coin (BNB) rose similarly by ~1.7% to ~US$215.

All eyes across financial markets are pointed at the US Federal Reserve as it meets on September 20th to make a decision on benchmark interest rates.

Broadly it appears that markets expect that America’s Central Bank is expected to leave rates unchanged. CME Group’s FedWatch Tool, which surveys interest rate trader sentiment, assesses that there is a 98% probability benchmark rates will stay the same at 5.25-5.50% and there is just a 2% probability that it rises by 25 basis points.

Bitcoin and digital currencies have generally performed well during periods when the Fed reduces interest rates and conducts monetary expansion and vice versa during period of monetary contraction. Currently, the Fed appears to be near the end of a contractionary period with signals that the US economy is ending its extended COVID-19 pandemic-driven slump.

Goldman Sachs also predicts that during the September 20th meeting, the Federal Reserve will raise its U.S. economic growth projections for 2023, from 1% to 2.1%. They say the Fed may raise interest rates “one more time, if only to preserve flexibility.

Data released this week from the University of Michigan, evidences that consumer inflation expectations have hit their lowest level since March 2021. The University’s data suggests that consumers expect prices to rise 3.1% over the next year, down from 3.5% last month. This is the lowest level in over two years.

In April 2022, the Fed began monetary tightening to try and reign in an overheated economy. Inflation had ballooned, growth had stalled and unemployment was still recovering from extremely high levels hit in 2020 during the COVID-19 lockdown period.

Over a year of interest rate rises and economic re-openings has helped to normalize the economy. Inflation is beginning to align with this narrative, clear signs of a more stable US economy emerging, may be a factor in BTC’s price gains this week.

Creditors of failed crypto lender Genesis Captial are set to be offered a life raft by the Digital Currency Group (DCG). DCG, the parent company of Genesis has proposed a new recovery plan that estimates unsecured creditors will receive “a 70–90% recovery with a meaningful portion of the recovery in digital currencies.”

The recovery plan extends to claims made by users of Gemini Earn. They write that remuenaration would be 95%-110% without any contribution from Gemini, the exchange offering the program. Genesis partnered with Gemini for the program. When the lender collapsed, Gemini Earn users were also caught in the landslide. A court filing from Friday, reveals that in response, Gemini has described the Genesis recovery plan as “misleading at best”.

Crypto news for the weeks ahead

September 20

The FOMC will be meeting. Futures markets are strongly leaning towards a prediction of no further rate hikes for the September meeting, thus leaving the federal funds rate target at 5.25 – 5.5% – for now. Fed Governor Christopher Waller, however, hinted in mid-July of the possibility for additional rate hikes in coming months, and Fed Chair Jerome Powell did likewise in late-August.

September 29

The US Bureau of Economic Analysis’ (BEA’s) release of August’s Personal Consumption Expenditures (PCE) numbers will be released. This is the primary indicator used by the FOMC to measure inflation and is considered carefully when considering interest rate levels.

September 29 (roughly)

The Holesky testnet is set to be re-launched. In what was a rare failure, Ethereum developers failed to get their new testnet to run properly. The launch of Holesky was set to a be a celebration of the 1-year anniversary of the historic Merge-update. Developers have said the misstep was due to a misconfiguration in the Genesis file and are aiming for re-launch in around two weeks. In the mean-time, the Goerli testnet can still be used.

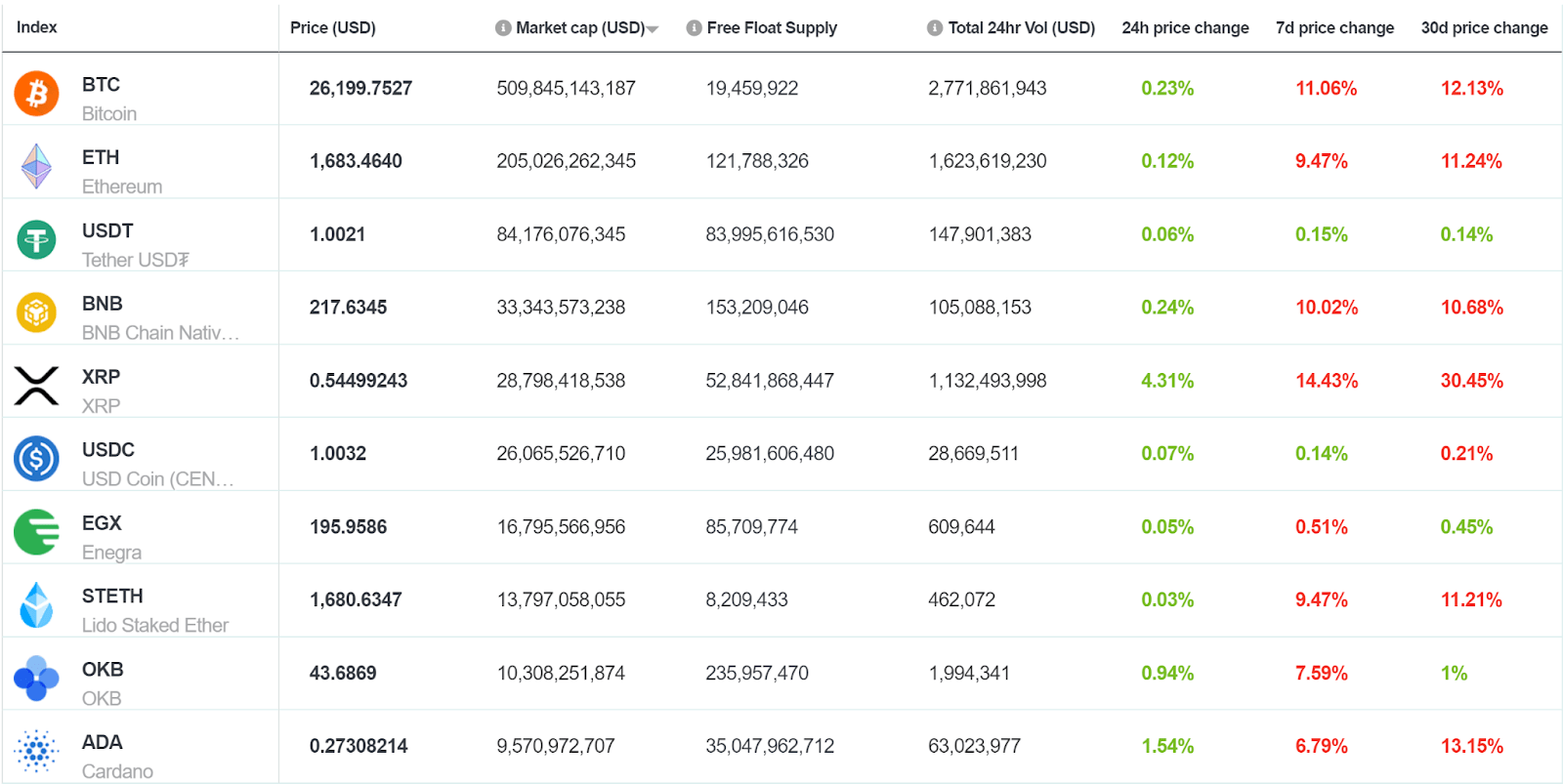

Top 10 Crypto Summary

BNC’s top 10 assets by market cap finished the week off — yet again — not far from where they started. OKB (OKB) is the best performer outside of BTC, and has historically shown an ability to outperform other alts in bearish markets. OKB has been noted for having a strong base of holders not willing to sell – this is likely because of rewards and the discount on the OKX tied to a user’s OKB holdings, this may be a factor in why it is able to resist external selling better than many other digital assets.

Bitcoin Price Chart

This week GLASSNODE finds that 85% of the Bitcoin Short-Term Holder demographic is underwater, or holding at a loss. This is based on their Short-Term Holder Supply in Profit metric, which assesses whether recent market entrants (BTC bought less than 155 days) are in profit. This much of this group being underwater is a bearish signal. This demographic is more sensitive to price volatility and short-term price swings, and they are less likely to hold through market downturns or accept their BTC portfolios being red.

Don’t miss out – Find out more today